Financial Markets Prediction: 2016--2018 Start of Major Financial Tragedy

Could the U.S. and the rest of the world be headed for a dire financial crisis, one that could even dwarf the most recent economic downturn, which is considered to be the worst since the great depression?

Although we mostly avoid mundane predictions such as international policy/economic concerns and earthquakes, and focus instead on private individuals and business consulting, since the late 1990s we’ve repeatedly noticed distinct, extremely off-putting cyclical timing patterns (negative or positive extremes are easy to spot) in the comprehensive charts of countless individuals and entities that alert us to a specific period of time in the future.

We’ve been saying for years that we believe the period of 2016-2018 is the start of an overwhelming financial crisis, possibly much worse than the 2000/2001 stock market collapse, and the 2008/2009 credit crisis. 2016 appears to be the peak of the financial markets and economic escalation, with the giant reverse beginning as early as 2016 and as late as 2018, but more likely as late as 2017.

An aside, from our perspective it’s much, much easier to assess financial prospects of individuals versus financial markets, corporate entities, entire economies, etc.; during economic calamities some individuals fare worse than others, and the degree is reflected in the patterns of their unique comprehensive charts including the checks and balances of our systems of analysis. The red-flagged time-frame of 2016--2018 has appeared over and over in so many charts that we have to bring it to your attention.

Please note, to be taken seriously, in our view, any professional making mundane predictions must list all public predictions--the ones they got wrong and right, on their website. No one is 100% accurate, but there must be a clear record of their successes and failures. Unfortunately, highlighting the hits exclusively and fabricating the successes is all too common in the professional psychic industry (and financial investment industry).

Our view is that there will be temporary downturns during the next major long-term upswing in the financial markets, which we believe will start as early as late 2010. By late 2011, the U.S. financial markets will have begun a dramatic, long-term escalation, but of course you will see occasional, now-common, heavy volatility along the way.

If you find yourself asking from 2011 through 2015 if a particular financial markets’ correction is the culminating collapse that will finally lead to feasible government policies (unlike the current ones) being put into action, it won’t be. You’ll know when the concluding crash happens and you won’t have to ask. It will be that big.

We believe that between 2011 and 2016-2018 will be known as the roaring teens period for the financial markets (especially the U.S. markets), and thus for the world’s major economies, and that many people will forget about the fact that booms frequently end in busts, especially when the foundation of the recovery is built on unsustainable economic policies.

What will cause the disaster in 2016--2018?

