5 Things To Watch That Will Signal The Coming Financial Collapse

Triggers to watch that signal the beginning of the end...

The economy is changing

Our life is changing.

We are being lead down the garden path. Find out how and by whom.

What is your government doing today?

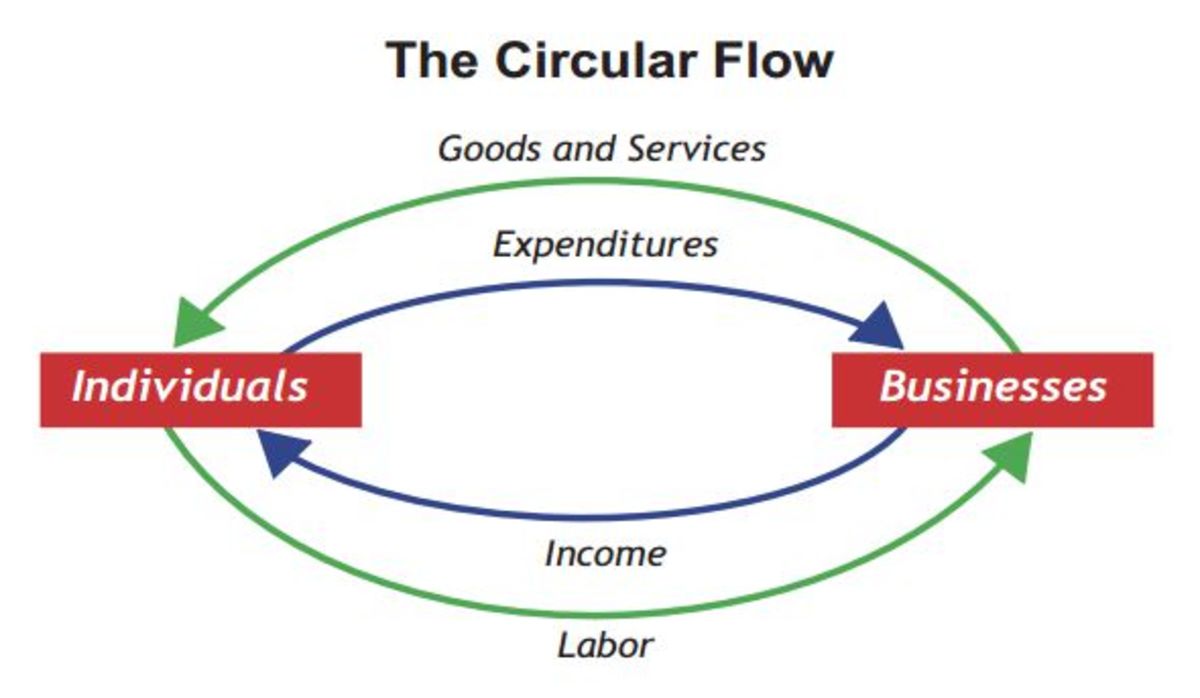

Federal Reserve Shenanigans that keep you enslaved to the establishment! Check out the short video below.

The recent debt ceiling fiasco that played itself out in the press recently has not been resolved, despite what many think.

The US government is insolvent and near bankrupt. The national debt is approaching $ 17 trillion and the annual deficit exceeds $ 2 trillion. The credit rating agencies have recently downgraded the credit status of the government and Congress is now refusing any further increases in the debt ceiling which means that the government will be unable to pay its bills. The next round of talks will get underway in late January 2014 and can only make things worse.

Mortgage failures are at an all time high. Corporate bailouts in the trillions of dollars have been unable to stem the tide of corporate failures as more and more corporations are becoming insolvent and the government has been unable to correct the problems plaguing the economy. Detroit has recently gone bankrupt. Corporations in the airline industry are lobbying the federal government for financial aid they can’t provide in order to survive.

What does all this mean for you, your family and your financial future?

