How Long to People Receiving People Welfare Keep On Getting It?

One of the favorite claims by the Right-wing is that once a citizen receives welfare, they are wedded to it for life. Now I know (hope) that is just so much hyperbole but the point they are making is that once welfare is given, it is a long-term affair.

Can any of you who believe that PROVE that it is effectively true?I've never really thought about it, but the rules of welfare seem to imply that a woman can qualify for welfare as long as there are minor children. Most women can easily ensure that there are minor children available to use for a large percentage of their lifetime. Their whole life, depending on their medical condition.

Since disability or unemployment qualify as welfare programs, that is another avenue to extend benefits. disability benefits could last a life time. I know a woman who was deemed disabled primarily because she suffered anxiety when working with the public. This was after about 35 years in the workforce. Nothing changed from pre disability to post disability disposition.

Some people who qualify may have to agree to work toward self sufficiency. This is an open ended arrangement which may last a lifetime. I would assume it would depend on what their case workers thought. I can imagine a person's records getting 'lost' in the system and benefits lasting indefinitely.

I am not, in any way, bashing anyone who is on the program. I don't know anyone's individual story or needs. I do know people who do appear to be on aid and it has lasted the entire time I have known them. They never work, have roofs over their heads and food in their mouths. They have no visible source of income and do spent a great deal of time in social service offices so it is not unreasonable to believe they are getting government assistance.No question that there are anecdotes where people abuse the system. My question, however, is that the norm? Are we talking about 0.25% or 0.5% or 10 - 20%. The latter is very worrisome for sure, but not the former.

Only someone with access to all the information within the system could answer that. What I might perceive as abuse could very well be valid need. I will say when I lived in a small town there were definitely long term recipients and members of that community (the ones struggling to make ends meet and working) complained the most about them.

"there were definitely long term recipients " - no doubt there were. My question would be if that was by choice or necessity? There are clearly anecdotal examples of people who actually prefer to live by handouts (and if they have children, then I would prosecute for child abuse) and they should be complained about. But I would wager (since I haven't looked for the studies yet) that the large majority of them are from necessity.

But there is a measurable portion of America's population (let's call them Conservatives) who think because a very few abuse the system, then nobody should be helped (or at least an extremely few) by the system."But there is a measurable portion of America's population (let's call them Conservatives) who think because a very few abuse the system, then nobody should be helped (or at least an extremely few) by the system."

I think you're right. I also think that there is a measurable portion of America's population (let's call them liberals) who think it is only a tiny portion of of people that abuse the system that it isn't worth discussion, when in reality it is a very significant portion.Define significant in terms of percentages?

5% would be significant. And I repeat: when 50% of the population is receiving charity it becomes rather obvious that there is a problem. A guesstimate only, but I'd have to say that 80% of those receiving don't need it; it is no more than a "want". It's likely true that that 80% is on the bottom of the $$ received list, but that does not change that massive amounts are going to people that don't truly need it.

And it's only opinion again, based on a few personal observations, but there are too many people that should get help but can't. Mostly in the area of disability, and the reason for that is that there is so much fraud in disability claims that extreme measures have been taken to decrease the fraud levels.

Might get some kind of idea if the number of people below the poverty level decreases more rapidly than the population increases. If that makes sense.

If 20M people are declared below 200% of the poverty level, we likely have (at least) 20M people getting assistance. 5 years later, with an additional 5M people in the country and 10% of those below 200% poverty we should see less than 20.5M below poverty. Just grabbing numbers, not meaning they are correct, in an attempt to show what I mean. As the number of people under that semi-magical 200% poverty level does not decrease appreciably it would seem that no one escapes, that no one leaves the roles of welfare. (Again, gross generalization just to promote understanding).

Of course, there will be some moving around: 2 leave, 2 more have an accident, lose their job, etc. but don't have a clue how to find those numbers: for sure no one is counting new additions to all of the 80+ welfare programs in the country like they do for new additions to the unemployment rolls.I see what you are saying Wilderness, and in a purely static environment, you would be correct. Your implied assumption, however, for that to be true is that the same identical people constitute those below the poverty line.

In fact, that is not true. Instead, there is lots of turnover. While the same number of people may continue to be under the threshold (which begs a different question) they are not the same people year in, year out. Many studies of different types show that to be true. So, you cannot make any conclusion as to how much time any given individual spends below the poverty line.

The question that is begging for an answer is "what is causing the number of people below the poverty line not to change?" You would think the following would be true, all else being equal:

1. If the economy grows, then the number of people below the poverty line out to decrease at least as fast as the economy is growing (faster actually because of economic symbiosis)

2. If the economy is stagnant, then the number of people below the poverty line is stagnant.

3. If the economy is declining, then the number of people below the poverty line should be increasing at an increasing rate (due to the compounding effect of negative growth)

There are several studies out there that you can find that either track individuals over long periods of time (10 - 20 years) to see 1) how those individuals fare economically over time and 2) how the children of those individuals fare. There are other studies who try to determine the same thing statistically using tax records.

No, but I can prove that it isn't true. Define welfare. Most people don't have a clue as to what welfare is and how many assistance programs it comprises. I assume for discussion's sake, simply because it is the one most commonly thought of, that they are referring to Title IV-D of the Social Security program in which an able-bodied person can receive assistance until that person can get proper training to be able to support oneself and his/her children. The duration is 24 months (2 years) and there are certain restrictions and conditions:

"Title IV-D Sec. 402. [42 U.S.C. 602] (a)(1) Outline of family assistance program.—

(A) General provisions.—A written document that outlines how the State intends to do the following:

(i) Conduct a program, designed to serve all political subdivisions in the State (not necessarily in a uniform manner), that provides assistance to needy families with (or expecting) children and provides parents with job preparation, work and support services to enable them to leave the program and become self-sufficient.

(ii) Require a parent or caretaker receiving assistance under the program to engage in work (as defined by the State) once the State determines the parent or caretaker is ready to engage in work, or once the parent or caretaker has received assistance under the program for 24 months (whether or not consecutive), whichever is earlier, consistent with section 407(e)(2).

(iii) Ensure that parents and caretakers receiving assistance under the program engage in work activities in accordance with section 407."

I set out the language that answers the question you specifically asked. Of course there is much more to it. Also there are other types of welfare programs such as food stamps, child care assistance, etc., that have their own rules and time limits, but I believe the above covers the general concept of "welfare". This law was signed into effect by President Bill Clinton, a Democrat, shattering the illusion that Democrats want perpetual welfare for deadbeats. This also covers noncustodial parents who try to escape paying child support for their children.

There is a difference for people who are legally disabled. If a parent can't work, he or she can draw disability temporarily or permanently as long as he or she is unable to work. I included the federal citation because looking up a federal law is difficult and a link doesn't always work."Define welfare"

Any money, goods or services given to citizens for which there is nothing given to the government in return.

There are some 80+ welfare plans, not the few that you mention. In addition there are massive loopholes, particularly when children are involved, allowing long term benefits.

https://singlemotherguide.com/federal-welfare-programs/So is your point 1) we are wasting our money on helping children, the elderly, the disabled, veterans, the unemployed, etc or 2) America is doing a great job in helping our citizens who need help?

BTW, your "nothing in return" argument is rather weak, don't you think? Let's take the biggest expenditure Medicaid. It is uncontroversial that, along with being the right thing to do, that it saves society billions in costs with taking care of people with no insurance. Let's say you are successful in doing away with the Medicaid program. What is the likely outcome?

1) when these poor uninsured people show up in the emergency room, they are turned away to fend for themselves (fortunately, that is illegal at the moment although I am sure there are about as many on the right who would prefer that outcome as there are people on the left who want to take your guns away)

2) when these poor uninsured American show up in the emergency room are taken care of at enormous cost which is then past along to you and me through higher taxes and insurance premiums.

