Does Bank of America Pay Taxes?

US Uncut is Targeting Bank of America as a "Tax Dodger." But it paid 28.4% Before the Financial Crisis

A new and loosely formed advocacy group called US Uncut is organizing picket lines outside Bank of America branches nationwide, accusing the financial institution of dodging corporate taxes. The group, which claims no central organization, is highlighting a previously little-noticed report by the Government Accountability Office from 2008 that found nearly two-thirds of U.S. corporations paid no taxes in an 8-year period between 1998-2005. (The original study, released in August 2008 by Michigan Senator Carl Levin is here; see Figure 1 on page 7 to grasp the two-thirds claim. I will return to it later in the hub.) While the GAO report makes no mention of Bank of America (or any other company for that matter), US Uncut has extrapolated from the bank’s financial statements in 2009 when it simultaneously reported a profit and received tax refunds. It has dutifully branded the company a “tax dodger.”

US Uncut is a new group trying to organize political action through social networks. It is modeled after a similar organization in the United Kingdom called UK Uncut that has fought anti-austerity measures in Great Britain. It also aspires to be a liberal answer to the Tea Party, making a case for collecting revenue to pay for government sources.

Curious why the group was picking on Bank of America, which isn’t usually lumped in with companies that have well-documented aggressive tax planning departments such as General Electric Co., I called one of its spokesman, Carl Gibson of Jackson, Mississippi. Mr. Gibson repeated, verbatim, talking points I could have found easily on his Web site without answering my question: “Since 2009, America’s most profitable companies such as ExxonMobil, General Electric, Bank of America and Citigroup all paid a grand total of $0 in federal income taxes to Uncle Sam,” Mr. Gibson said. “Tax havens alone account for up to $1 trillion in tax revenue lost every decade, money that could be invested in K-12 education, colleges, public health, job creation and hundreds of other worthy public programs. If we pay our taxes, why don’t they? If corporations profit here, shouldn't they pay here?”

There’s a lot going on in this statement, but it’s really just a collection of loosely connected string that doesn’t quite tie a knot. It alludes to the GAO report, which lists both the two-thirds of companies paid no taxes and the $1 trillion in tax havens figure (although takes pains to make no link between the two numbers). And it cites a single year, 2009, when Bank of America was profitable and paid no tax, with no mention of what turns out to be a legitimate explanation (that has nothing to do with “dodging").

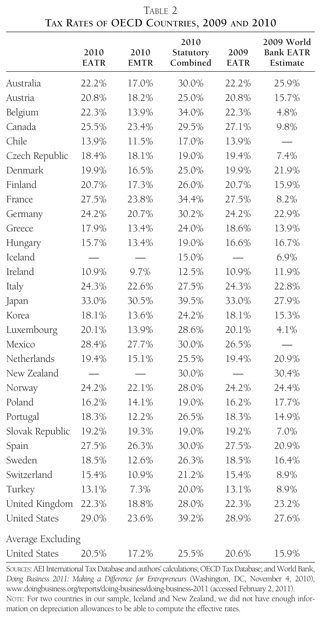

In fact, it neglects to mention that in 2007, the last year of robust financial health for the U.S. financial sector, Bank of America had an effect tax rate of 28.4 percent. Yes, that’s lower than the 35 percent statutory rate, but it was in the range of the 29 percent the American Enterprise Institute found was the effective average tax rate for a U.S. company in 2010. Bank of America paid nothing in 2008 (when it suffered huge losses due to the financial crisis) and in 2009, when it was able to write off losses similarly incurred by Merrill Lynch, which it acquired at the height of the crisis. Yes, the bank got federal bailout money, but that’s a separate question entirely. Singling out 2009, an anomalous year by all accounts, cheapens what should be a very serious debate about corporate tax policy.

I have no connection to any of these companies, nor do I have any love for them. But sometimes when my baloney detector goes off, I cannot ignore it no matter how try. And the klaxons were sounding as I listened to Mr. Gibson’s claims because I know a thing or two about tax policy and it was pretty clear his organization does not.

Generally speaking, banks are actually among the most heavily-taxed U.S. industries. Because of this they do dabble in abusive tax shelters from time to time – many of them including Bank of America got caught up in leasing tax shelters in the 2000s, for example. They’ve also done things like buy tax credits that support the construction of low-income housing, although that’s just taking advantage of deliberately placed incentives.

But the real issue with the corporate tax code has to do with the way the United States treats its companies that compete globally. Most of those companies are able to manipulate those rules to avoid having their foreign profits taxed in the United States. GE just released its annual report for 2010, which showed it saved nearly 20 percentage points off its tax rate because of these strategies (all of them legal) and reported having just a 7.4 percent effective tax rate. In 2007, the last year Bank of America paid taxes (it hasn’t yet reported annual results for 2010), offshoring saved it a far more modest 2.3 percentage points.

(Update: GE has issued a lengthy defense and explanation of its low tax rate here.)

The ability of some companies to defer U.S. tax on foreign profits is at the root of why so many U.S. companies are at paying less than “their fair share.” That’s the implication of the GAO report from 2008, and it’s at the heart of the burgeoning debate about overhauling the corporate tax code. (The GAO report also noted that most companies lumped into the two-thirds who pay no taxes category did so becuase they had no profits. You don't pay taxes if you're broke, either).

Corporate tax reform will inevitably pit the U.S.-based multinational corporations who have figured out how to keep their taxes low by expanding abroad against the more domestic-focused companies who are captive to the U.S. system. The trick for policymakers will be threading the needle between revamping the tax system so it allows U.S.-based multinational companies to compete with their foreign rivals on a level tax playing field without exacerbating the widening inequities between different kinds of companies within the U.S. and without inflating budget deficits; the Obama administration has made it clear it prefers a redistribution of corporate tax burdens, not a wholesale reduction in their collective liability.

So, why Bank of America? Maybe it’s still chic to pick on beneficiaries of federal bailout money. But I think the real reason is it’s a lot easier to find a bank branch to picket than to send supporters to a GE factory. It’s just a shame that the caricature the group paints undermines its broader message about ensuring U.S. companies pay what they owe. And that kind of misinformation will hurt lawmakers' abilities to make rational policy decisions.