Bank of America Fees

How Bank of America Cheats Customers

BofA first cheated me using this scheme back in 2002. I maintained a strict budget and sent as much money as I could to pay college loans down. I kept a $1.00 balance at the end of each pay period. Cash was withdrawn for monthly living expenses (envelope method- it works.)

I have forgotten the reason, but BofA erroneously charged me some $15 fee. This triggered a long stream of $35 overdraft fees. I came in and covered the first one, which they said was too late, and so the second $35 insufficient funds (NSF) fee kicked in. I came to the bank, reviewed everything with the banker, paid the fee again... and even more $35 fee notices came in the mail two days later.

Here is how they ensure your deposits to cover the fees and prevent subsequent fees are blocked: They snail-mail you a postcard-sized notice to let you know that you have incurred a $35 fee. This is very discreet of course. The mailman and your neighbors have no idea what that little 4" x 5" mailer with perforated edges and a bright "Bank of America" logo in the corner is because you irresponsibly handled your finances. Really, everyone knows. The mail man knows (or thinks he does). In that instance, I never received my monies back. Instead, BofA "generously" returned half of what they robbed from me.

When I spoke with BofA personnel (same for you, too, no?) and they returned half, they carefully worded the action as a generous act on their part. It was an insult! They even admitted the $15 was a mistake, and returned that initial fee. But, constantly referring to banking rules and what they were "allowed" to do and to not do, they just could not - very sorry - return more than half.

Yesterday, I copied a conversation with online chat at Bank of America. Read it and see how they obfuscate and avoid answering any questions!

Holding Checks in Limbo before They "clear"

