ACA Premiums, Politics, and the Truth: Separating Facts from Fear

The Truth About ACA Premiums and the Democrats’ Shutdown Demands

One of the major sticking points in the current government shutdown is the Democrats’ insistence on extending the enhanced Affordable Care Act (ACA) subsidies that were first introduced under the American Rescue Plan. Their argument is that, without these subsidies, millions of Americans will see their health insurance premiums skyrocket, to double and triple...

That claim simply does not hold up to scrutiny.

What Actually Happens When Subsidies Expire

What my extensive research shows is that when the enhanced subsidies expire, nothing sudden or dramatic happens on the insurer’s side. Insurance companies do not automatically raise their rates. What actually changes is that the consumer becomes responsible for paying the entire premium again, including the portion that the federal government had temporarily been covering.

To put it simply: before 2021, if someone was paying the full cost of their plan — say, $1,200 per month — that amount remains the true price of the plan. The enhanced subsidy just reduced the customer’s share of the bill.

From 2021 through 2025, during the subsidy period, a customer might have only paid 60% of that cost (around $720/month), while the government covered the remaining $480. When the subsidies end in 2026, that same customer would simply go back to paying $1,200 per month — the original premium — not some artificially inflated number.

While some insurers may increase premiums slightly (as most do each year), current data shows that typical annual increases range from 3% to 6%, driven by healthcare inflation and claims costs — nowhere near 200%.

The Laws That Protect Consumers from Unjustified Increases

There are multiple layers of legal protection built into the ACA and state regulations that prevent insurance companies from arbitrarily hiking premiums. These laws are designed to ensure that any rate increase must be justified, reviewed, and approved before taking effect.

1. Federal Protection: The ACA “Rate Review” Law

Under Section 2794 of the Public Health Service Act (42 U.S.C. § 300gg-94), created by the Affordable Care Act, any proposed premium increase of 10% or more must go through a federal and state review process.

Insurers must submit detailed actuarial data showing why the increase is necessary (for example, due to higher medical costs).

The Department of Health and Human Services (HHS), in coordination with state regulators, reviews the proposal to determine if the increase is “unreasonable.”

If the increase is found unjustified, the insurer must publicly post an explanation and may be forced to withdraw or modify the rate request.

Source: 42 U.S.C. § 300gg-94 — Rate Review

2. State-Level Oversight

Every state has its own Department of Insurance (DOI) that oversees rate filings. These agencies:

Review and approve or reject proposed premium increases before they go into effect.

Require insurers to submit detailed cost data to prove their rates are actuarially justified.

Can deny or reduce rate hikes they find excessive or unsupported by data.

For instance, the Michigan Department of Insurance and Financial Services (DIFS) reviews all ACA rate filings annually. Michigan law requires that premiums reflect actual medical costs, not arbitrary profit-taking.

3. Transparency and Public Accountability

The ACA also mandates public transparency for all rate filings:

Insurers must publish their proposed rate changes on Healthcare.gov and the state’s insurance website.

Consumers can review and comment before final approval.

This level of oversight makes it nearly impossible for insurers to impose sudden, extreme increases without public and regulatory pushback.

Competition Will Keep Prices in Check

As enhanced subsidies end, the market naturally becomes more competitive. When consumers must pay a larger share of their premium, they shop more carefully — and insurers respond by lowering prices or introducing new plans to attract customers.

In fact, smaller or regional insurance companies often enter the marketplace with lower-cost, narrow-network, or telehealth-based plans that can be 10–20% cheaper than major brands. Between 2020 and 2024, the number of insurers offering ACA plans more than doubled, showing that competition is alive and well.

So while some may experience a modest increase when subsidies expire, many others could find new, lower-cost options as companies fight for market share.

The Political Reality

Democrats’ push to permanently extend these subsidies is less about consumer protection and more about entrenching another social spending program. These subsidies were always meant to be temporary, created under the COVID-era relief packages. The Biden administration — and now Democratic lawmakers — are trying to make them permanent, a move that would balloon federal spending by hundreds of billions over the next decade.

President Trump’s renewed commitment to fiscal restraint and cutting unnecessary spending directly opposes this approach. His administration’s position is clear: the government should not continue paying what individuals can pay themselves, especially when the ACA system already includes strong safeguards against unfair pricing.

Anyone predicting an outrageous spike in ACA premiums — like 200% or more — is ignoring the facts and the law."Anyone predicting an outrageous spike in ACA premiums — like 200% or more — is ignoring the facts and the law."

