The burning question of our times: Where has all the money gone?

If there’s one phrase heard more often than any other these days it’s “there’s no money for that.”

Of course “that” refers to:

- Medicare, or medical care in general, particularly for the lower-income classes. (And yes, Virginia, there is a class system in this country, just like all the others – maybe more so.)

- Social Security, but never mind that all the money paid into the system -- particularly for the “boomer” generation who were required under Reagan to “prepay” their funds -- has been spent on other things to the tune of some $3 trillion. (Something resembling a form of theft or embezzlement to the casual observer like me, but apparently not as this "crime" is never mentioned in any discussion of that liability.)

- Education -- that is public education.

- Food stamps – Let them eat cake. Or peas, according to President Obama.

- Social services for the real poor, the disabled, the marginalized, the helpless. (Believe me, in my work with these people, many living on $624 monthly, “no money” is what I hear from social workers, the city, the county and the state, all the time.)

- Roads, bridges and public transportation.

- public and national parks

There’s just no money! The wealthiest nation in the world with the largest economy is broke. Don’t you get it?

Now I just have to say, I, for one find that implausible. It boggles the imagination. If this nation is broke, then something is terribly wrong with management here (in my humble opinion.)

But for now, let’s take those that cry “no money” at their word. Doesn’t that beg the question: where has all the money gone?

It is in the nature of money to circulate. When one earns money, one spends money and the taxman taketh at both ends. Indeed, in a healthy, circulating economy, the same dollar may be taxed many times over as it changes hands. In this way, the various levels of government receive the funding to run those communal services we all rely upon: public education, roads and other infrastructure, police and fire-fighting services, waste disposal, emergency services, security… all the stuff that makes our modern lives possible.

When the flow of money in circulation dries up, slows to a trickle, our economy stagnates and begins to die off – from the bottom up (something worth thinking about.) Less and less of it changes hands and our various levels of government, from municipal, to state, to federal, find little opportunity to take their cut and begin to wither from malnutrition. A good thing say some, but to those who cry “starve the beast until it is small enough to drown in a bathtub,” it behooves us to remind them it is public funding that drives the infrastructure of our society – certainly not private. (Quite frankly, if it is the wealthy who are the job creators, it’s time to examine the idea they truly suck at their job.)

To say the money is gone because the government spent it is even more simplistic than this elementary study of the nature of money.

If the government spent it, that same money should still be circulating – shouldn’t it? What possible spending could mean no money at all? If it is goods, then the manufacturer of those goods should be paying workers (who will in turn spend,) buying raw materials from suppliers (who will in turn spend,) using energy from producers (who will in turn spend,) and paying dividends to stockholders (who will in turn spend.) And all of it taxable. Same with services.

Even in this slippery global world where money may be earned in one society and spent in another that money should still be passing from hand to hand, with a portion of each transaction going into the public coffers, somewhere. But it isn’t.

To say the money is gone because it has moved into foreign economies through outsourcing is equally naïve, as it assumes we have nothing anyone wants and the money will never return (unlikely) and would equally assume that the circulation of money in those foreign places has increased relative to the decrease here.

It doesn’t take much of a study to find this is not happening, not for the average-man-on-the-street.

For those inclined to point to the giants of Asian success in disagreement, they’d better take a look at the lives of those populations as a whole. What we see is not a major increase in general standards of living, but a major increase in flight of capital. (China leads the world not only in poor working conditions and low wages, but also in money “leaking” out of their economy. FYI – Russia is second.)

To where? Yes, that’s the question: where has the money gone?

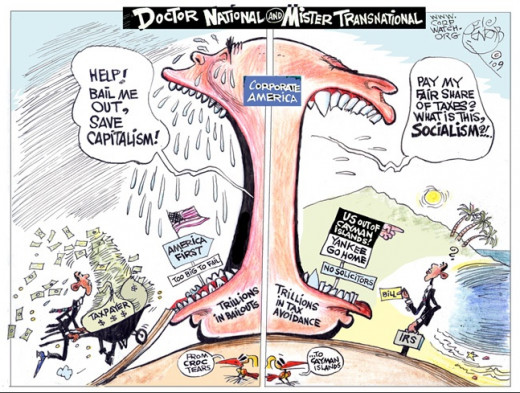

To say the world’s money is gone because we’ve squandered it on welfare, unaffordable, unnecessary, nanny-state social programs is perhaps the biggest lie of all. One thing is true: give a poor man a bit of money and you can rest assured it will immediately go back into circulation. (Indeed, instead of throwing money at those that created the problem but left the tab for the whole venture on the shoulders of the tax-payer -- in what had to be the greatest redistribution of wealth in history -- if bail-outs had gone to those hardest hit in our latest crisis instead of the banks, who kept it and did not loan it out as intended, we’d have a whole lot more if it in circulation and a healthier economy. Just sayin’.)

