The need to change the tax math calculations in Congress

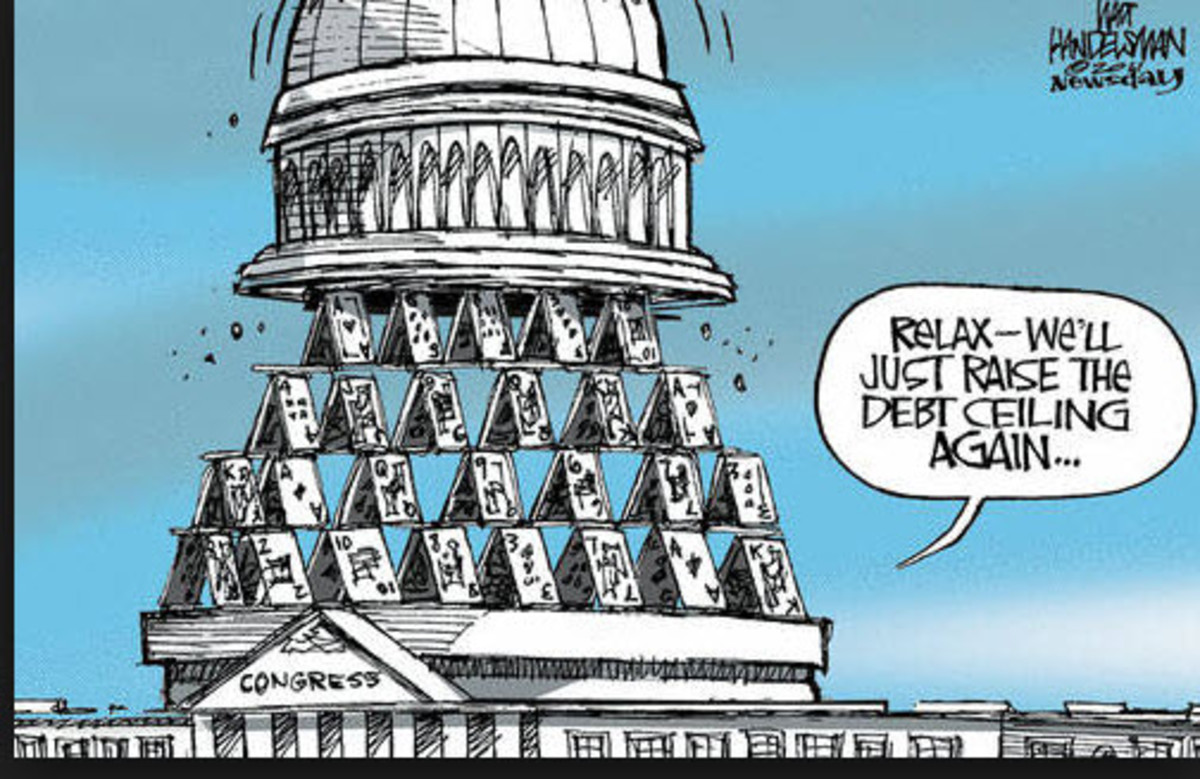

The actions of Congress in I do not know how many years has raised many questions for voters. The rules and actions in place for several committees in particular appears to be skewing the data to show what Congress wants to project rather than the real world situation and impacts on the economy. This relates to both positive and negative impacts and must be changed. A recent news event which seems to be drawing attention is related to the fact of the possible change in the control of Congress after the upcoming election.

A change in the control of Congress will potentially change the way one specific committee may operate. It is the Joint Committee on Taxation (JCT). This house committee along with the Senate Finance committee has specific responsibilities including statutory and Internal Revenue Code responsibilities. These responsibilities are provided below:

The statutorily prescribed duties of the Joint Committee are:

- To investigate the operation and effects of internal revenue taxes and the administration of such taxes;

- To investigate measures and methods for the simplification of such taxes;

- To make reports to the House Committee on Ways and Means and the Senate Committee on Finance (or to the House and the Senate) on the results of such investigations and studies and to make recommendations;2 and

- To review any proposed refund or credit of income or estate and gift taxes or certain other taxes set forth in Code section 6405 in excess of $2,000,000.3

Under Internal Revenue Code section 8021, the Joint Committee is empowered to:

- Obtain and inspect tax returns and return information (as specified in sec. 6103(f));

- Hold hearings, require attendance of witnesses and production of books, administer oaths, and take testimony;

- Procure printing and binding;

- Make necessary expenditures. In addition, section 8023 authorizes the Joint Committee (or the Chief of Staff), upon approval of the Chairman or Vice-Chairman, to secure tax returns, tax return information or data directly from the IRS or any other executive agency for the purpose of making investigations, reports, and studies relating to internal revenue tax matters, including investigations of the IRS's administration of the tax laws.

In addition to these functions that are specified in the Internal Revenue Code, the Congressional Budget Act of 19744 requires the Joint Committee to provide revenue estimates for all tax legislation considered by either the House or the Senate. Such estimates are the official Congressional estimates for reported tax legislation.5

The responsibilities as identified above clearly have an impact on any legislation being proposed involving the increase or decrease in revenue to the government. The method of calculation currently in place as to the impact of proposed changes is questionable at best. Specifically data is analyzed by the committee but all the data is not utilized in the conclusions presented. Data integrity is an important characteristic which should be a requirement of each and every committee in Congress along with the Executive Department. Sadly this does not appear to be the case.

Currently legislation which is proposes to rise or lower projected government revenues must be scored by the JCT usually over a 10 year period. The scores are based on projected alterations in taxpayer behavior due to tax law changes but not changes in the broad economy. Dynamic scoring or what Republicans refer it as reality based scoring which will include macroeconomic impacts in the JCT scores. Some of this data is collected by the committee but is never used in scoring the individual proposed legislation. Republicans hope incorporating dynamic scoring more centrally into JCT's work would produce scores that reflect claims that tax cuts sometimes pay for themselves by stimulating the economy and generating new government revenues. History supports this conclusion.

Understanding the scope of what is included in macroeconomic data is provided in the following definition from businessdictionary.com:

“Study of the behavior of the whole (aggregate) economies or economic systems instead of the behavior of individuals, individual firms, or markets (which is the domain of Microeconomics). Macroeconomics is concerned primarily with the forecasting of national income, through the analysis of major economic factors that show predictable patterns and trends, and of their influence on one another. These factors include level of employment/unemployment, gross national product (GNP), balance of payments position, and prices (deflation or inflation). Macroeconomics also covers role of fiscal and monetary policies, economic growth, and determination of consumption and investment levels.

Some of the information from the areas identified in the definition is already being collected but the data is not reflected in the scoring currently used by the JCT. It does not make sense to collect data with regards to scoring the impact of proposed legislation affecting taxes and not include it in the scoring place on proposed legislation. One of the obvious flaws with the current system is that the GDP (Gross National Product) is kept constant. If it is one thing that is not constant it is the GDP (domestic product). GDP measures the economy’s total output, how can this remain constant?

The impact on proposals affecting revenue to the government should not just include the amount of tax dollars that would be received. Changes in government income are not based on a reduction or increase in tax rates but activity of citizens and businesses across the country. When individuals have more money they tend to spend more which impacts income/profit of businesses causing more taxes to be paid.

.