Emerging Markets Investors Hit the BRIC Wall

Double Digit Emerging Market Growth Gets Challenged

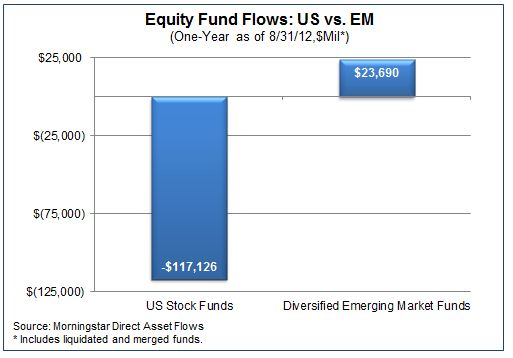

Investor flows continue out of US Equities into Emerging Markets. The commonly held view is that growth in Emerging Markets is faster and greater in magnitude than in Developed Economies that are indebted. Fundamental economic data is however challenging this thesis.

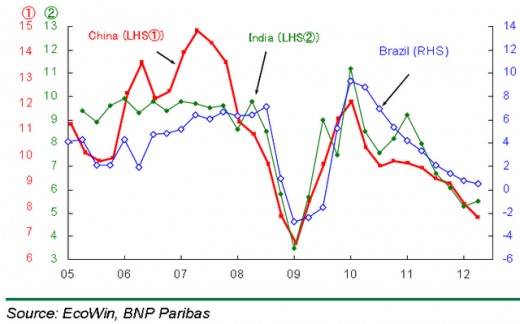

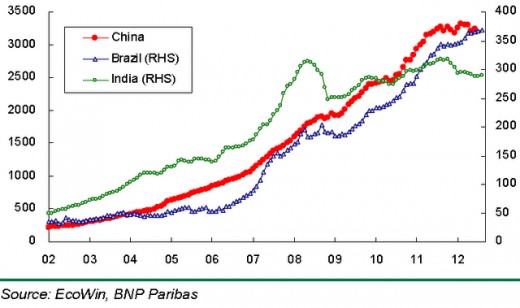

Investors may have been blind-sided by the impacts of Central Bank liquidity since the 2008 Crash. Emerging Markets rallied strongly from 2009, so it was believed that a return to the old high growth rates in Emerging Economies was to be expected. The BRIC countries, especially China, have shown that this is a false assumption. The large injection of Central Bank liquidity created a mis-allocation of resources and inflation in Emerging Markets. China for example, has had a property bubble and an inflation problem since 2009; that the policy makers began to address seriously in 2011. The double-digit growth rates, that Emerging Market investors have become accustomed to, suddenly look challenged by the attempts of policy makers to address inflation and asset bubbles. China has experienced a hard landing; created by the policy makers' attempts to cool the economy, in addition to the fall in global demand.

The Challenge to Emerging Markets From Quantitative Easing

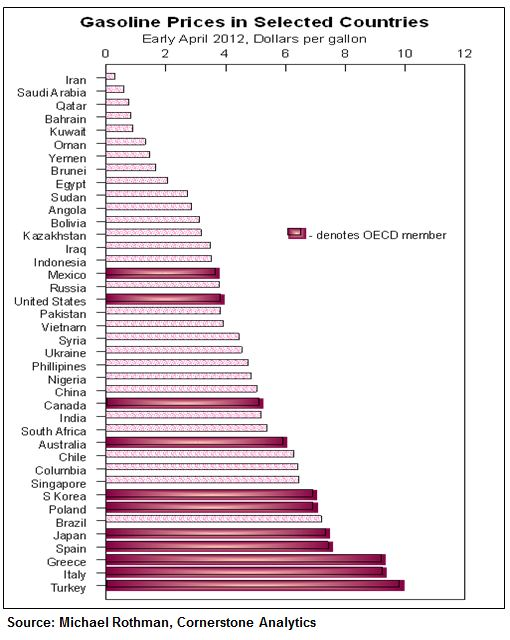

When the Developed Market Central Banks embarked on the Quantitative Easing process, it was assumed that this liquidity would seek out the high returns in Emerging Markets. Experience has proved that this is not the case. The liquidity has in fact gone into the energy commodity complex. Emerging Market economies have been able to grow at high rates, because energy inputs have been subsidized by their Governments.