The whole world seems to be out of money, as witnessed by near global “austerity programs” and the increasing poverty of the world’s populations as a whole. There is no global economic growth. Indeed, the only thing growing is our population.

So far, the only solution to our lack of circulating money dreamed up by our intrepid leaders is to print more of the stuff. We can call this a poor solution if we are inclined to be polite in our language. We can call it the bumbling efforts of those with little understanding of the task they are charged to perform, myopic in vision, self-serving and blatantly stupid, if we want to be a little more articulate. Not only does each new dollar bring with it its weight in debt, not only does each new dollar devalue those that came before but these new dollars seem to disappear as quickly as the presses can print them. Once again, those who can’t see beyond the next election year come up with their next idea: print yet more.

Hey gang, when something isn’t working, more of the same will not help.

Forgive my simple-minded meditations on money. However, the lack of sophistication does not negate the validity of the question.

Apparently, I’m not the only one pondering the conundrum.

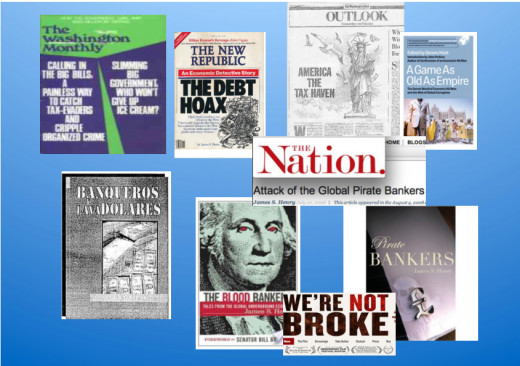

I strongly urge the reading of this report for anyone at all interested in this question -- which should be all of us (unless you're one of those with untold millions stashed away "off shore." At which point you're probably thinking "oh, shit.... The plebs are on to us.")

So has Mr. James Henry the former chief economist at the consulting firm, McKinsey and an expert on tax havens. He has compiled the most detailed estimates yet of the size of the offshore economy in a new report, “The Price of Offshore Revisited.”

The most mind-shattering of his revelations is this:

A minimum of $21 trillion to a possible $32 trillion -- [an amount equal to the GDP of the United States, Japan and the entire third world combined] -- is sitting in offshore “tax-haven” accounts, beyond the reach of any taxman of any nationality. [And if this isn’t enough to bring on a sense of vertigo, the authors go on to state: ]“We consider these numbers to be conservative”

Holy misers, Batman. I think we’ve found the missing money!

Or, as the authors describe it: the world’s economies are leaking wealth into a veritable black hole, one that until now, has resisted all attempts to adequately measure its dimensions.

Why, everybody must be opening offshore accounts and socking away whatever they can scrape up to amass such an unimaginable pile of cash! You’d think -- but in another shocking revelation the report delivers the following tidbit:

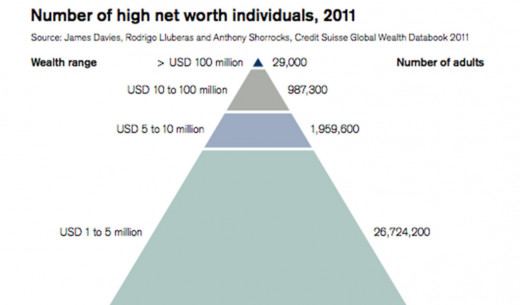

It turns out that this distribution is incredibly concentrated. By the authors’ estimates:

"...at least a third of all private financial wealth, and nearly half of all offshore wealth, is now owned by the world’s richest 91,000 people – just 0.001% of earth’s population. The next 51 percent of all wealth is owned by the next 8.4 million, another trivial 0.14% of the world’s population."

Leapin’ lizards, Daddy Warbucks, this means that the real one percent isn’t even 1%!