Lol..

Don't need to predict, millions have already received the news .

To reiterate: facts matter, and so do credible sources when presenting them. Laws matter as well—they exist to protect consumers. The ACA specifically requires insurance companies to justify any premium increases, ensuring they cannot gouge policyholders. Misinformation is a serious issue, and the best way to address it is by reviewing and relying on the facts.

Direct legal references regarding protections against excessive health insurance premium increases under the Affordable Care Act (ACA). The ACA established specific provisions to address this concern.

Legal Basis: Section 2794 of the Public Health Service Act

Section 1003 of the ACA added Section 2794 to the Public Health Service Act, titled "Ensuring That Consumers Get Value for Their Dollars." This section mandates that health insurance issuers justify any proposed premium increases to state and federal regulators before implementation. The goal is to protect consumers from unreasonable rate hikes.

Key Provisions:

Pre-Implementation Justification: Health insurers must submit detailed justifications for proposed rate increases to both the Secretary of Health and Human Services and the applicable state insurance commissioner. These justifications are subject to public disclosure.

GovInfo

https://www.govinfo.gov/content/pkg/FR- … hatgpt.com

State-Level Oversight: States are required to establish processes for the annual review of health insurance premiums to protect consumers from unreasonable rate increases.

GovInfo

Federal Oversight: The Secretary of Health and Human Services, in conjunction with the states, monitors premium increases of health insurance coverage offered through both Exchanges and outside of Exchanges.

GovInfo

Protections for Consumers

These provisions are designed to ensure that consumers are not subjected to unjustified premium increases. While the ACA does not impose a specific cap on premium rates, it requires transparency and accountability from insurers regarding rate changes. This allows for public scrutiny and regulatory review to prevent unreasonable increases.

Official Sources

https://www.govinfo.gov/content/pkg/PLA … hatgpt.com

https://www.govinfo.gov/content/pkg/FR- … hatgpt.com

For the full text of Section 2794 and related provisions, you can refer to the following official sources:

Public Law 111–148 – The Patient Protection and Affordable Care Act

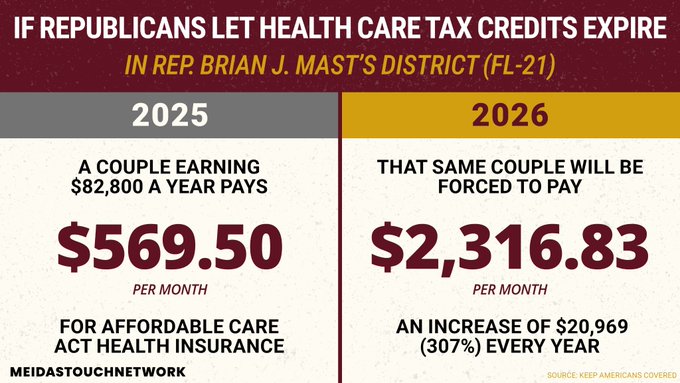

Federal Register Notice – Section 2794 ImplementationLetting the health care tax credits expire would devastate American families.

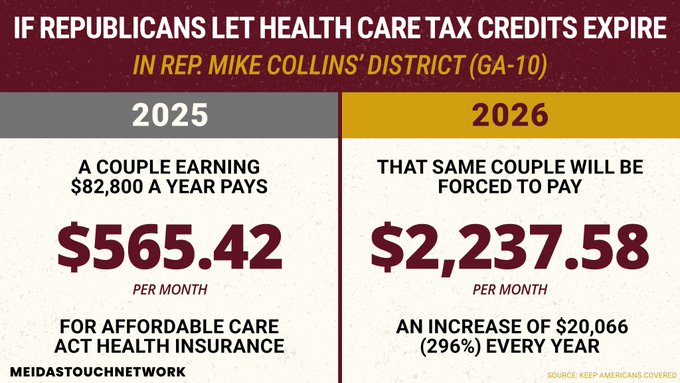

Let’s start with Mike Johnson's district (R-LA):

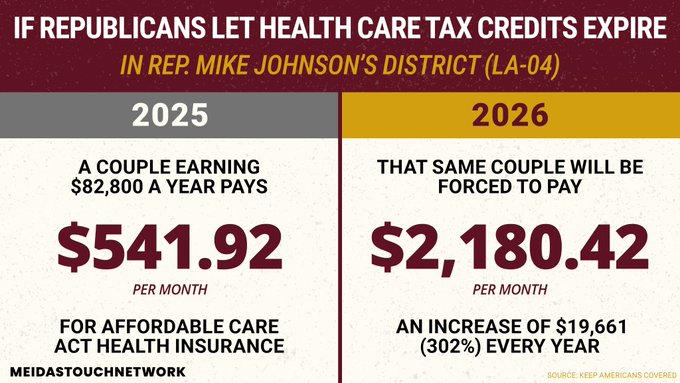

If you live in Rep. Brian Mast's (R-FL) district, buckle up. Your costs are about to skyrocket...

