Please Take My Money: Why American's Are Stock Market Crash "Test Dummies"

I am going to attempt to put this into simple words that anyone should be able to understand. You are a slave. Yes I am talking to you. Don't get mad, no don't get mad now, not at me. You should be and should have been angry with the people who are taking advantage of you. What's even worse than being a slave? Knowing it and convincing yourself that it's easier to work for free than to put up a fight. If you thought slavery ended in this country years ago I'm regretfully here to inform that it has not. It's just actually more alive than ever.

Before reading this article please pre-game by checking out these articles in advance. It might be more reading than you'd like and or want to put up with now, but I highly suggest reading them to get the full effect and understanding of this very useful information I am giving you.

Wave Em Like...YOU JUST DON'T CARE?

Do we care? Hopefully by now you've checked the links to my other articles and are back here to see how it all fits together. At this point you might be angry, you might be interested, you might be enlightened, you might still be in resistance to the obvious, or you might just believe that you are immune to the problem. For those people who think that none of this concerns them because they are "well off," let me ask you a question. Why do rich people keep working? Because, you can fill a tire with air, but it will never be enough to ride on for long if you have several slow leaks. You can patch the holes but eventually you'll have to get a new tire. If you get that metaphor, please proceed (you are now entering the mental zone).

Here in New York we have smart thieves. Thieves who will attempt to take your property by intimidation so as to remove themselves from wrongdoing. For example: A big, scary looking guy comes up to you on the subway platform. He tells you that he likes your ipod and asks you if he could check it out. If you're timid you hand it over. The big guy stands there for awhile and then turns to walk away with your ipod. You attempt to stop him by saying, "hey where you going with my ipod?". Now if you even get a cop down there in time and they find the guy he will claim you just gave it to him. He didn't steal it. Follow me?

The MF Global Scandal

In 2011 MF Global (formally Man Financial, yea really)a major global financial derivatives broker went bankrupt. No biggie right? This is not abnormal, it happens all the time. But what happens next is not business as usual, or at least not for us.

For the best explanation of the MF Global scandal you can check out, A Run On The Global Banking System—How Close Are We? by Gonzalo Lira. Gonzalo is an American novelist, filmmaker and economic blogger born in Burbank, California. His article

In a nutshell this is what happened:

MF Global (the brokerage firm) holds clients money in accounts and holds it in case a customer makes a trade. MF Global goes bankrupt and somehow these customers money gets used to pay off creditors. Not fair right? That's like if you had money in your "savings account" at your local bank, they go bankrupt and then use your money to pay off their creditors. Repeat "your" money. Most likely if this happened most rational people would be looking for the bank Manager or whoever is in charge. Who was in charge here?