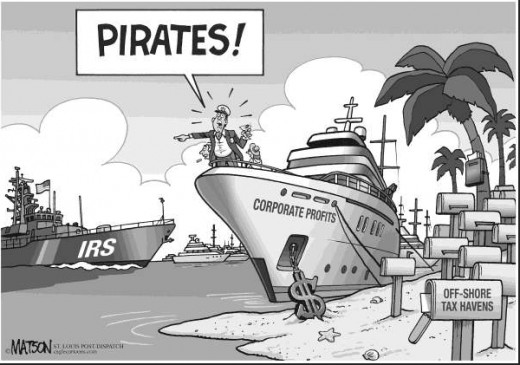

So, who are this 0.141% of the world’s people, these trans-national private elite? Of course, we don’t know; the pirate bankers’ code of “omerta” being even more sacrosanct than that of any strain of the Cosa Nostra. Even such a financial wizard as Mr. Henry, the main author of this report, found the dictum of ‘follow the money’ next to impossible, though he has come up with certain ‘tells’ that red-flag where and when money disappears.

We may be looking at military dictators of third world banana republics, officers of multi-national corporations, drug lords, industrialists making fortunes out of low-paid-next-to-slave-labor in Asian hell-holes, old-family money, stolen assets of Holocaust victims, organized crime, wheelers and dealers of all stripes, oil sheiks and oil barons, Russian gangsters, pirates, even certain American politicians and likely, just garden-variety wealthy people who don’t want to pay taxes.

One thing is certain; they have more in common with each other than they do with the rest of us. They share common needs relating to financial secrecy, discreet banking services, tax laws and regulation. Says the author:

“Increasingly, indeed, the individual members of this private elite may be assuming many of the same attributes as multinational companies, even as MNCs have been becoming more like private individuals, so far as political rights are concerned. This means that super-rich individuals are increasingly acting as citizens of multiple jurisdictions at once, even though they may be resident of “nowhere” for tax purposes; that they are able to relocate quickly across borders; and that they are able to acquire “representation without taxation,” the ability to exert local political influence in multiple jurisdictions, independent of whatever taxes they pay in any particular jurisdiction.

It also means that as a group this transnational elite has, in principle, a strong vested nterest in pushing for weaker income and wealth taxation, weaker government regulation, more “open” markets, and weaker restrictions on political influence and campaign spending across borders – with a huge “transnational haven army” of pirate bankers, law firms, accounting firms, lobbyists, and PR firms ready to do their bidding.”

Hmm. Sound at all familiar?

The effect of this “capital flight” on the developing nations:

"The detailed analysis in the report, compiled using data from a range of sources, including the Bank of International Settlements and the International Monetary Fund, suggests that for many developing countries the cumulative value of the capital that has flowed out of their economies since the 1970s would be more than enough to pay off their debts to the rest of the world....

The problem is that the assets of these countries are held by a small number of wealthy individuals while the debts are shouldered by the ordinary people of these countries through their governments.

The sheer size of the cash pile sitting out of reach of tax authorities is so great that it suggests standard measures of inequality radically underestimate the true gap between rich and poor.

Assuming [this] mountain of assets earned an average 3% a year for its owners, and governments were able to tax that income at 30%, it would generate a bumper [$187 billion in tax revenue] every year."

Where is off-shore, anyway? Doesn’t this phrase conjure up images of balmy tropical islands and secretive banks hiding behind nondescript doors?

Guess again. Off-shore, for the purpose of tax evasion simply means outside the boundaries of any jurisdiction that might have the right to tax your wealth, not just the usual-rounded-up-suspects like the Cayman Islands or Switzerland.

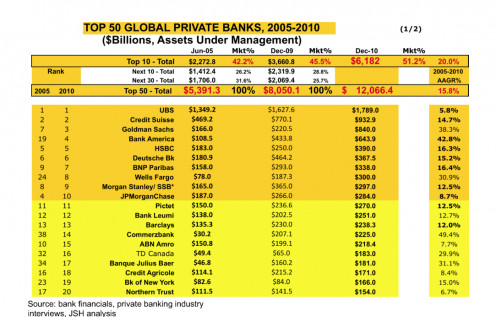

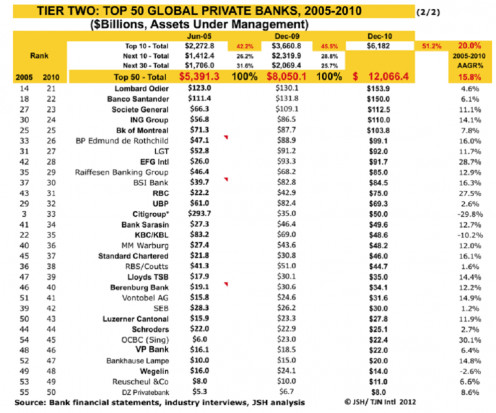

Nope, here are the names of the top banks managing international (read offshore/untaxed) accounts:

- UBS -- with an estimated $1,790 billion in “tax haven accounts” in 2010

- Credit Suisse – with $933 billion as of 2010 (Hey! Wait a minute, didn’t the Fed, under the TARP and TALF programs float them a giant low-interest/no-interest loan, one the American taxpayers guaranteed?)