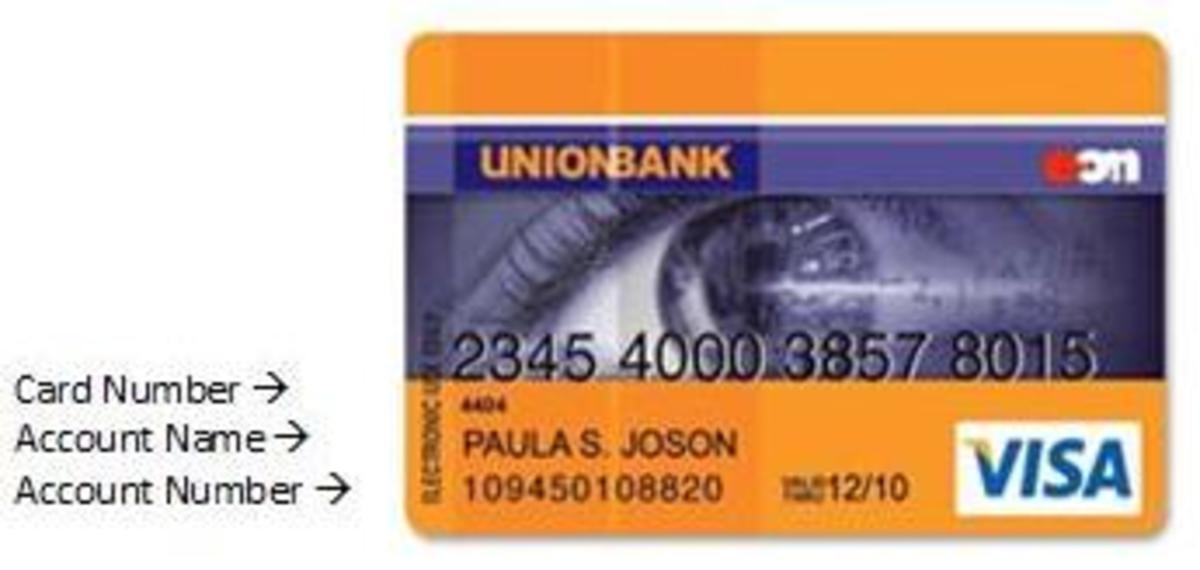

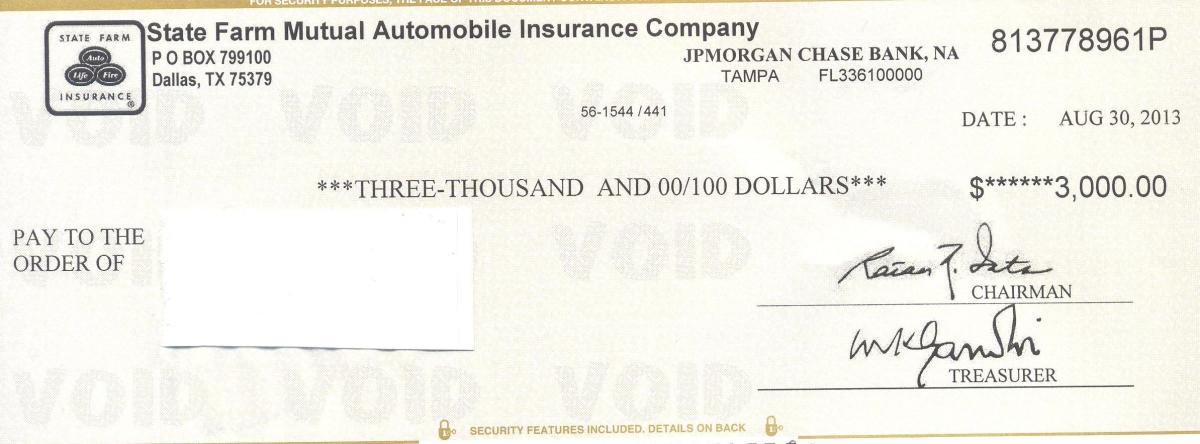

Here is how the shell game works: Let us suppose you sent out three payments (I'm using my own example from 2002). These are three checks to: a student loan note holder ($250), a clothing retailer ($10), and Visa ($25). You mail the two small checks on Friday, and the largest check on Monday morning. Thursday, you receive notice by mail that the bank charged you a $35 fee. As a courtesy, they are not charging you a second $35 fee. This is a one-time courtesy, and the bank will do this no more than once per month.

You go and deposit $35 to cover the fee and leave a $1 balance. Good, right?

Wrong!

You go home later that day and find another overdraft. It seems the bank cleared the $15 fee to itself (for not having direct deposit, which was actually set up, but not yet started- or some such nonsense) first, before any of the actually demands for funds (checks) which you yourself have ordered them to pay.

Here is where it gets interesting! Now, because the account is short $14, it certainly cannot cover all three checks. A reasonable person thinks, "I hope the important checks clear first!" But, that is not how BofA does things. The two small checks arrive first. The account had $286 to cover $285 in checks. But, the $35 fee left only $251. So, the two small checks should clear and leave only the student loan check to bounce, right? Wrong!

BofA receives checks and does not pay them on demand, as you desire and expect them to do. A check is a legal note, and should be "paid on demand". Instead, Bank of America (formerly the Bank of Rome) holds the three checks in a kind of limbo. But, they don't hold each check for three days and cash them each three-days-old. Instead, they wait and see if there will be enough demand on the account to bust the balance.

In my case, the loan check exceeded the available funds. So, they paid that check immediately, and then processed the two newer checks afterward. To do this, note that they do not hold the largest check for three days. I have read many descriptions of this crooked practice, and none have fully pointed this out: There is not really a three day "clearing" process. They simply delay checks hoping for larger checks which can break your balance and thereby cause the greater number of small checks to bounce.

This delay is entirely in favor of BofA collecting fees. If, for example, the three checks were all in limbo, and I walked in and deposited a thousand dollars cash, the bank would still collect their fees. (This has happened to me.) The delay in "clearing" the checks can only benefit the bank, not the victim. I mean, customer.

$286 - $35 leaves $251. Less $250 for the loan check leaves $1. Now, BofA clears the $25 Visa check, which bounces, and the $10 retailer payment, which also bounces.

The "clearing" process is a shell game that serves one purpose: to provide an opportunity for Bank of America to collect fees!

You Can Actually "Opt Out" of Some Fees!

After many visits to the bank to argue over fees in several years of my wife banking there, a local manager finally told us that she could just request it, and any debit card transactions that would trigger a fee would be denied. So, we said, "of course!" and they clicked a few keys on a keypad and that was fixed.

But, apparently, that does not include ACH fees, a fee sent by electronic transmission using the actual account number, and not a debit card number.

Both are just a series of coded 1's and 0's sent electronically from a retail computer to the BofA computer. Both are automatically rejected. But, one of these generates a $35 bonus for the stockholders, and the other does not.

In the next dialogue with a BofA representative (the entire conversation lasted more than an hour, despite it looking like it was shorter.) Notice how "Maricel" never answers with a "no" and never actually answers any questions.

When I opened the chat session, I was asked "In what state do you bank?" I informed the system with a click, "California". When I told the first operator, "Mayvelle" that I wanted a fee returned, she suddenly realized I was in California and transferred me to another operator, who handles California, apparently.

I suspect I was really transferred to an expert in exhausting all efforts from victims attempting to recover the immorally stolen monies. Every effort by "Maricel" is not really to justify my claim- it is to find a reason to blame the customer for the expense, and to get rid of the customer.

