- HubPages»

- Business and Employment»

- Small Businesses & Entrepreneurs»

- Entrepreneurship

6 Finance Tips for Start-up Business Owners

So you’ve taken the leap from the daily grind to becoming your own boss and are inspired by the challenges that lie ahead. One of the most crucial components to surviving in start-up land is getting your financial ducks in a row. Here are seven rules to guide you for long-term business success and commercial stability.

1. Pricing your product or service

Managing to turn a profit, whilst being competitive and remaining true to your brand is a mark many business owners often fall short of hitting. It all comes down to pricing your product or service correctly through determining an honest pricing objective. This will impact how you make decisions about business costs one day to the next. Pricing objectives can be defined as the following:

- Sales and finance targets.

- Profit and/or cash flow targets.

- Product positioning in the industry.

Pricing strategies are easy to come by online. The Department of Innovation, Industry and Science is a rich hub of information on this topic with comprehensive reading material outlining pricing strategies, should you need it.

2. Monitor your budget and expenses

The second rule of financial start-up success is laying the foundations to monitor cash flow. It’s understandable that the early stages of business will be a test of patience and character, yet this shouldn’t stand in the way of your creating a budget and maintaining daily spend.

Software and apps like Mint which track account usage and spending are a lifeline if you are feeling overburdened by money matters, and assist even if you operate an established enterprise but are time-poor or don’t have access to a financial planner on a regular basis.

Keeping tabs on your balance sheet helps you to identify trouble areas and show you where you’re spending too much. Similarly, online tools like Evernote are ideal for storing important documents such as receipts and invoices and in one place for added convenience with easy access.

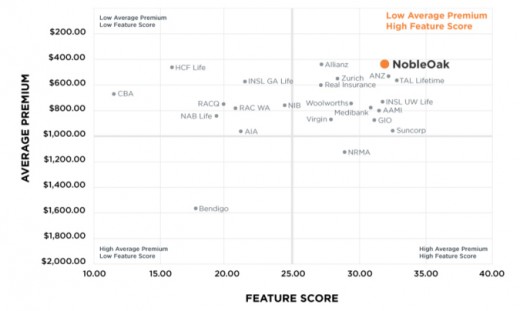

3. Take out insurance

How would you and your loved ones cope financially if you could no longer work and provide a fixed income? Getting insurance for your life or business serves to eliminate that very real risk.

Insurance products, such as income protection and business expense insurance work by paying a sum of money to you or a beneficiary in case the inevitable happens. This can range from simple accidents and injury in the workplace to the worst case scenario of death. It’s important to undertake due diligence to compare premiums from major insurers to access the most suitable cover.

In setting up a new company you may also want to integrate workers compensation insurance and liability insurance into your plan of operations.

4. Automate your business accounting

If taking on the responsibility of managing your own finances look to consolidate smaller administrative tasks by using automated systems and software programs. Freeing up your time with accountancy leaves you more wiggle room and less stress for attending to other important areas of business.

The internet is a goldmine for software resources and guidance. QuickBooks and Peachtree are two examples of user-friendly tools which help entrepreneurs to produce reports that follow financial best practise.

5. Know your annal tax obligations

There’s no shortcut to ticking off tax obligations for your business each financial year, however, you can take steps to be better prepared by understanding you’re your legal requirements and the processes to follow are. Hiring a tax professional with comprehensive startup involvement is a smart way to ensure sure you’re staying on top of your tax to-do list, from payroll taxes, sales taxes, to filing your quarterly and annual taxes.

6. Explore options for external funding

For a helping hand to launch your product and realistically compete in the marketplace you may consider visiting a business lender or investor for capital. Funding can arrive in many different shapes and sizes.

Your future benefactor will inevitably profile your company to gauge whether you can offer sufficient ROI, so be prepared to answer routine questions about your financial history and projections. Use this opportunity to present your business as a viable way of making money for potential investors, both in the short and long-term.

ROI calculators work well for scaling the financial growth of business.