Fragmentation May Save the Eurozone

Fragmentation Patterns

Eurozone Fragmentation

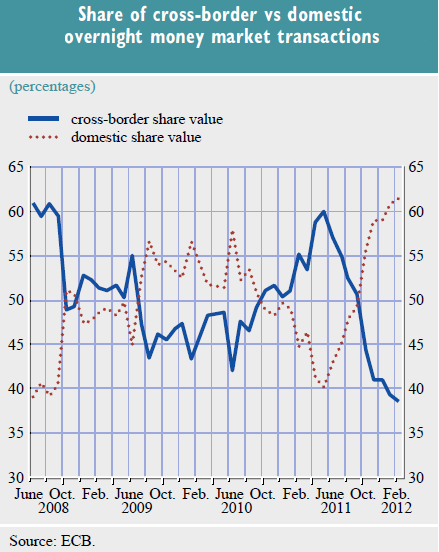

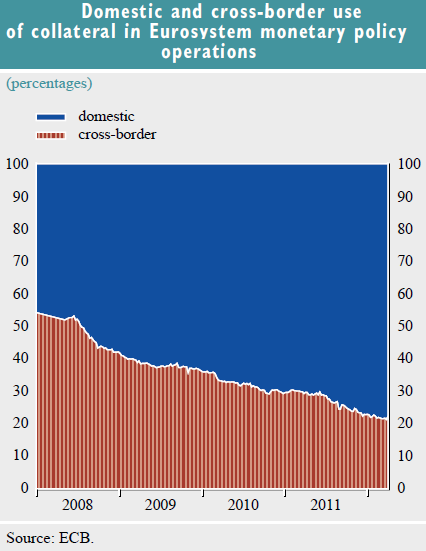

In August of 2012, the ECB reported that the volume of overnight financing transactions, across borders within the Eurozone, was continuing its declining trend that started in 2011. Financial institutions and companies are losing faith in their counterparties; and losing faith in the policy makers to prevent a breakup of the Eurozone. Consequently, lenders are voting with their feet; and will only finance counterparties within their own national borders. The very act of refraining from cross border financing therefore, is a step that pushes the Eurozone closer to a breakup. This endogenous process of breakup has been termed Fragmentation. Against this tide, sits Mario Draghi at the ECB; with his own tide of emergency lending across national borders to address the shortfall.

The tide of emergency ECB funding however has not stayed within deficit countries for very long; and it has been exchanged for other currencies such as the US Dollar and promptly left Eurozone circulation altogether. In addition to this pattern of capital flight, natural speculators have been encouraged to short the Euro; because they see the creation of more Euros, which are cheap to borrow since nobody wants them.

A negative feedback loop has been created that leads to a falling Euro. With the exception of the Bundesbank, no alarm has been raised over the falling Euro. It seems that there is an implicit policy of benign neglect. What can be the strategy behind this policy?

Weak Euro boost exports

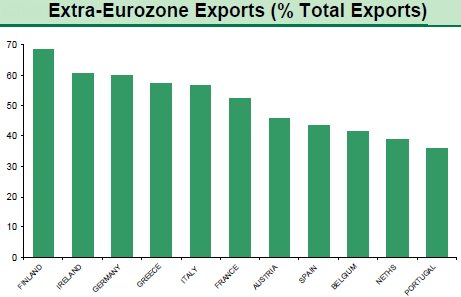

The obvious strategy behind the weak Euro neglect is the promotion of exports. Private demand is weak within the Eurozone because of recession; and this has been amplified by fiscal austerity reducing the demand from the public sector also. Exports are therefore the real source of demand; and a weak Euro can promote them.

Weak Euro

Fragmentation is its own solution

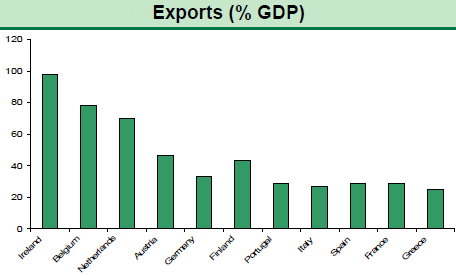

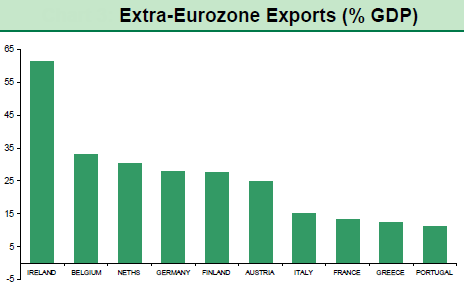

Each Eurozone economy is therefore competing with its neighbour in the global export market. Countries that internally devalue their economies, through the application of austerity and production cost restraints, will have the biggest rebound in exports. Ireland has taken the most radical steps to adjust itself; and as can be seen from the graphs, it has become the greatest exporter relative to the size of its economy.

Eurozone economies become export driven

The interesting dynamic from this export adjustment pattern, is that the more that Eurozone economies become global exporters the more they come to value the benefits of a weak Euro. A weak Euro will allow them to raise the domestic price level in their own countries; without seeing this translate to a fall in their export competitiveness. This is what is known as inflation. It will be interesting to see how the ECB will react to this; since it has a single inflation mandate.

It will also be interesting to see how other nations outside the Eurozone react, given that this amounts to beggar-thy-neighbour currency manipulation. The Chinese will be particularly interested, since they have been blamed in this regard for a long time.

Links

- One is tempted to say that the European Debt Crisis is over

When Angela Merkel's temptation to destroy the Eurozone is on the front page of the Economist, perhaps it is time to conclude the crisis is over. - The Latest Eurozone Trade Data is a Mixed Blessing

The latest Eurozone Trade Data shows that the issue of rebalancing between the Eurozone nations has still not occurred. It also provides interesting context on how the crisis is being managed; and the incentive for Germany to play its part.