There really is no middle ground is there? Compassion (forced for some on the right) or huge costs far exceeding the cost of Medicaid.

EITC - the alternative, since the one, two, or three jobs these people hold down don't pay a livable wage, is they go on total public assistance because that now has a better outcome than actually working at starvation level jobs."So is your point 1) we are wasting our money on helping children, the elderly, the disabled, veterans, the unemployed, etc or 2) America is doing a great job in helping our citizens who need help?"

Can you expound on the reasoning producing that? Because for sure I can't find anything even approaching such nonsense in the definition of Welfare in my post, or in the simple comment that there are far more welfare plans than the few mentioned.

"EITC - the alternative, since the one, two, or three jobs these people hold down don't pay a livable wage, is they go on total public assistance because that now has a better outcome than actually working at starvation level jobs."

Wait. The alternative to welfare (EITC) is welfare? Are you sure that's what you meant to say?

How about a different job? How about additional skills training? How about 1 full time job rather than 3 part time ones (no one can work 3, or even 2, full time jobs)? Not to mention that your idea of a "living wage" is far removed from mine?"Wait. The alternative to welfare (EITC) is welfare? Are you sure that's what you meant to say? " - Yes, that is what I meant to say. You have two almost binary choices.

1. Work, and get paid a negative tax so that you can afford to work and not starve but disqualifies you for many other public assistance benefits

2. Not get paid a negative tax, quit work so that you can get the other public assistance benefits so that you and your family does not starve.

There is no middle ground since working at starvation wages is a non-starter.

"How about additional skills training?" - who is going to pay for that and get you to the training site?

"How about a different job?" - what "different" job. Virtually all jobs which people who are in this situation are qualified for don't pay a living wage either. Further, many of these people in this situation already work multiple jobs.

"what about a full-time job?" - again, most of those that are available to these people do not pay a living wage either.

"Not to mention that your idea of a "living wage" is far removed from mine?" - tell me, for a family of three (one working adult and two school age kids living in Omaha, NE) what do you think a reasonable annual income is before all taxes?

"It is uncontroversial that, along with being the right thing to do, that it saves society billions in costs with taking care of people with no insurance."

There are two problems with this statement. First is that, while I personally find that helping with medical costs is "the right thing to do", not all will agree with me (or you). But embedded in that is that neither I nor you is footing the bill; we are requiring a third person (who may or may not agree with the sentiment) to do so, and that most certainly is NOT "the right thing to do". The "right" thing does not include playing Robin Hood, forcibly taking from one to give to another because we feel they need help. That "the ends justify the means" is a road fraught with danger, for it justifies nearly anything we might wish to do.

Secondly, also included in this paragraph is the notion that the "return" to society is that society will not be blackmailed into paying even more. That if we don't pay now we are forced to pay more later - an obvious fallacy for we are not "forced" to do anything of the kind. In addition, the same thing applies here in that if we choose (choose!) to provide medical care, it will be out of the pockets of a third person, not our own.

You are continuing to assume that our personal ethics and morals extend to everyone around us, and that they are superior to those of others, or perhaps declaring that our ethics are "superior" and therefore we have the right to impose them on others. Either that or simply ignoring our own unethical actions in taking what others have earned - this seems the most likely, for you and others steadfastly refuse to even discuss the ethical and moral dichotomy.And who is "we are requiring a third person (who may or may not agree with the sentiment) to do so," that third person. Someone who can afford insurance but refuses to buy it and then goes bankrupt when they get in a car accident because they can't afford the medical bill to put their body back together again? Is that the third person you are thinking of?

BTW, why is auto insurance mandatory (and it isn't because driving is a privilege).

"an obvious fallacy for we are not "forced" to do anything of the kind." - what is the alternative? Let them die?

Again "it will be out of the pockets of a third person, not our own." - what third person?

Your last paragraph sounds like you believe an individual does not have the moral duty (actually ethics is a bit different) to help improve the society that succors that individual? If that is the case, then society should withdraw every form of support it gives to that person (e.g. every road is a toll road for them but free to others who do feel a moral obligation to help improve society).

Wilderness, I had a reason for saying "define welfare." Perhaps I should have said "specify which welfare programs." Most people have no idea what welfare is and include in it a lot of programs that people pay into, and should have returns from, like Medicare and Social Security. The common mistake I find people making is referring to the program(s) that help support families who've lost their primary breadwinner or whose breadwinner has run out on them. People have always called those programs "welfare" and at one time, they could be on them for life. Again, thanks to President Clinton, there is a 2-year limit on those unless the person has a disability.

Now as far as disability, except for families with minor children, a person can't even draw SSI unless he or she has paid in for a certain amount of time and within a certain amount of time. Sometimes people who try to keep on working at odd jobs off the grid while sick, then when they try to get disability, they are refused because they have not paid anything into the program in the last five years.

As usual, you try to skew the real facts with semantics. Get real. There are people who really need to be on some kind of program and can't get on because of laws and other technicalities. Granted, there are also people who get on programs at birth (preemies with health problems, for instance) and their parents find ways, including sympathetic doctors who keep them on even after their health problems clear up. I know of one such case, and I'm waiting to see if his mother is able to keep keep him on by running him to the doctor every time he sneezes so the doctor will keep his asthma papers current. The kid plays soccer and takes martial arts and our taxes are paying him disability, so there are some abuses of the law. Granted it seems like all it takes is a good lawyer and numerous emergency room visits to keep an able-bodied child on on SSD. And yes, I remember the "crazy checks" that these kids used to draw because their parents coached them to act crazy whenever they visited the social worker.

But Title IV-D recipient has two years. The average person does not know this. Rumor has it that a recipient can be on it for life. Not so.

SNAP or food stamps are for working people who don't make enough income to buy adequate food for their families, as well as people on "welfare." I suppose you feel that it is justified when corporate greed causes layoffs and families go hungry while the fat cats get fatter.I prefer to say "thanks to conservatives" rather than "thanks to President Clinton" since it was their bill he signed (and at that point in time the Republicans might have had a veto proof majority)

