Wealth Inequality or The Great Divide

A quick comment:

The issue of wealth and income inequality is a complex issue. In order to get a clear and concise picture of what is going on now, I had to examine what events led up to the loss of middle class wealth. Along the way I discovered even more factors which might have contributed to the Great Divide that is the gap of inequality. I needed to research them too. The end result is a 4,000+ word article. I toyed with the idea of breaking it into several smaller articles to make for easier reading. In the end I rejected that idea in favor of keeping the flow unbroken. The impact of the information gathered here would be lessened if I forced the reader to wait for links to connect and pages to load.

Political Hi-jackers

Americans have been hearing about inequality of one type or another since the inception of the United States as a nation in its own right. It's nothing new. However, it has gained popularity as a topic of discussion when debating political issues. In the 1960's and well into the 1970's, the fury was over the obvious fact that black Americans and women in general were not treated equally when it came to job procurement, wages, or having a voice in any field in which they had a vested interest, IE: anything.

Then in the second half of the 1970's, though immigration policies were tightened and more restrictive, there was an influx of Asian refugees arriving from their war torn homelands. It didn't take long for inequality of the individual interest groups to be lumped together and referred to simply as minorities. Through the years, the topic of inequality has targeted specific groups and causes, changing in importance dependent upon the agendas of the politicians and special interest groups.

Debating the topic of inequality is alive and well in 2011. But instead of placing attention on specific subcategories of inequality, our attention is being driven toward that of wealth and income inequality. As the economy continues to plummet (in spite of the untruths we are being fed), Americans are being whipped into a fury over the growing Great Divide between the “haves” and the “have nots”.

Who's doing the whipping? I like to refer to them as Political Hi-jackers. They are the ones who take a very real issue that concerns every American and turn it into a circus, used for gaining a following for their campaigns, the agenda of which is not even remotely connected to finding a solution to the issue they have hi-jacked. Suddenly, the issue is no longer a social issue, but a political one. It is now identified with the political factions involved, either in a negative light or a positive one, depending from which party perspective it is being viewed.

When the atmosphere of politics is so polluted with emotional finger pointing that it creates a diversion from basic American principles (those on which the country was founded) to that of party dominance, one must step back and take a look at the big picture. Consider what party dominance really means to those involved. Put frankly, it means control; control of the direction to be taken in governing the very people who put them in power. Control does not reside in peace beside teamwork. Effective leadership does.

In today's politically charged atmosphere, anyone with at least one functioning eye, can see how members of opposing parties have begun to view their opponents as the Devil's disciples. When one hears a Democrat make reference to the Republican Party, he can hear the venom dripping from his voice as he spits out the term “conservatives” as though the label is the worst form of condemnation known to mankind. The same is true for Republicans who refer to the Democratic Party with scathing remarks about liberalism.

On average, those who criticize Republicans do so because they view them as the henchmen of the wealthy elite. They are the guardians of greed, put into power by the ultra rich who wish to maintain their status at the expense of the poor. They are the takers. Speak to a Republican about the Democrat's practices, and they will spout off a spiel about how they're the bleeding hearts who will destroy this nation by catering to the lazy and unmotivated masses sucking the country dry through undeserved entitlement programs. They want to give it all away. They're the givers.

Opinions rooted in emotional perspectives such as these are irrational, immature, and a definite sign that perhaps neither party has what is necessary to move this country forward. Every married couple knows that any prolonged imbalance in giving and taking will result in divorce, destruction of the alliance. And before anyone chastises me about my inability to understand the “real” facts, just can it. Save it for someone who wants to hear it. I was a straight ticket Republican, raised in a Democrat based family, up until first Reagan, then Daddy Bush turned me. You Democrats can cease your smug satisfaction, too. There are just as many idiots in the Democratic Party as the Republican. I'm looking for a new party to form. Screw the Tea Party; too much preening before the media for barely concealed efforts designed strictly to grab headlines. No, I'd much rather see the emergence of the American Party, united in their efforts to turn this country around, regardless if the ideas come from the left or the right, so long as they are designed for doing what's correct and ethical.

