Profitability Seems To Be A Dirty Word

Profits Are The Answer, Not The Problem

Now according to Obama's Boogie Man, you know the Big Oil Grinch, profitability on the part of the big oil companies is a bad thing. It's bad for the stockholders, it's bad for the consumer and it's just down right unfair that the suppliers of oil earn a reward for supplying the ever increasing demand for petroleum products. They're found in just about everything you know and oil does still make the world go round. That's the problem that Obama doesn't like, or is it the profitability issue? He didn't seem to mind when deciding to invest in Brazil's oil exploration. Was a side deal cut that would insure that Brazil makes no profit on its venture? I don't think so.

I'm not an expert on the oil industry but I do like to read, research and investigate. I also have a pretty strong academic background in economics. So lets lay a base here and tie the two together with a smattering of business acumen. Businesses, any businesses, are in business to make a profit. If they don't make a profit, and continue to make a profit, they close the doors. Turning oil companies into the boogie man based upon profitability is so easy to do that a 5th grader can do it. Not understanding the way the industry sustains a profit and the players in the field might contribute to this phenomenon. So lets take a look.

There are low barriers of entry into the industry. That's a plus because it fosters a competitive market. The barriers start to pop up after one begins the process, not before, and if one doesn't hurtle those barriers then the weak go by the wayside. That's one of the pillars of capitalism, which to me isn't a dirty word. There will always be winners and losers in the marketplace.

Who benefits from a profitable and efficient energy producing system ultimately? Consumers do in two forms. The first form comes in affordable energy prices. We aren't exactly in that mode now are we? The second is in an abundant energy supply. From all reports, there isn't an oil shortage out there. There is a shortage in our domestic production but that isn't the doing of the oil industry. That comes in the form of the federal government's interference in the marketplace primarily.

In the case of oil companies, they have to replace their reserves. They are being depleted on a constant basis. The failure to replace reserves in that industry is tantamount to putting out a shingle that says, "Going Out Of Business." That sale can be accelerated even further by not being allowed to operate efficiently. If you make it cost prohibitive to continue to drill crude it won't be being drilled too much longer. So the next question arises. Where does the capital come from to develop new, efficient methods of extracting crude oil from the ground? It takes capital to make more capital.

It comes from profits. Now according to the people over there on the left this profitability is a bad thing. That bad thing needs a government solution according to their line of thinking. The solution to any problem according to that crowd's mentality is always higher taxes. Confused? Go back up and read the last sentence of paragraph 4. They see the accumulation of profits as the end unto itself and that Big Oil is rolling in the dough. First of all, when you're talking about the size of the industry giants you are talking also about the size of the continued capital investments they have to continually make to replace the reserves I previously mentioned. We'll get back to that.

