"The Big Short" and the 2008 Financial Crisis

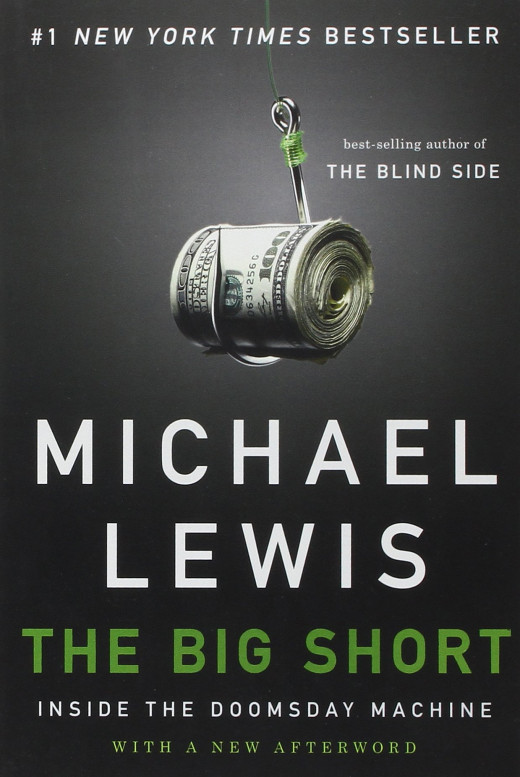

The Big Short: A Book by Michael Lewis

So what is Financial Deregulation anyway?

Definition of Financial Deregulation

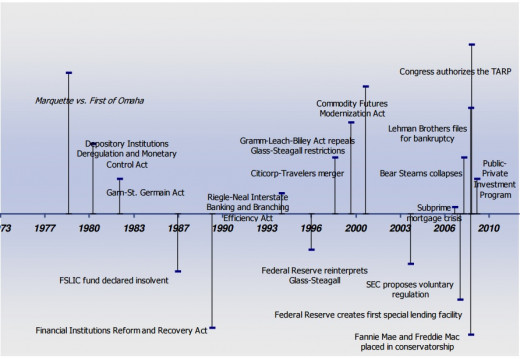

In 1999 Congress repealed parts of the Glass-Steagall Act of 1933, which stated that a financial institution could only act as either a bank, insurance company or an investment bank. The changes congress made in 1999 allowed any financial institution to act as any 2 or all 3 of these kinds of financial institutions and that action created the environment of a financial disaster created by greed and stupidity that could have ended the economy of the entire world in 2008.

The #1 proponent of Deregulation for many years was Alan Greenspan . For the entire 18 years Greenspan was Fed Chairman he consistently rang the bell of Deregulation thinking that it would stimulate very srong financial growth, never realizing that the greed of many of criminals would create a gambling casino and garbage bonds based on bad and bundled housing mortgages that would be leveraged to the point of financial collapse. Why Greenspan never realized something like this would happen is a mystery but he has recently stated that he was wrong, but never took full responsibility for being the number one cause of this world wide crisis that has put our country into 20 trillion dollars of debt and has created a great deal of misery for many millions of Americans, especially those in their 20's and 30's. Even now almost 8 years after this crisis was at its peak, this country has still not fully recovered from a disaster that almost created a second great depression.

The movie: The Big Short

The movie "The Big Short" is based on the book "The Big Short" , by Michael Lewis. In terms of a movie that educates its audience on a major historical event, it is by far the best movie I have ever seen. The use of humor and celebrities who make cameos to explain the extremely complex terms and concepts that represent extreme greed and stupidity were great. The movie fully explains what happened during the housing bubble in 2008 and makes you both remember all that you knew in 2008 and much that you didn't know. Based on AAA bonds that represented the housing market, bad loans were bundled together with good loans and the rating agencies refused or looked the other way when it became very obvious that the leverage of the bad loans was not only ruining the value of the good loans but in fact making the entire bond worthless.