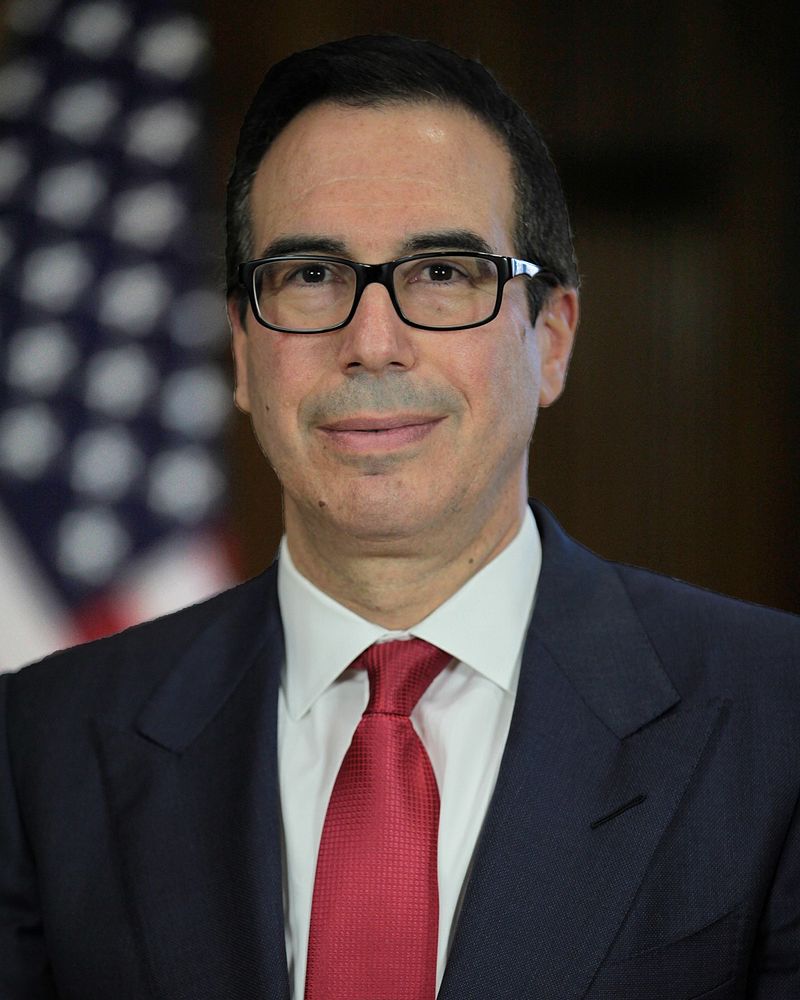

The corporate welfare tax cut scam Mr. Trump and his conservative accomplices in congress just passed is PERMANENT which means Steve Mnuchin, the corrupt weasel who just made a trip to Fort Knox with his obnoxious gold digging greedy wife to polish the gold bars, the dirty Koch Brothers, Sheldon Adlesson and all other greedy Wall Street free grazing dead beat executives who could care less about America, have just received an illegal benefit which will last in perpetuity: at the expense of your childeren's healthcare:

Welcome to 'Make America Great Again':

http://time.com/money/5269269/the-trump … e-program/

This lovely piece of work needs somebody to pay for his new obnoxious 100 foot yacht, and guess what? That somebody is YOU and your children:

Stripped of the inflammatory (and ridiculous) language, implicit in your post is that YOU own that wealth that the real owners are being allowed to keep. This is foolish on the face of it for you have done exactly nothing to earn it. Allowing the owner of anything - money, yacht, fancy car or anything else - to keep what they have earned and built is not "welfare".

I didn't read that into Jake Earthshine's words at all. He is saying that the Mnuchins are taking money that doesn't belong to them -- OUR TAX DOLLARS. That money could be building roads and bridges, sewers, the military, and the like. Get your mind off welfare for the poor and look at realism, if you are capable.

I looked for reports on how many military families are eligible for food stamps and found only one dating in the 1980s. Back then, up to 275,000 military families were potentially eligible. I'm guessing that number has risen with today's inflation.Thank you MizBejabbers: You've reiterated one of the exact points I was making in my last comment:

Billions upon Billions upon Billions of our dollars are boxed up daily by elite Wall Street execs and shipped from the USA to foreign lands for the benefit of foreign countries not us, and Mr. Trump and republicans through their corporate welfare tax cut just gave them 1.9 TRILLION more reasons to continue hoarding our money over seas while Mr. Trump unconscionably attempts to cut funds dedicated to children's healthcare:

This doesn't make Mr. Trump big, strong, great, smart nor a winner, it really makes him the very small, disgraceful coward that he is, and according to reports, his entire staff are of the same cloth:The real question is WHY this kind of data isn't being collected any more.

I found a 2013 estimate that 23,000 enlisted received SNAP. To find something more recent, I looked at the basic pay rates of E1 - E4's and found, on average, it is below the 130% of poverty rate for a family of 3 threshold, Granted there are other allowances like for housing but they are tiny in comparison. Then I noted that last year there are 169,548 families of enlisted in those grades. The implication, of course, is that many of these families are at least eligible for SNAP."Granted there are other allowances like for housing but they are tiny in comparison."

According to you, the poor pay about 40% of their income for housing; that housing allowance to the military is hardly "tiny" in comparison to their base salary. Then there is free medical care for the family - another large "bennie" that is hardly "tiny" and such niceties as the PX and coverage for moving a family rather than an employee. They are accumulating both a retirement plan and free college should they choose to avail themselves of it. The base salary for the military is a long ways from being their total compensation package.

But yes, they are sometimes eligible for SNAP.Since I am retired military as well as the original author to a base-closure model still used today by DoD that calculates all that you speak of, I am well aware of what the military members make.

What MizBejabbers was saying, America's tax dollars are needed to support underpaid soldiers.

As to the red herring "ownership" argument - it is based on a false premise, one that it is unethical to tax people and businesses. Everybody that can afford it has the DUTY to pay for the benefits the society provides for them to make their fortune. It is no more their money as is the money they pay for a movie ticket. Under your argument, it is unethical to charge a price for a movie ticket, it should be free.

Once the fee has been paid for the service provided, it is now America's money, not theirs. And then America elects people to represent them and determine how best to spend America's money.Is it unethical to tax the poor to give cash to business? Is it unethical to tax the middle class to provide cash to the rich? Should we raise taxes across the board, then give everyone with a car free gas?

No, my position is that it is unethical to take from one simply to give it to another. We tax people (or should be) to benefit the country - to provide a highway system, water supplies, military, etc. Not to simply turn around and give it away, for that benefits the one paying the bill absolutely nothing.Now you are on to something, maybe a RAV 4 Hybrid.

Which is more beneficial to society overall - An America full of healthy individuals or one full of unhealthy people?

Which is more beneficial to society overall - An America full of educated individuals or one full of uneducated people?

Which is more beneficial to society overall - An America full of individuals with cash in their pockets to create more demand or one full of broke people who can't create demand and a very few wealthy people who spend/put most of their money overseas and create very few jobs?

Geez My Esoteric, This is nuts that I keep feeling like I am butting in just to argue about some point you made. That certainly isn't my intention, and I know the primary exchange is between you and Wilderness, but it is a discussion thread, and I really do disagree with your "Red Herring" point.

Firstly, I do understand that there is a fringe faction that does think taxation is illegal, and thus they probably think it is also unethical. But ... that, I think, is a very small faction of folks that would call themselves Conservative. Probably comparable to the faction of Liberals that are just a step away from being Socialist.

I believe the majority of Conservatives support our graduated tax system - because we know it is necessary to support the operation of our nation. Both Wilderness and I have voiced that support here, but supporting a graduated system does not mean supporting unlimited demand for more - just because some think some can afford to pay more because some want more.

Folks that pay more under that graduated system are doing their duty, for you to say their duty is to pay whatever you think they should pay is just baloney. The concept of ownership is not a Red Herring, it is a foundation of American culture. "You didn't build that ... ," Harrumph! It might not have been built unassisted, but that does not mean it is a collective ownership. In most cases, (I would think), that assistance is paid for by taxes paid.

However, I do agree with you that once taxes, ("fees"), have been paid it is America's money. (Not sure what you mean tying that to services provided) But ... until then it is the owner's money - not yours And those fees, (taxes), have been legally determined, so when someone pays their taxes, they are very much doing their duty to support our country.

GANot a problem, GA. That is what these forums are for.

I do agree with you that there are small fringes that think socialism is better than capitalism or, on the flip side, the federal gov'ts only use is to provide and Army and Navy but yet have no right to tax to pay for them (I don't think they oppose excise taxes which is what the anti-federalist thought was needed).

But I wager the number of conservatives who oppose a graduated "progressive" income tax scheme is quite a bit larger than you think. I looked for a survey to give an idea how big or little that may be and ran across this 2003 NPR that shows how confused American are about taxes.

1. What’s more important to you, having the government provide needed services, or cutting taxes? ANS: 62% services and 31% cutting taxes. Now given the conservative and everybody else divide in America, I am not surprised by that result. HOWEVER, the next question was (these people didn't see the first question)

2. In general, would you rather have the federal government provide more services, even if it costs more in taxes, OR would you rather have lower taxes even though there would be fewer services? ANS: 44% more services/higher taxes and 48% less taxes/few services. ?????

While I know it is how you ask the question (I prefer #2) they aren't that much different. YET ... it is apparently.

