Moral Hazard and the Taxpayer

Moral Hazard: The Definition

Moral hazard refers to a situation in which a party makes a decision about how much risk to take, while another party bears the costs if things go badly, and the party insulated from risk behaves differently from how it would if it were fully exposed to the risk. Wikipedia

An example of Moral Hazard

In a free market capitalist economy, greed is counterbalanced by fear. Everybody is greedy (we all want to improve the quality of life for ourselves, our family, and close friends), and most of us do it by working for an income, getting an education in a trade or skill to get better pay, by starting a business that produces what people want to buy, or investing in an enterprise that can pay back interest. All of these endeavors ultimately improve the quality of life for everybody. The problem arises when this greed is not counterbalanced with fear. It would lead individuals to take on riskier, often fraudulent activities. Let me use an example to explain my point. Suppose an individual had $10,000.00 to invest. He would be cautious about who he would lend it to for he could be devastated financially by losing all of his investment. He would do his due diligence to see if the borrower had a good business plan, reserve cash or assets for collateral, and how credit worthy he was. The lender would charge an appropriate amount of interest associated with the risk he would be taking on by lending his money to this individual. He most likely would invest in a pretty sure thing, and will most likely get a conservative rate of return for his investment. Now let's add another factor. Let us assume that the investor has a rich uncle who tells him "If you lose the money you invest, don't worry about it. I will pay you back the $10,000.00 you lost". How would the investor behave now? He would most likely take a bigger risk chasing a bigger reward. He would be less likely to do his due diligence on the creditor. He would increase his probability to lose all of his investment. After all, it doesn't matter if he loses it. He still has his $10,00.00 one way or another. His uncle, on the other hand, will most likely lose his money (that crazy uncle). The fear of loss is taken out of the equation for the investor, and greed plays a bigger role in his decision. The scale of greed/fear is out of balance. Greed goes on a tear.

Moral Hazard and the U.S. Taxpayer

So what does this have to do with the recession (great correction) and the wealth inequality unfolding in the United States today? Plenty. It is giving capitalism a bad name. It is privatizing the big gains made by financial companies while socializing the losses to the taxpayer. What is worse, it is happening to the tax payer without him having any say about it. Unlike the rich uncle in the above example, the taxpayer is not rich, nor did he choose to have his money used through moral Hazard.

The New American has a story on how it happened in 2008.

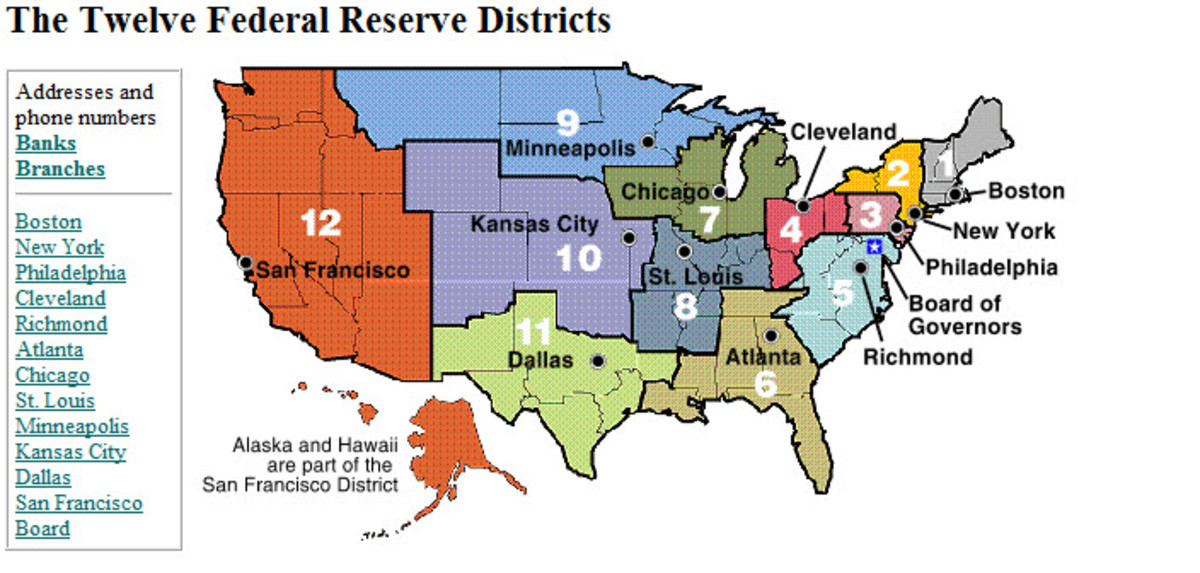

The Federal Reserve Bank committed some $7.77 trillion in funds to major Wall Street banks during the height of the 2008 financial crisis, according to a report published by Bloomberg News November 28 through a Freedom of Information Act request.

