Avoiding Foreclosure

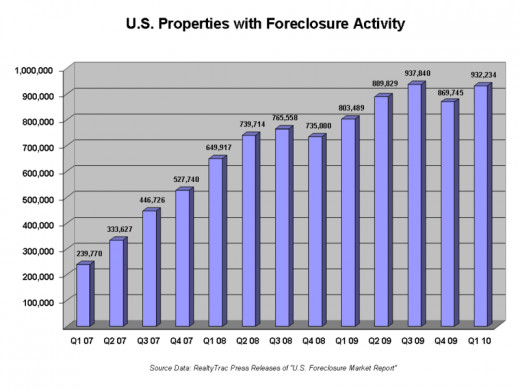

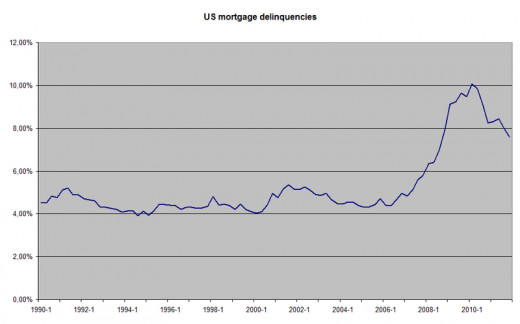

Are you behind on your mortgage payments and it does not look like you will be able to catch up? Or does the amount you owe far exceed your home’s value? Are you desperately hoping to avoid foreclosure and the fees and humiliation that accompanies it? Well you are not alone. Due to the economic slowdown of the last half dozen years, many people find themselves in the situations stated above. And yes many properties have already been foreclosed upon. But most financial institutions, with government pressure and assistance seem to be ready to help. Most larger lenders have experienced Loss Mitigation departments to deal with short sales. Smaller institutions often (but not always) have a little more leeway to deal with options. Within the past few years, many Government programs have been established to help people in difficulty.

The US Government has a great website (See link here) which explains the various options available to you in detail. If you need to refinance your mortgage to lower your payments, you are “underwater” (i.e. you owe more than your house is worth), or you are unemployed, or otherwise financially stressed, help is available.

If you find yourself in trouble, it is best to research your situation thoroughly by reading all you can about your options and speaking to experts in the field. It is imperative that you speak to your lenders early in the process. They may be able to find a solution which may help you save your house. Banks are in the lending business, not the home ownership business. They will only foreclose and repossess your home as a last resort. The earlier you speak to them, the more leeway they may have with you. The longer you delay, the more serious the situation can get. When faced with a tough situation, many people tend to try to avoid the situation. Early intervention may mean the difference between keeping the family home or losing it.

But what if you can’t save your home (or it’s not worth it for you to try)? Letting your home go to foreclosure is a very expensive option and the cost of it can run into the thousands. It may be worth it to you to get this albatross off your back. Below are a few options:

Deed in Lieu of Foreclosure

Basically this is a situation where the borrower will deed to property over to the lender in exchange for a discharge of the mortgage. The advantages to the borrower are the avoidance of an expensive and embarrassing foreclosure and although the borrower’s credit rating may be badly damaged, it is not as bad as a foreclosure. The lender does not have to continue with expensive foreclosure proceedings, but they will have a home that needs to be secured, maintained and sold, all of which cost money. Lenders are a lot more apt to accept a deed in lieu, if they are the only lien holder on the property. If there are junior lien holders, they would become liable for that debt. In many cases they would reject the deed in favor of the full foreclosure.

Short Sale

Simply put, a short sale is the sale of your home for less than you owe on it.

Most mortgages have a “due on sale” clause. This means the entire balance of your mortgage is due when the home is sold. Since a short sale will effect all lien holders on your property (first mortgage, second mortgage or Home Equity Line of Credit as well as any other liens you have on your property) , it is imperative to contact each lien holder. They will ask you for a Hardship letter. In the letter you will explain to them the reasons why you need to short sell your property. One of the first things they will do is determine the value of your property with an complete real estate appraisal or broker’s opinion. Make sure you contact all of your lien holders and get their permission.

Other lien holders

The way title on your house works, the first mortgage holder has the right to all proceeds of the sale equal to the amount of their mortgage balance. All subsequent lien holders have the right to the any proceeds that are left after the first mortgagor has been made whole. Thus, it is possible that a subsequent lien holder may not receive all he is owed or may be left out completely. See the example below:

Short Sale Price: $300,000

First mortgagor balance: 250,000

Second mortgage balance 60,000

Third lien balance 15,000

In this scenario, the first mortgage holder, would recover all their funds, while the second mortgage holder will only recover $50,000 of the amount they are owed and the third lien holder will be left with losing the entire balance. If a junior lien holder thinks that the property will sell for a higher amount at a foreclosure, they will reject your short sale request.

There are advantages to the borrower with this option. According to a study done by A Joint Economic Committee of Congress, a short sale can lower your credit score by 70-100 points and a foreclosure can cost you 250 -300 points. In addition your credit will be back up in order to let you qualify to buy another home in about 2 years. A foreclosure could keep you from purchasing again for up to 10 years.

Deficiency

One thing to consider if you chose to get a discharge of the mortgage by short sale is if the state you live in has laws pertaining to any deficiency you may leave after you make the deal. (I.e if the sale price leaves a portion of your liens unpaid.) In some situations, the lender may be able to pursue you for payment of the unsecured debt. (This can also happen after a foreclosure.) It may be a good idea to consult with a experienced real estate attorney.

*********

Disclaimer: Although I have spent most of my career in the mortgage industry, I don’t consider myself an expert when it comes to foreclosure avoidance. This Hub is meant as a overview of some options you have should you ever find that you are in trouble with your mortgage. Nothing in this piece should be construed as a recommendation. The only suggestion I would make is that you employ the services of a good real estate attorney to direct you through the situation toward an equitable and fair outcome for you.

© 2013 Bill Dussault