How to Calculate Before and After Tax Cash Flows When Real Estate Investing

The driving force behind real estate investing is the money real estate investors hope to make from both, a month-by-month cash flow flow of revenue generated by the property’s rented units as well as a significant profit due to appreciation once the property is sold.

The logic, of course, is simply a real estate investing basic. Namely, to purchase rental income property that produces more than enough rental income to cover operating expenses and debt service and has the potential to be re-sold at a price that exceeds the price paid to make the purchase.

As a result, real estate investors closely evaluate a rental property’s projected monthly and annual cash flows along with future sales proceeds before they make an investment decision.

This process of evaluation is what is commonly referred to as a real estate analysis, and it is strict requirement of all prudent real estate investors.

Fair enough.

But it should be pointed out that cash flows and sales proceeds can be computed before and after taxes. That is, they can reflect revenue that the real estate investor will have to claim and pay at tax time (revenues “before taxes”) as well as revenues that reflect what the investor might collect after he or she pays federal income taxes (revenues “after taxes”).

Since investors typically expect to see both computations for each of the revenues in a real estate analysis, it seemed like a good idea to show you how each are derived so you have a better understanding about this real estate investing nuance in general.

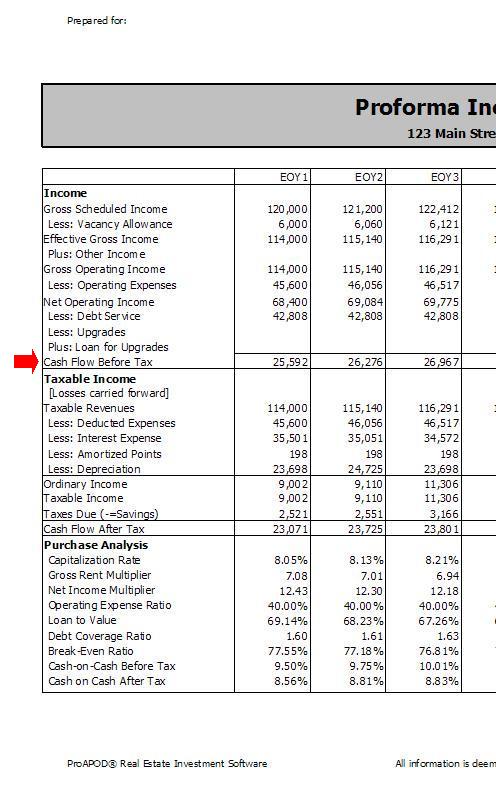

It should also be noted that all results displayed in a real estate analysis are commonly annualized.

Cash Flow Revenue

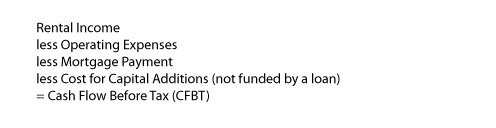

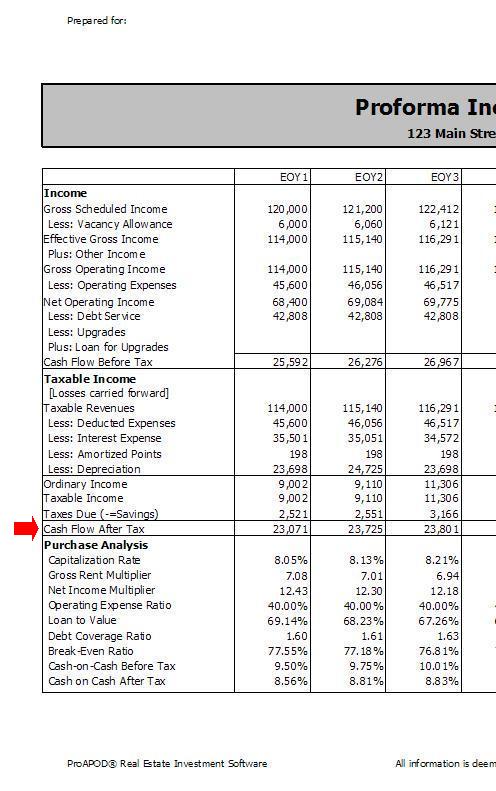

The computation for cash flow before tax (CFBT) is rather straightforward. It is the income collected from rents less the expenses required to keep the property in service less the mortgage payment less the cost for any capital additions that are not funded by a loan.

The computation for cash flow after taxes (CFAT) is somewhat more complex because it involves a computation for taxable income which in turn is used to compute tax liability which in turn is subtracted from cash flow before tax.

Let’s take a look.

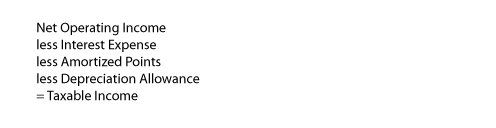

The computation for Taxable Income begins with the rental property’s net operating income (or NOI; rental income less operating expenses). Then from the net operating income you would subtract the IRS allowable deductions for the mortgage interest expense, amortized points, and depreciation allowance (for both the real property and capital additions). Any interest earned by the investor from the property’s revenue would in turn be added (but we’ll skip that likelihood for our illustration).

