Greed Goes Green

By: Wayne Brown

President Obama has made it clear that he wants to get Cap & Trade legislation past on his watch and the sooner the better. Senator John Kerry has clearly expressed that he is in favor or it and wants to move forward. Former V.P., Al Gore is said to have already profited in the multi-million dollar range with his voluntary carbon credit business. Rumor has it Obama may be one of the investors in a carbon credit operation in the Chicago area. Certainly there seems to be a number of folks in high places who are more than willing to move forward with this legislation. So what does it mean for you and I, the ordinary “Joe Citizen” you might ask?

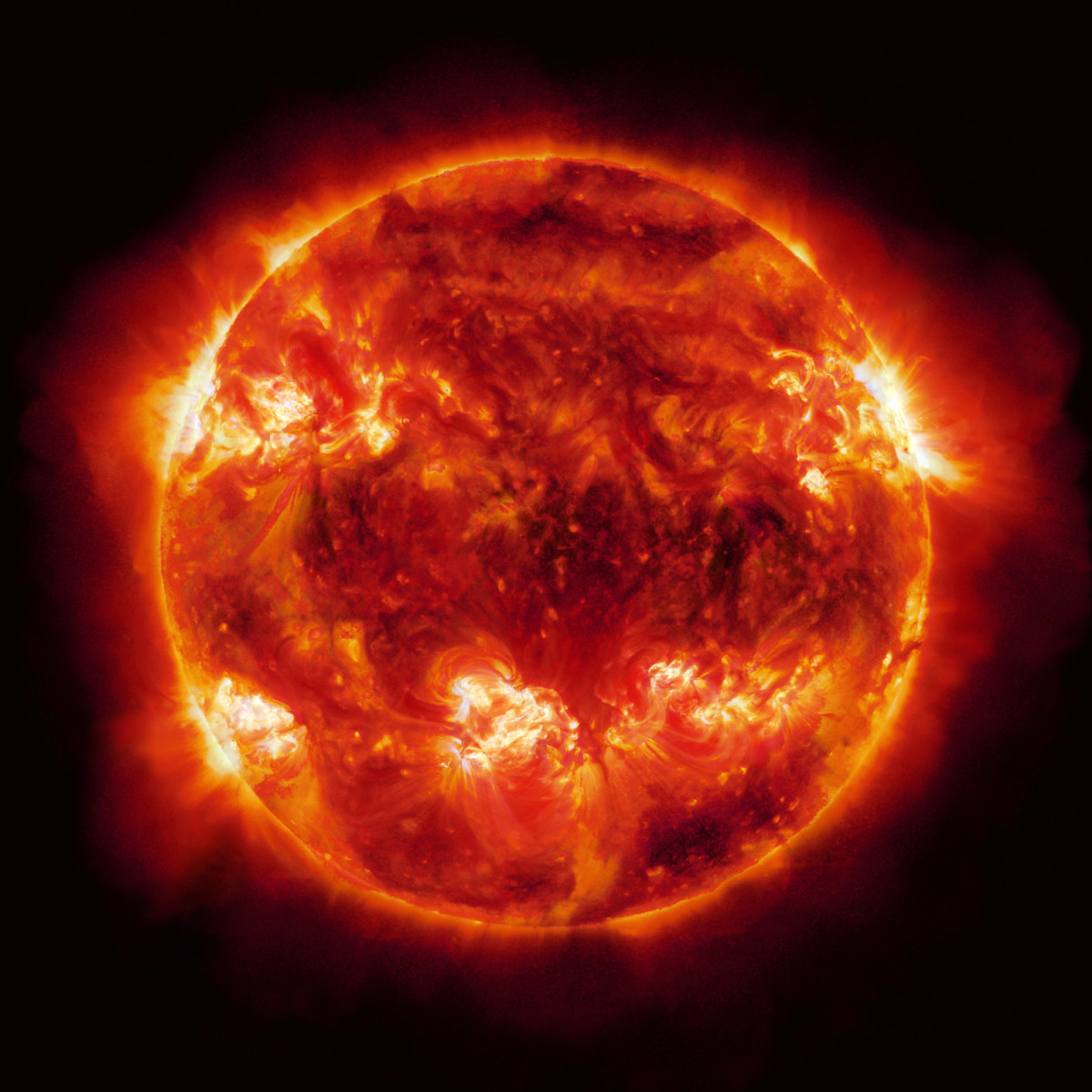

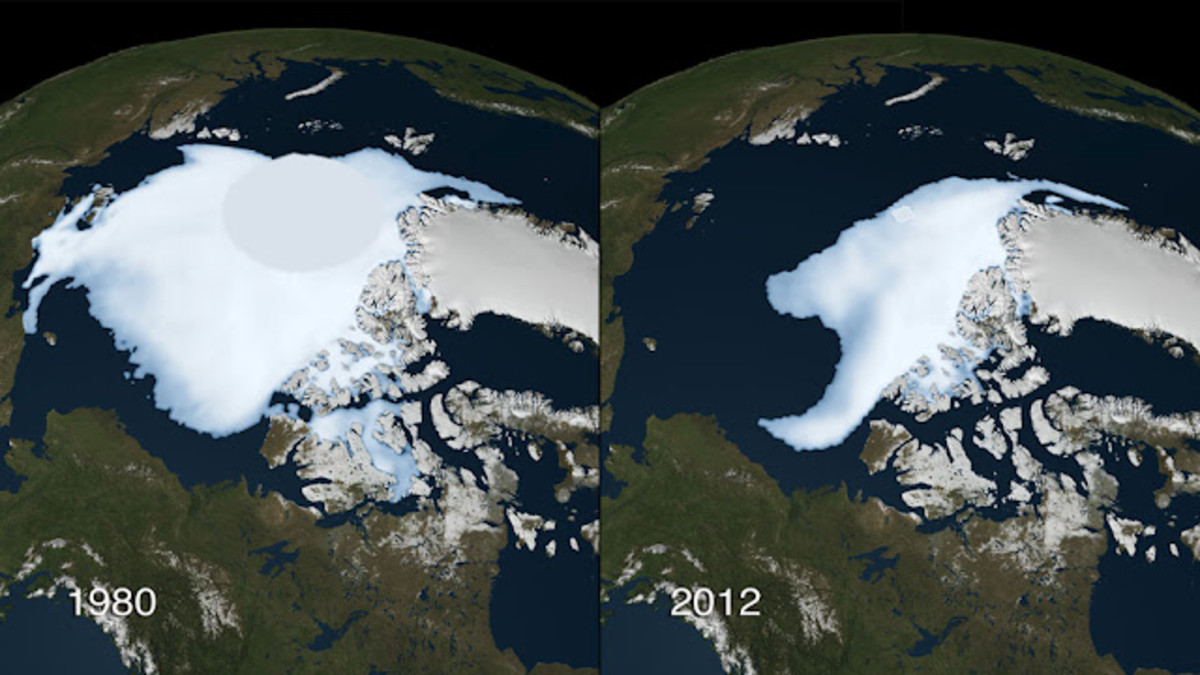

Cap and Trade as a global concept could certainly become quite complex but let’s boil it down to a simple model that we can grasp. First, there is the reference of “Cap” in the legislation. Basically, that is a reference to say that this legislation is going to establish upper cap limits for greenhouse gases generation on the basis of how much tonnage of carbon dioxide is released into the atmosphere. With those caps established various industries will then be analyzed for the amount of carbon footprint they have on an annual basis in the environment. Carbon credits will be established as a means of offsetting these emissions.

