The Allure of Fictitious Value

Fictitious value is caused when we attempt to create value "out of thin air".

We have become so used to cash, that we think that it is real value.

Most of us are confident that the money and credit cards in our wallets and pockets will provide for us through thick and thin. We center our lives on chasing and amassing money. We gamble, hoping to win the big one. Schooling and careers are centered on the single goal; money! Yet our savings for that great desire we hold seems to be ever out of our reach as the grapes are forever just out of the reach of the fox in the myth. The harder we save the bigger the gap between what we have in finances and what we desire is worth. We extend our reach with loans, credits and promises that have no hope in being fulfilled ever. All our actions are coordinated around this paper god we have accepted as our lord and savior. We hold these values to be true, that money is the be all end all and that the bearer will receive real commodities on demand. There is a big deception going on of which most people are "blissfully" unaware.

Of all the varieties of value that exist as defined clearly by Karl Marx, the one that has the world in thrall unknown to most caught up in the captivity of the fetish, is fictitious value. Fictitious value arose from the universal commodity, money that became detached from real use value, value, labor value and the like. Original money was attached to a use value like gold, silver, copper, diamonds and precious stones and before this, cattle and food stores. Precious metals and stones were often used as universal commodities that took on a virtual form of what traders wanted and were not directly available through barter. Gold, silver, copper, diamonds and jewels became the proxy of the desired item that could be held until the real item became available. These were the original fetish and this was fact was born out and proven in numerous gold rushes in history. The universal commodity could be traded for what was really wanted when a trader with what we wanted appeared with the desired commodity. As all commodities are not universally available everywhere around the world, a universal commodity was useful to achieve it virtually. The universal commodity was fine if the value remained absolute and fixed around which all other values were relative.

The idea of paper currency came into existence because it was easier to carry than gold, silver and other values, which were easily stolen. As long as it was attached and fixed to an absolute value, then everything was fine, unless the script was changed and enforced by law. The old script lost all value in favor of the new script. This trick of stealing value is not used much any more, but a more subtle approach is used. If however, the paper currency was severed from the absolute value of a real universal commodity, then it lost its virtual fixed value and in essence became relative; relative because it could now fluctuate in value itself; and fluctuate wildly and widely. Further, competing bourgeois interests made all kinds of paper currencies, usually based on nation states. Being alienated from real value, it took on the quality of being a floating value compared to other alienated and floating currencies. Paper currency has allowed speculators to buy and trade only on these, thus creating a maelstrom of fictitious value as almost all of the value was removed by inflation and devaluation, something that is hard to do with a fixed and absolute value. This maelstrom has allowed for huge gains, but also disastrous losses. Real values can only be exchanged on an equal basis on agreement by both parties.

So then what is real value and fictitious value? Real value is based on something concrete, material and of immediate use or can be altered through labor to have immediate use for human needs such as eating, drinking, shelter, clothes, transportation, recording ideas and host of other things of direct use. Fictitious value is no value at all, based on nothing more substantial than trust and an idea of value. It has become abstracted from the concrete value it is supposed to represent. It is not founded in anything concrete at all. In fact, looking at a paper currency note we can say that the real value amounts only in the paper, the ink and the labor involved in printing it up. Look at a one dollar note and a thousand dollar note. Both require the same amount of paper, ink and labor value, yet the thousand dollar note is supposedly a thousand times more valuable than the dollar note. Yet there is no difference in the real value to make both from raw resources and labor value. They are identical except one says it is a thousand dollars and the other is a mere dollar. It is not fixed to anything real, nor is it real in value and the two are actually identical in real value, which is tiny compared to the fictitious part. Thus the larger the denomination, the more fictitious value it contains and less real value. This is what we have come to trust and this is the crux of our very real problems when it comes to using it to obtain real values as a universal commodity of trade, especially when they are speculated upon and fluctuate wildly in what they have in trading value and power. Differing fictitious valued currencies become relative to one another.

The fictitious bank note not fixed to anything is subject to all kinds of abuse, such as interest charges, inflation, devaluation, mass print run offs and crashes in value. It is also used as a tool to amass profit insofar as it can be speculated upon between various floating currencies. The fictitious currency being what it is, can also be used by speculators to buy real stocks, real fixed values like gold, real estate and other concrete material values.

As a society under the oligarch's scheme of profiteering, we have become well trained to accept the fetish of cash and have been deceived into its captive thrall. We really think in most cases that the money we earn has real value and struggle for all we can muster to obtain and save as much of it as possible. In the meantime, we use some to obtain the values that are essential to support life, and this enhances the myth of the real value of money. So obsessive is this drive that it becomes a psychological compulsion as addicting as drugs, tobacco, gambling, alcohol and the like. By and large, the compulsion is so great; it rivals sex as an attractor.

