Avoiding Bank Fees

New Bank Fees Aren't Fair

Your bank is cheating you. I know you've used them for years and you've never had a problem before, but trust me, banks are changing the ground right under your feet by quietly instituting fees for everything from changing your address to wanting to use your debit card. Avoid bank fees by choosing a new bank that won't steal from you. They should be paying you to use your money.

Fees are not fair, especially new fees. I understand banks are going through a hard time. After they ruined their economy with their gambling addiction, after they came crawling back to the taxpayers to prop them up, the addiction has crept back, but they can't gamble with the taxpayer money. So, they've started stealing, as many addicts do, to satisfy their need. Who better to steal from than the people whose money is already in they bank.

Banks have instituted fees for everything from having an account to not using the account you paid a fee to have. Mid-west regional bank TCF once charged me a fee for "inactivity" because I didn't use my debit card enough. $25 dollars later, I closed my account and took my business elsewhere.

Bank of America, behemoth of bailout fame, is saying thank you to its customers by charging a $5/month fee just for using your debit card. One can avoid this fee by not using your debit card ever. I recommend getting a good credit card from a different bank and paying your balance every month to avoid finance charges.

U.S. Bank is charging if you change your address and forget to tell the bank. Five dollars for every returned piece of mail. I bet they are praying you move. SunTrust bank charges for moving your money through online transfers. PNC Bank charges a whopping $25 for a replacement debit card. Many banks are increasing their ATM fees as well. Bank of America and Wells Fargo charge $3, while M&I bank recently charged me $5 to withdraw $50, a 10% fee. Good thing my bank reimburses me for other banks' outrageous ATM fees.

Some banks have gotten so out of hand that class action lawsuits are pending.

The best defense against these fees is a good offense. Find out if your bank has fees you are likely to incur. Ask your banker if you can avoid these fees by changing the status of your account. Tell them bluntly that you will avoid fees even if that means finding a new bank. Most fees have loopholes. Your banker should tell you how to avoid them. One easy way to avoid overdraft charges is to set up overdraft protection by allowing overdrafts to be covered by an automatic transfer from a savings account. This is better than a line of credit because it saves you from possible future interest charges. Be careful that our overdraft protection isn't cause for a fee itself. Some banks automatically sign up their customers for this "service," and then charge them huge fees if they ever use it. Real overdraft protection should be free.

Even if you incur a fee, don't give up. Ask if you can have the fee forgiven. If they refuse, start looking for a new bank.