On the subject of wealth and income inequality:

I've come across many articles and books, all expounding on the authors' opinions of what might be the cause, or whether such inequality truly does exist, for that matter. I never cease to be amazed at the plethora of ways in which the same data can be skewed or ignored in an effort to substantiate support for the view being presented. Black is black and white is white. Period. Trying to convince me that unemployment rates are dropping when businesses are closing, jobs are moving overseas, and the lines in front of welfare buildings are wrapping around the block is an insult to my intelligence. I am not stupid. Neither are my counterparts.

Exhausting unemployment benefits does not translate to those people being employed. What it means is that they have hit rock bottom. It means they are close to homelessness and starvation. It means that hope is rapidly evaporating. It means they are that much closer to acts of desperation, which of course means crime, violence, and even death.

For a long time, Republicans held that the gap in wealth between the rich and the poor was not widening. They insisted that the high taxes, by which they are so severely punished, is an equalizer of sorts. They have cried and cajoled over the unfairness of it all. I agree, though not to the notion that higher taxes are an equalizer.....not by a long shot. I agree that taking a larger percentage isn't fair. It certainly doesn't serve as a motivator encouraging people to work harder to earn more raises in pay. It only serves to punish them for doing so. I can recall a time when I actually asked my employer NOT to give me the very generous raise in salary he intended. I would be content with an added week of paid vacation. The higher salary would take me to a level where I would actually be losing money from my net take home pay. That should never happen to anyone, rich or poor.

Eventually, the numbers couldn't be disguised any longer. The gap has become so wide that even a hardcore Republican can't dispute the obvious. Instead, the tactics changed. Now, it's construed as being a GOOD thing, something that actually HELPS the economy by providing an example of how much wealth a person can achieve if he will only work that much harder, if he will only get an education. It provides incentive to achieve. Read between the lines: If you're not wealthy, it's because you don't work hard enough or you're not smart enough. No one's fault but yours or your family genetics.

The most recent ridiculous explanation I've read to date was on a site called “Reflections of a Rational Republican.” In the top right corner: “All of the Reason, None of the Rage.” It is one of the most irrational examples of reasoning I've had the misfortune of coming across in all of my 51 years. This clown titled his article “Rising Inequality and Associative Mating.”

According to the author, the rising inequality in the US is related to the concept of natural selection. Exact quote: “Smart people marry other smart people and have smart children.” There you have it again; if you're not wealthy, it's because you're not smart enough and there's nothing to be done about it by government action. Another half-baked view is that those with more “male-like” brains achieve higher status and income. So that takes care of the Glass Ceiling myth. Ladies, the reason you are paid less for doing the same job isn't because of sexist actions based on twisted perspectives, it's because you're not “male” enough. It's a matter of natural genetics, not man-made unequal treatment. You ladies who entered the traditionally “male” professions met your spouses in those professions. He doesn't come right out and say it, but he implies that any wealth you may have gained through your choice of profession was actually gained through marriage to another in the same profession.

Bozo ends his editorial by claiming that the offspring of these highly intelligent parents (who met in male professions) are naturally selected for higher paying jobs and more opportunities because of the intelligence they have so obviously inherited from their parents. He even attempts to legitimize the lack of empathy for the downtrodden by the wealthy as being attributed to this extremely high intelligence.

It is by far the most irrational, self-serving piece of rhetoric I've ever had the displeasure of reading. The truly scary part of the story is that there are many, many others just like him, who will read his trash and concur, feeling justified in their continued efforts at maintaining the status quo.