And then there is this new turn:

3. What’s more important to you – (lowering your taxes), or (maintaining spending levels on domestic programs such as education, health care, and Social Security)? ANS: 18% want to lower taxes and 80% want to maintain spending levels. (Keep in mind, these are the same people who answered #1 and #2 AND it is a 50/50 split on whether the current tax framework is fair)

Anyway, you will probably enjoy the whole survey - https://www.npr.org/news/specials/polls … survey.pdf

Now here is another interesting factoid - Between 1955 and 1959 when marginal tax rates were huge, an average of 55% thought taxes were too high. In 2017, when individual taxes are lower than they have ever been, guess what percentage think they pay too much ... drum roll - 51%!!! (yet remember, Americans want all of those services)

As to "graduated system does not mean supporting unlimited demand for more " consider this excerpt from a 2013 study of taxes (keep in mind, it has just gotten more lopsided over the intervening 5 years) "What should shock and outrage us is that as the top 1 percent has grown extremely rich, the effective tax rates they pay have markedly DECREASED. " I don't think that is narrative which you think is true. https://opinionator.blogs.nytimes.com/2 … 9-percent/

Why haven't the effective tax rates at least stayed the same?

Would you agree that that richer you are, the larger portion of the benefits an American society provides you use? The rich's ability to covert those benefits into more wealth far outstrips your or my ability to do the same. You can't afford a lawyer to help maximize your wealth using these societal benefits (mainly the law that protects the wealthy and not the less wealthy). On the other hand, the rich can and do, often getting richer off of you.

"Folks that pay more under that graduated system are doing their duty, for you to say their duty is to pay whatever you think they should pay is just baloney." - Since I don't think that, it isn't baloney. What I do think is that the rich do not pay their fair share based on their outsized consumption of society's benefits.

What do I think the highest marginal tax rate ought to be for non-rent (meaning they actually earned it and the amount paid is commensurate with their contribution to the overall company) income? Somewhere in range of 50%.

What do I think it ought to be for unearned income such as wages over and above the value of their contribution and liquid inheritance? I could settle for 80%.

To get an idea of what I mean about societal benefits. Consider a mid-sized company, say Davis Trucking near where I live. They are doing very well in America under our laws and business friendly environment. I have to wonder if they would be doing as well in say Argentina, France, Russia, or Spain with their laws and not-as-friendly business environment.Re: your two questions.

Yes, it makes an enormous difference how something is worded. I would have said needed services over cutting taxes. But lower taxes and lower services over higher both.

But it's in the wording. Question 1 asks if the government should provide the services we need, and it should so I vote "needed services". But that does not mean that we can't cut taxes and keep those needed services while cutting services that are harmful or simply unneeded, thus the answer to #2.Semantics: Actually #1 gave a choice ... needed services OR lower taxes; the people chose services.

#2 gave a slightly more nuanced choice In general, More Services w/ higher taxes OR Less Services w/ lower taxes. Here it seems the people were not inclined to add more services, at a cost, while, and this is the counter-intuitive part to me, more people now would rather to CUT services in order to CUT taxes. I say counter-intuitive because in #1 they clearly liked the services they were getting and didn't want to cut taxes. Go figure.

Assume for the moment that Davis Trucking provides support for 5,000 people. Truck drivers, office workers, janitors, gas station attendants, motel employees - all those people that a good sized trucking firm might use the services of. If that were true, but they would not do as well in Argentina, how many of those 5,000 would not have a living with Davis and would have to find another source of income? You talk as if all the money that flows to a company as a result of that contribution by society is theirs to keep and buy yachts with, but 95% of it flows right back out and into the hands of someone else. And you want 70%+ of the lousy 5% of the money they handle.

For business services, typical ratio of Sales to -

Gross Profit; 75.8%

Employee Related: 12.6%

All other expenses: 41%

Net Profit: 22.3% (that was typical of what I found in the defense industry as well.

Now change the industry to food services, the net profit is much lower, near your 5%. Grocery stores are lower still at 2%, I think, because of the huge volume.

It seems the trucking industry might be around 10%.

In any case, that is not the question. The question is if the societal environment in America is more conducive to a businesses success that it is in Russia, France, Argentina, or Spain?

The point there is IF businesses have a better chance of success (and growth) BECAUSE they are in America, then there is a value-added from the American environment. It is that value-added that I suggest needs to be taxed. The same would be true for individuals.First, I don't believe for a second that the average company in the US has a profit margin of 22%. Nothing I've ever seen comes close to that as an average, although a small handful of companies do. I just had reason to look at average margins for drug companies and even those that we complain are making obscene profits don't. And, of course, a company may well do it this year...and next year take a huge loss.

But beyond that, the point is that that trucking business is a part of the society, and part of what makes the added value from the society in the country. So is everyone else, for the same thing could be said of the truck driver they support.

So why, then, is the company owner(s) singled out for higher taxes? They all live in the same country and get the same benefits - why are those people singled out to pay more taxes?

The answer is twofold. "Because might makes right, and we can", and because without their added contribution the country will not exist in the form it now does. That doesn't make it ethical, just necessary...when those taxes are collected for the needs of the country. When they are collected to satisfy the needs of the individual, an individual that supplies zero benefit or advantage to the company the necessity disappears and all that's left is "because might makes right".

I'm repeating myself, but I do think a good case can be made that a safety net for individuals is good for the country. I also think that some pure charity, lifelong if necessary, is also good for the country.

But when half the country is feeding at that trough, off the efforts of someone else, it has crossed any reasonable line. Rather than being good for the country it is almost pure evil, for it destroys the person and it will destroy the very country they are feeding from if left uncontained. There has never been a successful society where so many have depended on so few for basic necessities, and there has never been a successful (long lived) society where so many are net users rather than net producers. A human society cannot survive under those conditions.Well let's see (after a quick search)

1. Apple - 21%

2. J.P Morgan - 23%

3. Wells Fargo - 23%

4. Alphabet - 22%

5. Microsoft - 20%

6. Johnson and Johnson - 23%

7. Alteria Group - 74%

When I look for a company to invest in, one of the criteria is net profit >15% in three out of the last 5 years.

By Industry, Averages (which means about 50% are higher than)

Energy Services - 12.3%

Oil & Gas Explor - 15.8%

Consumables Services - 12.1%

Household Prod - 12.1%

Pharma - 19.5%

Software Services - 20.2%

Tech Hardware - 14.0%

Semiconductors - 16.9%

Do you want to reevaluate?Food staples - 2.9%

Health care equipment - 4.7%

retailing - 4%

autos and components - 4.2%

http://www.businessinsider.com/sector-p … 500-2012-8

Do you want to reevaluate? You cherry pick, I cherry pick and neither of us gives any useful information at all. How about we just take the S&P 500 as a whole at 9%, recognizing that those are the largest and most successful companies in the country? That adding in small business, which employs half the people, will inevitably lower that figure and that such low unemployment will lower it even further as wages climb?

Don't you find it just a little bit odd that 50% of the people of the richest country in the world you claim are deadbeats and another 20% I claim are wealthy and corporate crooks that steal from the other 80% to maintain their wealth.

It's a hell of world.First, I didn't claim half the country are "deadbeats" - that they accept what is offered does not make them a deadbeat. Second, you can claim corporations and corporate owners (if you purchase stocks you are one of those) are all crooks that steal from others, but making the claim doesn't make it true.

Regarding your surveys My Esoteric, it seems we all semi-agree that the exact wording is important. I would also suggest that even when specifics are included, much of the response, either for or against will be an ideological gut-reaction. Conservatives against higher taxes - Liberals for them. I know that is simplistic, but let's leave that debate and just absorb what each take from those results. My take is that as a general response, I am optimistic because those wanting lower taxes were a lower percentage than I expected.

As to the rich using a larger portion of society's benefits, no I would not agree, but I also don't understand your point. In what way do you think they use more because they are rich? Do they use the roads more, the bridges, the police? What do you mean they use more benefits of society?

And my disagreement with all your points just gets worse from there.

