Mortgage Rates Predictions - The Canary Is Dead! Warning Of A Deadly Threat To US Economic And Military Supremacy.

Mortgage rates predictions seem an unlikely thing to cause great concern. Sure, mortgage rates predictions are currently pointing upward, and mortgage rates themselves would undoubtedly be higher than they are if it were not an election year, but is that really something about which we need to be greatly concerned?

Back in the early days of mining, before there were sophisticated machines to measure air quality, miners would carry a canary in a cage with them. The silent, undetectable, poisonous gases common in coal mines would kill the canary long before they reached levels dangerous to humans. When the canary dropped dead - it was time to get out of the mine!

Mortgage interest rates have gone up before, indeed they were double their current levels back in the late 80s and early 90s, and nobody was talking then about any threats to the position of the US as the dominant economic and military power in the world.

Why are rising mortgage rates predictions now equivalent to the canary falling off its perch?

So, What Is So Different This Time?

Let's take a step back and look at the broader picture.

Mortgage interest rates are indicative of interest rates generally. The movement of interest rates helps to smooth the changing cycles of supply and demand for credit, be it mortgages, credit cards, business borrowings, or auto loans.

As such, there is nothing in mortgage interest rates themselves to cause concern. There have been times when mortgage interest rates were much higher than they are today, and the US military-industrial complex powered ahead regardless, with consumer spending bouncing merrily behind.

It is not the current mortgage rates which care the cause for concern, nor even the mortgage rates predictions pointing to rapid increases in mortgage interest rates after the elections in November, predictions of mortgage interest rates as high as 12% in the next decade. These figures in themseves are not the issue, stressful as they may be to the next generation of home buyers.

The real cause for concern is actually to be found in the underlying causes of the upward pressure on interest rates at this time in history.

Economic Power And Military Power

There is a close connection between economic power and military power. A strong military can allow a country to control economic resources and protect them against attack - anything from raw materials like oil, gas, iron ore, and mineral sands to industrial resources like aluminium smelters and factories.

A strong military can allow a nation to ignore the demands of weaker nations for equal access to international resources, for free trade, for environmental responsibility, and even to ignore demands to adhere to UN resolutions against going to war.

A strong military is very expensive, though.

There was a time when a nation's military consisted of its people, armed with their tools - pitchforks, scythes, axes and the like. Each nation was completely in control of its own supply chain - although it did have the effect of restricting the length of miltary operations to that period between planting and harvest, lest the crops fail and the army starve the following winter!

Professional soldiers require a functioning economy to produce food and equipment for them, and enough wages to support their families.

Modern warfare requires not only the soldiers themselves, but masses of incredibly sophisticated and expensive weaponry, surveillance systems, and transport. No one nation controls all the raw materials required to build, for example, nuclear submarines. This means that isolationism is no longer an option for a nation which wants to maintain a strong modern military. Trade is an absolute essential as part of the process of supplying one's army.

In order to trade, one must have goods to exchange, or hard currency with which to buy the required products and materials.

What Happens When The Economic Engine Fails

Recent history has provided an object lesson in what happens to a state held together by a strong military, when the state loses its economic power.

The USSR in the 1980s was suffering from internal weaknesses in its economy, coupled with the crippling cost of maintining is occupation of Afghanistan against mobile resistance fighters armed with the USSR's own captured weaponry.

In the ultimate irony, the USSR's own heat-seeking misslies shot down hundreds of the USSR's attack helicopters, until the USSR could no longer afford to replace them. Blinded by either arrogance or an unwillingness to face the magnitude of the problem, the Politburo presided over the sudden, catastrophic collapse of the entire USSR government apparatus.

Soldiers and public servants went unpaid, state assets were stolen and sold off to the highest bidder to keep some families fed and warm through the winter, and situations of complete farce were commonplace - such as the (nominally State-owned) electricity provider cutting off the electricity supply to the (nominally State-owned) Dobrovnik submarine base, because it hadn't paid its electricity bill.

Almost overnight, the USSR ceased to exist as a meaningful power on the world stage. The Berlin Wall came down immediately. Such is the power of economic ascendancy in maintaining military ascendancy.

Worrying Sounds In The US Economic Engine

Since 1989, the US has held almost unchallenged economic and military ascendancy. The government, and indeed the people of the USA, have come dangerously close to assuming this state of affairs is a God-given, permanent and unassailable ascendancy. Such an assumption would be hubris, one of the seven deadly sins, and would be as short-sighted as the members of the Politburo were in the early 80s.

The US sailed through the high interest rate period of the 80s and 90s on the back of high levels of covert operations spending and an open war in the Middle East supporting the military-industrial complex, while high consumer confidence and rising house prices maintained the domestic economy through the occasional recessive dip.

At that time in history, the US dollar was worth just about twice what it is worth today against international currencies, particularly those of the other Western democracies like Europe, England and Australia.

