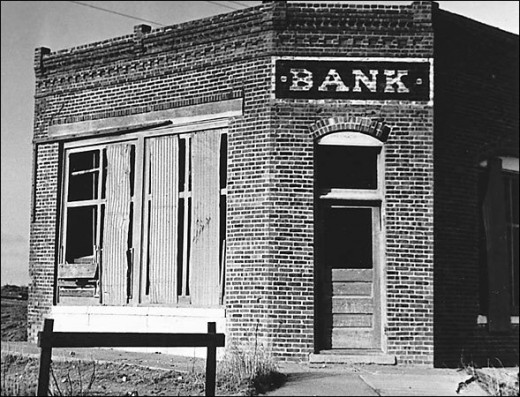

Post Bretton Woods: U.S. Banking Fiduciary Uncertainty!

The First Sights Of Banking

Early on, gold and banks sort of had a symbiotic relationship with one another. In fact, the first sightings of commercial lending institutions started popping up when the monetary rule of law became the gold standard. In the United States from 1882 to 1933, gold certificates were used as paper currency. These same gold certificates were freely exchanged for gold coins at federally backed banking depositories. As a major part of the monetary system, the early history of the bank functioned to regulate the money supply; thus, provided protection against monetary inflation. But after the gold standard emerged, the bank’s role within the economic scheme of things shifted to massive accumulation of gold. So much so that banks began to serve as these “gold warehouses” that presented bank notes for payment in gold and silver to their customers. This wouldn’t have taken form if gold wasn’t considered the standard monetary unit. Therefore, it could only be conjectured that without the establishment of the gold standard, there wouldn’t be commercial banks in use today.

Now That Gold IS Completely Gone, What’s Next?

Now that all these dollars are floating around, what lurks behind the curtain of monetary uncertainty is a sure fire license to steal, defraud and distort the American people. Scholar F.A. Hayek couldn’t have said it better than when he postulated the following:

The suggestion of depriving government of the monopoly of issuing money and of its power of making any money “legal tender” for all existing debts has been here in the first instance because government have invariably and inevitably grossly abused that power throughout the whole of history and thereby gravely disturbed the self-steering mechanism of the market.

What he’s saying is quite simple: The market—if left alone— has self-steering mechanisms to steer its own monetary motor—it doesn’t need the federal government’s help. It’s almost like trying to get a Ferrari to go faster by putting in Nitrous Oxide. How much faster do you want a “Ferrari” to go? Now that gold has gone out of the window, we’re seeing, first hand, how this monetary metamorphosis has been shaping our money supply. Ever since exchange rates have been allowed to float, its probable economic implication can’t be overstated: this major economic folly was the catalyst for our current declining economic state of affairs; and if certain measures aren’t taken, the results could possibly yield an almost certain declination of our standards of living.

Alas, the U.S. government created a major “faux pas” by going off the gold standard. Prior to such a decision, there was no such things as strong or weak currencies; therefore, no concept of currency purchasing power or imbalances of trade. In addition, this miscalculated decision paved the way for the U.S. banking system—in collusion with “big gov”—to do what they want with our money; and with impunity. It should be noted that things like fractional reserve banking, bank bailouts, corporate greed, etc, would never have existed in a gold standard world.

Fractional Reserve Banking And Its Causes For Concern

What exist in today’s banking system is a plethora of convoluted banking practices that have been slowly deteriorating the U.S. monetary system for over 30 years now. Since the infamous Nixon closing of the gold window, commercial banks having been operating on a kind “you scratch my back, I’ll scratch your back” frame of mind; and to the discernible few, it’s been free market complicity of grandeur. Have you ever heard of fractional reserve banking? This concept is as absurd “in theory” as it is “in practice.” Fractional reserve banking is just what the name implies: it’s the banking practice in which banks keep only a “fraction” of their deposits on reserve (as cash and other highly liquid assets) and loans out the rest.

What’s so bad about this? Well...everything! Fractional reserve banking is a very deceptive tactic by commercial banking institutions to debase our monetary system. For example, let’s say you were to go inside a commercial bank and deposit $100. Under a fractional reserve system, banks are allowed to loan out 90 of those dollars. What would happen if you decide to withdraw your money? Would those funds still exist? Not to worry, banks know that they can depend on the word of “big gov” as a form of economic backup plan, after all, because our money isn’t backed by a commodity, the government can just print dollars at will. If things got really bad like a bunch of people “running on the bank,” the U.S. treasury just turns on the machines and the average tax payer receives the bill. This misleading monetary method has been the modus operandi of commercial banking institutions—in collusion the Federal Reserve—since Bretton Woods came to an abrupt end. Put simply, fractional reserve banking is fiduciary illegality at its best. In addition, fractional reserve banking hurts the overall economy on three fronts: 1) It nearly triples the money supply; 2) It just about doubles aggregate debt; and more importantly 3) Because it creates consumer distrust, it tends to discourage savings.