Millennial, Social Security, and Retirement

The Full Retirement Age Is Increasing

According the Social Security government website, full retirement age is increasing again! The age gradually increases until it reaches 67 for people born after 1959. Why? They say it is because our health as a nation is increasing! The age expectancy is increasing and people are believing in living a life of better health.

Is this a government ploy to cover their terrible spending? Or is it really true that people are being more healthy? Whether or not you want to get into that discussion is besides the point. The real question is will it be there for you? And Millennial don't even think about it! With their current criteria, in 40+ years from now, when the Millennial become of full retirement age, will the age still be 67?

CBS News found that 26 percent of people 50-to-54-year-olds and 14 percent of those age 65 and older have no savings. 28% of Americans have no emergency savings. Why? They can't! They are living paycheck to paycheck. And often there is more month then there is money. They are accruing more and more credit card debt to help make it month to month.

Trust in the Government

Even the government themselves are unsure if they funds will be there. According to their website they say, "Since the trust funds allow the Social Security Administration to pay benefits when program costs exceed tax revenues, benefits would have to be cut once the trust funds were exhausted. Therefore, Social Security would be able to pay only 73 percent of scheduled benefits in 2039, with further reductions relative to scheduled benefits in future years.1"

I hope your confidence level is increasing in your social security, because for me...it is not! They continue to say, "If no action were taken to strengthen Social Security, the benefit reductions caused by insolvency would double the poverty rate of beneficiaries who were between the ages of 62 and 76 at the time insolvency took place. All beneficiaries would have their scheduled benefits cut by 27 percent in 2039."

What does this mean for you? And what does this mean for me? Don't count on it! If people are living paycheck to paycheck, what can be done to even save for their retirement? Your money is all locked up into your monthly bills and debt and there is no end in sight with you being able to retire!

Take Back Your Future

There is a rule that anyone and everyone should follow. Never trust anyone else to your future. The only person responsibility for your future is you. With that being said, WHY would I want someone else to dictate how I am going to retire? How much money I am going to have to retire with? And at what age I am going to retire at?

If you think about it, this is just good...no great advice. But it really is just plane logical. Should you trust your financial adviser, stockbroker, bank, cpa? Not really or not completely! They all have their particular niche that they are experts at. They do not know the whole market, nor do they understand the whole market! So if I cannot trust those people that understand my individual needs, why in the world would I trust the government?

Now before you are jumping down my throat, saying you sound like anti-government, that is just simply not the case. But I am very much against the government taking care of my money! At the time of the writing the national debt is $18,157,621,996,931 and rising fast. If they are in that much debt....I do not want them near my money! So I will avoid giving them my money as much as possible! I am not anti-tax and I do pay my taxes. But my future they will not take a hold of financially!

What Should You Do?

So now that you are completely discouraged in the system! What should you do? Here are a few simple steps to securing yourself and your financial future!

1. Educate Yourself

You do not know, what you do not know! I would say if you are not willing to educate yourself, than you deserve the Social Security check that you will get when you are at full retirement age, which may be nothing! Education will be the success of you if you go to the right places! But make sure you follow the education you learn! Apply the knowledge! Do not just learn about it!

What should you educate yourself in?

- Stocks, bonds, and mutual funds (Do not invest by yourself until you have a good grasp on stocks)

- Business ventures (Make sure you understand timing and saturation)

- Residual and linear income (Learn how to accomplish and conquer residual income)

- Currency and metals (Understand investing in oil and metals may be dooms day)

- Online business (85% of all sales goes through internet, this is a great place to start a business)

2. Do Whatever Possible to Establish a Residual Stream

Trust me when I say, when you fully understand what residual income is, you will do absolutely whatever in the world you can to get residual income! If there is one book I would recommend on understanding this concept, it would be a book by multi-millionaire Robert Kiyosaki, (no relation) Cashflow Quadrant. Here he explains what is residual income is, and how you can obtain it!

Here is a brief video explaining what the difference is between linear and residual income

Residual or Linear...you choose!

3. Learn How to Invest

When I say invest, I do not just mean in stocks. Although that can be rewarding. But think bigger today! The online world is full of new business ventures everyday. Now I am not necessarily encouraging you start an online business. The failure rate is an astounding 90%! And most people back out after the first 120 days. Let me tell you that online business or any business is tough and especially in the beginning. However, if you hang on and get tough skin, you will see some really awesome benefits.

Before I go too much on a rabbit trail, let me get back to the point. With the internet business world there are many companies that would be GREAT companies to join or even invest who start and continue to be online. There is an incredible amount of business and money that you can tap into! Think about all the websites that are even household names now, but were not 2 years ago. Kickstarter, Quirky, Indiegogo, and many more!

