Bankruptcy isn't for the faint at heart

I'm screwed either way

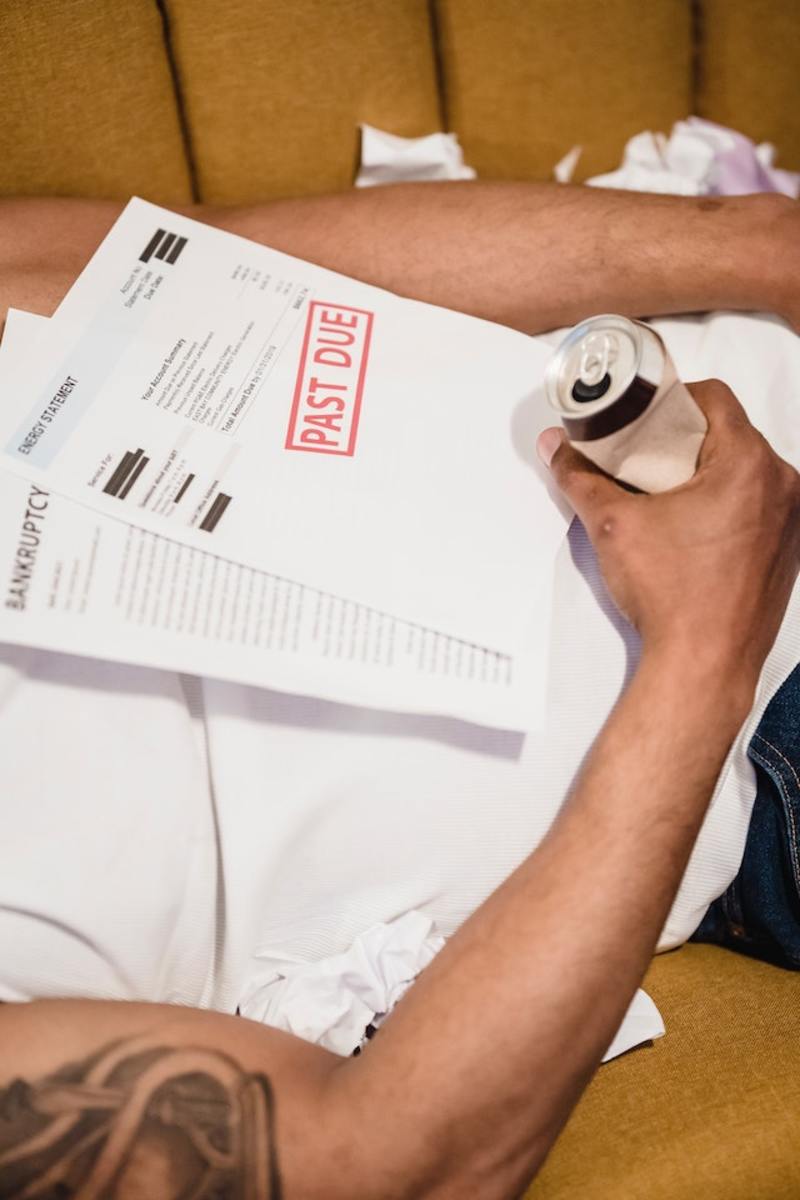

The word bankruptcy, I thought, would never be part of my vocabulary. When I took my children and moved out of the marital home 7 years ago, I had quite a bit of debt from the divorce. Since the marital home didn't sell for two years and he chose to live there (and trash it so it wouldn't sell) I was paying on two mortgages, two insurance policies, two tax payments (a total of 7K a year) so all of my paycheck went to paying for the homes and car payments. I lived on credit for a few years so that we could eat, have a phone, Internet services and a TV to watch shows. I left much of the furniture and essentials with him so that my kids would have them when they went to stay with their dad and therefore, I also took out a loan to furnish their bedrooms, buy paint, wallpaper, dishes, pans, etc. for the new house. I shopped mostly at Walmart and Target and searched the net fervently to find deals on household items and furniture. All was manageable and fine until the marital home was finally sold at a loss and I had to pay off the divorce, my bridge loan on my new house and some various debts tied into the sale of the marital home.

I was two days late paying the credit card payments and my interest rates went from 3% to 36% in a matter of days. At that point, I couldn't keep up with the minimum payments now and I called my creditors repeatedly to convince them that I was a reliable client and would they lower my interest rates again? Mind you, since I had branched out on my own, I was unable to get large amounts of collateral on the cards so I had many credit cards on which I had carried myself for two years. This only screwed me more because I had all of my interest rates increased and therefore, my debt to each of them grew by hundreds of dollars instead of decreasing. I began to fall into the pit of having to pay late, which increased the rate more and finding my meager payments only covered the late fees.

Last year, after being denied loans to consolidate and having no luck with creditors, I crawled into a lawyers office to file the dreaded bankruptcy. Please know, this is not a good thing, as now my credit is lost to the wolves. No more big purchases, no loans and constantly scraping money together for things. Chapter 7's are a thing of the past. If you make a decent salary, it doesn't matter to the bankruptcy court that you can't keep up with your bills; if you want to keep your home you will need to file a Chapter 13, which is what I ended up having to do.

You see, I'm screwed either way. I either would have accumulated 100's of 1000's of dollars over the years, trying to pay off the creditors with their late fees and increased interest rates or I could pay a trustee 1/2 of a paycheck each month to pay off a portion of that debt for 5 years. I chose the latter. Being financially unstable is one of the hardest things I've had to deal with in my life. My children lack for nothing; they have a lovely home, they get new clothes when they outgrow what they've got, they have food to eat and occasionally, if I have some extra cash, we see movies, go out to eat or go to a museum or something. What I struggle with is the personal loss of control over where my money goes. One check covers my current mortgage and some of the household bills. 1/2 of the next check goes to pay my debt in the bankruptcy and I am left with half of a check to cover doctor co-pays, household bills, food, and the many items that surface monthly that have to be taken care of.

I've learned nothing is free and that it's very important to set up a plan for yourself early on. Budgeting is under-rated. My children see me balancing my checkbook, working on my budget for the month and worrying about new expenses that arrive. I hope that my experience will teach them that while credit cards are easy and a way to hold off payment, they are not the answer in the end because credit card companies are not there to make your life easier- just the opposite. They are blood suckers that will just snap your neck when you are down.

I've learned that cooking at home is actually enjoyable, especially when we all sit around the table and talk with each other while we eat. We laugh the most during this time of day. Doing projects myself not only save me money but give me a sense of accomplishment when I finish. Making things to decorate my home allow me to reach the inner artist in myself. Walking is just as good an exercise as joining a gym. Spending more time talking with my kids and watching TV together makes for good family time. Allowing them to have friends over and serving mac and cheese makes them just as happy as ordering pizza.

I encourage everyone to budget and to teach your children the importance and value of the dollar. I find it difficult because their father spends aimlessly on them, giving them the idea that if mom says no, then they can always turn to the other. Real life is a balance between the two. If you are struggling to make ends meet, and I know most of us are, I wish you luck and hopefully you will be able to find a way to get out of your debt without having to claim bankruptcy in the end. Good luck.