Should I Pay Off Student Loans or Invest?

How you answer this question is the difference between tens of thousands of dollars over the span of your lifetime.

The answer is simple. If the return you can get by investing is higher than your student loan interest rate, you should invest. If not, focus on paying off your student loans.

How to determine those rates is a bit more difficult.

#1) How to Calculate Your After-Tax Student Loan Interest Rate

There is one good thing about having student loans: the interest you pay reduces your taxable income. For example, if you had $75,000 in student loans at a 10% annual rate, you would pay $7,500 in interest during the first year. You would be able to deduct that $7,500 interest off your taxes. Even in the lowest tax bracket, the Government would give you $750 back at the end of the year.

So how does this tie into figuring out whether to invest or pay off loans?

Essentially, the tax break lowers the real interest rate on your student loan. How much lower depends on which income tax bracket you're in. Look at the charts below and find the range where your expected annual income falls under. For example, if you’re single and making $35,000 per year, you would be in a 15% tax bracket.

For a single person:

10% if under $8,700

15% if between $8,700 and $35,350

25% if between $35,350 and $85,650

28% if between $85,650 and $178,650

For you married folks:

10% if under $17,400

15% if between $17,400 and $70,700

25% if between $70,700 and $142,700

28% if between $142,700 and $217,450

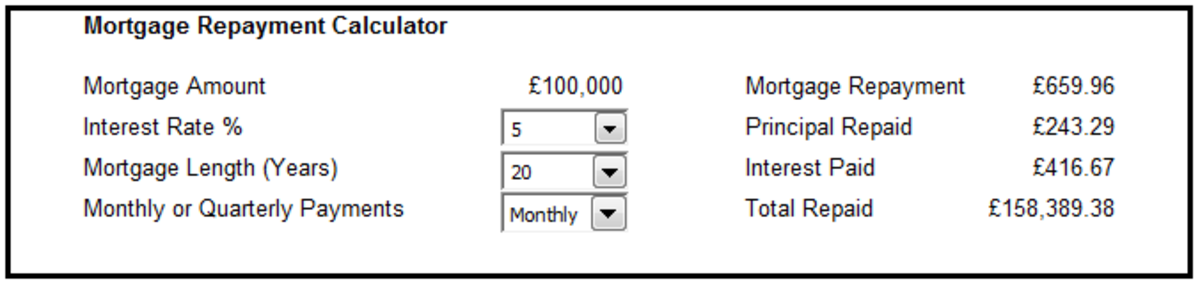

Now, take your tax bracket and subtract it from 1. In our example (single making $35,000/year), we would take 1 – 15 = .85. Now multiply the answer by your loan’s interest rate. If the interest rate in our example was 6%, we would take .06 * .85 = .051.

And that’s it! In our example, the after-tax interest rate would be 5.1%. In this case, if we expected to make at least 5.1% on our investments, we would be better off to invest.

#2) How to Calculate Your Expected Investment Return

Investment returns will depend on a lot of factors like how long you invest, what you invest in, economic growth, fiscal policy changes, taxes, and many other variables.

Yet since there’s no way for you nor I nor anyone else to predict all of these factors, the best estimate we have is history. And 140+ years of history say stocks return roughly 9% (calculated at the compound annual growth rate) before inflation.

We can assume that if you invest in a tax-advantaged retirement account (such as a Roth IRA) over the long-run (20+ years), your stocks will return close to the historical market average. If you think the U.S. economy is destined for ruin and it would help you sleep better at night, knock a percentage or two off just to be on the safe side.

Decision Time: Calculate Your "Float"

The simple difference between your expected investment gains and the after-tax interest rate on your student loans represents your “float”. If your float is positive, you would want to invest. If not, you would try to pay off your student loans as quickly as possible.

In our example above, the float is 9.0% – 5.1% = +3.9%. Since the flow is positive, we would pay the minimum monthly payment on our student loan and invest the rest into a tax-advantaged retirement account.

Other Factors

In a perfect world, everything would be as easy as doing these simple calculations and making easy mathematical decisions. But we know they’re not.

Your student loan rates could go up or down. The stock market could only produce 5% returns over the next century. Taxes could go way up and stifle investments. Lots of stuff could happen that throw your plan off.

There’s so many different scenarios and each situation is different for every person. If you are someone who hates having debt hang over your head, then you'll be better off paying your student loans as early as possible and getting a good nights rest. If you’re confident that the stock market will continue to produce (as history tells us it will), go for the investments.

No matter what you decide to do, take comfort that you are doing something. Whether you pay off your loans or invest early, you’re making a better financial decision than not doing anything at all. So just make the best decision you can and don’t sweat it!

It’s your turn, readers. How did you make the decision to invest vs. pay off loans? What kinds of factors did you consider? What strategy did you take? Leave comments below!