It means that we are on the brink of a financial collapse the likes of which has not been seen since the Great Depression. It means that the American dollar is being devalued and worth less and less every month. It means interest rates are about to start increasing to hyperinflation levels will all the money in circulation that has flooded the economy. China has started to hoard gold bullion and has recently called for the replacement of the American dollar as the currency of choice in international settlement of debts. China holds more than $ 1.4 trillion worth of Treasury Bonds that experts believe they will soon try to unload. When that happens the pressure on the American dollar and the attendant consequences to their economy will be devastating, at a time when it can least afford any major disruption.

Here are 5 signs to watch that will foretell the coming financial collapse in the not too distant future:

1.) Prime rate charged by the Federal Reserve Board (The "Fed")

Once the Fed starts to raise this rate - and they will - that will start the beginning of the end for the American economy. Rates across the economy will rise across the board and will increase the price of everything including money, automobiles, houses, food, and transportation to name but a few. By trying to stop the hyperinflation that is about to occur, the government will actually be giving it a boost, much like trying to put out a fire by dousing it with gasoline.

2.) Unemployment rate

The number of jobless claims will shoot through the roof as workers everywhere will begin to lose their jobs as the corporations begin to lay them off in efforts to reduce costs. Millions more will lose their jobs as the economy begins to go through structural changes that will continue for years. Manufacturing industries will shed more jobs as they are exported to countries like China and Mexico where the wages are significantly lower. Massive increases in unemployment payouts by the government combined with dramatically lower income taxes not being paid by those laid off will put severe and additional strain on the already fragile government finances. Once this unemployment rate starts to rise, the end is not far.

3.) Inflation rate

The inflation rate has already started to rise in certain sectors of the economy. All the trillions of dollars that have been pumped into the economy in the form of bailouts will gradually start to increase the inflation rate to all time new highs and when that happens we will be past the point of no return.

4.) Rate of default of residential mortgages

Near record defaults in mortgages in the recent past will pale in comparison to what is now on the horizon. More and more home owners will begin to default as the economy worsens, inflation increases and jobs disappear. There will be a glut of houses on the market and no one to buy them even at fire sales prices. Banks will not be able to cash in on them. Once that happens, entire cities and towns will turn into shanty towns and congregations of the unemployed and their families. Urban blight will begin, civil unrest will spread, and the infrastructure will begin to crumble.

5.) The price of Gold

According to some experts, the price of gold will increase to between $ 5,000 and $ 6,000 per ounce and perhaps higher. When that happens, the US dollar will cease to exist as we know it as it will become worthless in purchasing power and for settling accounts. The price of a loaf of bread could escalate to levels of $ 500 or more.

Combine these five elements together into one scenario and the American economy will cease to exist. There will be no government money to bailout people, cities, towns or states, and in some people's reckoning, no government either. Civil unrest will be the norm and entire populations will start to starve and revolt. With no more government services available, those who were still paying incomes taxes voluntarily will cease to do so thereby causing the government to take drastic measures to keep the calm including calling in the National Guard who will be the only employees receiving their pay from the government.

Society will collapse.

Is there anything you can do to protect yourself from this bleak future?

Yes there is, and it involves a change in thinking and taking action now. The answer is to buy gold. Buy more gold. Buy even more gold and hold it. gold is the only store of value historically that has held its value in good times and bad, an will continue to do so in the future. Unlike governments all over the world who have put us into this mess through the gradual devaluation of fiat currencies by printing trillions and trillions of dollars and putting them into the economy, the mines are not producing trillions and trillions of ounces of the precious metal meaning that its value will not only be maintained, but dramatically increase.

The time to buy gold is now, before these five signs manifest and everyone is aware of their existence and begins to rush to buy the precious metal as well. Once everybody clues in to what is happening it may be too late to lock in your gains and protect your wealth. Without sounding alarmist the race is on and to the victors go the rewards, while to the losers go the spoils.

Where will you end up? What will you do?

In whose best interests is the Fed acting in this entire mess?

The Fed is going to blow up the economy.

Do you think that the Fed and those who control it are planning something BIG for us in the coming years?