This meant that the US was paying half what it pays today for its imports, leaving aside any real price increases, like the recent oil price rises.

The sub-prime crisis was a disaster waiting to happen from the moment that house valuations came loose from the actual sale prices of houses. If it is possible to buy a house worth, say, $100,000 in pre-foreclosure for $50,000, then what does the valuation of $100,000 really mean? It doesn't mean the house is worth $100,000 on the open market - not if pre-foreclosure sales are common. And indeed they are, even in good times. These days, there are so many distressed sales going on that nobody in their right mind is paying full price (ie valuation) for a house in the US at the moment.

What the valuation of $100,000 really means is that a lender will advance you at least $80,000 if you offer the house as security. As long as you keep making the payments, nobody has to admit that the house is not REALLY worth $100,000 on the open market.

The whole US financial system is built on the premise that these houses are worth their valuations, and if that house of cards comes crashing down, the US economy will implode. Of course, the bankers and politicians know this, and there is no way such a situation will be allowed to come to pass. The government will keep writing checks to bail out lenders until the housing market settles.

But where is that money coming fom? It's not as though Uncle Sam has a piggy bank. The US government is in debt to the rest of the world, as is the US economy in general, through business borrowings and overseas borrowings by lenders.

In essence, Uncle Sam is printing money, and we all know there is only so much of that you can do before you get rampant inflation. The world knows it, too, which is why the US dollar has lost 25% of its value against the other major currencies over the past year or two.

The Changing World Stage

There have been some major changes in the world economy over the past two decades - the period of the unrivalled economic and miltary supremacy of the US.

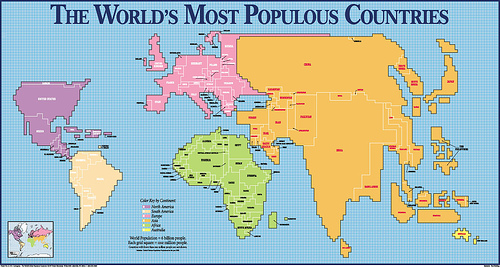

Most significantly, the two most populous nations on Earth, China and India, have started to reap the benefits of a systematic approach to economic development and the education of their growning middle classes.

Yes, there are sill millions living in grinding poverty in both nations, but it not China and India's poor who will rock the foundations of the world order - it is their educated middle classes. There are already more university graduates in India than there are people in the United States. Given that the average American, even a college-educated American, would have trouble naming the capital of India and placing it correctly on a world map, there is a growing disparity between the two nations in terms of future potential.

The Sleeping Giant - Education

The ladder from weakness and poverty to strength and wealth has always been education. America's greatness over the past 50 years has rested largely on the output of highly educated researchers, engineers, and scientists, working on well-finded projects to develop computers, rockets, and even nuclear weaponry. Along the way, a wide range of by-products were spawned from these projects, including plastics, robotics, and a wide range of medical tools and treatments.

Back in the 50s and 60s, the USA was the pinnacle of academic and scientific endeavor. A degree from Harvard, MIT or Stamford was unquestionably a passport to success. The cutting edge thought leadership was taking place within the shores of the USA, fuelled by a generation of kids growing up watching the space race, dreaming of being astronauts, and partaking of the great American dream of college education for all who had merit.

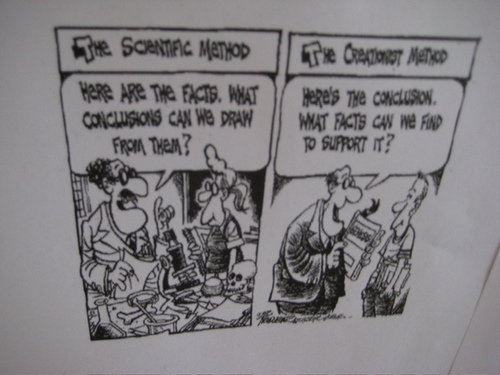

These days, with scholarships harder to come by, the reputation of science continuously being undermined by religious zealots, and the absence of a grand national vision equivalent to putting a man on the moon, education is not valued for its own sake, nor for the grand journey of research and discovery. Instead, students are flocking to accounting, law, and other transactional disciplines, their aspirations being not so much to change the world as to land themselves a good, secure job with health benefits.

The performance of any nation over the next 50 years will depend on a small number of vital factors - its access to raw materials, its ability to process those raw materials locally (or pay to have them processed by another nation), and its ability to innovate, that is, the quality of its research and development.

The key areas of research which will be vital in the future are biotechnology (alternative fuels, new medicines, better food crops and production methods) and engineering (particularly quantum computing and quantum materials, which are very cool and will change the world).

For the past 30 years, both China and India have been playing catch-up in the education stakes - at first, sending their brightest students abroad to be educated, then inviting Western universities to set up campuses within their borders, and finally gowing their own crop of academics and researchers. Westerners have scoffed at the quality of graduates from these programs, but over time two trends have steadily become visible - rising standards in education in both China and India, and falling standards of education in the US.

The Achilles Heel Of The USA

Just as the mightly hero Achilles had a fatal weakness - and in fact today it is still called the Achilles tendon, and cutting it will cripple any person - the mighty USA also has a fatal weakness.

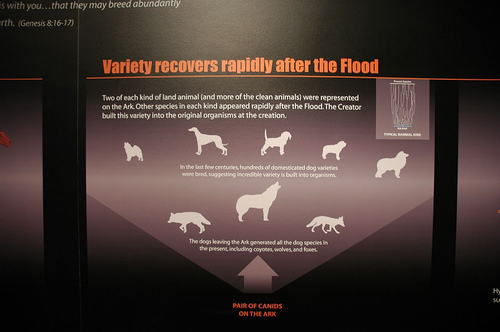

The USA has handed control of its most important strategic asset - the education of its children - to the ignorant masses. Elected school boards and community busybodies have managed such unthinkable atrocities as banning the teaching of the process of natural selection, or the requirement that "intellgent design" be taught with equal seriousness as though it were supported by equivalent evidence.

When the nature of scientific inquiry is so mutilated in the minds of children before they even reach high school, they are behind the curve in the realm of science forever more. Students in the US routinely test below the students of other English-speaking nations at every age on standardised tests of mathematics and science. The USA has given away its one great advantage - thought leadership.

Believing its current position on the world stage to be unassailable, the USA has ceased to "reality check" against other nations and has indulged in a self-focused orgy of backward superstition masquerading as freedom of religion. The greater the sense of entitlement and arrogance, the further the attention of the US has slid away from international reality and toward domestic scandal and religious posturing. Yet international reality is very, very worrying.

How To Survive If The Worst Happens

The Worrying Reality

The US Federal deficit is blowing out - again.

The falling dollar is raising the price of paying interest on that debt in real terms.

The growing middle classes in China and india are putting growing amounts of tax revenue into the hands of those governments. China is already buying up companies which control oil, gas, and gold reserves around the world.

The falling US dollar is also raising the cost of imports, and putting upward pressure on interest rates.

The rising price of oil, the flow-on inflationary effects, and the rising cost of imports again put upward pressure on interest rates.

The sub-prime crisis, or as we should call it the financial crisis in general in the US, will require massive Federal bail-out on an unprecendented scale to prevent a complete collapse of US housing values. This bail-out will itself put further downward pressure on the US dollar and thence upward pressure on interest rates.

A weaker US dollar makes it harder for US companies to buy up strategic reserves in other parts of the world - and makes publicly listed US businesses potential targets of hostile take-over bids. Especially US companies involved in oil, gas, gold, or emerging technologies.

Rising interest rates will affect consumer confidence and consumer spending, resulting in a recession - but with ongoing inflation, the dreaded "stagflation" of the early 70s revisited.

At some point, the ability of the US to carry on printing money and borrowing from the rest of the world will reach its natural limit. Until that time, the US will remain strong in appearance, maybe even militarily stronger, just as the USSR did in the 1980s.

It is unthinkable that the US economy might collapse to the point that the US is unable to maintain its military supremacy - just as the fall of the USSR was unthinkable in 1988.

Mortgage rates predictions trending steadily upward are the warning bell. The canary is swaying dangerously on its perch.

This time, the US economy is not rocking and rolling strongly. This time, the US dollar is not riding at an all time high. This time, the US government is not in a position to fund two or more multi-billion dollar wars at once. This time, the US is like a family which has been living in its credit cards for several years.

At some point, there will be nobody willing to advance the US any more money, or at least the interest rates required to service the loans will get higher and higher. The US will be caught in a spiral of international debt the likes of which has never been seen before.

The end result, if no action is taken, will be a financially crippled USA unable to do more than defend its own borders, if that.

The standard of living will decline drastically in the US. The wealthy and educated will either retreat to havens like Manhattan, which can be made secure against the masses of disaffected poor, or they will leave the US for more financially stable parts of the world like Australia - a place which is rich in natural resources, is geographically and economically close to the the rising economies of both China and India, is already home to many well-educated expatriates of both nations, and will therefore be able to effectively "piggy back" on the rise of those two nations.

The question which should be on everyone's lips right now, and being shouted to the halls of power, is not any self-absorbed and trivial question like "what are you doing to bring down gas prices?", "what can you do to help me pay my mortgage?" or "what are you doing to protect my child from Godless evolution-teachers in schools?"

The question which every American should ask their elected representatives today, and to which you should DEMAND an answer, is "how will you prevent the USA from losing its place as the dominant economic and military power on this planet?"

Images: striatic, jimbowen0306, DuckBrown, tinou bao, cell105, upyernoz, John Scalzi, MsLiberty, transplanted mountaineer