Obviously you can do the conventional investing in stocks and brick businesses as well. But again make sure you educate yourself in those things!

4. Consider Network Marketing

I know I probably just lost half of you here, but if you go back to point number 2, you might understand. I know many of you probably have a HUGE stigma against MLM's and rightfully so! But let me just tell you, this is where I first got my taste of residual income....and still do today! I still get a check, and it is only growing every month!

There are many network marketing companies out there that I would say are well worth the time to look at and invest in from becoming a business owner. But before you jump into network marketing, understand that just like any business....it takes work...hard work.... It is not a get rich quick scheme, but if you work it hard, you will make more money in 5-10 years than you will in any job that you now have!

Also, many major millionaires and billionaires HIGHLY endorse network marketing. Donald Trump, Warren Buffet, Jim Rohn, Robert Kiyosaki. Many of them say if they would do it all over again, they would probably start with network marketing!

Is network marketing illegal? Well I will direct you to this article to learn more about that...in SHORT ABSOLUTELY NOT!

All in all, network marketing is the best business to invest in for a small amount and the biggest potential payout!

5. Traditional Brick and Mortar Business with the Idea to Franchise

This is a great option, but it also has a high risk. All of the other steps take little investment. This however is a fairly large investment! When talking about buildings and overhead, traditional business by far has some of the largest overhead.

This can be a very rewarding business, but at the same time has some of the largest stress involved altogether. If you are able to get the business running and franchise it, or have a buy out! You can have a BIG payout!

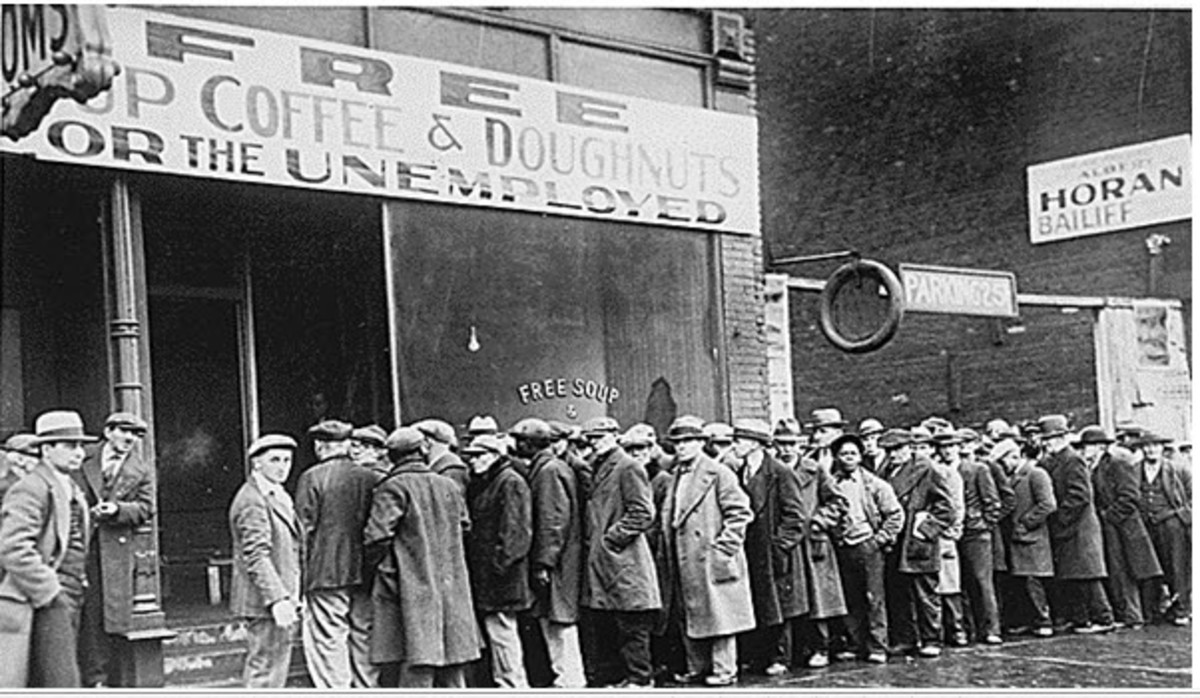

Social Security if truth be told by the government is definitely on the way out. Are you going to wait for them to tell you that? FDR made this system to benefit the society of the time in my opinion. He did not understand the business and economy of the time. He only understood what he could see back then. Back then was 1935. Much has changed in almost 100 years!

Social security is only kicking us in the pants now, because FDR could not see the future! With this being said, we have to plan on the unexpected. We should not hope for something that has such a shaky ground! Do what you need to do, to be fully and financially secure! Take a step forward for your education and your financial future!