Five Reasons Why I Would Not Buy Facebook Stock

Facebook is set to go public on Friday May 18, 2012 and a lot of people stand to make millions, and in some cases billions. There is a lot of hype surrounding this initial public offering (IPO). I’ve seen this before and I’m not impressed at all.

Here are five reasons why I would not invest in Facebook stock:

1. It’s an IPO.

An IPO is typically a high risk investment. No one can forecast with any degree of certainty which way the price will go once you plunk down your cash and own the stock. There is too much emotion involved and investment decisions should not be based on emotion.

2. What does Facebook produce?

Toyota makes cars. HP makes computers. Goldcorp produces gold bullion. What does Facebook produce?

It’s a social networking site and millions of folks have a lot fun connecting with their relatives and friends. I used to be one of those people but quit my presence on Facebook because I eventually concluded that it wasn’t for me. It was a time waster. I became bored with it.

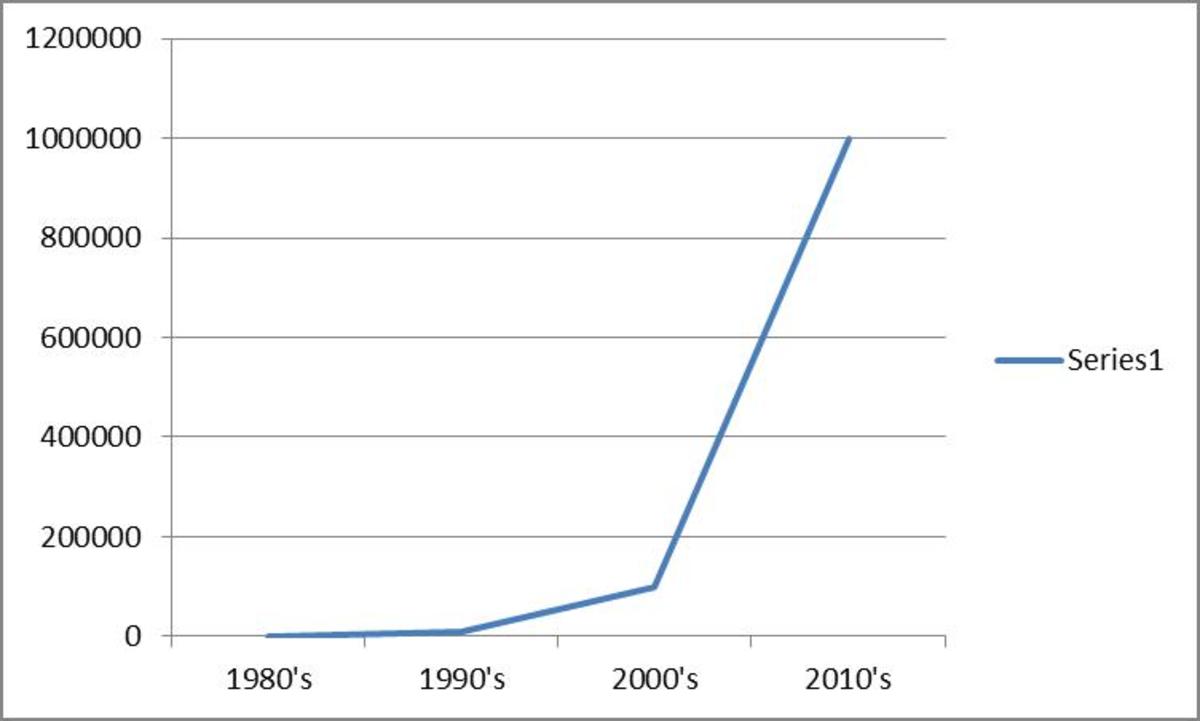

I think that people will eventually lose interest in Facebook and latch onto the newest fad.

3. Facebook has no track record.

One of my rules is to invest only in companies with a solid track record of making a profit and paying dividends. Facebook does not meet this test.

4. Early investors are planning to sell their shares

Reuters reported on May 16, 2012 that the IPO size is being boosted by 25% and that many of the early investors in the company will sell their shares. This says a lot to me; it’s an opportunity for these folks to make millions and they’re taking advantage of it. I can’t say I blame them.

If they thought that the future looked great, would they not have wanted to own even more shares of Facebook? Instead, they're selling.

5. Zuckerberg

Mark Zuckerberg is obviously a very smart individual. However, looking at him dressed in a t-shirt doesn‘t inspire much confidence in him as an astute businessman. Putting on a suit will not make him any smarter, but one should dress appropriately. He is the head of what will be a major American corporation and I think that he should dress accordingly. If it does nothing else, dressing in a business-like manner shows respect for those who will willingly part with their money to own a piece of Facebook.

Bonus reason: there are better places to invest your money, solid companies which are profitable, and which pay dividends.