Invest in Ishares Brazil ETFs

Brazil ETFs

As a Brazilian visa holder I am entitled to invest in Ishares Brazilian ETFs via my bank HSBC Brazil (see http://br.ishares.com/home.htm). These ETFs offer great diversification benefits and access to the Brazilian equity markets. Investing in shares and ETFs are still not a common strategy among Brazilian retail investors as government bonds historically have offered return in excess of 10% annually. However with the recent interest rate declines from 12.5% last year to 7.5% in 2012, the returns from the equity market may offer attractive diversification benefits for a pure bond portfolio.

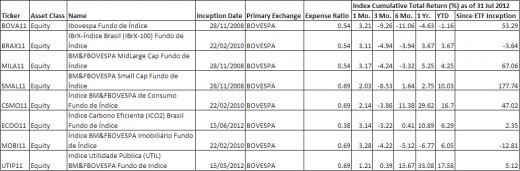

Ishares offer the following ETFs:

·

· The ETF Ibovespa Fundo de Índice replicates the Brazilian Bovespa Index.

· The ETF IBrX-Índice Brasil (IBrX-100) Fundo de Índice replicates the Brazil Index (IBrX 100).

· The ETF BM&FBOVESPA MidLarge Cap Index Fund replicates the performance of the BM&FBOVESPA MidLarge Cap index.

· The ETF BM&FBOVESPA Small Cap Fundo de Índice replicates the performance of the BM&FBOVESPA MidLarge Cap index.

· The ETF BM&FBOVESPA de Consumo Index Fund replicates the performance of the BM&FBOVESPA Consumo index. The BM&FBOVESPA Consumo Index consists of companies representative of the cyclical and non-cyclical consumption sectors.

· The ETF Carbon Efficient Index Brasil Index Fund replicates the performance of the Carbon Efficient Index. The Carbon Efficient Index - ICO2 is a market index comprises of stocks of companies participating in the IBrX-50 that agreed to participate in this initiative, adopting transparent practices in respect to their emissions of greenhouse gases (GHGs).

· The ETF Índice BM&FBOVESPA Imobiliário Index Fund replicates the performance of the BM&FBOVESPA Imobiliário index. The BM&FBOVESPA Imobiliário Index comprises of the stocks issued by the companies representative of the real estate sectors, composed by residential building construction, property agency and financial/real estate

· The ETF Índice Utilidade Pública (UTIL) BM&FBOVESPA Index Fund replicates the performance of the Public Utilities Index - UTIL. The Public Utilities Index – UTIL comprises of the stocks of companies representing the utilities industry (electricity, water and sanitation and gas).

The historical returns from the various ETFs are illustrated below.