Top 3 Ways to Improve Your Credit Scores… in a Hurry

Are you in the market for a car, house or a boat—perhaps you’re pressed for time? If so, then now could be the perfect time to start thinking about improving those stubborn FICO scores. There are, indeed, many false claims in newspapers, television and internet ads proclaiming to raise your credit scores overnight. Realistically, raising your credit score will take a little time, effort and depend on a number of different variables. The following list below outlines three areas of concern in regards to raising your credit scores in the fastest possible timeframe.

#3 Checking Your Reports for Errors

The American credit reporting industry (consisting of Equifax, Experian & Transunion, mainly) is arguably the most advanced of all globalized countries. Despite the great benefits of the current system, however, it’s estimated that up to 80% of all credit reports contain some type of error, according to the Federal Reserve Bank of New York. Put simpy, credit reports aren’t infallible. In fact, for the millions of Americans who will be buying their first car or house, checking ones credit report for small errors becomes the very first step to increasing your FICO scores. In theory, what appears to be a small error to the financial novice isn’t so small when you factor in its ability to affect your credit scores in a very big way.

After thoroughly examining your credit reports for errors, the main thing you’ll certainly want to do is look for any inaccurate, obsolete and fraudulent accounts. If you find any accounts that fit this description, you should immediately dispute them, following the guidelines of the Fair Credit Reporting Act, which affords consumers the right to identify, submit and dispute any inaccurate items from their credit reports. Getting any negative accounts removed from your credit reports, will help raise your FICO scores in a rather short period of time!

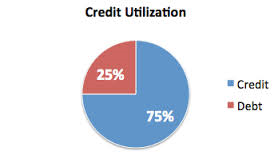

#2 Lowering Your Credit Usage Percentage

One of the major criteria used by FICO’s scoring formula is a little thing called credit utilization, which is simply the percentage of credit used versus total credit available. Moreover, a credit utilization ratio of 30%, or perhaps below, represents an objective barometer of an individual who is considered responsible with his or her personal finances—thus is rewarded with a higher score. Conversely, any individual who falls on the other end of this scale (namely, someone who maxes out his or her credit cards or use a greater percentage of them) is considered someone who is financially irresponsible and therefore is rightfully penalized under the current FICO scoring system. The financial adage here is quite simple: “Pay Down Your Debts!” By paying down your credit card debt, you will be effectively decreasing your credit usage, while simultaneously increasing your FICO scores. In addition, if you find that you’re not able to pay down your debt, a couple of options exist whereby you could call your credit card companies with said balances and request higher credit limits, or you could simply apply for other credit cards with higher limits, both of which could cause your utilization to fall below 30%, effectively increasing your FICO scores perhaps 30-50 basis points in the process.

#1 Paying Your Bills on Time

In regards to rapid credit score increases, individuals would be foolish to dismiss the advantages of making on-time payments to his or her credit card bills. In fact, FICO thinks highly of you. Their reason: “Individuals who make payments on time epitomizes the idea of financial responsibility.” The FICO scoring system, as complex as it may appear, is truly based on the single premise of financial responsibility, holding individuals accountable for his or her financial obligations. Ideally, an individual who is financial responsible is someone who doesn’t take out too much credit, keeps his or her balances rather low—and more importantly, pays his or her bills on time, preferably over a two year time period.

Improving ones credit score appears to be part art, part disciple, with a little bit of luck thrown in for good measure. A virtual enigma of sort, the FICO scoring system appears to have a mind of its own. Nonetheless, amid the system’s uncertainty, there are a several options available to the select few who truly learn how to master the science of credit score enhancement.