Why You Want Traveler's Insurance

by Kathy Batesel

How and When to Purchase a Trip Insurance Policy

If you're anything like me, you see insurance policies as a gamble of sorts. Whether it's life insurance, health insurance, auto coverage, or travel insurance, paying for a policy is making a bet that the worst can happen. Since it only pays when the worst does happen, we lose money when things go well. On the other hand, when unexpected events come into play, the consequences can provide disastrous if we haven't anticipated how to handle them.

I never purchased traveler's insurance for trips I made. It didn't matter if I was driving or flying, staying in the U.S. or heading outside its borders. I'd been offered coverage at car rental companies and airlines, and always said, "No thanks, I won't need it."

Then I was assigned to write an article about people who had purchased traveler coverage, and I found myself realizing how many times I had dealt with similar problems. I realized how much easier and less expensive dealing with the "little things" would have been. From now on, you can bet I'll be getting travel insurance before every vacation I take!

Before you head out for your annual vacation, take a look at some things that can happen to anyone....

What Kind of Vacation Do You Like Best?

Click thumbnail to view full-size

Travel Tips

What Does Travel Insurance Cover?

Trip insurance can cover a range of problems that commonly arise at any time between the moment you start making plans and the time you return home from vacation. About one in six people who purchase a travel policy end up filing a claim, so these events may be more common than you might think:

- Ticket cancellations due to your own circumstances or external influences like airline delays. Imagine planning a cruise and a week before it's scheduled to begin, the cruise company cancels the itinerary for some reason. Will you lose the $500 you spent on airline tickets to reach the departure port? When I planned a trip to Chicago and my ticket was cancelled due to bad weather, I was stressed and worried. I'd purchased my ticket as an economy fare, which meant it would not be refunded. If the plane couldn't take off within a day and return on time, I would lose my money and forfeit my trip, or else risk losing my job. Travel insurance would have ensured that I wouldn't have lost money and could reschedule my trip later, but I didn't have any!

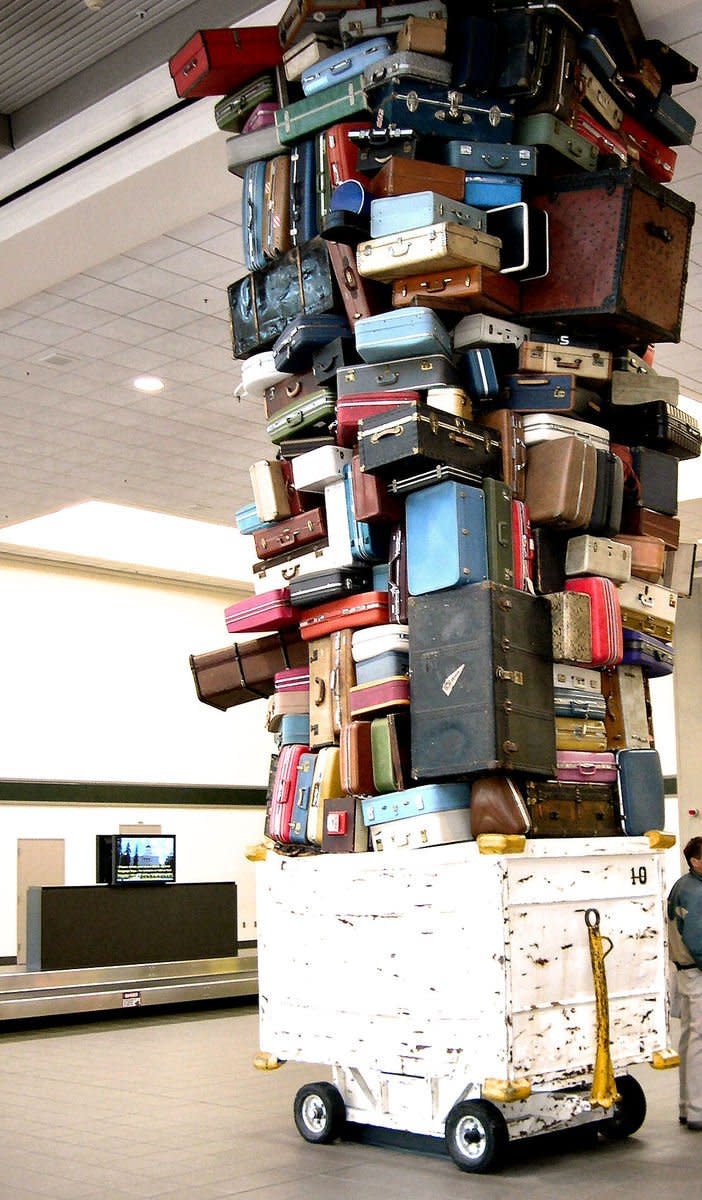

- Delays like lost baggage or ticketing changes can result in extra hotel stays and purchases of clothing, hygeine items, and other seemingly "small ticket" items. One year, I bought tickets for my daughters to visit me in Georgia. They were flying as unaccompanied minors, which meant that an airline attendant was assigned to watch over them throughout the trip. They had a layover in Atlanta before they would be able to transfer to the plane that would get them to my nearest airport. Atlanta was about four hours from my home. Unfortunately, their flight was delayed for several hours and landed too late in the evening for them to get onto another plane. Although the airline offered to put them in a hotel overnight, I didn't feel ok with the idea of them spending a night in a hotel with a complete stranger! I drove four hours to pick them up, only to discover their luggage had been on a different plane. Traveller's insurance would have enabled me to pick up clothing for them until they could get their baggage, and would have made it easier to get them by reimbursing my expenses or paying for another safe form of transportation instead of putting them at risk.