When tools like electronic transfer is used to move money from one account to another between a company CEO and an employee, money verges on becoming a numbers game. No bank notes are exchanged; only an electronic signal that the employee is entitled to X number of unit bank notes in his or her bank account from which they can draw at any time and obtain actual bank notes, which in themselves are fictitious value. Electronic banking has proven to be wide open to all kinds of electronic theft and skimming, scamming, phishing and so on. Almost everyone in the developed and industrial world works for fictitious value unless they get an additional perk like an actual car, a gift of chocolates, flowers, a watch or some other concrete object of real value. For the most part, payment is made through bank notes of one kind or another. In effect, labor is paid not in labor value, but in fictitious value. As it is, labor value is divided by capitalists into necessary value and surplus value. The necessary value is that part that is used to reproduce labor for the next round of work and the next generation of workers. The surplus is created by mechanization, longer work hours and the like. The worker is deceived that they are making and hourly wage that is a device used to extend the daily allowance for labor costs over the hours worked. It seemingly covers all the hours of work when in reality, only part of the work day is engaged for necessity and the rest is surplus which the CEO takes as their own. The worker is paid in fictitious value bank notes or increasingly in this age of computers, electronic deposit.

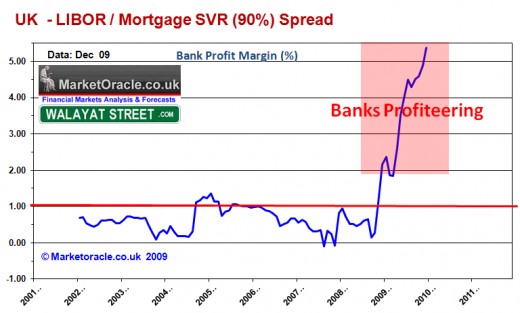

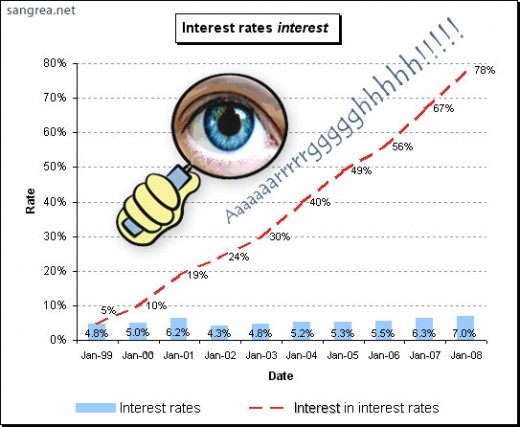

The nature of fictitious value allows for the use of Interest and factious value credit schemes. Interest, formerly called usury, is a way money lenders use in order to turn a profit off a timed loan. Usury was condemned in the Old Testament and Jesus overthrew money changes in the temple accusing the money changers of committing theft. So charging interest is by far from something new. Money lenders have improved the technique to turn a profit. Sometimes it can go terribly wrong such as in the sub-prime collapse of the fall of 2008 in the US. However the bankers were protected and bailed out, even though they kept all the payments of the mortgage until default and the real estate too. The person who was paying down the mortgage and defaulted wound up penniless on the street. The other way loans are made is through credit cards. Today credit charges can be used for anything and interest charges are often high, sometimes rivaling the old loan shark rates. The result is that credit card purchases inflate the cost of real values with added fictitious value that is profitable for the bank as long as payments are made and not in the full amount of the debt.

Inflation is one of the banes of modern existence that forever keeps the big ticket items out of our reach. Thus we are forced to take on the mortgage and loans on things like cars and boats. This has become so pervasive that loans are now offered on site for furniture and other household items. Every worker knows that wage increases seldom match inflation or "the rise in the cost of living". Often the worker continually falls behind. On top of this, the raise in wages is often blamed for inflation, but as of 2008, this lie has been demolished with heavy job losses and lowering wages in an era of high inflation. Inflation is especially hard and true for workers that are on a fixed minimum wage income along with pensioners on a fixed pension. Inflation puts everything further and further out of reach. Every worker is also familiar with the reality of price hikes that match wage increases and often surpass the wage increase. Capitalists don't like inflation as this slows down consumption and thus profit gathering.

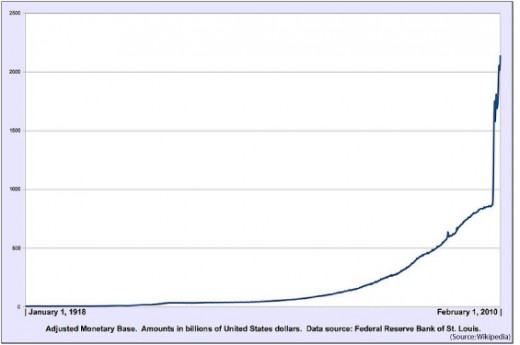

Devaluation results when the government is forced to multiply the money supply, such as in the market, bank and sub-prime bailouts of the 2008-2009 period in the US. In order to pay down bad debts and save the banks themselves from insolvency, the US government invoked the use of the Federal Reserve to print up vast sums of bank notes. No clearer example exists of the generation of value seemingly "out of the air", which is the clearest expression of fictitious value generation. The end result of printing all that extra cash is a major lessening of the value of all of it, which is mostly fictitious anyway for reasons detailed above. The result of mass print run offs exposes the true nature of fictitious value and how the entire working class is furtively stolen from legally en-masse. An example of this exists in history in the run up to Nazi Germany. At the conclusion of WWI, Germany was forced under the terms of the Versailles Treaty to pay punishing war reparations to the winners and at the same time they could not have heavy industry, especially if it could develop munitions. The result is that the government had to continually print ever more Reich marks and with each run the currency devalued. It got so bad that workers insisted in being paid every hour and it took a wheelbarrow full of Reich marks to buy a loaf of bread. The current collapse that has affected the entire world threatens to take us collectively down the same path. Yet, we are still captivated by the allure of fictitious value. Faith in the dollar remains unshaken at large, though governments may dump dollars in huge amounts during a panic.

