Grocery Store Brand: Private Brand vs Name Brand

The past couple of years have been economically tough for consumers worldwide and value for money is becoming an increasingly important factor when making purchasing decisions. This has prompted a change in consumer buying behavior, one that is particularly visible with grocery shoppers choosing private labels increasingly more over name brands. Despite this trend, shoppers are continuing to buy brand names but only in certain categories. This article analyzes the emerging trend of the thrifty shopper and evaluates factors that lead consumers to continue buying certain brand names during tough times and in other cases, switching their loyalty to private labels.

Grocery Store Brand

Private labels, also commonly referred to as ‘store brands’ or ‘generics’, conventionally tend to be viewed by the public as low-cost imitations of branded products. In its early years, the packaging was plain white, the lettering was solid black and the product quality was inferior to name brands. In recent years though, private labels have been able to overcome this earlier reputation and have been able to achieve significant growth.

Private label goods are products sold by retail stores that are also produced by the same retail store. For example, Portuguese supermarket Pingo Doce will sell Compal passion fruit juice and right next to it will sell its own brand of passion fruit juice. Private label products are always less expensive than brand name products because they need to be able to compete with the big brands. They save money by not having to spend money on distribution channels and advertising since they have their own.

Retailers are capitalizing on the recent shift in public perception by offering quality private label products, which can foster a feeling of brand loyalty. This can give retailers a significant advantage over competitors.

According to a US Food Marketing Institute study titled “The Food Retailing Industry Speaks 2009,” retailers earn a 35 percent gross margin on store-branded products compared to 25.9 percent on comparable nationally advertised brands. So retailers are heavily focused on boosting customer service and the quality of their store brands to build customer loyalty, which in turn, builds profit.

Grocery Name Brands

Name brands, also commonly referred to as ‘national brands’ or ‘big brands’ are brands that are more expensive due to higher marketing and advertising costs than their generic counterparts and/or shelf positioning. Name brands have many advantages over generic brands, these include:

- Brand recognition

- Brand loyalty

- Competitive advantage

- Brand equity

- Packaging advantage

Consumer Packaged Goods Trends

Rising commodity prices and consumer desire to get the best price over value products are driving private label's growth. According to a study released by the Nielsen Company in November of 2008, nearly three-fourths (72%) of American respondents surveyed viewed private label brands as equivalent to name brands, while 62% said store brands were just as good as name brands. This trend is not limited to the United States but is global.

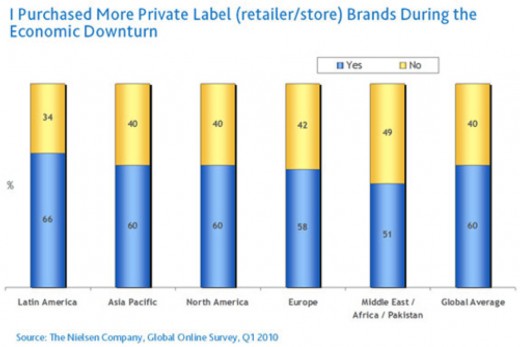

Two years following the abovementioned study, Nielsen conducted a global online survey that revealed that 60 percent of consumers across 55 countries from Asia Pacific, Europe, North America, Latin America and Middle East/Africa[1] are stocking their cupboards with more store brands as a result of the economic downturn. The chart below illustrates that this is a worldwide trend, with similar behavior across regions.

Specifically in Europe, consumers in Spain, Portugal and Greece reported the highest levels of private-label purchase intent during the economic downturn, at 79%, 74% and 70% respectively. On the contrary, the lowest reported drift toward private label came from consumers in Sweden (70%), Thailand (62%), Hong Kong (60%) and Denmark (59%) who indicated they did not purchase more store brands during the recession.

[1] Saudi Arabia, Pakistan, United Arab Emirates, Egypt and South Africa

Customers Will Continue Buying Private Food Labels

A whopping 88 percent of shoppers globally said they intend to keep buying private label even after the economy improves, suggesting that store brand quality has reached parity with brand names and delivers on consumer expectations, according to Nielsen. Countries with the most value-conscious consumers when it comes to private label include Austria and Germany, registering a better than 95 percent intent to continue purchasing private label. On the other hand, shoppers from just four countries have no intention to buy private label in the future - the Ukraine (31%), Pakistan (28%), the United Arab Emirates (27%) and Venezuela (27%).