- Goldman Sachs – with $840 billion in “international assets under management” in 2010 (Not YOU again!)

- Bank of America -- $644 billion (It figures.)

Well, here, see for yourself: (look at the photo neatly borrowed from this report and replicated below for you perusal. Hope you have a magnifying glass -- but such difficulty in reading does seem apropos to the murky subject matter.) I'll try and add enough photos so you can bring this one up to screen size.

"Intermediary" and "destination banks" -- from off-shore to your shore, an excerpt from the report by Mr. James Henry (which could be called, "Pray, tell me, my dear, who is it that does such a good job of laundering your money? -- so squeaky clean!")

“It is important to distinguish between the “intermediary havens” which act as conduits for wealth and “destination havens” where private wealth ultimately ends up.

We typically associate offshore legal entities like shell companies, asset protection trusts, captive insurance companies, and haven banks with the conventional list of “offshore havens” (or “Treasure Islands”) …sultry, dodgy tropical islands like Bermuda, the Cayman Islands, Nauru, St. Kitts, Antigua, and Tortola; or the European bolt holes such as Switzerland, the Channel Islands,Monaco, Cyprus, Gibraltar, and Liechtenstein.

These 80-odd front-line havens, most of which are “offshore” by anyone’s definition, collectively provide a home to over 60 million people, and over 3.5 million paper companies, thousands of shell banks and insurance companies, more than half of the world’s registered commercial ships above 100 tons, and tens of thousands of shell subsidiaries for the world’s largest banks, accounting firms, and energy, software, drug, and defense companies.

For while there are millions of companies and thousands of thinly capitalized banks in these fiscal paradises, few wealthy people want to depend on them to manage and secure their wealth. These stealthy investors ultimately need access to all the primary benefits of “high-cost” First World capital markets -- relatively efficient, regulated securities markets, banks backstopped by large populations of taxpayers, and insurance companies; well-developed legal codes, competent attorneys, independent judiciaries, and the rule of law. Generally, these can only be found in a handful of so-called First World countries like the US, the UK, Switzerland, the Netherlands, Belgium/Luxembourg, and Germany. So we have to look to these “destination havens” in order to get a handle on the size and growth of unrecorded cross-border private wealth.”

Such revelations bring many questions to mind, but author James Henry does a much better job of raising them than I would. Here’s another quote from his report:

“…. the top ten banks grew even faster than the industry as a whole, an AAGR of over 20 percent per year during this period, sharply increasing their share of the group’s assets under management from 42 percent in 2005 to more than 51 percent in 2010.

The irony here is that every one of these leading global banks, except Pictet, were deemed “too big to fail” by their governments in 2008-2010, and collectively received hundreds of billions in taxpayer-financed capital injections, standby credits, loan guarantees, toxic asset guarantees, low-cost loans, and the US Treasury’s February 2009 swap deal with Switzerland.49 They benefitted greatly from the $80 billion AIG bailout and the virtually-zero real interest rate environment established by the world’s central banks. Without these “too big to fail” government subsidies, several would have disappeared.

Did the Treasury Departments around the world not understand that these very same banks are leading the world in enabling tax dodging – indeed, to some extent, precisely because offshore investors know that they have been under-written by their Treasury Departments?”

Good point, Mr. Henry. Why were the taxpayers of the world made responsible for gigantic sums of money given to those who enable the world’s wealthy to evade taxation? (A great scam which many call the "the greatest redistribution of wealth in history," though for some, the idea that redistribution of wealth actually works from the bottom up is so alien, so radical they may choose not to believe it.

After all, this same study finds that this money is not in circulation, not put out to work, but parked in relatively low-interest bearing accounts, tucked away out of sight, out of mind, out of use.

What this truly boils down to is this:

The elite, who control the assets of the world have taken an inconceivable portion of the world’s wealth and removed it from the economy, while leaving the taxpayers to shoulder the resulting debts.

So, at least now we have a good idea where all the money went, if not much else.

New words to an old folk song

Where has all the money gone,

Long time passing?

Where has all the money gone,

Long time ago?

Where has all the money gone?

To offshore banks, ne’er to return.

Oh, when will we ever learn?

Oh, when will we ever learn?

With apologies to Peter, Paul and Mary.

Lynda M Martin, August 14, 2012