Singapore: Don't bank on your bank's sales pitch

In Singapore last week, many retail customers of a local bank were affected when Lehman Brothers collapsed. They had bought a product called DBS High Notes 5. According to a Straits Times Singapore article (Sep 17, 2008 Will my money be safe?), the value of that particular product was "partly determined by a basket of eight reference entities, including US investment banks Merrill Lynch, Lehman and Morgan Stanley." Investors in this product are likely to get very little back.

What struck me though, was not that there was an investment loss, but reports of customer complaints that the risks were not properly represented to them. Think these customers are complaining only because they lost their money? My own experiences with "customer relationship managers" and "financial advisers" at Singapore banks suggest to me that these customers are likely painting an accurate picture.

In my experience, bank officers tasked with selling financial products often do not provide a full and accurate picture of the products they're marketing.

Quotes from customers

In another recent Straits Times Singapore report (Some good news? Bank says customers with High Notes product may get something back Sep 20, 2008), bank customers who invested in the DBS High Notes 5 Lehman-linked product were reported to have complained of misrepresentation of risks, unwise advice from the bank, and overselling:

- One investor, a retiree in his 60s, Mr K. Tay said: 'I just wanted make a fixed deposit at DBS after I withdrew my CPF funds, but the bank staff told me to invest in this low-risk product that could give me higher returns.'

- 'I just received a letter from DBS, telling me that although there is a downward rating on the notes, I will only suffer a paper loss and not actual loss,' said a High Notes 5 investor who only wanted to be known as Mrs Lim. She produced the letter from DBS when she met with The Straits Times on Wednesday.'The letter was dated June 27 and in July, my investment of $25,000 was halved but yet I chose to hold on to it because the letter said that the product was designed to be held to maturity - I feel cheated,' said the 59 year-old retiree.

I can tell you from personal experience that officers in many banks do the same thing. And many customers take the advice and information offered by these bank offers, because to some extent, they still believe that certain banks are reliable.

Banks are now sales organisations

Banks used to be institutions we can place our trust in.

No longer.The business of banking has changed a lot over recent years. Banks are now aggressive sales organisations. They sell a dizzy variety of financial products: from credit, to unit trusts, structured products, insurance, etc. And they are driven largely by the profit motive. Customers need more than ever to understand this, particularly with the economy going through so many bumps.

Among the practices that I've noticed:

- misrepresentation that they offer financial planning

- misrepresentation of products

- misrepresentation of risks

Financial planning? What financial planning?

Banks nowadays try to sell their products by touting an overall financial planning concept. Witness their advertisements filled with images of happy families who have planned their finances well enough (with the help of their bank, of course!) to afford everything they want in life, from taking care of their health to their children's education.

And, to reinforce this, bank officers often ask you to fill in a financial profile when you visit the bank, ostensibly so that they can design a financial plan for you. But do they actually have your interests at heart? Very rarely.

Notice that at least one DBS High Notes 5 investor had put his entire savings into that one product. What happened the principle of diversification? That is one of the central tenets of financial planning, yet this customer was not advised to spread out his investment.

What I find often happens is that bank officers try to get you to put as much as possible in whatever financial product they're trying to push at a particular time, whether or not it is suited to your particular situation.

Many of the "customer relationship managers" are also very young, barely out of university, without enough experience of financial ups and downs to provide useful advice to customers.

Misrepresentation of risks

I bought a structured product a few years ago (with another major bank in Singapore, not DBS). I thought to ask about the penalty for early withdrawal, the bank officer said that that can only be determined at the point of withdrawal but it would not be much. He even suggested that I split my deposits into three separate lots, in case I want to withdraw the money to go into a better investment. Fast forward a couple of years, when I inquired about the penalty if I were to withdraw the money, I was told that the penalty was in the region of 13%. A lesson there: always insist that whoever sells you the product tell you the worst-case scenario, and in writing. If the officer refuses to do so, do not buy the product, and you should also write to the bank's head office providing details of your experience.