So what, then, is the reason for the widening gap? Let me first say what it is NOT. It isn't race or gender, nor single parenthood causing the problem. It isn't computers and technology that is the culprit. Studies done by several economists have shown the gaps between blacks and whites, and between the sexes have not really grown over the last 30 years. They haven't been reduced either, but in order for them to be responsible for causing the growing divide, they would have had to increase. They did not. While computers and other types of technology have reduced the need for human beings to fill certain types of positions, they have also created equal income producing positions to take their place, so it's a wash.

Immigration is responsible for the widening gap by about 5%.

Nobel-prizewinning economist Paul Samuelson outlined the effects immigration policy can have on income equality. When a restrictive policy is in force, wages remain high. When there is a liberal or more open policy in effect, wage inequality grows. The majority of immigrants take up low skill level jobs, creating competition for natives who are seeking employment. Such immigrants usually come from underdeveloped countries where conditions are much worse, therefore they are willing to work for less. And though there are certainly immigrants who come with a college degree in hand, they are fewer and not enough to create competition for the wealthy who actually work a job. Pay rates in these top levels are not adversely effected by educated immigrants.

Taxation policies and rates are responsible for another 5% of the gap.

Since the Great Depression, the top tax bracket, stood at or above 70%. During the 1950's through the early 1960's the top bracket was more than 90%. These high rates of taxation, waged against top earners were in effect during booming economic times, and inequality dwindled as a result. Once Reagan came to office, the top tax bracken was reduced from 70% to 50%, eventually landing at 28%. Since then it has moved back and forth between 30% and 40%.

Anyone who has computed their personal income taxes using forms other than the 1040-A knows there is more than just wages from a job to be considered when determining personal tax liability. In addition to wages, there's income from investments, businesses, and interest to be considered in computing total income. By the same token, there are tax credits, and special calculations used to reduce the raw numbers to a final amount of taxes owed/paid. Tax policies are what determine how much income is claimed. They also determine how much it is reduced and by what means of reduction. When Reagan took office, the effective tax rate on the top 1% (extremely rich people) was 42.9% and 32.2% by the time he left, according to the Congressional Budget Office.

There are more ways than one to define the three classes of rich, poor, and middle class. The same data used to define effective tax rates has been used by a number of economists who say those tax rates have gone up, in direct opposition to the earlier stated findings above. The point is that the fluctuations, whether up or down, serve to demonstrate that it's not so easy to prove the huge impact with which tax rates have been credited. Paul Krugman, Princeton economist and New York Times columnist, and the author of “The Conscience of a Liberal” has concluded that the largest sources of rising inequality can be found by charting correlations between what the government has or has not done in relation to economic trends and political ones.

Trade and trade policies are responsible for 10% of the Great Divide.

Twenty years ago, the British economist Adrian Wood argued that trade with underdeveloped countries would lower wages for unskilled workers in the developed nation. He reasoned that a bevy of low wage earners in such countries would result in higher levels of goods importation, leading to bigger drops in manufacturing employment for the nation importing the goods.

At the time, other leading economists didn't believe it because goods from low wage countries accounted for only 3% of gross domestic product. Wood was adamant in his argument that the effects were subtle and indirect. Ten years later opinions shifted. In 2006, the United States was importing more manufactured goods from underdeveloped nations than from other more advanced ones. The wages for workers in the two countries most responsible for increased trade were China and Mexico. China only paid its workers 11% of what American workers received for the same job, while Mexico paid a paltry 3%.

The decline of labor is responsible for 20% of the Great Divide.

There was and has continued to be a glaring coincidence of timing in the events of the widening gap of inequality and the decline of organized labor. Union members now only account for 7.5% of the workforce, a reduction of 4.5%.

Thirty years ago, economists believed that unions were responsible for driving the prices of wages up, which one might conclude is the reason for the growing divide. Harvard economist Richard Freeman disabused anyone of that notion in 1980. He demonstrated how the higher wages among higher paid union workers and those of the lower paid union workers had the effects wiped out by their ability to effectively reduce income disparity. David Card, a Berkeley economist, calculated in 2001 that the decline in membership accounted for 15%-20% of inequality among men, though women were not a factor as their membership had remained stable.

