Ways to Save Money: Get Your Free Annual Credit Report

Getting A Mortgage or Financial Loan? First Check Your Credit Score

Get Credit Information, Know Your Rights

What is a Credit Expert Report?

"Those who understand interest earns it, those who don't, pay it."

(Unknown)

It would be liberating and immensely exhilarating to be able to cut up and dispose of the credit card, give two fingers to the banks and return to the old ways of doing business. Unfortunately, the pleasure would be short lived. We are already on the crazy merry-go-round, and it is near impossible to get off.

Until some clever individual comes up with a better way to manage our hard earn cash, we need to be smart about how we spend our money, and how we manage our debts.

To do this, we need to be aware of the information held in our credit reports, and we need to know how we can improve our credit score to get the best deals, especially on interest rates that will allow us to save money.

A credit report contains detailed information gathered by a Credit Reporting Agency (CRA) on an individual's credit history.

CRAs are profit-making companies, the Information they compile includes where you live, how you pay your bills, any county court judgments against you and if you've been sued or filed for bankruptcy. The CRA then sells this information to creditors, insurers, employers and other businesses to evaluate a loan applicant's creditworthiness and their ability to pay their creditors.

Consumer advocates, advised, that we review our credit reports annually to ensure that the information stored is accurate, complete, verifiable and up to date.

Which Credit Reference Agency

There are three nationwide credit reporting companies authorized to provide free annual credit reports that people are entitled to under the law. There is a central website, a toll-free phone number and mailing address for ordering a free annual report.

Be aware, some sites claim to provide free credit reports, free credit scores or free credit monitoring. However; they are not always what they appear to be. Often, the so-called free product comes with strings attached and may convert to purchase that requires payment at the end of a trial period. If you fail to cancel the product within the trial period, you will be inadvertently agreeing to allow the company to begin charging fees using your credit card details.

The three nationwide U.S. credit reporting companies required by the Fair Credit Reporting Act (FCRA) to provide a free annual copy of an individual's credit report on request are:

-

Experian

-

Equifax

-

TransUnion

The FCRA promotes the accuracy and privacy of the information stored with the credit reporting companies. To order visit annualcreditreport.com, this is the only website that is authorized by federal law to provide free annual credit reports.

The UK sites are:

-

Equifax www.equifax.co.uk

-

Experian www.experian.co.uk

-

Callcredit www.callcredit.co.uk

According to the money experts, we should take the time to manage and improve our credit scores. It is more than just obtaining a mortgage, a loan or a credit card. Your credit score can also affect your mobile phone contract, car insurance, bank account and a lot more.

When we apply for a loan, before the lender, bank or building society will agree to part with their money, they'll first need to know that they will recoup their investment.

Banks need to know whether the individuals to whom they are lending their money, have a good track record when dealing with debt. Most of us have experienced financial difficulties at one time or another, but what's important, is how we managed the debt.

A credit score or credit expert report allows the bank or lender to decide if it is prudent to approve an application for credit, and if so, on what terms. However, each lender will have their secret rating system and will look at the individual's application and previous dealings with the bank, to generate a credit score.

Contrary to what most of us believe, there is no credit blacklist, and we do not have a single credit score, the main CRAs all have different scores. Therefore, it is entirely possible that another may well accept an individual who has been refused credit by one lender.

Get The Best Credit Deals, When You Boost Your Credit Rating

A Good Credit File Can Save You money

"The only way to beat the banks is to make them fight for your business!"

(Scott Bilker)

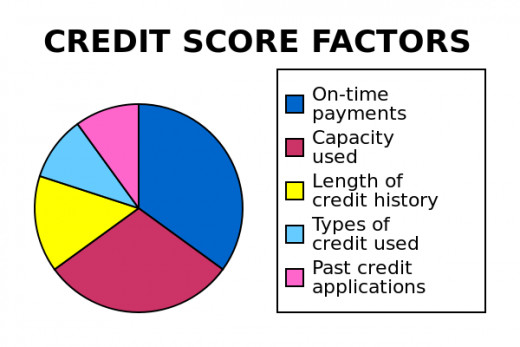

It is vital to know what information is held in out credit files; this information is used to predict our future behavior based on our history. This information affects whether or not we are allowed to borrow money, take out a mortgage or even get better terms on credit offers. A good credit score can save us money; a high score can improve the chances of qualifying for a 0% credit card deal.

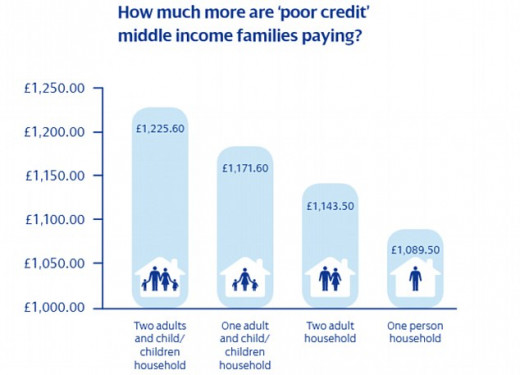

Borrowers with bad records are much more likely to have applications for credit refused or charged exorbitant rates of interest.

Credit reporting agencies store an enormous amount of information on us, some of this information are often wrong, errors can adversely affect our ability to get credit and all the money saving advantages that goes with it, such as:

- Reward points

- Cashback

- Borrow at 0% interest

- Extra protection on purchases

What can Damage Your Credit Score?

-

Missing a monthly payment, while this may appear to be a minor transgression to most of us, our creditors may beg to differ. They charge a fee for late or missed payments, and may also increase the interest rate. Late payment can be added to credit reports when a payment is more than 30 days late. By making both the payment and late fee before the deadline, damage to an individual's credit record or score can be avoided. Payment history accounts for as much as 35% of our credit score and can impact on a person's ability to get new credit in the future.

-

Late mortgage or credit card payments, one late payment on a mortgage, loan or credit card can affect a credit score negatively, and incur certain penalties, the severity of which, will depend on several other factors. The length of time as discussed above, the longer the account remain in arrears, the more severe the impact on the credit score. Mortgage companies may find it necessary to initiate foreclosure when arrears exceeds 90 days or more. If the debt is not reaffirmed during the foreclosure process, the credit score can drop by as much as 200 points or more to dramatically increase subsequent borrowing cost.

-

Making only minimum payments on credit cards every month

-

Declared bankrupt

-

Enter into an Individual Voluntary Arrangement (IVA)

-

A County Court Judgment against your name

-

Have never borrowed money in the past, therefor have little or no credit history

- Borrowing only small amounts or diligently pay off credit card bills in full each month (while this may be a prudent way to manage your debts, it is not profitable for lenders)

What is a Credit Score

Credit scoring is about attempting to predict a person's future behavior. However, it's well to remember that they are not set in stone, different lenders may have their own ideas about what is a good credit score, some lenders are more selective than others.

A bad credit history can prevent an applicant from acquiring a loan and can exclude them from the best deals that other borrowers are enjoying. However, there are ways to mend a credit history over a period.

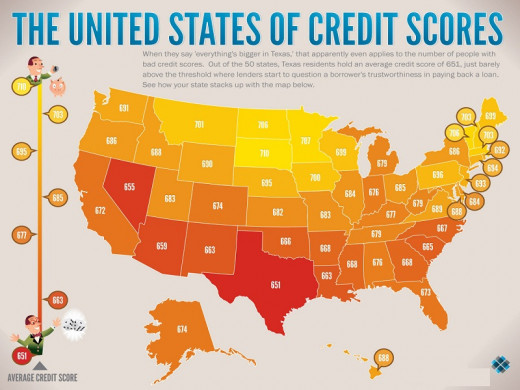

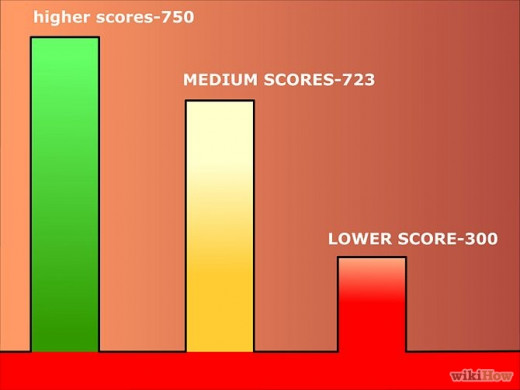

Examples of Credit Scores

Excellent Credit: 750+

Good Credit: 700-749

Fair Credit: 650-699

Poor Credit: 600-649

Bad Credit: Below 599

Do You Know Your Credit Score?

How Often Do You Check Your Credit Score?

Five ways to improve your credit history.

1) Register your current Address on Electoral Roll

Since lenders tend to use the electoral roll to check potential customers name and address, someone applying for a loan, who is not on the electoral roll, will give the impression that they have no credit history and may well be rejected automatically.

2) Make Payments on Time

Manage debts well. Stay within your credit limit and don't miss credit deadlines. If you are unable to make a timely payment, contact your lender and make a request for a smaller, more manageable repayments. Before applying for further credits, first, close any old credit card accounts. Even if there is no money owed, lenders may look at all the available cards before making a decision on an application for credit.

It is prudent to sever all financial ties with previous partners with whom you've shared a joint account, as this could influence the lender's decision. You can do this by making a request from all three credit reference agencies to add an invoice of disassociation to your credit files.

Remember to Sever Financial Ties With Ex-Partners To Improve Your Credit Score

Some Consumer Credit and Debt Statistics From Credit Cards.com UK

- At the end of 2013, outstanding credit card debt in the UK averaged £57.4 billion per month

- As of February 2014, U.K. borrowing was growing at an annual rate of 5.1%, almost 40% of borrowers took advantage of 0% interest offers on balances to manage their cash flow

- Unsecured consumer debts nearly tripled in the last 20 years, reaching close to £160 billion in November of 2013.

- Households in the poorest 10% of the country have average debts more than four times their annual income

- At the end of November 2013, there were 90.5 million debit cards in circulation in the U.K.

- At the end of November 2013, 75% of all spending in the U.K. retail sector was made using plastic cards.

- 40% of consumers paid off outstanding balance in full each month or at 0% interest rate

- The APR or average percentage rate on credit cards had dropped from 17.69% in March 2013, to 11.08% in March 201.

- As of April 2014, 266 people in the UK were declared insolvent or bankrupt daily

- In the first quarter of 2014, there were 24,931 individual insolvencies in England and Wales. This Included 5,671 bankruptcies, 6,549 Debt Relief Orders (DROs) and 12,711 Individual Voluntary Arrangements (IVAs)

3) Gradually Build A Good Credit History

Without a credit record, companies will finds it difficult to assess an individuals reliability, and are highly unlikely to give them the benefit of the doubt. To build up a credit record it is necessary to borrow money and pay it back on time each and every month.

Some people will find it very difficult to borrow money without a credit record. However, there are credit cards especially aimed at people with bad credits, these cards usually have a higher interest rate attached to them, and should only be used in this case, if the money can be repaid before interest is incurred. This is a good way to benefit from the use of a credit card, while simultaneously repairing a credit record.

4) Check Your Credit Score and Know Why You Were Rejected

Sieve through your credit records to ensure that the information is correct and up to date.

Ensure that any paid court judgments are shown as settled, bankruptcy order that have ended, should say so in the report. Applying elsewhere for credit without investigating, will only increase the chances of rejection, since every credit check is logged. Spacing out applications is always a good idea, lenders may view too many applications in a short period of time as desperation, and can further lessen the chances of a positive outcome.

5) Give Credit Repair Companies a Wide Birth

Credit repair companies can in fact worsen the situation and should be avoided. The Office of Fair Trading warns that the advice and information from these companies may be wrong, similar services can be provided free of charge by other companies. For information on paying off debts look at the government's website.

Conclusion

Whether we like it or not, our modern world runs on credit. You may well ask, why we need credit at all since we only get deeper in debt while the banks get richer. It's a fair question, but when we understand how the system works, we can make it work better for us.

Excellent credit rating means better insurance rates, better employment options, cheaper loans, and mortgages. We can benefit from the positive credit. Borrowing can save us money, but only when we use it sensibly. The higher the credit rating, the lower the interest rate.

Since we all use credit, we need to learn how to use it well, and the first step is ensuring that the information in our credit files is accurate, complete and timely. When we know what information is in our records, we can take the appropriate steps to have outdated information and errors removed, only then can we start to improve our credit scores and credit ratings to get the best deals that can help us save money.