Very seldom do you find outright lying from bank staff. However, they are very likely to highlight potential gains (making it sound as much like a sure thing as they can), and either downplay or neglect to mention potential risks.

Since the Asian financial crisis in the late 1990s when customers suffered losses in unit trusts, many banks now make you sign a document saying that you are aware of the risks of the product you're buying. In fact, many customers sign this without a clear understanding of the risk-reward picture. All their information comes from one person, the bank officer who has a vested interest in presenting a glossy picture of the investment(s).

That's why, as I stated earlier, it's important for customers today to adjust their mindset, and always remember that the bank is trying to increase its profits. Never invest in a product based solely on information from a bank officer, or information from literature from a bank. And never invest in any product you don't understand fully. Do your own research before you put your money into anything.

Misrepresentation of product

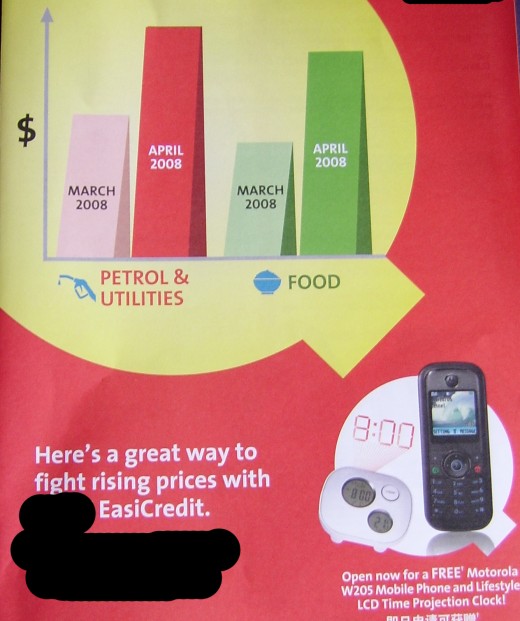

A few months ago, I blogged about a flyer I had received for a Credit Line facility which has the caption, "Here's a great way to fight rising prices..." The flyer had a graph showing the sharp rise in prices in April 2008 over the previous month (see flyer in picture on right), coupled with the promise that ‘You can get cash to tide over this period of rising prices on necessities' [bolding is as on flyer] . Using credit to deal with inflationary increases? A no-no, I would have thought, yet that's what the bank seems to be saying in its advertising.

Another experience: Recently, a bank officer wanted to introduce me to a "savings" product offering high interest. Once she started explaining how it worked, I knew that it was likely an endowment (insurance) product. And of course she had to admit that it was when I questioned her. This is not the first time I've had occasion to listen to this type of sales pitch, by the way. Other officers from other banks have also done so. It was only because I had some familiarity with insurance products that I understood what product they were actually marketing.

Don't be swayed by freebies

In Singapore, you'll find banks setting up booths in shopping malls and exhibition centres. They entice you to listen to their sales pitch with a freebie, and they offer attractive free gifts when you sign on the dotted line.

Take the free gift for listening to them, if you want (that's how I know so much about their tactics, by the way).

But be extremely wary of any product that they try to sell to you. Bank officers who solicit your business are first and foremost sales people, rather than professionals whose main interest is to help you plan your finances wisely.

Remember: Always do your own research, and find information from impartial sources before you put your money in any product being sold by the bank.

And, if you believe that a bank officer has misrepresented an investment to you, contact the head office of the bank as soon as you can to get an explanation.

Educate yourself on personal financial planning basics

Finally, I'd just like to say that I'm not saying that you should not never buy a financial product with a risk. Or that financial planning is not useful.

Personal financial planning, and products such as insurance, investment, and credit, do help you increase your chances of increasing your wealth. But you need to learn the principles of financial planning yourself, and not just rely on people who are trying to sell you something.

Read up on various products, discuss with friends, ask the advice of people who have successfully managed their money over many decades, in other words, do your RESEARCH.