Foreign Exchange Market Risk

Evaluate Then Manage

What are the risks?

The foreign exchange market might be the largest unregulated market in the world and the most exciting, but it is not a market for timid people, timid behaviour or risk averse traders. With a daily turnover of 3.2 trillion dollars this market has many traps to fall into. It is a market that is susceptable to interest rate risk, exchange rate risk, credit risk and country risk.

Exchange Rate Risk

Exchange rate risk is the probability that the price of a currency will move in such a way that it is detrimental to the position in that currency that is held. For example a trader has taken a long position in sterling pounds at 1.4050 because he feels that the dollar will depreciate against sterling. The sterling/dollar rate moves to 1.4025 and the trader starts getting nervous. He has an open sterling position of 10 million sterling so now he is 25 pips down which is $25,000 in the hole. The trader has not hedged this position and so now he is left with two options. Option 1 is to sit on the position in the hope it improves. Not recommended. Option 2 is to cut his losses and get out of the a position that is losing him money. Of course in hindsight the trader should have hedged his position using forex futures or forex options.

Risk

Interest Rate Risk

Interest rate risk is the risk that movements in the forward forex spreads cause outstanding mismatches and maturity gaps in forward maturing contracts. This risk applies to currency swaps, outright forwards, futures and options. If for example a trader has maturing dollar inflows between 2 and 3 months out and an offsetting amount of outflows in dollars between 4 and 6 months out. These maturing amounts were transacted at a certain price in the past at the prevailing interest rate differentials at the time. If the interest differentials have changed dramatically against the trader then matching these inflows and outflows may generate a big loss. To minimize interest rate risk traders should set limits on the total size of mismatches. A good approach is to separate the mismatches, based on their maturity dates, into blocks of 3 months such as 1-3 months, 4-6 months etc. Nowadays all transactions are computerized so calculating the positions for all the delivery dates as well as gains and losses can be done daily. This continuous analysis of interest rate levels is necessary in order to forecast any changes that may impact on outstanding gaps.

Settlement Process

Day Trader

Day Trading

Do you think you could make money day trading

Credit Risk

Credit risk is the possibility that an open currency position may not be repaid as agreed, due to a deliberate or involuntary action by a counter party. Such an event is called a default. Forms of credit risk are:

Replacement Risk

The risk that a party will not fulfill their end of a contract, thus causing the other party to replace the traded item, and potentially incur a loss while doing so. If one party is not able to complete the contract for any reason, typically a replacement contract will be drawn up which requires the other party to return what they've already been given. However, in many situations this is not easy for the party to do, because the value of the traded item is probably not the same as when they originally received it. Therefore, this party could possibly suffer a loss. This is known as replacement risk.

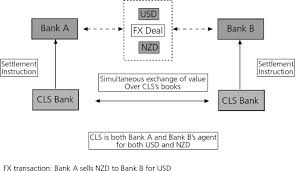

Settlement Risk

Settlement risk occurs because there are different time zones around the world. Consequently, currencies may be delivered at different times during the trading day. The trading day follows the sun, so trading starts in the far east and Australia and ends in the United States. Australian and New Zealand dollars are delivered first, then Japanese yen, followed by the European currencies and finally the U.S. dollar. Therefore, payment may be made to a party in Europe before their dollars are delivered in New York, and the European bank declares insolvency immediately after, but prior to executing its own dollar payments to America.

In assessing the credit risk, traders must consider not only the market value of their currency portfolios, but also the potential exposure of these portfolios. The potential exposure may be determined through probability analysis over the time to maturity of the outstanding position. The computerized systems currently available are very useful in implementing credit risk policies. Credit lines are easily monitored with today's technology. In addition, the matching systems introduced to the foreign exchange markets in 1993 can be used by traders for credit policy implementation too. Traders input the total line of credit for a specific counterparty. During the trading session, the line of credit is automatically adjusted. If the line is fully used, the system will prevent the trader from dealing with that particular counterparty. At maturity, the credit line reverts to its original level.

Sovereign Risk

Sovereign Risk

Country risk is the probability that the government of a country (or an agency backed by the government) will refuse to comply with the terms of a currency agreement during economically difficult or politically volatile times. Although sovereign nations normally don't go into bankruptcy they can assert their independence in any manner they choose, and cannot be sued without their assent. It is virtually impossible to mitigate sovereign risk except by simply not doing business with a country that has grave economic problems.