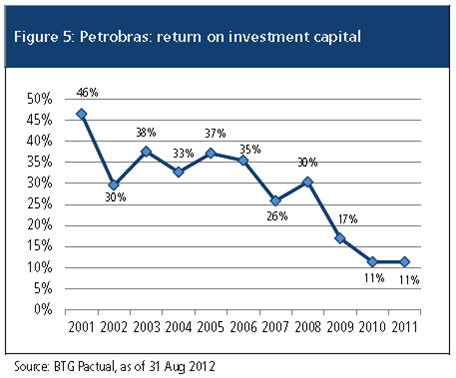

When the Developed Markets were running up debts and consuming exports from Emerging Markets, these Developing Nations had trade surpluses that could be used to subsidize their energy costs. Now that Developed Markets are deleveraging and not consuming, the Emerging Market surpluses are falling; making it harder to subsidize their energy inputs. India has recently tried to raise energy prices; and the country has collapsed into strikes. Brazil has actually forced primary energy companies and utilities to provide cheaper energy; and as a consequence the equities of these companies have underperformed. It is ironic to observe that Petrobras has become the cash cow that the Government milks to subsidize the economy. This was once a criticism levelled at Russia and its handling of Gazprom. Now only Russia, which has vast energy reserves, has been able to benefit within the BRIC sector. However going forward, as President Putin is under pressure; he may also have to use his windfall from higher energy prices to subsidize his political position.

In September 2012, the Federal Reserve and the ECB embarked on new rounds of Quantitative Easing. If past experience is a guide, the liquidity will not flow into Emerging Market equities; but into inflation hedges. Emerging Markets are a very poor inflation hedge. When there is weak demand for Emerging Market exports, the trade surplus cushion that buffers inflation shocks through subsidized energy prices is no longer there. In the current global environment therefore, Emerging Markets (ex-Russia) are the worst places to invest.

By comparison, America has abundant Natural Gas; and is also emerging as a Shale Oil giant. It is certainly true that America has a bigger debt crisis than Emerging Markets; but America has addressed this through Quantitative Easing. As a consequence of Quantitative Easing, America has also exposed the poor inflation fundamentals in Emerging Markets. America thus has a mitigated debt problem; and the mitigation creates an Emerging Market inflation problem. Both America and Emerging Markets have a growth problem; but the Emerging Market growth problem is dependent upon American growth and subsidized energy. Since America is not growing and is also challenging the subsidized energy business model in Emerging Markets with Quantitative Easing, it is fair to say that America has the economic edge. In addition, America's energy challenge has been addressed.

Thus far, Emerging Markets investors have not thought through this fundamental structural challenge that Quantitative Easing has created for their portfolios. They are still expecting cyclical growth to return globally; which will have a greater Beta impact on Emerging Market equities.When they think through the Quantitative Easing/Inflation dynamic, the flows will reverse back from Emerging Market equities to US Equities.

Links

- China’s Slowdown Reverberates as ADB Cuts Forecasts - Bloomberg

China’s services industry expanded the least in more than a year, underscoring a slowdown that spurred the Asian Development Bank to lower its 2012 regional growth estimate and caused a slide in Australian coal exports. - China Slowdown - Effect on China's Trading Partners

- If It's All About Macro These Days, Why Haven't EM Stocks Done Well? - AllianceBernstein - October 1

Explore an exclusive database of accounts from high- and ultra-high net worth investors. - Damages - PIMCO - October 2, 2012

Explore an exclusive database of accounts from high- and ultra-high net worth investors. - Volcker Says Fed Bond-Buying Has No Effect on Inflation - Bloomberg

Paul Volcker, former chairman of the Federal Reserve, said the U.S. central bank’s latest bond-buying program isn’t creating inflationary pressure. - Korea Consumer Prices Rise 2% From Year Earlier on Storms - Bloomberg

South Korea’s inflation accelerated the most in three months in September after typhoons damaged crops and a holiday boosted demand for food, according to a report nine days before the central bank decides interest rates.