Though David Card's calculation may be correct as far as the declining memberships themselves, he missed the mark from another perspective. Following WWII, President Harry Truman in an attempt to soften the abrupt changes about to be made in the labor market in the advent of returning soldiers, convened a summit in Detroit in November of 1945. In an effort to minimize disruptions in the labor force, he promised continued governmental support. The result was a five year contract between United Auto Workers and the big three automakers which included cost of living adjustments, productivity based wages, health insurance, and guaranteed pension plans. It was dubbed the Treaty of Detroit and adopted by other industries, even non-union ones.

The treaty was short lived once the Republicans gained majorities in the House and Senate soon after. They were quick to pass the Taft-Harley Act over Truman's 1947 veto. The act outlawed mass picketing, secondary strikes of neutral employers, and sit downs. It slowed down any new organizing by removing the method of card checks. When organizing a union, cards were issued to employees who were pro-union, authorizing a union to negotiate and speak for them. Instead, the Act required hearings and periods of campaigning, and secret ballots, creating controversy over the likelihood that potential union members would be intimidated into not voting for the union, since he'd be under the influence of his employer for many hours of the day.

The Taft-Harley Act also allowed employers to pull employees aside in a private meeting for the purpose of threatening and chastising anyone who wanted to organize. As inflation began to escalate at frantic paces in the late 1960's/early 1970's, a new breed of labor consultants began convincing employers that they could fire workers at will, fire them deliberately for exercising their legal rights, and nothing would happen. The last nail in the coffin of the Treaty of Detroit was pounded into place when the Senate filibustered a pro-labor reform bill aimed at easing union organizing in the south. The final shovel of dirt was dumped with Reagan's choice to break the air-traffic controllers' union and to slash top income-tax rates.

During Reagan's two terms in office, the federal minimum wage remained stationary at $3.35 an hour for almost a full decade. Previously it had been adjusted upward every 1-2 years. Later, with George W. Bush in the oval office, the $5.15 minimum set during the Clinton Administration would remain in tact for another ten years. It's buying power had reached an all time 51 year low.

Raising the minimum wage does reduce income equality, but to a rather negligible degree. Some would agree the increased cost of labor is passed on to the consumer through higher prices. And while these statements may be somewhat true as stand-alone's, their impact is rather flat. Individual policy setting is generally linked to an entire platform or program, designed to achieve a set of goals. When faced with issues of finance, labor, immigration, etc..the end results are not etched in stone. Crises and failures can always be traced back to the policies embraced which may have set events into motion, as well as being put into action at the height of the crisis. Income inequality was not inevitable in the United States. Other industrialized nations faced similar problems but enacted different policies, which led to a different outcome.

A number of failures in our education system contributed 30% to the ever widening gap in distribution of wealth and income.

As computer technology crept into every area of our lives, it wiped out a need for many moderately skilled jobs, but it increased the demand for college educated workers . There were great strides in all types of technology that created additional demand for the degree'd employees.

During technology and industrial booms prior to the mid-20th century, the education system was able to increase the supply of better educated workers. In other words, it was able to streamline the educational curriculum with the demand, graduating better educated workers able to do the work required. By the middle of the 20th century, educational achievements were stagnant. Graduates entering the workforce were less prepared than those going before them. Just when the labor sector needed smarter employees, Americans got dumber. We weren't able to learn as quickly as others had during earlier similar technology booms. We also weren't learning as quickly as those in other industrialized nations. The inability to find amply educated employees drove wages up for those with college and advanced degrees, creating a bidding war type atmosphere.

During the first half of the 20th century, education was much different than in the latter half. By 1933 most high school aged students actually attended government funded high school. These schools differed from other earlier models in that they weren't just designed for those going on to college. Their purpose was to educate everyone. Only 8% of the workforce had college degrees in 1950. By 2005 the number had changed to 71% having at least some college, 32% having a degree. Government had a hand in raising these numbers through development of the 1944 G.I. Bill and the National Defense Education Act.