Effects of the Current Recession

Despite the trend toward consumers buying private label brands, some categories of consumer packaged goods (CPGs) or Fast-moving consumer goods (FMCG) have been able to maintain customer loyalty toward brand names, according to Nielsen Company findings.

Generally, store brand share is strongest in commodity categories as seen above in carbonated drinks, fresh eggs, plastic cups and plates, but also in products such as milk, rice, edible oil, vinegar and sugar/substitutes or in those with little differentiation i.e. first aid and wrapping materials.

It’s been found also that there are certain categories that are not impacted by economic downturns, those categories are: seafood, dry pasta, candy, been, and pasta sauces. Notably, brand name loyalty persists among categories where there is strong marketing support (e.g., candy, gum, beer) and those where a high-level of innovation occurs (e.g., detergents, deodorant, and cosmetics).

Influential Factors for Long-Term Success of Brand Names

So what is it that makes some categories’ brand names “recession-proof”, while others get highly impacted by economic downturns? Nielsen Company has released a report in 2010 that analyzed just that. The company evaluated 11 consumer packaged goods’ categories and examined the success of the top three brands dating back to 1949 from each category, including 33 apparently unbeatable national (U.S.) market leaders. Nielsen found that by 2009, less than a quarter of those brands were still in the top three in their category and only two brands had maintained a consistent #1 position across the timeframe (Ryvita Crispbread and HP sauce). Based on this analysis, five factors appear to influence the long-term success of a brand:

- The age at which the emotional engagement occurs

- The impact of “creative destruction”

- Strong brand management

- Justifying a premium positioning

- Domination of the emerging channels

Concluding Remarks on Store Brand vs Name Brand

Name brands stay big primarily because people buy what they know; big brands stand for something real; and big brands are consistent over time. In order for name brands to stay big, a brand needs to have an emotional engagement with children, it needs to be managed to meet the macro consumer trends, it needs to be continually supported to maintain a premium, and it should be focusing its resources on the emerging retailers – those factors may lead to long term success.

Name brands have something that can only be achieved through marketing investment, which is brand equity. Name brands have their own identities (brand image), consumers are aware of their existence (brand awareness), brand responses, and brand relationships. Store brands don’t have their own brands but only products. They only differentiate themselves through low-cost but they don’t have a brand image nor build loyalty and if a consumer shops in a different store, they won’t mind getting a different brand. This is not the case with name brands. With name brands, consumers seek the product in any store.

Although there is a clear trend toward consumers choosing store brands over name brands, it is also apparent that name brands are here to stay, especially in those categories that consumers care most about.

Sources:

Hollensen, Svend, “Global Marketing- A Decision-Oriented Approach”, 4th Edition, Financial Times/Prentice Hall, England, 2007.

Fill, Chris, “Marketing Communications – Context, Strategies and Applications”, Essex, Prentice Hall, 2002.

“The Power of Private Label in Europe: An insight into consumer attitudes”. Available: http://nl.nielsen.com/site/documents/PrivateLabelinEurope.pdf

Carlton, D and Perloff, J., “Modern Industrial Organization”. 4th Edition, Pearson, 2000

Twyford, Craig, "What Makes Big Brands Stay Big?" Nielsen.com. The Nielsen Company, Mar. 2010. Last accessed: 31 Jan. 2011.

Wong, Elaine. (2008). “Nielsen: Private Label Deemed Equal to Name Brands”. Available: http://www.brandweek.com/bw/content_display/news-and-features/packaged-goods/e3i39f08ab5c0c81e8d5b0cdb8b97bf9bf8. Last accessed 2 Feb 2011.

http://plma.com/storeBrands/sbt09.html

http://www.web-books.com/eLibrary/NC/B0/B64/042MB64.html

http://blog.nielsen.com/nielsenwire/consumer/the-global-staying-power-of-private-label/

http://tr.nielsen.com/site/documents/Big_Brands_FI_Apr10.pdf

http://www.nielsen.com/us/en/insights/press-room/2008/nielsen_reveals_consumer.html

http://www.pullinc.com/private-brands-vs-name-brands-whos-winning-the-consumers-loyalty/