- Medical emergencies. We've all had them, but how many of us expected them before they happened? Illnesses, physical conditions like appendicities, injuries, and allergies can all strike unexpectedly and incur high medical costs. Many health insurance policies either don't cover or provide very little help for non-network providers, much less overseas! I had always thought medical coverage would transfer out of the U.S., but it turns out that I was wrong. Some policies do, but many do not.

- Interruptions can prove costly, too. Bad weather, political events, and personal emergencies can force vacationers to abandon their trip or undergo evacuation. Travel insurance can reimburse expenses so that you can reschedule your vacation at a later date.

- Other losses, like those due to theft, may be eligible in some policies. My brother-in-law was glad he had a policy when his wallet was stolen when he travelled to Greece. Even though he'd left most of his traveller's checks in his hotel room, thieves made off with a few hundred dollars, his driver's license, and his credit cards. He was able to get reimbursed for his losses because he'd bought a full coverage policy.

An added advantage to having a trip policy while on vacation is that you can get phone assistance to handle these kinds of problems. Your insurance company can help you locate a doctor, find a police station, replace prescriptions, and provide other services if you need them.

What Do YOU Do?

Do you normally purchase travel insurance when you vacation?

If You Buy Traveler's Insurance

If you and in good health and taking only a short, weekend trip to an area with low risks, you might decide to forgo spending for insurance. You may have great medical insurance coverage that covers you no matter what happens, and perhaps you've got enough cashola to pay for extra nights in a hotel room and cover the cost of extra tickets if the worst happens. On the other hand, since policies really don't cost much - a few dollars a day - the peace of mind might be worthwhile.

To be certain you're getting the coverage you think you are, pay attention to these details:

- Verify that your insurance company is a good one. Look up its Standard and Poor's rating on Insure.com before you buy. (I personally only choose companies with ratings of AA or AAA, because years ago I had a problem filing a claim with a company that closed its doors despite its A rating.)

- If you have pre-existing conditions, verify in the policy that they won't interfere with your coverage. Don't simply rely on what a sales agent tells you.

- If you have special needs, such as children or pets travelling with you, business needs that could require you to locate equipment, or you plan to take part in sporting activities, ensure the policy doesn't have exclusions or limitations that can result in denial of claims.

- Other limitations can restrict the reasons that your company will pay for cancellations, delays, and medical treatments, so review the policy's exclusions to verify whether you'll have extensive coverage or limited coverage. (I recommend getting a no-limits policy whenever possible, since the cost of travel insurance is reasonably low in the first place.)

You may have to purchase additional riders to get precisely the coverage you need. A rider is an extra clause that is added to your policy to provide more coverage than the basic one has. They're usually provided at a low cost.

Have you filed a travel insurance claim before?

One Way to Compare Online Policies for Families

When You Buy Insurance Online or Off

There are three main ways to buy traveler's insurance:

When you purchase tickets to travel, your airline or cruise company may offer you a policy from one of their strategic partners. This is convenient, but you may not get the best price and if you have a problem later, airlines and cruise companies have been known to say, "Not my problem" if your policy declines your claim for something that should have been covered.

Some people contact the insurance agent they work with on their other policies. This can be a good option because they know their agent and are already familiar with how the company works. The primary consideration when working with a familiar company is whether they provide trip insurance as one of their specialities or merely as an offshoot of their regular business. If they're not well-established in the travel insurance field, you may not get the same level of quality service if you need help or have to file a claim later.

The third way to purchase is to compare policies and prices online. Every policy will have slight variations, so it's important to review the bullet points I listed above to make certain you get what you need for your vacation. Don't forget to check their ratings and coverage!

Trip Preparation - Tips and Ideas

- Riding an Amtrak Train Overnight Tips for First-Time Rail Travelers

Traveling overnight on an Amtrak train can be an unusual, enjoyable, and even exciting adventure. Hopefully, some of the tips in this article will be helpful if and when you decide to try this unique travel experience. - My Top 10 Tips For Traveling Alone Around The World

In 2004 I took a trip around the world, but only gave myself a few weeks to plan everything, so I learned lot of lessons the hard way! Based on what I learned, here are the best tips I can give to anyone else who has this itch and decides it's time t - Beach Vacation Checklist

We maintain a master vacation check list. We add or subtract items based on each vacation we are taking. Consider using our checklists as a starting point and save time and stress during your vacation planning!