From 1900 through the middle 70's incomes became drastically more equal, proving that education served to level the playing field for workers entering the workforce. The change in direction took place around the mid-70's at the same time as educational achievement was beginning to stagnate. While the Vietnam war raged, students flocked to colleges in order to receive a deferral from active duty. When the draft was ended in 1973, the quantity of college graduates who began entering the workforce served to lower the previously inflated wages earned by predecessors.

A book titled “The Overeducated American” hit the stands in 1976. It made the argument that a college education no longer provided the monetary return on investment it once had. With the draft gone, would be soldiers didn't have to enter college to avoid the soldiering life, but the once swelled ranks of baby boomer students was dwindling. The demand for college graduates began to grow again and has been growing ever since, accounting for 2/3 of the increase in income inequality during the widening gap.

Why the increase in the gap if all students are continuing to receive the educations of earlier generations? The truth is that they're not receiving the same educations because the quality of education in the elementary, middle, and high school levels has deteriorated. Another equally important fact is that a college education is fast moving out of the reach of the average student.

Wall Street and corporate boards are responsible for 30% of the Great Divide.

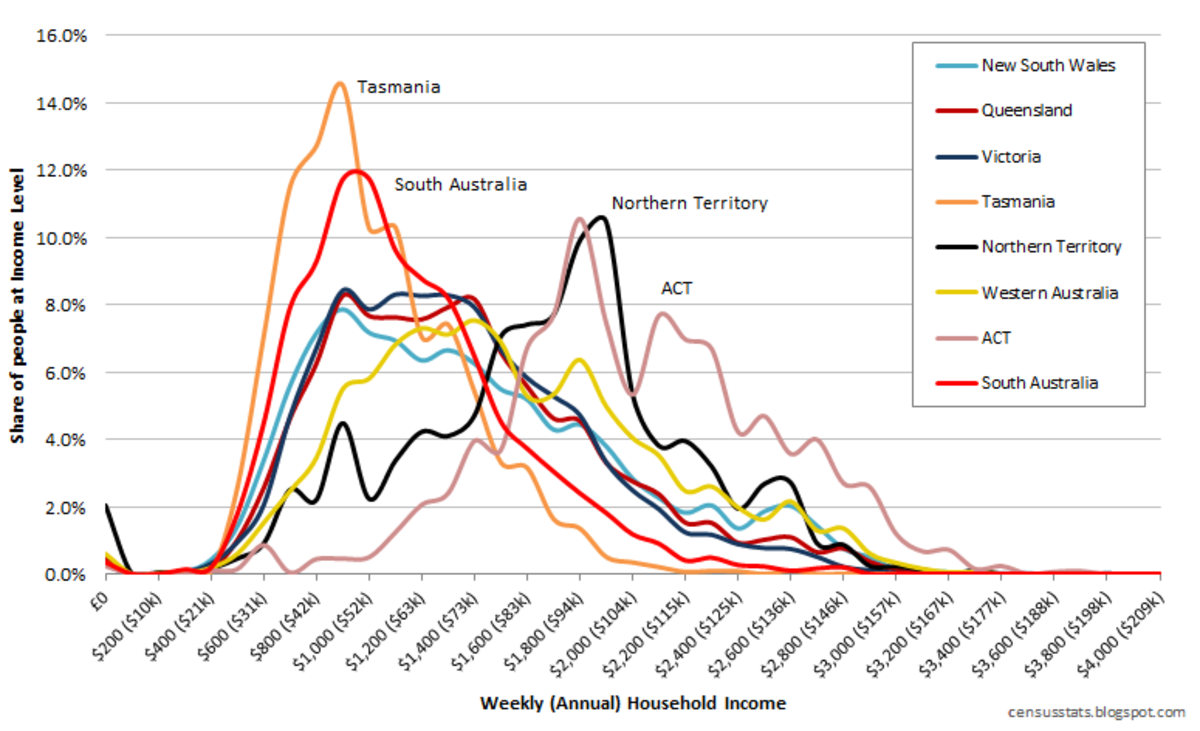

Figures from 2007 (the latest currently available) paint an alarming picture of financial wealth distribution in the United States. The top 20% of the population possess 93% of the wealth with the top 1% holding 42.3%. That leaves a whopping 7% of the nation's wealth to be shared by 80% of the population. The inequality of distribution is staggering!