A Conversation in Online Chat with Bank of America Reps

Welcome to an online chat session at Bank of America. Please hold while we connect you to the next available Bank of America Online Banking Specialist. Your chat may be monitored and recorded for quality purposes. Your current wait time is approximately 0 minutes. Thank you for your patience.

Thank you for choosing Bank of America. You are now being connected to a Bank of America Online Banking Specialist.

Mayvelle: Hello! Thank you for being a valued Bank of America customer! My name is Mayvelle. How may I assist you with your personal checking and savings accounts today?

You: Hello.

You: Hello, Mayvelle.

Mayvelle: Hi. How may I assist you with your personal checking and savings accounts today?

You: thank you.

You: I have a bizarre overdraft fee on

You: 9/30/2011

You: I had sufficient funds, but BofA charged me an NSF fee!

You: Can you believe it?

Mayvelle: I understand that your concern is about the fee. Thank you for bringing this to my attention, I appreciate you giving me the opportunity to help you.

Mayvelle: Before I can go ahead, can you verify your complete name & last four digits of your account number as it appear on your statement please?

You: (omitted for publishing on the www)

Mayvelle: Thank you for the information, (omitted).

Mayvelle: Please allow me some moments while I look into your concern.

Mayvelle: Thank you for patiently waiting.

Mayvelle: I see that you opened your account in California.

You: yes. Oakdale.

Mayvelle: We do have a different dedicated department who assist customers who have concerns with regards to their account opened in California. I am able to transfer you to our specialist. Would that be alright with you?

You: Yes. I know there are two different Bank of Americas.

You: east coast, west coast

Mayvelle: I appreciate your patience and understanding in this matter.

Mayvelle: Please allow me some moments while I transfer the chat.

Please wait while I transfer the chat to the best suited Bank of America Specialist.

Thank you for choosing Bank of America. You are now being connected to a Bank of America Online Banking Specialist.

Maricel : Welcome to Bank of America. My name is Maricel. How may I help you with your Bank of America personal Checking or Savings account?

You: Hello Maricel.

You: I have a phantom NSF fee.

Maricel : I understand your concern regarding the $35.00 assessed on your account. Please give me a moment to check that for you.

You: 9/30/2011.

You: I had a balance of $52.35... but was charged an NSF fee.

Maricel : I am still checking, please bear with me

Maricel : Thank you for your patience.

You: sure.

Maricel : I see that you were charged with $35.00 fee because of the electronic payment on September 29 which was returned unpaid against insufficient funds

You: Can you return that $35? Bank of America did nothing to earn it.

You: It is immoral, don't you think?

Maricel : To view the complete details, please click Accounts tab, then click on Account Details tab and on the left hand side, you'll get the option to view the Account Balance History.

You: It only shows back to 10/20.

You: after 20 clicks, I got to it.

You: So, as I said, BofA did nothing for me... but automatically (by computer) reject a request.

Maricel : I see that your account was charged correctly, we can only reverse the fee if it was caused by bank error

You: Please return the $35 fee.

You: The bank errs in charging where it has no moral or legitimate right.

You: 10 years ago, someone had to process a check.

You: Today, it is electronic- FREE, for the bank.

You: Charging is ugly and dirty.

Maricel : I see that your overdraft setting is Decline All, with this setting, we only authorize or pay a debit card purchase, ATM withdrawal, check, Online Banking Bill Pay and other electronic payment when we determine there's enough money available in your account or in your linked Overdraft Protection account at the time of transaction. However, under certain circumstances, you can still pay an NSF: Returned Item fee when you don't have enough funds in your account.

Maricel : For everyday debit card purchases, your transaction is declined and your Overdraft or NSF: Returned Item fee is $0.

You: Exactly.

You: For the bank there is no difference.

Maricel : For checks, Online Banking Bill Pay or other electronic transactions using your checking account number, your transaction will typically be retuned or declined; you pay a $35 NSF: Returned Item fee for each returned item. You may also be charged other fees by merchants.

You: a computer rejects the request. done. no service provided.

Maricel : For recurring payments using your debit card number, such as a monthly phone bill, your transaction will be declined and your NSF: Returned Item fee is $0.

You: Netflix is a recurring fee.

You: therefore, the bank has erred!

You: Bank error. Hurray!

You: Every month, Paypal (for Netflix) bills my acct.

You: every month. Check it out.

You: So, Maricel, please return our $35. Thank you. You are being a great help.

Maricel : The only transaction I see from that certain merchant was the transaction for $17.16 on October 6, (name omitted for www)

You: This is how I have always been billed for Netflix.

You: via Paypal.

You: The next charge is due tomorrow.

You: I've had Netflix (via PayPal) for many months... maybe more than a year.

