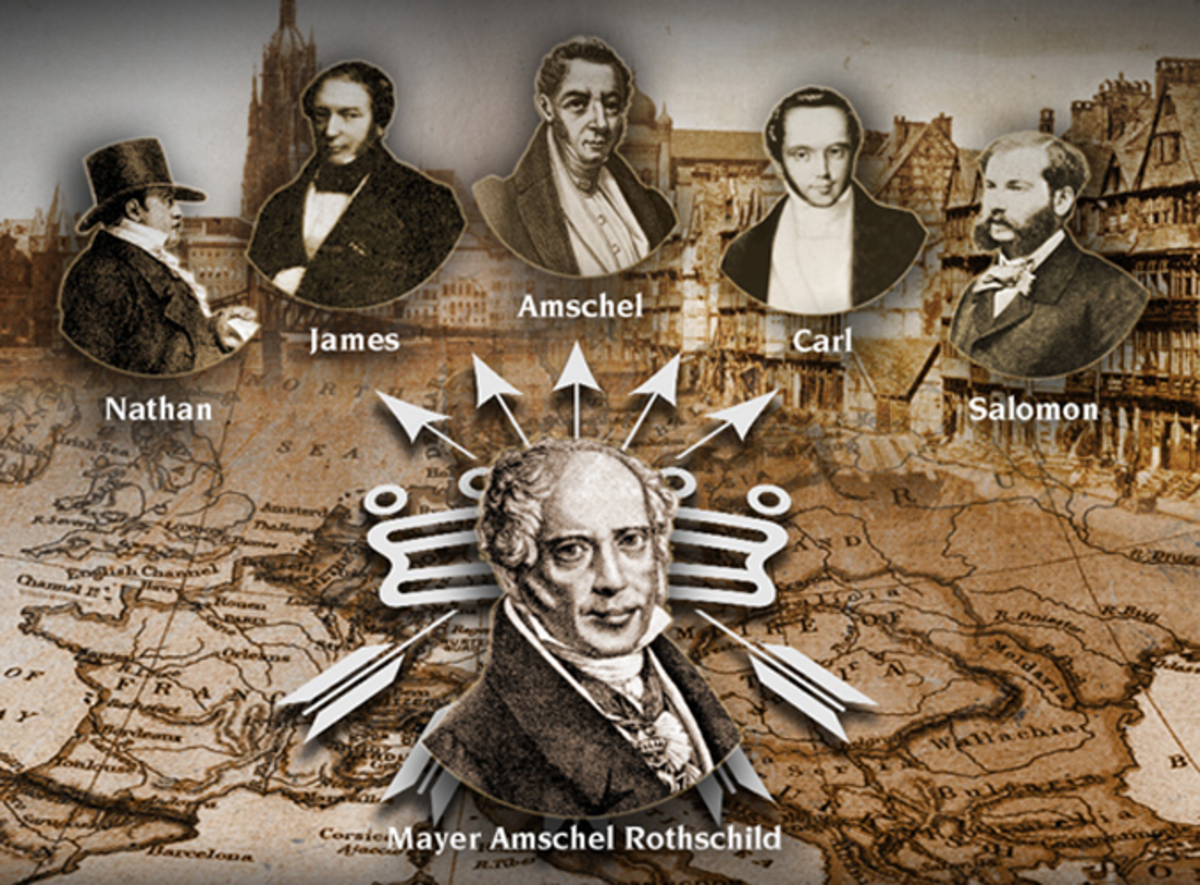

The Max Keiser "Crash JP Morgan Buy Silver" campaign

The "Mad Max" campaign

There is currently a campaign to try and force JP Morgan into bankruptcy. The campaign is based on the idea that JP Morgan is 30,000 contracts short on silver. This is only a portion of the 137,000 short contracts on the COMEX exchange. Each contract is 5,000 ounces of silver, so that would mean JP Morgan is short 150 million ounces of silver.