That the rich's wealth offers benefits the non-wealthy can't access - so, what. Nothing new there. And nothing wrong there. Are you saying it is unfair that the rich can afford financial accountants to maximize their benefits? Do the non-rich need those same services? That the rich can get favorable rates because their volume offers benefits to the providers? Think about Cosco's business model. Etc. etc. etc, what are these unfair benefits and coveting of societal benefits you are talking about?

And then comes the ... OMG! "fair share" argument. guy pays a hundred million in taxes, but because it doesn't hurt him it isn't his fair share?

And you want to determine how much someone's efforts are worth to the company? Since the company hires those folks, shouldn't compensation be their determination? How can you possibly justify your 50% rational? Other than you being the arbiter of someone else's choices?

And unearned income ... geez. So someone achieves a life position where now they can let their money work for them instead of their backs - and you decide that isn't really earned Let's ban power mowers and go back to the scythe - now that was real work.

And then, the cherry on top. If it wasn't earned in a manner you accept, then off with their heads, they owe us 80% of that money.

Regarding your Davis Trucking Co. Do you suppose they would survive on the same business model in Argentina, France, Russia, or Spain? I don't see value in that comparison.

Nope bud, we parted ways at the top of this response. Set legal standards and I will abide them. Which is exactly the standards of our graduated tax structure. Anything else is mine. Gotten by my efforts, whether it was brains or brawn that got it. Claim all the need you want, but you are standing on a foundation of air.

GA" Conservatives against higher taxes - Liberals for them." - I would reword this to say "Conservatives against higher taxes in general whether they are needed or not - Liberals for higher taxes on the wealthy but only when needed."

Needed by whom? The general population of the country or a select few that want more than they can afford?

Welll ... I don't think your "needed" qualifiers retain the gist of my point, but I do think they illustrate a part of it.

GA

"As to the rich using a larger portion of society's benefits, no I would not agree, but I also don't understand your point. In what way do you think they use more because they are rich? Do they use the roads more, the bridges, the police? What do you mean they use more benefits of society?"

GA, Here's an example, a true one: Our Capital city of nearly 200,000 started moving to the west of town over 20 years ago, depleting the downtown area of funds for upkeep. The western area gets more moneys for roads, sewers, police departments and other city services. Meanwhile the folks in the downtown area, who can afford to move, start moving to the new area, not because they like it so much, but because when they turn on the tap, they want to know the water is there or their sewer doesn't back up. They want to know if they call the police, an officer will respond within a reasonable length of time. They want the potholes from the last big storm to be repaired. Next thing you know, the downtown residential area that people have worked hard to restore for the last 40 years is turning back into a slum. Crime is moving back in and overworked police are slow to respond to an emergency situation in the area. The federal grants to restore existing properties have dried up and more of the old homes are being torn down. But nobody except the downtown residents care because those living in expensive homes in the new part of the city are happy. The downtown area again loses much of its tax base because the wealthier residents who have restored old homes have again moved out for lack of services and joined the rich in the western new part of the city.

This should also answer Wilderness's question "needed by whom...or a select few that want more than they can afford." Why, because many of these people who leave their downtown homes walk off and leave them. Banks repossess the houses and they basically stand empty and deteriorate or take a loss on the sale. All because they join the nouveau riche in the new part of the city. Our taxes pay for all this both directly and indirectly.The cops can't keep up with the crime in old city, even though there are more cops per person than in the new area (who is getting the most funding?). The grants to improve the area are starting to dry up but the new area does not get ANY improvement grants. Who is getting the most from society? Downtown tax base is drying up, so other tax bases must pay instead of residents - who is getting the most from society as opposed to paying for their own needs?

Downtown died because society - ALL the people - did not keep up with needs. The "rich" left to where they are not required to pick up the share of those that don't pay...and this is somehow the fault of the rich.

No, it is the inevitable result of over-taxing a few to cover what the rest of society won't pay for. It is what happens when a few are expected and required to pay all the costs. Just as in Seattle losing the Amazon HQ because it wants Amazon to pay for what the city wants but doesn't want to pay for.

We can see a similar thing in schools. Most school systems are primarily funded from local property taxes, and the rich areas most definitely have better schools. The poorer areas fund from both state AND local taxes, on the other hand, and even with the extra cannot keep up. The poor are getting more benefit (the rich pay for their own schools), and it is most unreasonable that the rich give their money to the poorer schools (more than they already do), letting their own schools go downhill, until the two match.

The "rich" built downtown while the poor depended of "society" (the rich) to pay their share. The "rich" got tired of doing that - couldn't keep up with what "society" was being required to support - and left, to build another area where their expenditures could build something nicer. Who was and is getting the larger benefit from "society" - those that depend on it for their needs or those that not only supply those needs but build a new areaa for themselves at the same time?I knew you would twist that around to suit yourself. I know that isn't how it was at all, but it would do no good to try to explain to a closed mind so I won't bother except to say that some unspoiled wilderness went up for sale because the owner died, acres and acres of an area around a mountain. The rich saw their golden opportunity to despoil this natural beauty and at the same time practice segregation from the blacks who lived among them downtown. Twenty years later, the government went into this area and built low rent apartments and integrated it with poor people and low quality people of all races (They are not the same, you know.) So how do you feel about segregation? When you start talking the rights of the rich v. the rights of the poor, you have to get into segregation v. integration. In the South, the blacks are the first to go back and re-segregate themselves from integrated society even when we were under federal orders, so it is only fair to bring it up for discussion.

You really don't know much about society except what the rabid conservatives tell you, do you. The people with money to restore the downtown did just that. They brought up the quality of life for all races and classes of people. When they moved out, the quality of life went down for everyone who stayed from the poor to the rich. But then you probably don't know about such things. Fox News doesn't discuss constitutional rights for poor people.Yep - it's all about how it's spun, isn't it? If we try hard enough we can even make it all a race thing, even though we know very well that it was far more about escaping the slums. Why, we can even denigrate those that build a new home or subdivision as "despoiling this natural beauty" that they own and have the right to do with as they please if we just put the right spin on it.

You may find it necessary, when discussing the rights of rich vs poor to make it about racism; I'll just leave it at "We all have the same rights". Black, white, red or brown; rich, poor or in between; male, female or other; even those to whom race is of supreme importance or who try to shame people into giving up what they built because they don't have enough melanin in their skin; we all have the same rights.

"The people with money to restore the downtown did just that. They brought up the quality of life for all races and classes of people. When they moved out, the quality of life went down for everyone who stayed from the poor to the rich."

Gotta love it, for that's exactly what I said - the only difference is that I went on to point out that the poor were getting more from society than the rich. That the rich built a nice town, but couldn't support it without help, so when it went downhill because the poor didn't provide anything they left to try again somewhere else. You might not like it, but the whole story tells the tale far better than shifting blame to someone that just wanted a nice neighborhood to live in.

You want to show that the rich get more benefits from society than the poor you're going to have do something other than give examples showing the opposite is true. And a whole lot more than just saying it's all about what race people are.

I think I understand the thought behind your example MizBejabbers, but I don't think it is a valid example of the "usage" claim.

My small town is only about 60,000, but we too have struggled with trying to revitalize our downtown for 30+ years also. We have also seen the new development flow from one end of town to the other. In short, I believe my town has experienced all that you put in your example, and, although we also suffer with semi-blighted/newly poor, (just a category descriptor, not necessarily an accurate descriptor of the inhabitants), areas just as you mentioned, I can see nothing that relates to the point of the "rich" using more public resources. The death of city "downtowns" is both a historical and national problem that is a normal economic and societal occurrence. I don't think it has anything to do with a rich or poor qualifier.

