How To Set Up Your Own All In One Account: Consolidate debts and pay off your mortage

How it Works

Everybody has debts! Car loans, mortgage, student loans, credit cards and more. In the last few years, many products have come on the market allowing you to combine, or roll, all of your debts into one account and save money, while paying down your mortgage faster.

The All In One account is based on obtaining and HELOC - Home Equity Line Of Credit. The bank will loan you a percentage of the value of your home, usually around 70 to 80%. This money is then used to pay off all outstanding debts (car loan, student loans and especially credit card debt). A HELOC usually comes with a nice low interest rate (Prime or Prime plus a few percent), which is certainly better than the 18% or more you are paying on your credit cards! Basically what you are doing is reducing your multiple debt interest rates (Credit card 18%, Car Financing 5%, Student loans 6% etc) down to one common lower interest rate for all - at the time of writing this Prime is 3.0%. Already you can see the savings!

Not all banks offer an All In One account, and those that do, often charge costly " monthly administration fees" and offer higher interest rates on the HELOC.

How To Set Up Your Own All In One Account:

Go into your bank and ask for a HELOC. The bank will send out a home assessor to obtain a house value. Once the value of your home is assessed, the bank will offer you a HELOC for 80% of the home value. Lets say your house was worth $500,000, you would receive $400,000 as a HELOC.

This money is a Line Of Credit, and Not and Loan! Why is this better? Because a loan makes you pay interest on all the money loaned to you - $400,000. Where a Line of credit only charges you interest on the amount of money used. If you use that HELOC to pay off your credit cards, car loans, student loans etc, and that amounts to (lets say) $50,000 - you only pay 3% interest on the $50,000.

What about the mortgage? Its likely you don't own your house out-right. Your $500,000 house might still have $300,000 in mortgage owing on it. And lets say that your mortgage rate is 6%. You use your $350,000 remaining to pay off your mortgage and bring down your interest rate from 6 - 3%. Now you are paying 3% interest on $350,000 total, with $50,000 extra waiting to be used if you need it. If you don't use it, you don't pay any interest on it.

The Real Benefit:

You have now consolidated your debts and reduced your mortgage rate, but wait! There's more! Tell your bank that you want your HELOC account to be your everyday Checking account. Every paycheck from work will go into that account, reducing the amount you owe interest on. Over the course of the month, gas bills, food etc get taken out of your checking account like normal and the HELCO goes up - but not as high as the previous month (assuming you can save money each month).

Another secret is the Rewards Credit Card. Put your debit card away and get yourself set up with a credit card that offers cash back on purchases (usually 1-3%). Use this card for all your everyday purchases (food, gas, meals out, hair salon etc). Why?

- For each purchase you are receiving money back - hundreds of dollars a year!

- All your monthly expenses are going onto you credit card and NOT your HELOC. You save paying interest all month on the items purchased. At the end of the month, you pay off your card entirely using your HELOC checking account (I have it set up that Mastercard automatically withdrawals the card amount from the HELOC at the end of each month).

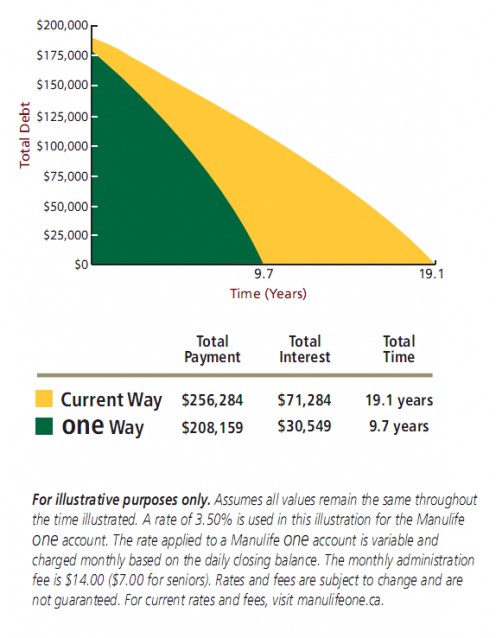

Doing this system yourself will save you money each and every month. And each dollar saved, reduces your HELOC that much more and pays its self off in 1/2 the time! You avoid those over priced bank fees to manage an "all in one account", and avoid paying thousands to private companies who will set this up for you.