The term CDOs or (Collateralized Debt Obligations) was perfectly defined in The Big Short represented a basket of bad and good loans that represented the US housing market. What was even more outrageous about this level of irresponsible level of greed was the fact that financial institutions were placing best on the people who owned these CDO's and they became synthetic CDO's. This eventually became a gambling casino of bets placed on bad bonds that for some were considered perfectly safe and the leverage of bets like this turned in some cases 10 million dollars of leverage into over a billion dollars of leverage. Gambling like this was all allowed to go on because of Financial Deregulation and it was this leverage that almost brought down the economy of the entire world and forced the US Government to bail out several financial institutions including AIG, which provide much of the insurance that was suppose to take away all the risk from the gambling that was going on. Nobody realized until it was too late that the majority of mortgages the housing bonds were based on were mostly worthless because in 2002-2004 anyone could buy a house, even a person with no income. On top of this the people who were buying these houses didn't realize that in about 2 years the interest rates would adjust to the point that they could no longer afford the monthly payments. Ultimately, the American taxpayer had to hold the bag for all of these bad loans and now this country is 20 trillion dollars in debt.

So who is to blame for the 2008 Financial Crisis?

People to blame for the 2008 Financial Crisis

According to this article above there are 25 people we can blame for the disastrous financial crisis of 2008, but for me the person who started it all and wanted and pushed for Deregulation for many years is the first and most responsible for what happened, Alan Greenspan. As soon as all or most of the Government regulations for financial institutions were eliminated, the flood gates opened and gambling and over-leveraging became the norm, and as a result we almost had a world wide great depression much worse than the one in 1929. In the back of all our heads you at some point have to worry that this could happen again, or our National Debt which was most caused by the bailouts of 2008 might create another economic crisis.

Financial Degregulation Timeline

Greenspan and Irrational Exuberance

Greenspan's Irrational Exuberance Speech

In 1996 Greenspan called the stock market a case of "Irrational Exuberance" and starting in 1998 -2000 he conducted a campaign of raising interest rates 6 times due to his fear of inflation and managed to kill not just the stock market bubble but also the entire US economy. Then to try to fix his many mistakes with interest rates, he lowered interest rates 13 times in failed attempt to revive the US economy. After 13 times lowering interest rates, they were at 0 and rates have been at 0 for 9 years until they were raised 1/4 of a point just recently in December 2015.

The real issue here is giving one person so much power that Greenspan had to control the economic reality of the entire world. Of course there was a committee of fed governors to back up and support Greenspan, but during Greenspan's 18 year tenure, It seemed that whatever he wanted, he would get. One person can never be given this level of power over the world economy and that is the main lesson from what happened in 2008 and the year 2000.

Greenspan had an "irrational fear" of inflation even to the point believing that if many people were employed and doing well in the stock market that this was ultimately bad for inflation. Many of these mistakes could have been prevented if only there were more checks and balances and that the effect of each raise in interest rates starting in 1998 was more carefully monitored before another interest rate hike was added to the US economy. Another tragedy is that because of the internet bubble and the jobs generated by the year 2000 date correction problem, the job market had a completely skewed and inaccurate reality that was just temporary and obviously not a long term reflection of the current employment picture in this country. So because of all of this, interest rates were raised 6 times unnecessarily and ultimately made the year 2000 internet bubble crash far worse than it needed to be.

So why are the people most responsible for the Financial Crisis of 2008 not in jail?

Below is the list of the already wealthy individuals who were outside of the political world and who directly profited from the horrendous Financial Crisis in 2008. The question for all of us still remains. Why aren't all of these people in Jail? Considering the incredible long term damage they have done to this country they should all be in jail for a very long time but for some reason, none of them are. Why?

Conclusion

Hopefully we all can learn from the events that really started in 1998-1999 that caused a chain reaction that lead to the year 2008 and an almost world-ending financial crisis. Its clear that financial degregulation will never be allowed again, but will we ever give too much power to one person who is the head of the Federal Reserve? In the back of all our minds there is always going to be the worry that our debt might cause many more problems for the United States and the world and it sure doesnt seem like we are ever going to bring down out debt in any significant way. Here is hoping that things will all be OK because I for one am not sure if they will be.

Check out the book the Big Short on Amazon "The Big Short".

Check out my profile and my movie review blog.

The Big Short - Movie

Alan Greenspan

The 2008 Financial Crisis

Who do you blame for the 2008 Financial Crisis

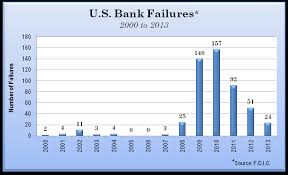

US Bank Failures

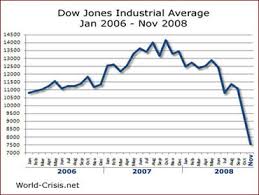

The Stock Market Crash: 2008