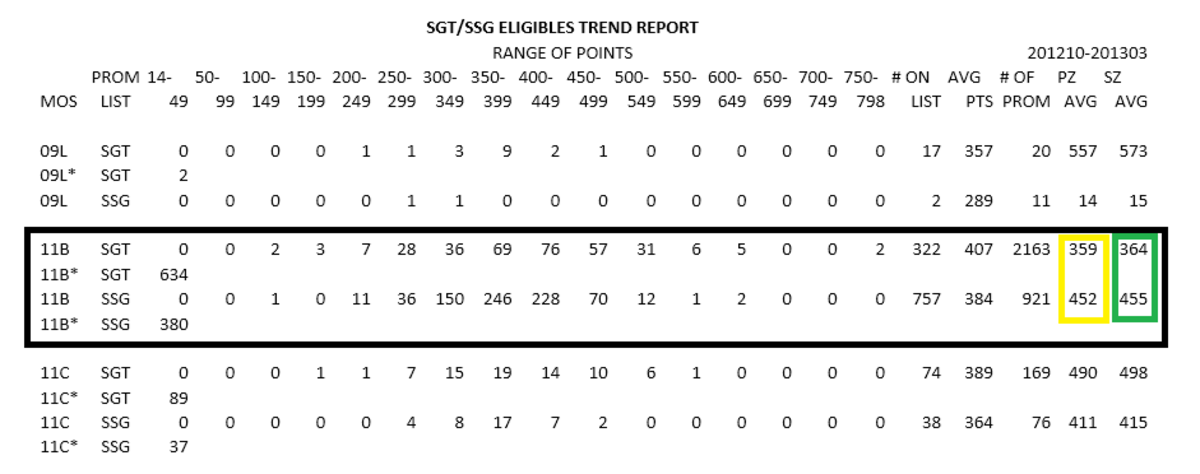

Generally oil profits are used for two main purposes. The first is to replace reserves which is critical and to replace them efficiently. The second is to pay dividends to the company share holders. You know those "speculators" who invest their money with the expectation of making a profit themselves. The chart below illustrates who has a stake in the oil companies.

After examining the chart one can see that the people who run these operations aren't the big, bad wolf. They have a 1.5% share of the total pie. So much for the boogie man theory.

Domestic oil production is a strange animal in reality. That oil is primarily produced, to the tune of about 93% of production, by small independents who are allied with The Independent Petroleum Association of America. These independents, by necessity and not convenience, must grow to thrive. Using that concept they are less inclined to pay high dividends and end up reinvesting the majority of their net income (read: profits) to the tune of 100 - 150 percent.

Free market dynamics can be found in the very active shale gas marketplace. New technologies, which cost money, in extraction methods has led to a glut of natural gas which has led to lower prices. Stable prices are in the range of 4 to 4 and a half dollars per million BTUs. This amounts to about one quarter of the price the same oil input derives. In the long run this is unsustainable as the price of product dampens the exploration of gas for the average company. Their survival will be dependent on better technologies or efficiencies or outright plain old having a head for business - maybe a combination of all three.

Econ 101 enters in here. Supply goes up, prices go down. Has Big Oil placed any bets on the natural gas market? Sure they have. Exxon made a capital investment to the tune of $41 billion and has not had its ROI as of yet. What does that have to do with it? Speculation and market manipulation. If Exxon is manipulating the oil market which is enormous, how easy would it be for them to manipulate the much smaller domestic natural gas market to start seeing a return on their investment of $41 billion? Not exactly boogie man material is it?

Back in the Carter administration, Big Oil was public enemy number one. During the oil embargo of the 70's all sorts of government centric gimmicks were tried. Nixon had his price controls, Carter had his 1978 Natural Gas Policy Act and his Windfall Profits Tax. There is a certain irony that the oil industry experienced one of its biggest booms during those years and gas prices elevated rather than declined while the federal government was waging war on the oil companies again. So along comes Ronald Reagan with a cure. He ended all price controls and revised the tax code. The result was that oil prices collapsed. So much for government interference.

Our domestic oil production is in shambles. Areas of profitable exploration are out of bounds, It is compounded in the international marketplace. Why? Because all trading is conducted using an ever deteriorating US dollar. That pressure makes our suppliers up the ante on gas prices in order to remain viable businesses. Contrary to what Obama and his minions contend the profitability of the big 5 oil companies is not the problem. Those are huge companies making the huge capital investments necessary to continue to deliver what the world runs on - oil. Any increases to their tax liability will cause a disincentive for them to reinvest, not the other way around. So maybe a good question to ask is, "Why are huge state owned oil companies allowed to operate so freely in outr marketplace?" There is no accountability for the likes of Aramco, Citgo (Chavez), CNOOC (China), or Petrobras (Brazil). In fact, Obama wants to become Petrobras' best customer and forked over $8 billion of our tax dollars to help get us there.

Something to think about from The Frog who doesn't ever know what he's talking about. I don't work for the oil industry BTW. My son does, but I don't. Maybe the government should start pointing its finger in the right direct - at itself.

As Always,

The Frog Prince