Reverse Mortgage

What is a Reverse Mortgage Loan?

A Reverse mortgage loan is the exact opposite of the typical home equity mortgage loan. In a home equity loan, you pay a monthly sum for a certain numbers of years until the loan is fully paid. In a reverse mortgage, instead of you paying for a monthly equity, it's you who get a monthly payout or a lump sum.

Reverse mortgages, available to people older than 62 who own their homes outright or have only minimal home-loan debt, allow borrowers to receive funds in a lump sum, as monthly payments, through a line of credit, or some combination thereof.

Unlike other home equity loans, no repayment is due on a reverse mortgage unless and until the borrower passes away or no longer occupies the mortgaged home.

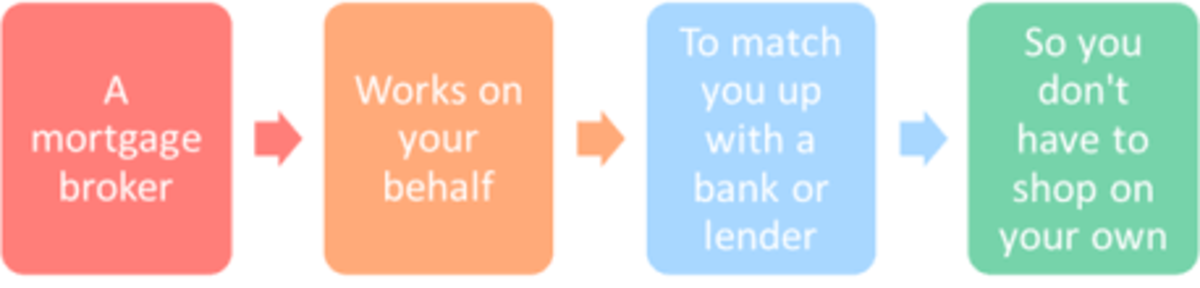

How a Reverse Mortgage Works

Types of Reverse Mortgage

Home Equity Conversion Mortgage

The most popular and widely available type of reverse mortgage. Provides the largest loan advances, gives you the most choices on how the loan is paid to you, and most of all, you can use the money for whatever purposes that you may have in mind.

Proprietary Reverse Mortgages

This type of reverse mortgage can provide larger loan amounts than the Home Equity Conversion Mortgage program, but they are generally the most expensive type of reverse mortgage. But even if you could get a larger loan amount from a proprietary plan, it might not actually provide you with more in total loan advances than a HECM would provide.

DPL (Deffered Payment Loans)

This type of reverse mortgage loan is usually offered by local and some state government agencies for repairing or improving homes. This type reverse mortgage provides a onetime, lump sum advance.

Property Tax Deferral

This type of public sector reverse mortgage generally provides annual loan advances that can be used only to pay your property taxes. The amount of the annual PTD loan advance is generally limited by the amount of your property tax bill for that year. Some programs limit the annual advance to some part of the tax bill, or to a specific amount.

Dangers of Reverse Mortgages

Reverse Mortgage Pros and Cons

Reverse mortgage can provide a convenient way to increase one's income during retirement, but it also has its own drawbacks. The mortgage fee (interest rate, loan origination fee, mortgage insurance fee, etc.) is higher compared to other types of mortgages. Also, if you need to move permanently from your home (like entering a care facility) the loan becomes due and payable.

Related Articles on Reverse Mortgage

- Reverse Mortgages - Let the Bank Pay You Instead

Reversed mortgages began as an act of charitable kindness when Nelson Haynes of Deering Savings & Loan of Portland, Maine wrote a reverse mortgage for the widow of his high school coach. Although they are no longer a charitable act, they do offer - Disadvantages of Reverse Mortgages

Reverse Mortgages are a new way to get money out of your home. You won’t have to put your home up for sale or do any loan repayments. What a reverse mortgage does is give you a loan without payments back to the loan company. The loan goes to the... - Reverse Mortgages And Why You Should Think Twice

Reverse mortgages have become a fairly decent way to get what you need in the later years. Still, there are some very serious considerations to be clear about before you dive in and do it. Come read up about reverse mortgages today and see if you can