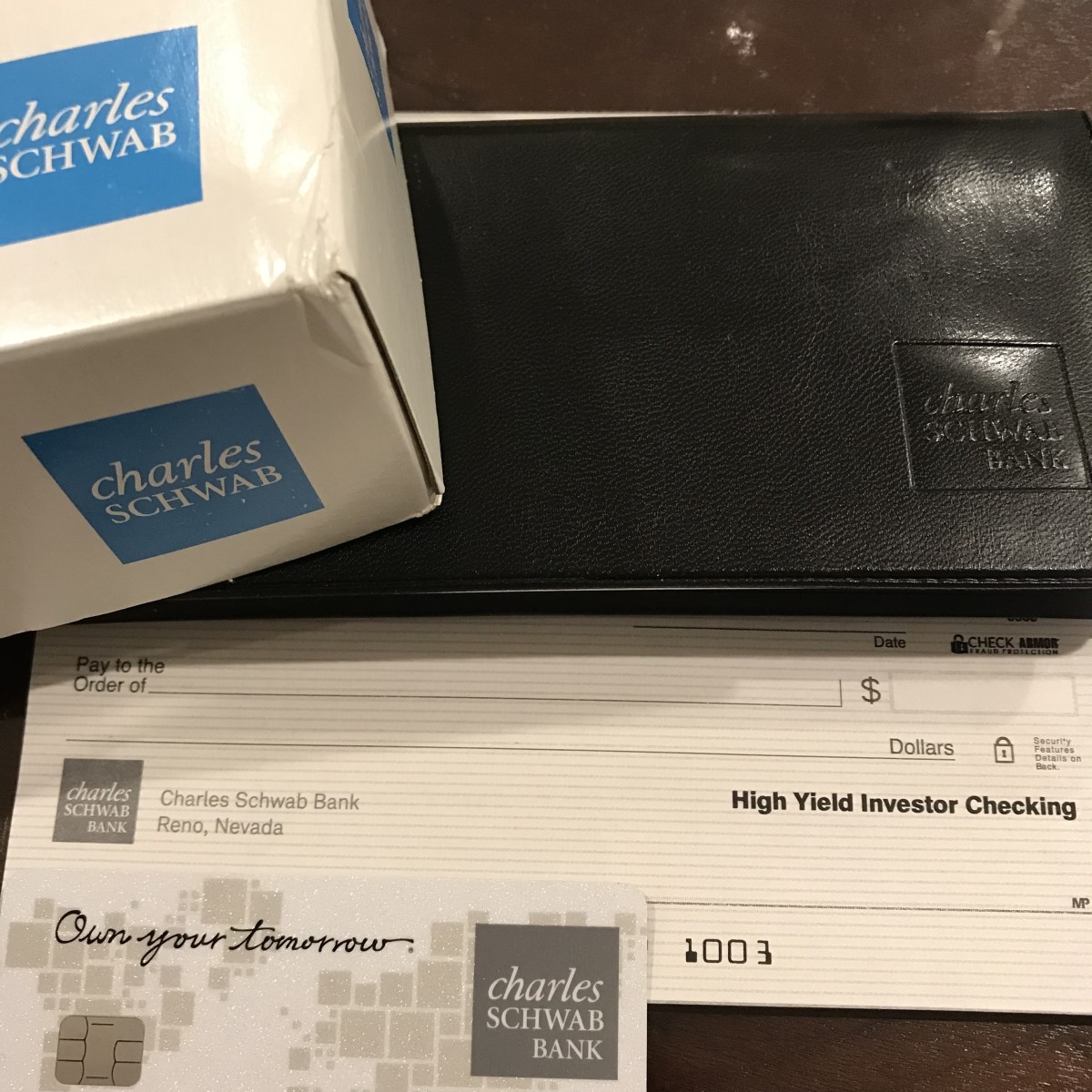

Some banks, such as online bank USAA, have very few fees. While they don't have bricks and mortar branches, they have an awesome online banking system. Besides, would you really miss going to the bank? To get money, use any ATM and USAA pays the fee. To deposit, take a picture of the check with your phone–it's instant. Most importantly, USAA isn't looking for a way to steal from you with fees.

There are other honest banks. Most credit unions have better fee schedules than big banks, and with a growing network of coop credit unions, you may be able to use your ATM card coast to coast. Be suspicious of large national banks. Many of them have the attitude that you need them more than they need you. Also be wary of banks that cater to students and other financially insecure clients. These banks thrive on fees. They lure clients in with big offers, set them up with accounts, but then they punish them with fees when they make a mistake.

One final tip: when you find a bank worthy of your business. It may be worth consolidating your finances into that one bank. Many banks reward accounts that have higher deposits. Plus, the bigger a customer you are, the less likely they are to scare you off with unfair fees.

Bank Account Magically Reopening?

Sometimes people close their accounts only to find that they magically reopen and accrue more fees. If this has happened to you, there are two possibilities.

1. It is possible that you have an agreement with a third party vendor–the power company or Amazon–that has the power to deduct or deposit money into that account. You have to go back to that third party and change account information with them. Your bank can legally (incredibly) reopen your account and charge you a fee.

2. The other possibility is that you bank is screwing with you. That's not the technical term, but you get the idea. You can ask the bank to prove that the money was legitimately deposited or withdrawn from your account and that there was cause. If they can't prove it, ask to speak with the manager's manager's manager. If they don't give you your money back, find an attorney with pockets deep enough for a class action suit. You won't get your money back, but you will sleep better at night knowing the bank is answering for its irresponsible fees.

Why did you dump your bank?

- Dump Your Bank: Why did you change banks?

This website has comments from real customers who changed banks. Hear their reasons why, who they bank with now, and how they rate their current bank. Maybe you will find a new home for your money.