Take your roads, (potholes?), example. In my area, the highest traffic roads get the first attention - whether through a newly developed area, or a newly poor one. Of course if a road was high traffic before the exodus and received priority maintenance, but is now a low traffic road, then it is only natural that it is bumped down in priority. My impression of our police presence is the same - priorities are placed where the highest need is, which seems to contradict your thoughts, because it is the newly poor or exodus areas that usually have more need of police resources.

GAI like the pothole explanation, but it isn't always true. I live in a suburb of Boise (around a quarter million) but road maintenance is by county, not city, and I'm in the same county. We get potholes (winter guarantees that!) but by midsummer they're gone. Everywhere. We have the best road maintenance I've ever seen...and we pay for it. The Ada County Highway Dept. is second only to schools in the county budget.

A mile away is another town, same as I live in - a suburb of Boise - but in a different county and their roads aren't half as well maintained. It's also a much poorer county (albeit it with higher property taxes) and doesn't have the tax base to do good road maintenance. Potholes stay for years before being repaired - I quit using one path to visit my son there because the road was tearing my car apart.

And a hundred miles away is another town, another state, where other relatives live and that I often visit. I don't think they ever do anything outside of putting down a chip and seal once a decade! I remember an underpass under the RR, where a farmer suddenly stopped during a heavy rain, yanked a 4X4 out of his pickup, jammed into a hole in the pavement that was fountaining water up 3' high, drove it in with a sledgehammer, cut it off with a chainsaw and went on his way. That's their idea of maintenance! The road in front of my mother's house was nothing but pothole and it stayed that way for years and years. It's also a very poor town of 10,000 in the middle of nowhere and the only jobs are farming and store clerks. I think the town exists on SS and welfare.

Poverty most certainly can affect potholes; if there is no money there is no repair, and living across a county line (or city boundary) can make all the difference.I can see the truth in your comment Wilderness, but even with those illustrations - and remembering that we are talking about localities, whether they be a city or county, do you think any of your example localities would have been changed by an economic shift from one part to the other?

If the rich folks of that poor town of 10,000 moved to the outskirts of town instead of downtown, or to the north end of town from the south end, would that have changed the "pot holes" situation? I believe that county, even with its limited funds, would, like my county, still direct those funds to the most traveled roads first.

GAOh, they do (do the most traveled first)! But it might take a few years to fix a pothole on the main street of town, and side roads may become half dirt before THEY get fixed.

But I was also pointing out that it is a political "locality", not a physical one, that likely makes the difference. Move to the north end of a metropolitan area and you may very well cross a political boundary, finding a very different attitude (and/or funding) to potholes.In that respect, you are probably right Wilderness. I understood that from the beginning, but was hesitant to introduce the "favors" or "powers-that-be" aspect of directing where the "pot hole" funds are spent, because the funding amount doesn't change, and the needs priority doesn't change. It is only the "who pulls the levers" that changes.

GA

That's what I said. You want their money. That you label it "tax money" when you take it does not make it yours to take (ethically; obviously might makes right legally). You could be spending what they earned on bridges, sewers and military so think you have the right to take what they earned.

Because you cannot afford to build the roads (etc.) with equal contributions from all that use the road system, you have decided that it is your ethical right to take what you want from someone else to accomplish your goals; that it is wealth that belongs to you because you want it.

It is always odd to me to hear people claiming the right of ownership to what others actually own, to do with as they choose without regard to the needs or wants of the real owner.Deleted

General motors, since mar. 2009, has ranged from -55% to 7.06%

WalMart, since Oct. 2005, ranges from 1.4% to 5.2%

Bank of America, since Dec. 2005, ranges from -73.13 to 30.5%

Pepsi, since 2005, ranges from -3.6% to 17.2%

Sears, from 2005, ranges from -15.25 to 4%

Explain again that the average profit margin for US companies is around 20%? Wait:

https://www.stock-analysis-on.net/NASDA … fit-Margin

gives the profit margins for fortune 500 sectors. It shows the entire S&P 500 to be 8.6 to 9.2 over the past year (keep in mind these are the largest 500 companies, and most successful, in the country). Only one sector (software) reaches 20% and of course food is at the bottom with 2.9%.

"The fastest growing small-business sector among those analyzed by Sageworks was construction, which generated double-digit growth (10.6 percent)." "the average net profit margin among construction companies continued to strengthen in 2015, hitting 5 percent. " Small firms accounted for nearly two-thirds of the net new jobs created between 1993 and mid-2013, and they provide nearly half of private-sector employment."

https://www.forbes.com/sites/sageworks/ … 98a6d52f0b

I'd have to say that small business, with half of all private sector employees, has a much lower profit margin, dragging down the S&P average considerably. And I'll throw another one at you; with unemployment hitting rock bottom, labor prices will rise. When a 16 year old boy starts his first ever job at $10 it says something, and that is very likely going to be transmitted to lower profit margins.

So you go ahead and claim all you want that a normal profit margin in the US is 22% - I'll stick with the truth at less than half that. (While admitting it is higher than I thought.)

Sorry, but corporate big trucks don't pay their fair share of taxes to support the interstate highways they drive through. Legislatures raise gasoline taxes to raise highway revenues, but the burden falls on the people who live in those states because the truckers fill their tanks in the states with cheaper gasoline taxes before they hit the interstates going through the high-taxed states. Corporate welfare again.

Did you read your own post?

States raise their gas prices beyond neighboring states to raise more road taxes with the result that truckers gas up in the neighboring states. This is wrong, and corporate welfare, (when a great many of those trucks are owner-operators), because truckers should give their money to the states they drive through that demand the most. Truckers should use the roads in states that require less of them, but save their money for spending in states with the highest tax rates.

This is a good point, and just one more example of legislatures ignoring negative aspects of over-taxation. Of legislatures assuming that business (and consumers) will pay whatever the legislature wants, when the truth is that eventually people (and truckers) simply leave.

- RTalloniposted 7 years ago

0

Anyone wanting to gain first-hand insight into what's happening in the welfare system should spend some time talking to retired social workers. They start out young and idealistic, trudging through an often difficult job. Often having to watch their backs at work just to keep their jobs, if they want to climb the corporate ladder they have to do things that would bother their conscience if they thought them through. As they age their experiences can be eye opening. Here is a thought-provoking true story.

An acquaintance told me of her take-your-breath-away moment in time when it finally dawned on her that she was not helping people. A family shows up for a regular report to her. The grandmother was a long-time "client" making sure her daughter stayed registered with the system. In tow they had a grandchild with them, meaning three generations sat before her.

Doing her job well the social worker took care of business, then took a moment to chat with the little one, but she was stunned by the savvy question the child asked her: "Will you be my social worker when I grow up?" That social worker, now retired, is still shaking her head over the realization that hit her on that day. My question is along the lines of why it took her so long to see the truth that was set before her everyday of her career. I wanted to ask her whether not connecting the dots before that point was because she wanted to keep her retirement in place. However, in spite of her shock at the time, she was not willing to have that discussion.

This discussion has an interesting evolution to it. Doing a search on "welfare system failures" can take one around the world to look at the info of, for instance, Nordic countries (and more), to see something of what they face in the consequences of their responses to the concept of welfare systems.

Some books that give more awareness of the topic's issues include:

https://www.amazon.com/Never-Enough-Ame … 1594035849

https://www.amazon.com/Please-Stop-Help … helping+us

https://www.amazon.com/Federalist-Paper … 9VAQK5HJZDYou are right that some do abuse the system. The child I described in one of my earlier posts who plays soccer and martial arts and still draws a disability check as a teenager is the son of an African-American lawyer. Yet there are people who truly need disability who can't qualify, and those who do, like those with congestive heart failure, have to jump through hoops each year to pass their health tests to qualify. They live with the fear that they will be denied benefits when they have no way to support themselves.

The abuses, both by those running the system and receiving the benefits, are the consequences of not heeding the warnings about establishing the system in the first place. Sadly, nothing else could be expected.