Maricel : May I please have the last posted transaction from Paypal before the transaction on October 6?

You: I'm checking my paypal acct.

You: Aug 28 and July 28- both for $10.73

You: I don't know why this month was more

You: before that, they were all on the 28th... for $10.83

You: This is the unlimited streaming + 1 DVD at a time plan.

Maricel : I see, thank you for the information. That is the reason why you were assessed with the fee. I kindly suggest that you contact Paypal in this regard.

You: What?

You: It is a regular, recurring payment.

You: Does a recurring electric bill have to be exactly the same each month?

You: If I contact Netflix, and they say there was an error, it should have been $10.73, will BofA return the $35?

You: I don't see why, according to what you told me earlier, the funds cannot be returned right now.

You: Can you further define "that"?

You: I don't really understand "that" is the reason you were assessed the fee.

Maricel : Thank you for waiting. I'll be with you in just a moment.

You: Thank you.

Maricel : I am unable to find the transaction for $10.83 from Netflix, Svitlana

You: July 28th

You: June 28th.

You: May 28th... April 28th.

You: These are all billed from Paypal.

Maricel : I am able to find the transaction from Paypal on May 31 and June 29, both for 10.83.

You: Great!

Maricel : I kindly suggest that you contact Paypal in this regard.

You: Why?

Maricel : When a merchant applies a credit to your account through your debit card they will send us documentation to process the transaction. Until we receive this documentation we are unaware that you will be receiving a credit.

You: You have not answered my question about an electric bill

Maricel : However, once we do receive information from a merchant that a credit is to be applied, we will post the funds to your account the same day that we receive them from the merchant.

You: Paypal is not going to refund me any monies.

You: Why do you think they will?

You: There seems to be a misunderstanding.

You: I am not disputing the PayPal fee.

You: I just don't understand why they increased it.

You: Why were you even trying to locate the previous transactions, if you were only going to return to "contact PayPal"?

You: Bank of America policy is $0 for a recurring fee, is it not?

Maricel : Thank you for your patience, I will be right with you.

You: thank YOU!!!

Maricel : I apologize for the delay. I'll be with you shortly.

You: Thank you.

Maricel : I apologize for the confusion. The payment was presented when you do not have insufficient funds on your account on September 29. This is an electronic transactions using your checking account number, not your debit card information

You: I believe PayPal utilizes my debit card.

You: What is the difference?

Maricel : I advise that you contact Paypal to verify this transaction, from our end, it is showing as an ACH(electronic) payment.

You: What would a debit card transaction look like? Not ACH?

Maricel : Thank you for waiting. I'll be with you in just a moment.

You: So, the difference is really just e-semantic. Because we have a "decline" position on debit cards (legally mandated option following a lawsuit, no doubt), but not on ACH transactions (which also come to BofA electronically!), Bank of America pretends to itself they have a right to take $35 ?

You: Is it possible, is it within your personal decision-making power, to return the fee?

Maricel : I apologize that I have checked this and since it was charged correctly, I am unable to refund the fee

You: Also, can I "elect" to have all future ACH requests rejected, same as debit card requests?

You: Really, both are electronic requests to my account. Isn't that right?

You: Why should they be treated differently?

Maricel : You can contact the merchant to stop the ACH payment from your accounts, (name omitted)

You: Of course I can. That is not my question.

You: Also, can I "elect" to have all future ACH requests rejected, same as debit card requests?

You: I mean, if there are insufficient funds, it should be rejected, without fee... same as debit cards requests.

Maricel : I apologize for the delay. I'll be with you shortly.

You: thank you!!!

Maricel : Please call Paypal to verify this transaction as from our end, it is showing as an ACH(electronic) payment.

You: it is not Paypal problem Maricel

Maricel : As I was saying, this transaction appears as an ACH(electronic) payment, not using your debit card

You: Paypal is not going to refund me any monies. Why do you think they will? There seems to be a misunderstanding. I am not disputing the PayPal fee. I just don't understand why they increase Why were you even trying to locate the previous transactions, if you were only going to return to "contact PayPal"? Bank of America policy is $0 for a recurring fee, is it not?

You: So, the difference is really just e-semantic. Because we have a "decline" position on debit cards (legally mandated option following a lawsuit, no doubt), but not on ACH transactions (which also come to BofA electronically!), Bank of America pretends to itself they have a right to take $35 ? You: Is it possible, is it within your personal decision-making power, to return the fee?

You: Please return 35$

Maricel : For recurring payments using your debit card number, such as a monthly phone bill, your transaction will be declined and your NSF: Returned Item fee is $0.

Last text message receivedMaricel : I am unable to return the $35.00 Svitlana, as I have said, your account was charged correctly