How to Raise Your FICOs 100 Points in Just 90 Days

Coming off the heels of one of the greatest economic downturns since the Great Depression, “The Great Recession of 2008-2010” transformed many fiscally responsible households into virtual economic basket cases overnight. One such case is Mary LaCour, (who before things went from bad to worse in the macro economy) had very high FICO scores, a low debt load, and near flawless credit reports. Then all of sudden (perhaps hit with a mountain of debt) as so many consumers like her experienced, things wasn’t looking so great. In short, Mary, like millions across the country at the time, would find herself in a whirlwind of financial trouble, including losing her job as a mortgage broker, as well as being in almost certain default mode on her student loans. Obviously, with the US housing market at a virtual standstill, Mary couldn’t find any work in the financial sector. So, she started working as a part-time bartender “I just fell behind” she says. “My student loans were in default, and I really couldn’t see a way to turn things around without a dramatic new start, which included selling my car and a lot of other stuff I didn’t need.”

After moving back in with her parents, Mary felt she needed to find a way to boost her FICO scores (which took a big hit during this ordeal) back to pre-disaster standings. Financial calamities like Mary’s tend to reveal a lot things about a person, but mainly it should reveal what has truly has value in life and what doesn’t. In the world of personal finances, nothing holds more weight than your FICO scores. Simply known as FICOs, this three digit number carry with it very substantial power, especially in regards to its ability to allow you to obtain a home, purchase an automobile, or even get low premiums on insurance. Thus, it goes without saying what restoring your credit situation—namely, boosting your FICO scores in a short period of time means:

Creating a Proven Credit Score Boasting Strategy…

What’s a credit score strategy? When it comes to increasing your FICOs, nothing beats knowing how the scoring system actually works. FICO’s scoring model looks at a several things, but mainly will grade you on three criteria, such as payment history, credit utilization, and credit history length. Thus, it stands to reason what you should be thinking right now: “How can I find a way to improve making on-time payments, lowering balances and increasing my credit tradelines?” The thing about the latter is this: It can only be improved with time; nevertheless, if you really want to boast your credit scores, then you must find a way to come up with a proven strategy for lowering your debt used versus credit available, and of course, finding good tradelines with good length.

Adding a Good Authorized User Can Really Improve Your Situation…

Perhaps unbeknownst to the vast majority of the credit paying world, is a little known concept called an authorized user. What’s an authorized user? An authorized user is a person who authorizes you to use his or her account. Essentially it works like this: 1) You become an authorized user on someone’s account; 2) You will then have your name added to the existing credit card account belonging to that person; 3) A few days later a card with your name on it will be sent to the primary cardholder. But here’s the great news: Within a few months the great history associated with the account will then be added to your credit reports. Why does FICO allow this to happen? Who cares, if it improves your credit scores, then it's win-win situation for both you and primary cardholder. In brief historical review, the very infamous practice known as “piggyback” riding, made the idea of adding an authorized user a very sinister event. The bad news is that not all credit card issuers will allow this to happen—namely, the adding an authorized user won’t prove anything—so do a little research before you decide to go through with it.

Lowering Your Debt Used Verses Credit Available Can Really Boast Your Score…

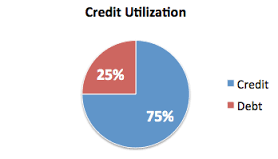

What’s credit utilization? As the name implies, it’s really nothing more than a ratio that measures the amount of credit used versus credit available. Why does FICO’s scoring model look upon this feature so heavily? Here’s a guess: A person or individual that uses too much of his or her credit can’t possibly be credit responsible—at least, in theory. Thus, the idea behind credit utilization is perhaps rooted in personal financial lunacy—that is, to say, if you can’t manage to get a handle of your credit usage behavior, then you don’t deserve to score high with FICO score. Fair enough!

Thus, if you want to boost your credit score in as little as three months, then it behooves conventional wisdom what you have to do: 1) Find a way to pay down your credit card’s utilization to at least percentage of 30 percent; 2) Apply for a retail credit card (i.e., a jewelry card of some kind), which then acts to lower your credit utilization under the coveted 30 percent threshold, raising your FICOs in the interim.