Blame the Great Depression caused by greedy dishonest stock brokers and overzealous stock market investors (according to my U.S. History class in college) for the welfare system. After the crash of the stock market and the depression of the 1930s, hungry unemployed people began to riot.

"MINNEAPOLIS—Several hundred men and women in an unemployed demonstration today stormed a grocery store and meat market in the Gateway district, smashed plate glass windows and helped themselves to bacon and ham, fruit and canned goods.

—from the New York Times, February 26, 1931"

What should have been temporary assistance for people affected by the Great Depression continued despite the prosperity of post-WWII. If I remember correctly, Presidential candidate Barry Goldwater had some possibly feasible ideas about eliminating the system, but lost the 1964 election to LBJ because people were more interested in civil rights and fighting Communism than eliminating the New Deal. After that it seemed like the country had passed the point of no return with Johnson's Great Society.Miz Bejabbers - Why do conservatives insist that America be like third-world countries where most of the income and wealth is controlled by a very few, there is a small middle class and a huge lower class (which, ironically, contains most of the #TerribleTrump voters)

I hope that is rhetorical, ME, because I certainly don't know. I mentioned that my father was a conservative Democrat, but those were an entirely different breed from today's conservatives. He never took a handout in his life. He had only contempt and scorn for people who wouldn't work and lived on welfare. He taught us to be self-sufficient and not take handouts either. In fact he went so far as to not let me apply for student loans. I had to work to supplement my college scholarships (which he had to concede that I had earned).

You mentioned being like Third World countries, I'm afraid that is where this country is headed. If things don't change, we won't be like a Third World country, we will BE a Third World country. The trickle down theory doesn't trickle down, it runs up. I can't credit that quote, but I think it was Warren Buffet. I know that he said something to that effect and that he hoped the country would catch on.Yes, that was rhetorical.

I would agree with your father when he says "He had only contempt and scorn for people who wouldn't work and lived on welfare. " But those people, based on my research, are few and far between in today's society.

And then there is the case where the "people" he is referring to have dependent kids. What would his thoughts be regarding the kids?

"The trickle down theory doesn't trickle down, it runs up." - never have truer words been written.

I wonder if your dad knew that it was "loans" that was the engine of American growth.

I’ve read through the forum with interest, but haven’t responded before because these discussions are about America, and there’s little common ground between the USA and UK where I live; so I can only respond from a British perspective.

Although I think the question is aimed at the narrowest definition of welfare e.g. support for the needy. In respect of the UK the definition given by wilderness is perhaps more meaningful e.g. “Any money, goods or services given to citizens for which there is nothing given to the government in return” , in that in the UK most people benefit from some form welfare in the broadest sense; not just the needy.

However, speaking for the UK, in the narrowest sense of welfare e.g. support for those in most need; welfare is means-tested and regularly reviewed (which can be stressful for the applicant), so no one (other than benefit cheats) will be in welfare benefit for life unless they are genuine. As regards benefit cheats in the UK, the official data suggests it’s less than 2% of total benefits paid, and most benefit cheats are caught and prosecuted eventually.

I stated that for the UK it’s easier to talk about welfare in the broadest sense as not all welfare in the UK is means-tested and everyone in Britain benefits to some degree. For example, Healthcare aka the NHS (National Health Service) is free to all at the point of use; Education is free to everyone under the age of 18; and Child Benefit isn’t means-tested in the UK either.

My wife gets Personal Independence Payment, which is a ‘Disability Allowance’, because she has a medically diagnosed bad back. The Disability Allowance she gets isn’t means-tested, although she only gets it until she gets her State Pension (which is a good few years away yet). Whereas, because my wife gets a Disability pension, and I look after her for more than 35 hours a week I’m entitled to a Carers Allowance; which although not means-tested I’m only entitled to provided I don’t earn more than the minimum wage, but work pensions don’t count so the fact that I am retired and my pension is more than the minimum wage is immaterial. So effectively the Government is paying me to be a househusband, which having taking early retirement is what I am.

With reference to minimum wages (something I noted cropped- up several times in the forum); in the UK the aim of the Legal Minimum Wage (which is $10.55 per hour) is to give people in full time employment on a low wage a liveable wage. And for those people not in full time employment, there’s a whole host of means-tested benefits to help ensure they don’t live in poverty e.g. housing benefit where the Government pays the rent to a maximum of $2,000 per month for a three bedroom house; albeit if you have a mortgage the Government will only pay the interest on the loan.

Also, in the UK, to help resolve the issue of a poverty wage for those in part-time work, and to help ease people back into full time employment, the Government pays a benefit to top up wages of part time workers to what is officially considered a liveable income; which the UK Government has currently set at approx. $16,000 per annum.

So as you might see from above, attitudes towards benefits is different in the UK than perhaps the USA e.g. it’s not just welfare benefits for the needy but also social benefits that benefit everyone, and which forms an important part of British Society; with the boundaries between welfare benefits and social benefits often becoming blurred because of the high number of benefits that most people can benefit from (regardless to their wealth) because they are not means-tested.Hello again nathanville, as you noted, and as has been shown in previous threads, it is a difference of perspectives that define our views.

Without needing to get into the justifications; your "carer's" allowance, in your situation, doesn't make sense to me. You are retired - with a pension, so why should the government, (aka your fellow citizens), pay you an allowance to do something you would and should do on your own - look after your wife? That is my perspective. It has nothing to do with British rationalizations - because we already know it is simply that our perspectives differ.

I have a similar perspective regarding your part-time and full-time wage supplements. If a government ensures someone has a non-impoverished income - then they have potentially stolen someone's motivation to do better in life. If a non-achiever doesn't have to become something of an achiever to get by in life, then why not just lay back and enjoy the ride?

Again, I don't make those points as a challenge - we have already been down that road, but only to confirm our different perspectives.

Regarding NHS and education*, (until 18), I have a less firm perspective than illustrated above. On these issues I think the times may dictate a consideration of change - in some form, for the U.S.

*the U.S. already has the same free education - almost. Your cut-off is age 18, which could in some instances include a year or two of college, (university?), whereas our cut-off is grade-level, the 12th grade, in which most graduates are 17. So there seems to be a small difference of one year of age between our systems

GAHi GA, good to hear from you, I haven’t been on the computer much in the last couple of months because we’ve had some glorious weather in England (Global Warming); so I’ve been spending a lot of my spare time in our back garden, enjoying the good weather while leisurely gardening as I start off the season to grow our organic vegetables and fruits.

Carer’s Allowance

Yes, I agree with you, the rules on the ‘Carer’s Allowance’ in the UK do seem a little bizarre, but I didn’t make the rules; previous Governments did.

I can remember back in the 1980’s, in the UK, that there was a philosophical discussion in some of the ‘media’ on whether morally ‘Housewives’ should be paid by the Government on the principle that they can work as long and as hard as their husbands who goes out to work. Obviously no one took the debate seriously, but the current rules on ‘Carer’s Allowance’ do remind me of those discussions.

The Carer’s Allowance was introduced under a Labour (Socialist) Government in 1976. At that time married women were not eligible; which under today’s culture would include househusbands. However, in 1986 the Courts ruled that this was ‘discrimination’ and therefore illegal. Therefore, the then Conservative Government changed the rules to include married women (househusbands) to stay within the laws on ‘human rights’.

The Carer’s Allowance I get isn’t to be sneezed at e.g. at $4,500 per year (plus the Christmas bonus) is quite respectable. Whereas my wife’s Disability Allowance is just $4,000 per year because she can get about with the aid of a walking stick; if she was more severely disabled then she would get significantly more benefit.

The Christmas Bonus is another quirky British Benefit; which has now become part of our tradition. The Christmas Bonus of $15 paid every Christmas (as a gesture of good will) by the Government to everyone on certain benefits (excludes unemployment benefits, but includes disability benefits and carer’s allowance etc.) was first introduced by the Labour (Socialist) Government in 1972; and every Government (Labour and Conservative) ever since has honoured the nominal once off annual payment as a ‘gesture of good will’.