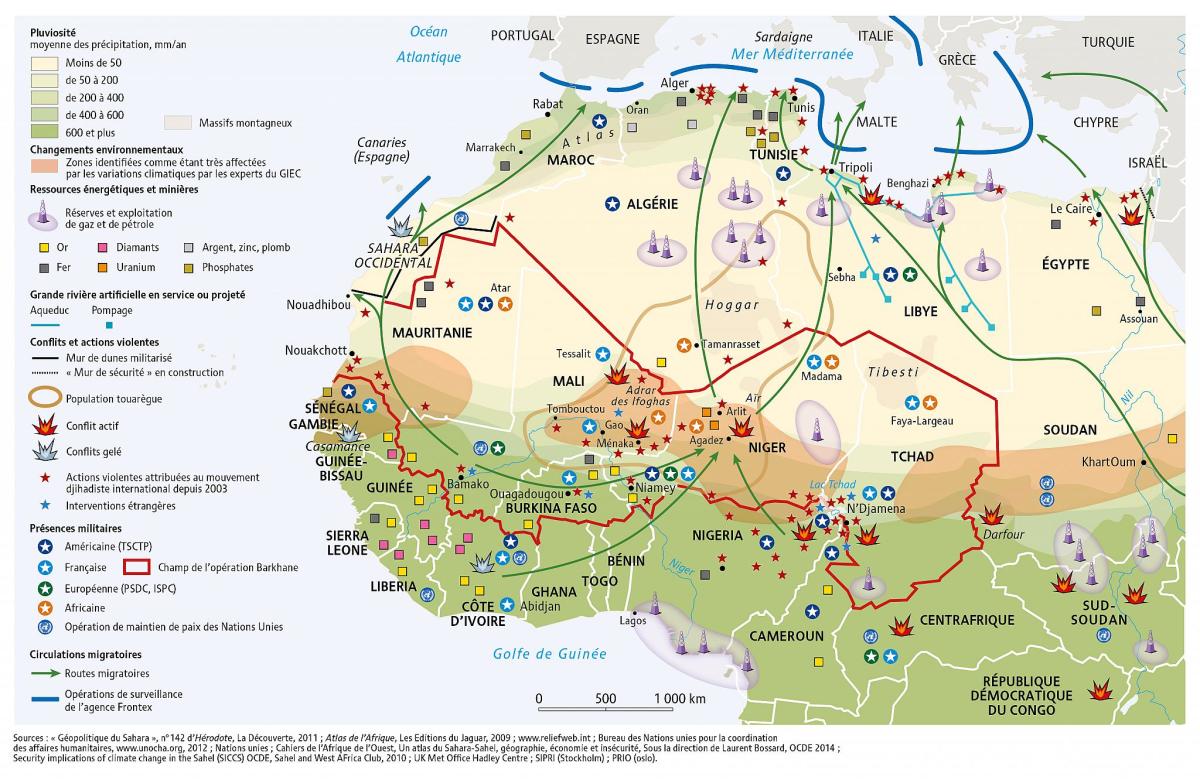

What’s currently happening in Greece may foretell the imminent. The Greek government has been spending and borrowing way beyond its means for years, is being suffocated by debt, and is all but bankrupt. 25% of the Greek workforce are government employees and many have fat pensions and full retirement benefits: 14% of Greeks are government early retirees (at age 50 for women and 55 for men), with the average retirement age of 61. Unfortunately, too many Greeks have become used to excessive government entitlement programs and since such programs have to be downsized to deal with economic reality, they are outraged.

Why Greece Isn’t Really Saved

Although many financial experts are now saying the Greek Tragedy has been averted with a financial rescue plan by the International Monetary Fund and the European Union, Simon Black, Senior Editor of the website SovereignMan, says, “...anyone with two brain cells to rub together recognizes that Europe’s economic woes cannot be contained with more paper money... and now the problem just became $1 trillion worse.”

“Battling back from an economic crisis requires hard work, savings, and minimal disruption from the government. There’s no magic pill, entitlement program, or paper money bomb that will suddenly make things better.”

“Instead, governments should be curtailing social benefits that encourage people to be lazy, while simultaneously stripping taxes to the bare bones in order to give entrepreneurs and investors the proper motivation to work hard, take risks, and hire employees.”

“These things are not happening, nor will they ever happen in the foreseeable future. And so, backed by Europe’s trillion dollar pledge, Greece will likely go back to business as usual... spending money that it doesn’t have, and making its problems exponentially worse.”

The U.S. is on the Same Path

Even though the European debt crisis may appear to be under control by the end of 2010, it’s to be expected that Europe, including Greece, America, and Japan are heading for a financial brick wall with government spending and regulations out of control and funny-money solutions. The causes of previous financial crises mirror how politicians are handling the problems now, which will only serve to create the next crisis.

Although the overall message we relay here isn’t very optimistic, everything is cyclical, and there will be more prosperous times after the coming financial catastrophe we speak of. We believe that the U.S. won’t cease to exist for at least another 200 years, and the U.S. will likely shock many with its resiliency and subsequent economic triumphs.

The root (or at least a major part) of the next financial calamity, as outlined above by Simon Black, now seems obvious. It is clear to us that the world’s governments will not have the foresight or ability to act and change the path we’re on until after the next huge disaster.

Just keep this in mind when the financial markets are soaring in the upcoming years: When things look too good to be true, remember that they usually are. Capitalize on the trends, but avoid excessive risk.

Copyright © 2010 Scott Petullo, Stephen Petullo