American Dream: Tax Policy Part 1

IS THIS FAIR?

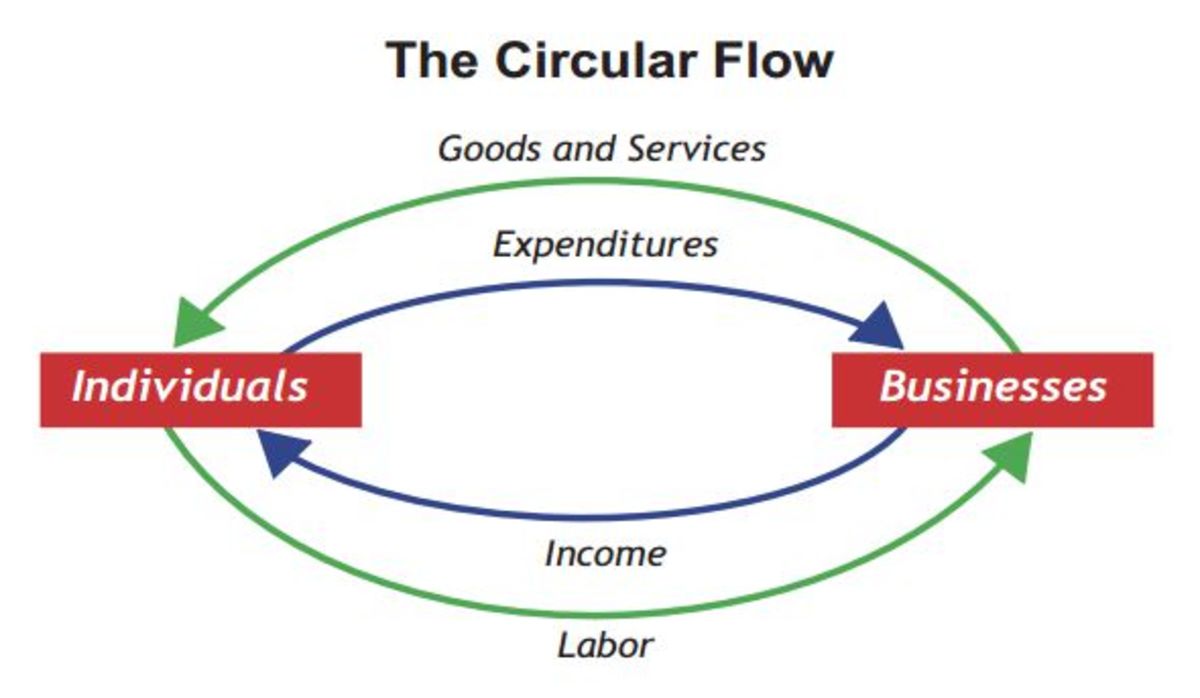

THIS HUB IS LOOKING FOR ANSWERS. For three years now, President Obama has been pushing for a slightly higher marginal tax rate on the wealthy to help pay down the deficit; his reasoning is that they can afford it. For just as long, Conservatives have successfully stopped this from happening arguing that raising taxes on the wealthy, even a little bit, will kill jobs because the wealthy will have a disincentive to invest their money in job producing investments.

Just recently, in the 2012 Republican Presidential Primary, the subject took on new life when Mitt Romney revealed that his effective tax rate on over $20 million in income was around 14% in 2010; this didn't sit well with many Americans, it really seemed unfair. It sure seemed unfair to me with my 19% effective tax rate on an income that was less than 1/100 of Romney's!

Why is Romney's rate so low and mine relatively higher? Because most of his income is taxed at capital gains rate of 15%, which, using the Conservative reasoning, is a reasonable rate given the benefit his "investments" provide America in terms of job and business growth. Well, in Mitt's, and people like him, case, this isn't really true. (Just as an aside, about half of Romney's income was in the form of a salary, just like you and I get, but it was a special salary. Because he was the manager of a particular type of investment company, a sort of a hedge fund, Congress created a special tax break for them; their pay is considered "carried interest" and is taxed at 15%; he managed other peoples money, he didn't invest his own money for this compensation! )

With this as background, let me get to my question about fairness relative to the rational Conservatives use to justify not raising taxes on the wealthy. I took my Turbo Tax and created these three very simple situations.