Got that? 7.77 trillion loaned to Wall Street, courtesy of the Federal Reserve. Why? Because these big institutions made risky loans and needed to be bailed out or the whole financial system will fail (so they say). Where does the Federal Reserve get the money? It prints it (more on that in another blog). Who ultimately pays? The tax payer, both through inflation and taxes. This is moral hazard. The article goes on:

Bloomberg noted that most of the major banks receiving the below-market-rate loans made billions in profit from the Federal Reserve policies. The Federal Reserve Bank loaned funds to major Wall Street banks at rates of between 0.10 percent and 0.25 percent and at the same time banks were encouraged to purchase U.S. Treasury bills. Two-year Treasury bills the federal government was selling were fetching more than one percent interest. The deal — borrowing at a discounted rate from one agency of the federal government and taking loans earning interest at a higher rate from another agency of government — amounted to a cash transfer from the federal government to the big banks that Bloomberg estimated netted the banks some $13 billion in profit.

So, not only did the banks get bailed out from making risky bets through moral hazard, they then turned around and bought Treasury Bills from the same government for profits of 13 billion plus. It sure is a nice gig if you can get it, but it is fraud, pure and simple. The precedent for this type of moral hazard, in which the government bails out financial institutions can be traced back at least to the Savings and Loan scandal in the 1980's. Then came along Long Term Capital Management in the 90's, and finally the sub prime mess we have now. Another factor that loosened up the purse strings for big bankers is the fact that the big wigs alternate between working for the big banks and working for the government, kind of a revolving door policy. This is a very clear conflict of interest.

One of the problems I have with big government is exactly this. Moral hazard that cannot be kept in check. When we get taxed, we lose control of what we want to do with that money. It no longer is ours. We have no say. We are supposed to live in a representative democracy, and with that people assume taxes collected upon the citizenry will be used for the "public good". The call for more taxes because we need them for social programs, to protect our country, etc...pull on our heartstrings, but is it really for our best interest? Can it ever be for our best interest? What if, instead, we were only taxed 5% of our income and that is all we can be taxed? What if we had a sound money system that did not allow for the printing of money out of thin air? Well, we would be able to say "no" to the big banks. I do not want to bail you out. You are financially insolvent, and I don't want my money to be wasted to keep you alive. The banks then would have to behave differently. They would have to be more fiscally responsible with the money they do get. They need to have a positive cash flow statement and strong balance sheet, or they would go out of business.

This is sound business. Everybody would benefit. The banks would practice sound money storage and lending, our money would retain it's value, and more importantly, big bankers could not fraudulently make profits hand over fist on our dime with us taking on the risk. The greed/fear scale would be in balance.

Moral Hazard is pervasive, both in the public and private sector. The difference lies in the fact that in the private sector, moral hazard can be detected sooner and rectified easier. The investor simply can stop investing with the organization in question (as a matter of fact, this is the primary reason for bank runs. Bank runs, or the threat thereof are actually a good thing. It keeps bankers honest more so than regulations ever can). In the public sector, not so much. The politicians can override the wants of the majority (and often do).

The Occupy Wall Street movement is right in that the bankers are to blame for the mess. They did get the bailouts. But the solution they want is for more regulation and taxes. The OWS don't realize that the government played a big role in this form of moral hazard, and that the solutions they propose will not change that. The best thing we can do is fight for sound money (getting rid of the Federal Reserve), free competition with banking (for example, we can have state banks and private banks that offer their services on the open market along with the federal banks and other financial institutions), and roll back taxes to a reasonable level. This gives people more freedom to choose where to store their wealth. These measures, although will not completely eliminate moral hazard (nothing can), will keep it in check. There would be better prosperity for all.