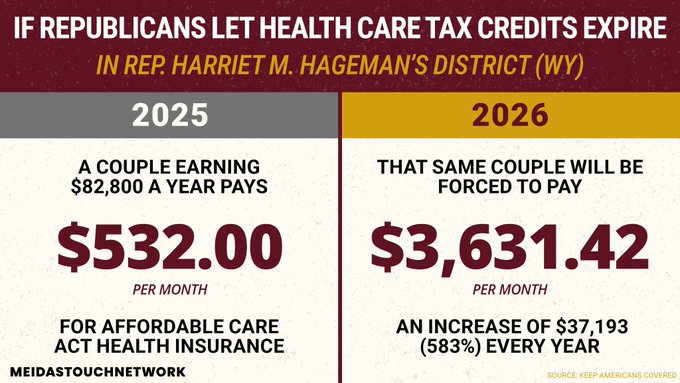

This one is jaw-dropping. Rep. Harriet Hageman (R-WY) has a whole lot to explain to her constituents:

Facts and Laws speak louder

Rate Review Requirements

The ACA established a rate review program to protect consumers from unreasonable rate increases. Under this program, health insurance issuers in the individual and small group markets must submit proposed rate increases to either the state or federal government for review if the increase meets or exceeds a certain threshold. Currently, the threshold is set at 15%.

The review process aims to determine whether the proposed rate increases are reasonable and justified. If a proposed rate increase is found to be unreasonable, the insurer may be required to modify or withdraw the increase. This process helps ensure that consumers are not subjected to excessive premium increases.

https://www.cms.gov/cciio/resources/fac … hatgpt.comSo people should make a complaint that their premiums increased due to the the premium tax credit loss?

Don't think that's going to work...

Related Discussions

- 28

Biden’s Band-Aid Is Falling Off—And Now Trump Takes the Heat?

by Sharlee 3 months ago

Blaming Trump for a Bidden Band-Aid Falling Off Misses the PointIn recent weeks, headlines have warned that Obamacare premiums are set to spike in 2026, and predictably, fingers are being pointed at Donald Trump. But let’s take a step back and look at the full timeline of events before buying into...

- 21

Can anyone explain the Affordable Care Act to me?

by Eric Seidel 8 years ago

Can anyone explain the Affordable Care Act to me?I was honestly going to make a Hub about this, asking this very question, and I had written 800 something words on the subject. Ok actually it's more like a mild rant, but I think this would be better as a Hubpages question rather than a Hub that no...

- 55

7 GOP Senators stopped the healthcare reform

by Jack Lee 8 years ago

Here are the 7 -"Arizona's John McCain, Alaska's Lisa Murkowski, Ohio's Rob Portman, Tennessee's Lamar Alexander, West Virginia's Shelley Moore Capito, Nevada's Dean Heller, and Maine's Susan Collins were the dissenting GOP Senators on the Obamacare Repeal Reconciliation Act (ORRA) Wednesday....

- 43

Health Care - Thank you Mr President

by theirishobserver. 11 years ago

At Last - A Patient's Bill of Rights Good afternoon,It seems like everywhere you go in this country, you hear story after story of Americans who have been let down by the private health insurance system. Parents in Texas unable to buy coverage for their infant born with a...

- 13

The burden of Obamacare is on the poor and middle class

by Eric Newland 13 years ago

People are pretty excited lately about the new health insurance regulations. And sure, I'll admit, it probably feels like a godsend for those who can now have health coverage who previously couldn't. No more lifetime limits! Hurray!But oops, we forgot something: someone has to pay for all this. The...

- 19

New health care bill will increase costs:

by Holle Abee 15 years ago

I thought this article was interesting, especially since it appeared in the NYT. According to this guru, costs will INCREASE, not decrease. This is the same guru that democrats hailed as wonderful when he challenged Bush. Don't worry, though, costs will increase by only a few billion, and what's a...