The computation for Tax Liability is made by multiplying the investor’s taxable income by his or her marginal tax rate (federal and state income tax rates combined).

Before we move on, though, let me point out that tax liability can also result in a tax savings. Here’s how it works.

If the investor’s taxable income is a positive amount (i.e., the investor earned an income after allowable tax deductions) then he or she would be required to pay taxes on that amount and thus has a "tax liability" which must be subtracted from cash flow before tax. Whereas, if the taxable income is negative (i.e., the investor earned no income from the property after allowable tax deductions) then the result would be a taxable income "savings" which in turn can be deducted as a loss from his or her income taxes and is added to the cash flow before tax.

The final computation,

Sales Proceeds

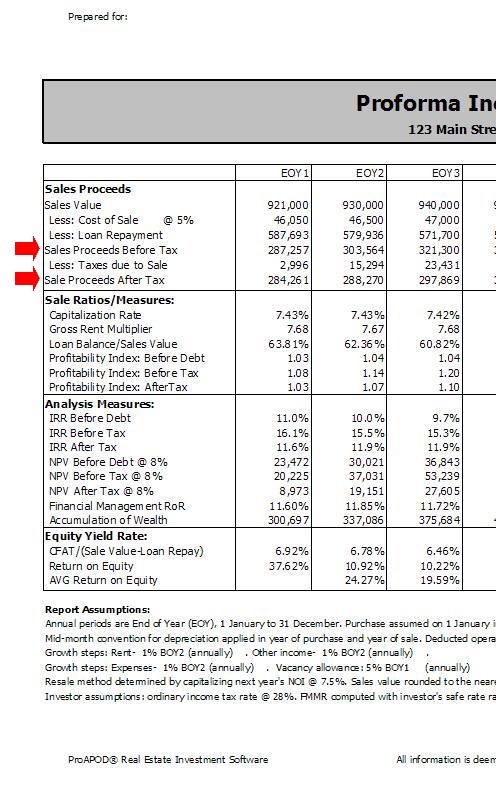

Upon the sale of an income property, after escrow settles the debits and credits it will cut the seller a check for the sale proceeds. Of course, the investor would hope that the investment would have appreciated enough in value to repay the balance on existing mortgages, cover the cost of sale, and in turn even afterward yield a substantial profit for the investor.

Nonetheless, the dollar amount that the investor walks away with from escrow represents his or her Sales Proceeds Before Tax.

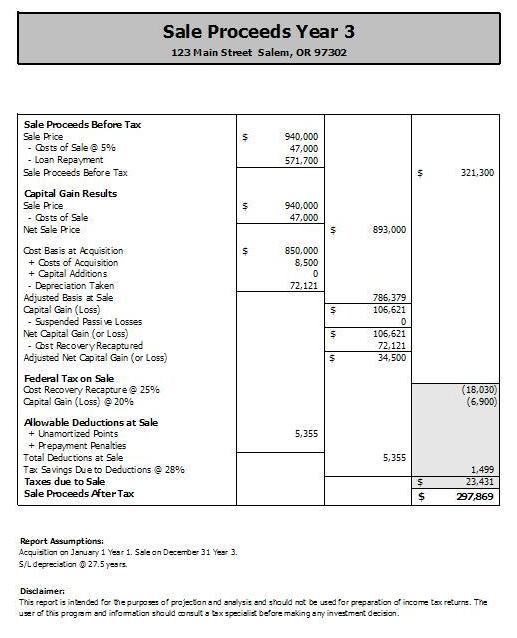

The computation for sales proceeds after tax is more complex because there must be a computation made for what is referred to as taxes due to sale.

This is derived by through a series of steps that include payment for the capital gains and depreciation recapture taxes at the investor’s marginal income tax rate as well as a credit back to the investor for any loan points that were not amortized during the holding period (also at the investor's marginal tax rate).

Once the taxes due sale is calculated it is subtracted from the sales proceeds before tax to arrive at the Sales Proceeds After Tax.

In the Sales Proceeds report shown above, the taxes due to sale computation is inside the gray portion of the report. In this case, the report reflects a sale taken in the third year of ownership.

In this article I attempted to illustrate the importance of cash flows to real estate investors, and why they want to see both the "before and after tax" results in a real estate analysis before they make an investment decision. I also provided the computations for your learning.

Hope this helps.

About the Author

James Kobzeff is a real estate professional and the owner/developer of ProAPOD - leading real estate investment software solutions since 2000. Create cash flow, rates of return, and profitability analysis on rental property at your fingertips in minutes! Learn more at www.proapod.com

Want to learn the formulas? Get function and learning online 24/7 with our Real Estate Calculator

Other articles by this author

- The Present Value of a Future Cash Flow - Why Unders...

Learn the difference between present value and future value and why these time value of money concepts are crucial to your cash flow analysis of investment real estate. - Understanding Net Present Value: Knowing Whether The...

Learn about net present value, its calculation, and how to use it in a real estate analysis. - The 4 Ways You Make Money With Investment Real Estat...

Learn the four basic ways real estate investors make money with investment real estate.