Let’s look at this from another angle. Currency was once tied to gold as a standard of value. One this was severed, the currency floated along with other currencies going up and down in value relative to the others. For the US the severing took place under the Nixon administration in 1971 and the currency promptly devalued due to an economic crisis. If we look at gold standard dollars versus 2008 dollars we find that the 2008 dollar is worth only ten percent of the gold standard dollar. This means that 10 percent is real and 90 percent is phony or fictitious. Factor in the bailout of the projected 7.7 trillion dollars and that disparity will be something like 3 percent real and 97 percent fictitious.

Crashing economies are nothing new in the modern economy. The International Monetary Fund (IMF) and the World Bank were both created to deal with financing the economies of entire developing countries. Often loans were taken to pay off loans and the result ended where loans to pay down loans could even address the interest charges. This occurred in Bolivia and Mexico. The result is that bailouts in the form of buying up faltering currencies to prop them up were the means to keep whole countries from defaulting on loans. Here is fictitious value being run on an international scale.

So pervasive is money in our culture that it has become one of our main obsessions. Due to decreasing buying power of fictitious value currency many people are now forced to work longer hours and both man and wife work in order to "make ends meet". Still, we continue in the main to trust in fictitious value. There will come a point where all the effort that the worker can make will be insufficient to meet their necessities. But the equation does not escape on the capitalist’s side as well. The failure to sell surplus value is a formula for loss of profit and economic collapse. Left to its own, the whole thing will spiral into oblivion. The inherent contradictions of capitalist economy are made plain, but for the most part we are enthralled by the money method of economics.

The developing trend is to credit and e-money via internet in today’s market. The internet appears for all the experience to be the exercise of fictitious value in its ultimate form. It has become well known that most offers on the internet are scams and phony offers. Some figures suggest that 99 percent of all offers for financing, getting loans or schemes to get rich are devoid of real value and are means to get the neophyte to part with their money for nothing substantial in return. MLM schemes promise the world and usually deliver nothing, except an inferior or questionable product in some cases. Often this is not regulated and the net has been compared to the wild, wild west. At the bottom of it is fictitious value that is bidding for ever more fictitious value that presumably is being turned into real value by someone unseen and unknown.

Gambling on futures, the stock market, debts and so forth has resulted in the loss of savings, pensions jobs, etc. These represented the faith that the masses placed in various savings programs whether government bonds, career pensions, 401k pensions, stocks, bonds, securities and so on. Much of this has been destroyed due to banks and speculators investing and gambling on the strength of things like currencies based on nothing but fictitious value. Many are now left without everything they struggled a lifetime to achieve. Now they are faced to work until death, if health doesn't fail first.

Wealth and poverty go hand in hand though this is not recognized by many. We see them as separate, yet in an economy run mainly on fictitious value, wealth and poverty are two sides of the same societal coin. The practiced manipulator of fictitious value with the aid of the hired government is able to extract a lot of real value out of the chaos of a crashing economy. With timely trades and market manipulation they can move money in their own direction at the expense of the rest of the population, the workers, the unemployed, the aged and the sick people who become increasingly mired in poverty. With government help, the really big financial crisis gets a massive "welfare for the rich" bailout, while for the poor and the working people, it's "end welfare as we know it." Here is a towering monument to hypocrisy, especially when we hear mouthing and hand rubbing to the tune of "make poverty history" that keeps being pushed off into the future.

Hedges are offered as a means to protect one from inflation and these are often tied to real values. But hedges are often "leveraged" which translates that a ten percent fictitious value investment can control ten times as much in real value like gold. The current term for this is fractional reserve banking, where a ten percent reserve in the bank can control and allow ten times more in loans. To the uniformed this sounds great, but if real commodity prices collapse due to "no market", not only does the holder of the hedge lose the initial investment, but they are responsible for the whole. For some this has been a huge disaster placing them in instant massive debt and ultimate bankruptcy. The real bankrupt here due to all the fictitious value, is the capitalist system itself that has amassed fantastic wealth on the books that is not actual or real value.

The future gives us two choices; the one of real value and a planned economy based on concrete reality or one of desperation based on the fetish of fictitious value. If we continue our present course, we shall see ruin, the likes of which has never been seen. We are already seeing the outcome in many ruined lives, but we are being encouraged to stay the course with all its consequences of further debt, more devaluation, more misery, harder longer hours at work, people too poor to survive, disease, terrible wars and all the things that have been the hallmark of life for the 20th and now early 21st century.