For the top oner's (1%) the average annual income is $7 million, the majority of whom work in finance. Those not involved in finance are of the corporate or entertainment fields, as are many of the next 19%. The finance sector enjoyed a rise in corporate profits from less than 10% in 1979 to more than 40% in latter years. Government deregulation in the finance industry was a major factor in the obscene escalation of profits. Another factor to be considered is the accepted practice of job jumping. Corporate executives who have some proven track record, a bit of experience, and a degree from a prestigious University are the recipients of an extravagant salary, benefits, and bonus packages offered in an effort to romance them away from a competitor. The more wealth they create through good leadership, the more they are financially appreciated by the shareholders.

They are also rewarded based on how much of the wealth they are able to keep out of the hands of the government. They will head up efforts to ferret out every tax reducing policy, every single expense down to a rubber band, every penny dropped in the interest of holding on to the cash. This is as it should be. It takes money to make money that's taxable.

However, the exploitation of policies put in place for the purpose of employing fair taxation practices is despicable. Setting up phoney “store front” corporate addresses in non-taxing foreign countries and territories is nothing less than fraud and income tax evasion. Shuffling money earned in the US into foreign accounts for the sake of “deferring” taxation is still fraud and income tax evasion. They are crimes. Using the accumulated wealth to purchase Senators and other government officials to support their illegal income tax evasion is an act of conspiracy to commit a crime, as well as bribing an official, among other equally unlawful acts.

This last piece of the puzzle, in my opinion, is the most unforgivable. It represents willful manipulation of financial markets for the sake of further enrichment of the extremely wealthy at the expense of millions of Americans. It represents protectionism of self-serving practices which drives the price of goods up, while decreasing wages for the lower level employees. It ignores the very real trickle down effect born of impoverishing the middle classes. It represents the hoarding of wealth for the very limited few in order to attain power and control of the masses.

Proponents of this trend and the methods employed will parrot the phrase that it's the capitalist way, therefore, the American way. No, it's not. It is self-serving greed and avarice, dressed up as some noble attempt at doing what's best for a dying economy. It is pseudo Patriotism and there is nothing American about it.

If you found this information helpful, please pass it on by clicking the Tweet, Like, or +1 button provided at the top of the page.

- The Dismantling of American Liberties - Act I

Part 1 of a three part series aimed at explaining how we arrived at our loss of liberties through deception, manipulation, and greed. The dismantling of our American liberties began in ernest with the inception of the CIA in 1947 and has continued on - Middle Aged Americans Are Losing Their Quality Of Life

Middle Aged Americans Are Losing Their Quality of Life chronicles a dozen years in the life of one middle aged woman. Within the contents is shown how the economy has taken its toll, creating a situation where two full time jobs are required to barel - American Corporations: The New Slave Masters

Corporations crying over the high tax rates levied against them, have continued to move American jobs overseas. The question begs to be asked whether a 30% foreign tax rate truly makes the difference over the 35% American rate, or if the true lure is - Outsourcing The American Dream

Unemployment is rising despite government's attempt at reworking the numbers to exclude those whose benefits have run out. The fact remains that the United States has been bleeding hundreds of thousands of jobs. The culprit? American Corporations hun - Tax Scams And Corporate America

Corporate America is angling for another tax holiday for the repatriation of an accumulated $1 trillion in off-shore profits. Promises of job creation, research and development, and domestic investments head the list of what they claim they will do w