Who is Max Keiser?

Max Keiser was born January 23, 1960. He graduated from New York University in 1985 and began a career on Wall Street. What makes Max Keiser unusual is that he is also a filmmaker and broadcaster. He has combined these skills together to become a financial reporter with a bit of flair. He has branded himself as a "Financial Anarchist" and has produced several short videos. He has gone against the financial mainstream press and he has not been afraid to let his opinions be known about the economy. His first well published prediction was in the September 2004 issue of "The Economist" where he predicted the collapse of Fannie Mae and Freddy Mac due to cheap money and an overgrown derivative market. He expanded on this prediction in 2006 and stated that sub-prime mortgage-backed securities would causes a recession in 2008.

On the negative side Max Keiser founded a company called Karmabanque that makes money via a form of environmental blackmail. Karmabanque will sell stock short in a targeted company and then have environmental groups boycott that company in exchange for some of the profits being given back to the boycotting groups. Targeted companies have included Coca-Cola, McDonald's, Exxon Mobile, Walmart, Starbucks, Yahoo, Monsanto, Apple and Microsoft. Karmabanque encourages rich speculators to help them by targeting their victims more by price to earnings ratios than by the amount of alleged environmental harm.

Birth of a Meme

The Crash JP Morgan Buy Silver Campaign Idea

On October 27, 2010 two traders (Brian Beatty and Peter Laskaris) filed a lawsuit against JPM (JP Morgan) and HSBC. In this lawsuit, they accused the two companies of manipulating the price of silver by amassing huge short positions in the silver market. The next day the NIA (National Inflation Association) stated that the extreme short position of JPM and the small silver market could push silver to over $50 per ounce if JPM eliminated all short positions with silver. In a video by NIA called "Meltup", JPM is stated as being 150 million ounces short on silver (representing 31% of all silver short contracts on COMEX exchange).

Silver Slippers and the Wonderful Wizard of Oz

On November 12, 2010 Max Keiser was on the Alex Jones radio show. During a break, while talking to Mike Krieger, he came up with the idea of "Crash JP Morgan - Buy Silver". Alex didn't seem very interested, but the audience loved it and the idea took off on the internet. Max Keiser, never a person to let a good opportunity go to waste began leading the charge to buy silver. He has produced and continues to produce videos supporting the downfall of JP Morgan. He claims that JP Morgan is a financial terrorist and needs to be destroyed by the power of the common people. His idea is that if enough people bought silver, then the price of silver could be driven up. If the price of silver rises enough, then JPM loses money on their silver short positions. If JPM loses enough money, then they go bankrupt.

Crash JPM Cartoon

Will JP Morgan go bankrupt?

I figure that even if JP Morgan lost $20 on each ounce of silver, they would be out only $3 billion dollars. JP Morgan is a huge company with many subsidiaries, so they may very well be long on silver elsewhere. $3 billion dollars may sound like a lot, but JP Morgan is huge and has a lot of financial resources, for example, they just bought over a billion dollars worth of copper. Also, if a crunch came, I wouldn't be surprised if the U.S. government would be willing to help JP Morgan out if needed.

So what do I think are the odds of success. Maybe if silver went to $500 per ounce, an extremely unlikely scenario, resulting in losses of over $70 billion dollars. Even then, the U.S. has abandoned the capitalist ideal and switched to corporatism, so JPM would probably be bailed out. Admittedly, I don't know everything about JP Morgan, but I am guessing the odds of them going bankrupt (and not bailed out) to be about 1 in a 100. This is a fun meme to follow though, and I am definitely rooting for Mad Max and his wacky campaign. I am really curious to see if this can even put a dent into JP Morgan and I will certainly keep following this story.

Disclaimer: I keep most of my savings in silver and gold and will continue to do so until the U.S. stops financing its deficits by printing money.

Other Hubbers on Mad Max Keiser and/or Silver: