Platinum Public Pensions - Can the United States Afford Socialized Retirement?

American public pensions have gone too far. Transparency of what has happened needs to be recognized and adjusted.

This did not happen overnight and we all are responsible. Don't point fingers. If you are not a part of the solution, then you are part of the problem.

The retirement systems both social security and the define public pension funds should be supplemental. Yet we have gotten to view them as the sole source.

Can America afford the offer sole source pensions?

Can America be competitive overseas if we offer pensions that are a sole source of income during retirement?

Are sole source pension a form of socialized government?

The pension funds understand the value of the retirements they offer. These retirement plans are not supplemental, they are not silver status, and while some are gold status, for the American wage-earning American, small business owner, the pension plans are platinum.

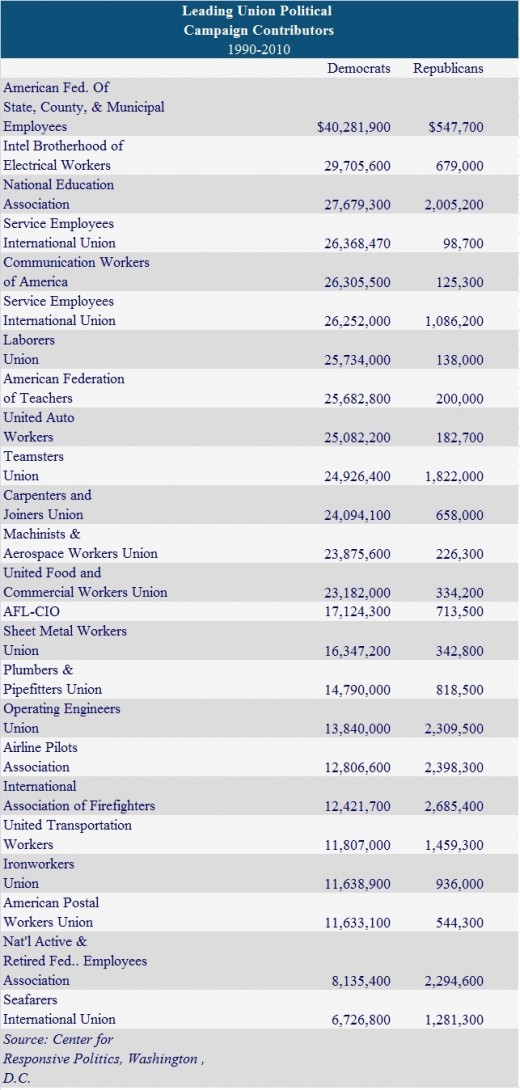

The pension plan trustees, administrators know this and actively contribute to political campaigns. Provide below is a table copied from an email I received today. These numbers tell the whole story.

General Motors Says No More Pensions for White Collar Workers

GM Shifts From Defined Benefit to Contributed Pensions 401

General Motors is creating a better financial framework for their global competitiveness by changing from a defined benefit pension plan to a contributed pension plan (aka 401). The difference financially is immense. This change lessens the burden of the cost of labor for GM and lessons the financial responsibility of the American taxpayer.

Many insiders confide that the real reason behind the bailout of General Motors was the defined benefit program.

Hiding this fact, not addressing this fact has multiple implications across our financial and political decisions.

The country will also need 'new forms of social welfare' instead of its current system which is excessively centred on pensions.

— Giorgio NapolitanoSolution - Recognize The Cost and Who is Paying The Bills

The solution is taking responsibility. The costs are detailed by professionals called actuaries. The gatekeepers are the trustees, pension administrators. The stakeholders are the taxpayers.

Even the unions that are "private" have public impact. The car manufacturers have bailouts. The car manufacturers have unemployment. Recently, the lost of jobs overseas has caused foreclosures in many neighborhoods across the United States of America.

Reclaim American Jobs - Take Responsibility

Capping retirement benefits sadly needs to be an effort supported by both state and federal laws. Governors have started the process, recognized the problem and yet it must be a team effort.

The trustees of the private defined benefit funds have not served the American people.

And the American people are not speaking out.

Every American citizen needs to take responsibility. It is the jobs of our neighbors, it is the jobs of our children, it is the jobs of our grandchildren that we are fighting for.

Restore democracy, end the socialized platinum public pensions.

Fight for financial freedom for the next generations.

Pensions

Struggle is a never ending process. Freedom is never really won, you earn it and win it in every generation.

— Coretta Scott KingToo Big to Fail - Private Pensions

So the question is if banks can be too big to fail, should we be taking measures to ensure big corporations don't create a private pension system that is too big to fail?

Perhaps the real question here is essentially antitrust laws. If we had antitrust laws that were strong and consistent, would we have the behemoth corporations?

Share Your Opinion

Have private pension funds become too big to fail a socialized benefit in the American democracy?

Pensions

Recognizing private corporations have become too big to fail was a first step in setting boundaries. Now the job of the legislators needs to be to insure reasonable defined benefits in tandem with ability to pay.

Underfunding pensions is not new but it is a new insight. With greater knowledge comes greater responsibility.

Holding pension trustees and governments accountable is the first step in reclaiming the financial freedom that an overburdening pension system can place upon our global competitiveness.

Just as our soldiers fight for our freedoms, we too, must step up and understand the financial implications on a global scale. Take a stand, share your opinion, be apart of the solution.

© 2012 Ken Kline