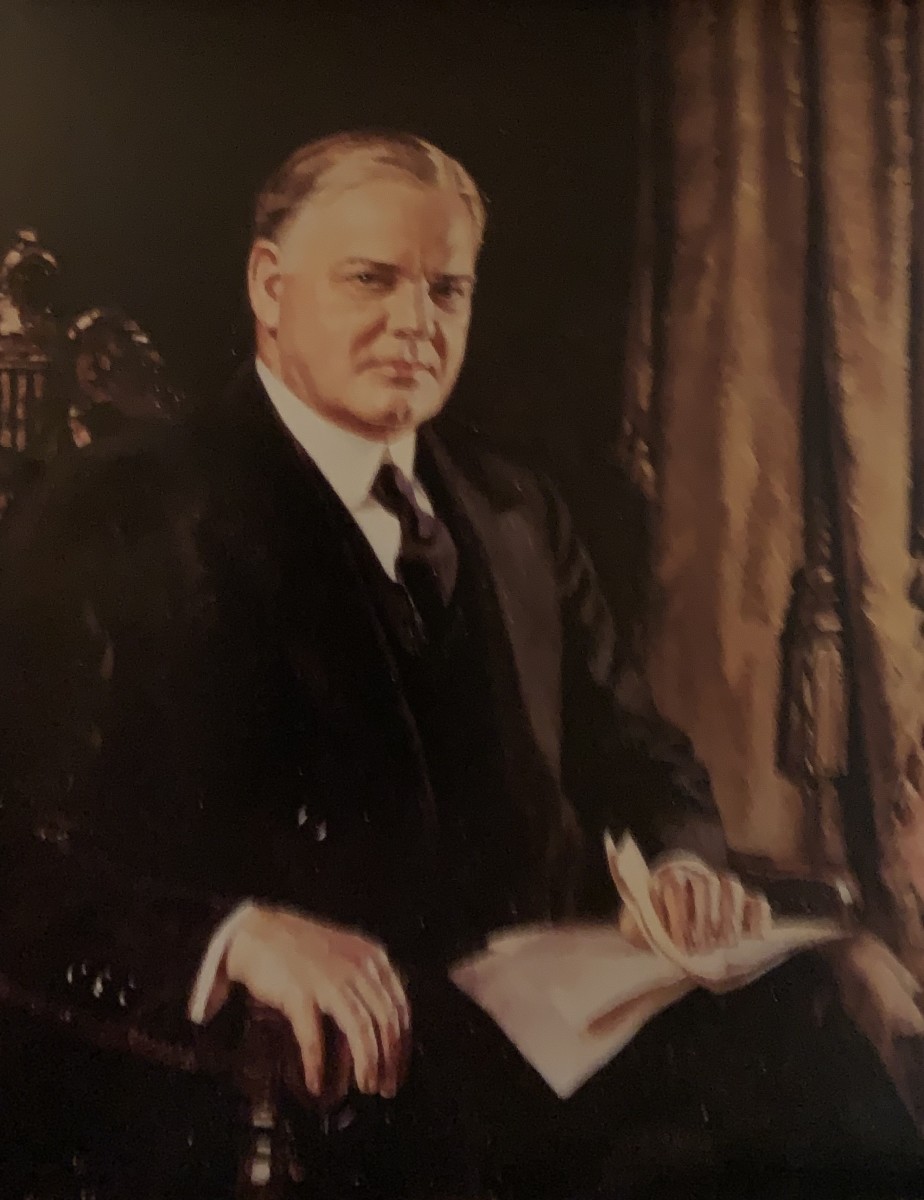

Honorable? Really?

Something Smells Funny

Former New Jersey Governor John Corzine was Chief executive of MF global during this whole quagmire. You want to know what he said when the word first got out about this scandal? When asked where customers missing money was he said, " I simply do not know where the money is" (usatoday.com). No shit, he really said that. Check the USA Today link provided for you right there. Really check it out!

So this guy is the Executive Chief and his brokerage firm goes bankrupt, but not before 'transactions' are made:

"One of the Oct. 26 transfers—a movement of $165 million—was reported earlier by The Wall Street Journal.

That transaction accidentally dipped into customer funds instead of a different account at an MF Global unit, according to the trustee's report. MF Global employees tried to correct the error, but had trouble getting the money back. Later in the week, MF Global appeared to tap a credit line to replenish the account." (online.wsj.com)

Accidentally...Riiiiight. And then he doesn't know where the money went. August 3, 2012, all of the customers still don't have their money back. Corzine made millions before and after the brokerage went bankrupt. He's still making money and is not in jail.

Come on baby you know you wanna give it to me (Your Money)

The Libor Scandal

Look at this piece of work right here.

For this scandal I had to search the web for the clearest and easiest to understand explanation of what 'Libor' is and how the scandal affects us. The way this crap is set up you have to have a damn degree in finance to understand it. I landed on this financeyahoo.com article that does the job pretty good. Here's a quick explanation of how Libor works, but to find out how it affects us you should check out the link above.

How LIBOR works

"You probably don’t think much about where interest rates come from. On everything from credit cards to savings accounts, you’re presented with a rate, then you simply decide whether to take it or not. Whether you’re borrowing or investing, you logically assume the rates you pay or earn are set by competition.

Interest rates on trillions of dollars worth of financial products start with a benchmark called the London Interbank Offered Rate, or LIBOR.

While the label makes it sound complicated, it’s just the average interest rate big banks pay to borrow from each other. The term starts with “London” because it’s computed in that city. But that’s misleading, because it affects interest rates worldwide on some (but not all) adjustable-rate mortgages, credit cards, and student, car, and other types of loans. In addition to loans, it’s also used to set rates for institutional investments – the kind that mutual funds, pension funds, and government agencies might use to earn interest on short-term investments." ( Stacy Johnson, financeyahoo.com)

Oh by the way the guy in the picture of above is just Timothy Geithner, the current United States Secretary of the Treasury. He also used to serve as the vice chairman of the Federal Reserve (Yeah that again) the second highest highest ranking position. He claims to have known about this since George W. was in office, but awww no one listened to him. Riiiiiight.

Wake Up People

If you are a racist I have some bad news for you; we are all in the same boat. Yes you might want to have a seat.

Whether you are black, white, yellow, green, etc. we are all slaves to a system that is being run by a bunch of overseas bankers that get richer as we get poorer. Like slave masters they crack a whip and make profits from your hard work, your sweat, and your tears. While you sit in your big house with your beautiful family thinking that everything you've read here does not affect you, you are putting your beautiful family at risk with your ignorance and arrogance. Many people have lost their jobs, you could too. Many people have lost their homes, you could too. Many people have lost their saving, you could too. Big banks continue to fail, the social security ponzi scheme is running on empty, and every dollar you make and put into the system to pay your taxes or attempt to save or profit from is being stolen right in front of your face. In fact you are giving it away. You've handed your ipod to these bullies and they have walked away to the tunes of your favorite playlist. Do you want your property back?

One day someone who has read this will be in a bad position financially, the law of averages confirms it. When that day does come you are going to try and jog your memory in an attempt to remember why what is happening to you seems so familiar even though it has never happened before. When that day comes I will hopefully still be around and even if you didn't believe me before I will open my ears and eyes to listen to you.