Non-impoverished Income

I know where you’re coming from, but the current benefit system relating to low wages is an attempt to try to limit the problems of the ‘Poverty Trap’.

In British terms the ‘Poverty Trap’ (which was a big issue back in the 1980s) is where unemployed people were better off than those in work and on a low wages; therefore at the time there was little incentive for the unemployed to seek work.

So back in 1996 as a first step towards limiting the negative effects of the ‘Poverty Trap’ the Conservative Government introduced the ‘Job Seeker Allowance’ e.g. an extra benefit for unemployed people who could prove that they were activity seeking work.

Then in 2003 the Labour Government took it one stage further and introduced what they called ‘Working Tax Credits’ e.g. people in work, but on low wages, getting Government Benefits so that they would be financially better off than if they stayed on the doll (unemployed); thus giving a positive financial incentive for the unemployed to actively seek work.

Then in 2010, the Coalition Government (Democrats and Conservatives) tweaked the system in an attempt to simplify it by merging a whole host of welfare benefits under one system called ‘Universal Credits’; which they have slowly rolled out over the past 8 years, gradually replacing the old benefits, tweaking the system bit by bit to iron out all the bugs; but essentially the new system isn’t that different to the old system other than being more streamlined.

Albeit in 2015 the Conservative Government (when they came to power in a General Election) did try to slash benefits to the unemployed and low paid by $18 billion; but was blocked by the House of Lords on the grounds that it would have hit the poorest the hardest. So the Conservative Government (rather than face a Constitutional Crisis) dropped their planned cuts to the welfare system.

Education

FYI: There is another slight difference between UK and USA Education system e.g. in the UK there is a distinctive difference between College and University. University (from the age of 18) is where students go to study for their Degrees; while college (from the age of 16 to 18) is for further education and a stepping stone to gain entrance to university.

So yes, in the UK school and college education is free for all under the age of 18; including the text books.

Even then, from my understanding, the university fees system in the UK has some fundamental difference to the USA.

In England and Wales, university fees are capped as about $12,000 per annum; and (like the USA) students can get ‘Student Loans’ to cover the fees. However, where the UK may differ from the USA (you can correct me if I’m wrong about the USA system) is that UK Student’s only start paying their Student’s loan back once they are earning more than $33,000 a year; and even then they only have to pay back a minimum of £250 a year (the more you earn over $33,000 the more you pay back, on a sliding scale) until they reach State Retirement Age, when any reminder owed is written-off. And if you never earn enough to start paying-off the Student Loan it is automatically written off after 25 years.

However, if you live in Scotland then University education is free for all UK citizens regardless to age (except to the English, who have to pay) and free to all other EU citizens from outside of the UK e.g. Scotland is ruled by a Socialist Government who believes in free education for all.

"wages of part time workers to what is officially considered a liveable income; which the UK Government has currently set at approx. $16,000 per annum."

"the aim of the Legal Minimum Wage (which is $10.55 per hour) is to give people in full time employment on a low wage a liveable wage."

!0.55*2080 hrs/year = $21,944. Is a "llving wage $$16,000 or $21,944? In the US a single person should not have a real problem living on the $16,000 figure, although there won't be much in the way of luxuries.Hi wilderness, good to hear from you; and a good question.

Yes, I didn’t word things that well; I was trying to keep it simple while at the same time being aware that some words can have different meanings between American English and British English.

For clarity; the British Government has decided that the $16,000 is the minimum income people in work should be on in order to have an acceptable level of basic living standards and not be in poverty.

The $21,944 is defined by the Government as a ‘Living Wage’ by today’s standards e.g. allows people to have a few luxuries such as their TV’s, mobile phones, holidays and able to afford to run a car as part of essential modern living.

So if you’re in work, but not working full time e.g. in part time work, and earning less than $16,000, then you don’t pay any taxes and the Government makes up the difference to ensure your total income is $16,000; which helps to encourage the unemployed to seek employment.

If you are unemployed then the cash benefits (basic unemployment benefit) from the Government is obviously a lot less e.g. giving you the incentive to look for work, but to reduce the risk of you living in abject poverty you do get lots of other (non-cash) benefits e.g. for the unemployed and for those in work earning less than $16,000 the Government pays your rent and some of your local taxes etc., means-tested and on a sliding scale.

The benefit to the Government in setting the ‘Living Wage’ at $10.55 per hour is that is the minimum wage the employer has to pay. So provided you are in full time employment and on the minimum wage then you’ll be paying 20% tax to the Government on the difference between the $16,000 threshold and the $21,944 minimum wage you earn e.g. $1,188 in taxes per year.

It’s a delicate balancing act to keep the right level of ‘carrot and stick’ to encourage the unemployed to seek work; which is carefully monitored and rebalanced each year by the Government e.g. to take into account inflation and employment trends, and to balance the books etc. but generally it seems to work more or less as intended.

I hope I’ve clarified the points and made it a little clearer e.g. the present UK benefits system, first introduced by the Socialist Labour Government back in 1948, and tweaked numerous times by successive Labour and Conservative Governments since, is a complex subject.If you don't work you get your taxes paid (1188), rent 12,000?) and other help - enough to live on above "abject poverty" with the total likely over 20,000

If you work part time you get enough to ensure 16,000.

If you work full time you get 20,000 from the employer, nothing from society.

I'm not seeing much incentive here, except not to work. After all, you will get pretty much the same as someone working full time - your full time work will net you only a few thousand per year, if that. If you DO choose to work, you will earn 21,000 and then be required to give 1,000 of that to those that do not so choose, bringing them up to, or near, your level.Hi wilderness, it’s probably my fault for not explaining clearly enough. It’s a complex subject that can’t be summarised accurately in just a few short paragraphs e.g. as in America, there are tons of different benefits for different purpose; some means-tested, some not means-tested but with different qualifying criteria and some that everyone benefits from. For each benefit there are pages of basic guidance followed by all the different ifs and buts and variants e.g. some benefits (such as carer’s allowance) you either get in full or not at all; and other benefits such as Universal Works Credits, Job Seekers Allowance or ESA (Employment and Support Allowance) are all on sliding scales and calculated on a case by case basis e.g. between a minimum and maximum different people get different amounts dependent on numerous factors that are taken into account when calculating your benefit entitlements.

Hopefully, to clarify:-

If you are unemployed and on just basic benefits the cash you get may be as little as $3728 per year, which isn’t much to live on; albeit you get you rent paid and other non-cash benefits so that you don’t starve and do have roof over your head etc. And to get those basic benefits you are scrutinised closely by the authorities, with the risk that benefits can be cut at any time if you appear to be making false claims; which from people I know who are on such benefits can be very stressful, and the idea of a proper holiday is a luxury most can’t afford.

That being said; when you add up all the non-cash benefits the net worth can be equivalent to someone earning $20,000.

Whereas, if you at the very least you do get a part time job, and earn some money, you are not taxed, and you retain most of the non-cash benefits you had when unemployed plus your earnings are made up with Government money so that you end up with a lot more cash in hand than you had on the doll. So you do have more money (physical cash) that you can spend and you’re not monitored by the authorities so vigorously, so it’s less stressful.

But once you are earning over $20,000 then you do become more self-supporting and need less State Aid; and get less hassle from the State, which is a lot less stressful.

British Governments (both Conservative and Labour) have been grappling (on a serious level) with the points you make since 1996, and from their perspective the key to prevent low income employment from being less attractive than unemployment (which was the problem in the UK in the 1980s) is to wean people off of benefits on a sliding scale e.g. the more you earn the less benefits you get; but carefully balanced so that as you earn more you do end up with more money in your pocket, are slightly better off, and have more freedom to spend the cash you got.