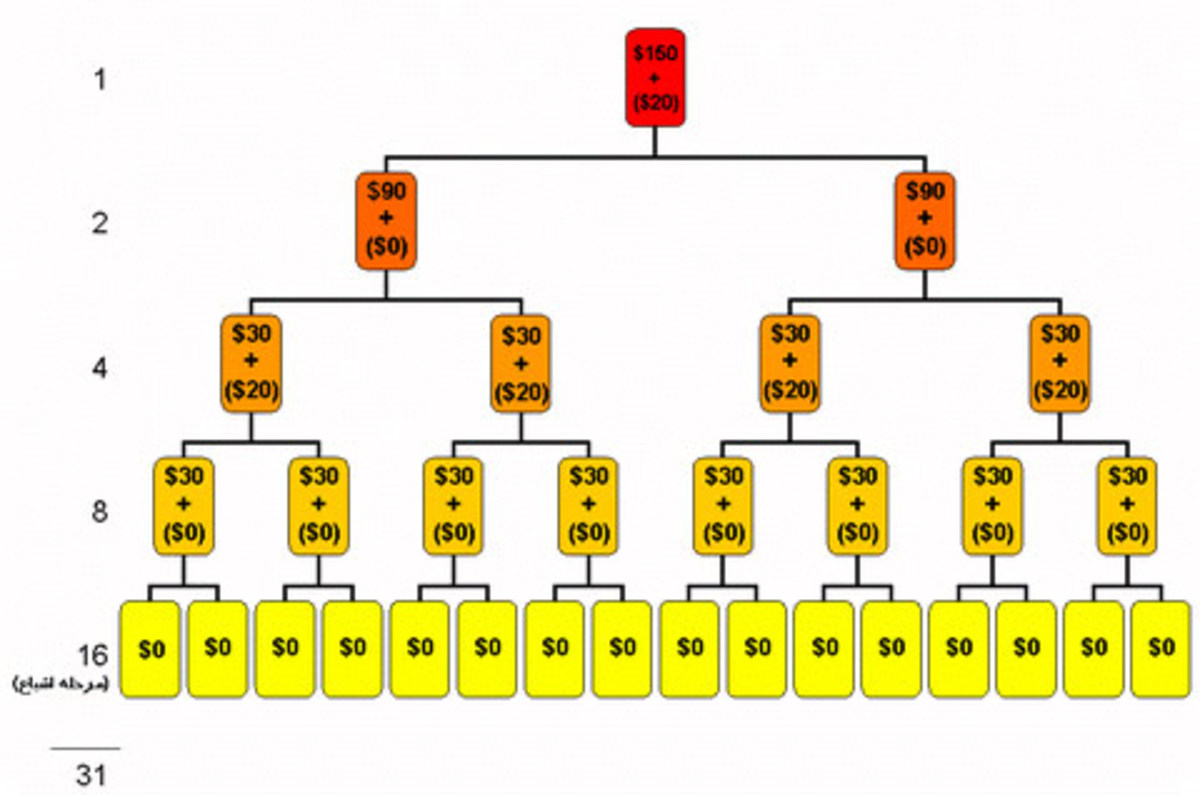

- Taxpayer 1 is married and earned $1,000,000 in interest from a savings account. That is it; no other income or deductions, just a spouse and $1,000,000 in interest. - This taxpayer will pay $319,424 or an effective tax rate of 31.9%

- Taxpayer 2 is married and earned $1,000,000 in capital gains from the sale of stock purchased on the New York stock exchange years ago. This taxpayer will pay $142,415 or an effective tax rate of 14.2%.

- Taxpayer 3 is married and earned $1,000,000 in qualified dividends from stock purchased on the New York stock exchange years ago. This taxpayer will pay $0 or an effective tax rate of 0%. (There may be a cap, but pretend there isn't for the moment because the example could be changed to pick a figure below the cap and make the same point.)

Conservative reasoning is this is fair; taxpayer 2 should pay the lower rate because it was an investment that created jobs, correct? Well, it could have been, but not in this case. If taxpayer 2 had bought the stock directly from Company A, then yes, a portion of that investment might have ended up creating jobs, but, that is not what happened in my scenario. Instead, taxpayer 2 bought the stock from someone else, not Company A; therefore Company A received no benefit from the investment, hence, no jobs. So, please let me know why taxpayer 2 should get a 15% tax break that taxpayer 1, or a normal wage earner, does not get? Is that really fair?

It gets even worse when you consider taxpayer 3; in this case there is no tax liability at all. The reason is Congress, in a desire to stimulate investment, exempted dividends from certain companies from being taxed. Again, like with taxpayer 2, the reasoning for this being fair is the same - most likely the party benefiting from the tax break did not actually "invest" in any company. Instead, they speculated.

© 2012 Scott Belford