Now, mind you, the carbon credits do not stop the emissions, they simply represent a fee that a company has paid in order to emit that level of carbon dioxide into the atmosphere. The hope here is that the companies will find this purchase of carbon credits to be an irritating added expense to their operation and look for more and more ways to reduce their dependence on fossil fuel products in order to reduce their carbon footprint. In reality, there are few real alternatives to fossil fuel use in the near term future that will support the load of industry on a competitive economical basis. Thus, this purchase of carbon credits really becomes a penalty or tax for emissions. As with all types of fees, taxes, etc., this becomes “overhead expense” to the companies and they simply then build it into the pricing of their products and pass it on to the consumer…you and I.

As consumers, we do not have anywhere to ‘pass the expense’ thus we have to absorb it and the effort to reduce carbon emissions then falls at the feet of the individual consumer rather than the large companies who are actually producing them. So, theoretically, every time you turn on a light, or start your car, or crank the lawn mower, you, as a consumer, are expanding your individual carbon footprint. You then pay for that expansion through higher prices in the market place or an increase pricing for your electricity based on your proportional share of the total consumption in a given period. Ultimately, it is simply a tax on the consumer.

Now, does someone stand to get rich in the process? The answer is ‘most definitely’, and herein is the basis for the popularity of the concept. Yes, we all should be environmentally conscious and do what we can to reasonably take care of our world. With this carbon credit approach, there will be businesses established (already are out there) who will sell or broker these credits. They in turn make a margin or fee off of each transaction just like a stockbroker. Since there will be a defined quantity of carbon credits in the market based on the tonnage cap established in the legislation, these credits will begin to have variable values based on the demand for them in the market by various companies. Just like stocks, bidding wars could drive the price up or down, and the fees these companies make will likely be a percentage of the agreed upon end price when the transaction is made in the market. This is the “trade” portion of the name reference.

Realistically, corporations which produce products do not look for ways to reduce production. Given the reality of availability and the associated costs, the near term future result for Cap & Trade will hinge on acquiring enough carbon credits to keep your company producing on a daily basis at the production level necessary to satisfy demand and make a profit. The status quo will remain and the amount of carbon dioxide released into the atmosphere will be capped at best. Those companies exceeding their carbon credit level with emissions will likely just be assessed a fine under the legislation. Thus the government gains revenue from potential fines and the private sector has another avenue to ultimately soak the poor consumer who is standing at the bottom of the consumption ladder and has no where else to pass the expense. Until companies have a viable way to earn carbon credits which become more profitable to them than making product for sale, they will continue to pass-thru the expenses associated with this legislation.

Now ask yourself, if this President is so against the wealthy class getting wealthier, why is he so for this legislation. There are two apparent reasons, the first of which is that he will likely reap some of that wealth himself if he indeed is invested in the carbon credit business as rumor states. Secondly, he courts the ‘rabid environmentalist’ vote by pushing this legislation. The more votes he gathers, the higher his chances of re-election. The same held true with Obama-Care and will hold true with the comprehensive immigration legislation this president will propose. It’s about money and votes clearly.

As you can see the pressure to reduce the carbon footprint in America will clearly fall into the domain of the consumer on the short-term in the form of assessed fees and increased prices. In most cases, these costs will be assigned to items that are considered essentials to our daily lives, essentials that could become luxuries depending on the price of carbon credits. The reality is that the American consumer is not likely to do without for very long and will ultimately absorb the costs with a minimal reduction in their normal habits. Thus, Cap & Trade will simply become a scam which pays well for those who are in the business of buying and selling carbon credits on the open market. It is certainly capitalism at work but not in a positive way.

This is not something we as consumers should just shrug our shoulders and ignore. We will certainly feel the effects just as if the government decided to tax us for our consumption. In the end, that is really what this is about…a tax on consumption. It puts money into government coffers which can then be spent on pork barrel projects by those in high elected places. While the intention is there to reduce carbon footprint and ultimately reduce the volume of greenhouse gases, the pass-thru to the consumer will minimize the effect and the true end result is that we consumers, we taxpayers, will be paying more taxes to support more tax and spend legislation in America. The concept certainly has “green” implication but the reality is the green is more about money than the environment.

© Copyright WBrown2010. All Rights Reserved.