The Real Wealth Redistribution

Common political myth

holds wealth redistribution to be a socialist-inspired evil that takes the

hard-earned money of those who’ve worked, produced, innovated, planned and

contributed in order to give to those who’ve done none of these things: the slackers, stoners,

welfare-bums, the undeserving poor, the criminals, the ne’er-do-wells.Certainly, this can and does go on, but these costs are a mere spit in the ocean in the big picture of how wealth is taken from one pocket to line another.

In actual practice, wealth redistribution goes on daily through millions of transactions, public and private but neither in the manner nor the direction this myth presupposes.

The truthful part of this myth is that government (i.e. public) expenditure is the vehicle by which a large part of this transfer of wealth is realized.

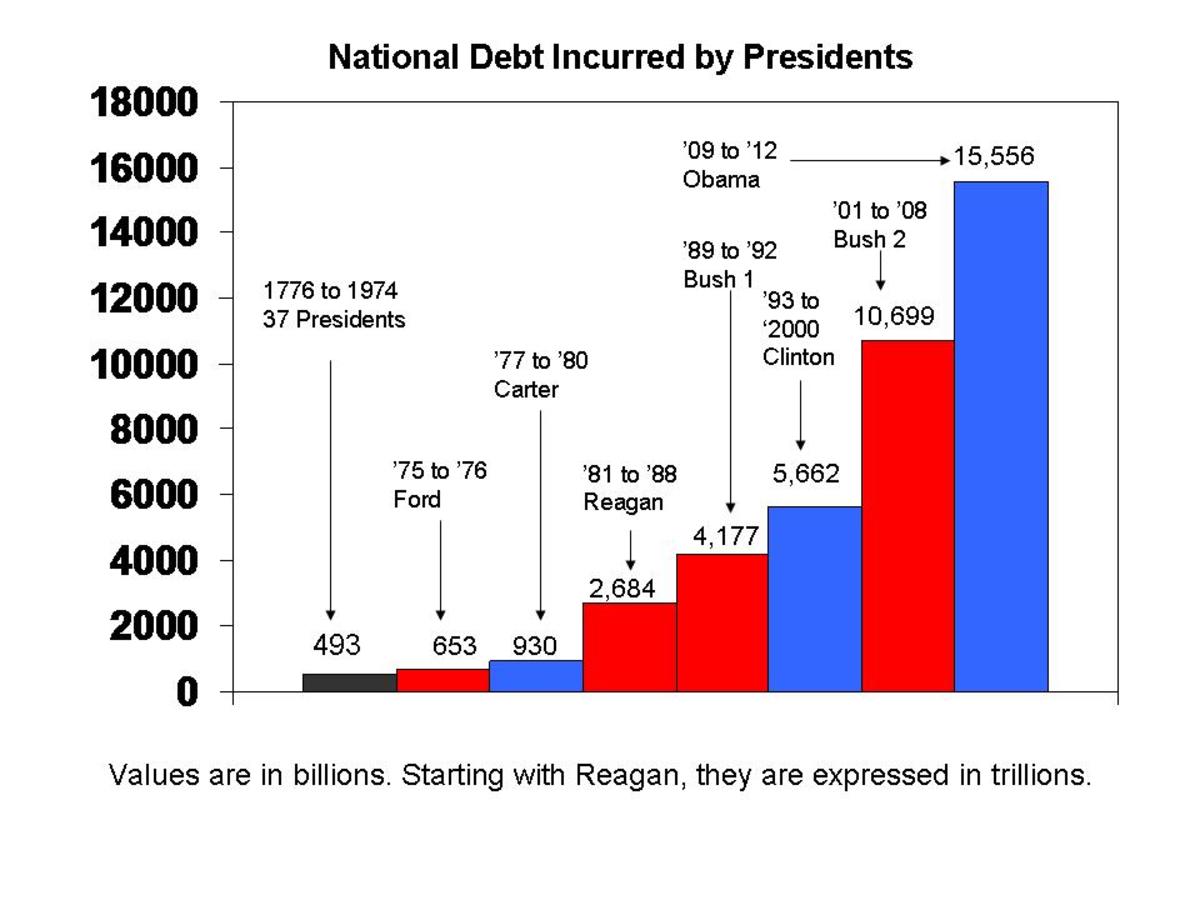

As it is also true that the past four years have seen what can only be termed as insanity in government spending, we have the perfect opportunity to study how wealth redistribution really works.

With taxation, the mechanism by which resource transfer occurs is transparent, so the persons responsible for new tax-financed government spending are accountable to the public through the political process. With borrowing or with the printing of money (or its modern equivalent, Federal Reserve monetizing of debt through purchases of Treasury obligations), the burden on the private sector is largely disguised, avoiding the accountability desirable in a democratic society.

The big questions

April 15th just passed a couple of weeks ago, and we all sent in our tax returns, or filed an extension. However reluctantly, we paid what we owed; that is the 51% of Americans who actually pay taxes.

Every one of us understands what taxes are – a portion of our earnings we are obligated to provide the government (at various levels) in return for needed services. Our money goes in, and out comes infrastructure, police services, fire-fighters, education, the War on Drugs, the War on Terror, the War…, our legislative assemblies themselves, the masses of public employees … and so on. We know and accept that there are many things in civilization we need to fund collectively.

But, do you ever stop and ask yourself why it takes $3.5 trillion dollars for the government to provide the basics of civilization to 340 million people, each and every year? Have you done the math? Does it seem credible?

Somehow, somewhere, at some point in history it all seems to have gone wrong. It must have. Lord knows we're in a mess.

"Do you find yourself wondering: How did we get here? How did the United States of America get into such a predicament whereby in one year, 2008, the financial system nearly vaporized, the stock market crashed, real estate tanked, and major corporations were being bailed out. . . .How did our great country, a bastion of capitalism, devolve into a Bailout Nation where the gains were privatized, but the losses were socialized?" -- from the foreword by Bill Fleckenstein to the book “Bailout Nation” by Barry Ritholtz

During both FY2009 and FY2010, the U.S. government collected about $400 billion less than FY2008 revenues of $2.5 trillion. During 2009, individual income taxes declined 20%, while corporate taxes declined 50%. At 14.9% of GDP, the 2009 and 2010 collections were the lowest level of the past 50 years.

How much tax revenue did the government collect from the nation in fiscal 2010?

Approximately $2.16 trillion from an economy producing an estimated $14.7 trillion annually, or approximately 15% of GDP (gross domestic product.) This is made up of individual income taxes (42%,) Social Security/Insurance taxes (40%) and corporate taxes (9%.) Social Security taxes are supposedly to finance that particular program alone so this means a rounded figure of 50% of all collected revenues are available to fund government expenditures, or $1.8 trillion.

How much money did the government spend in 2009?

You would think that would be an easily answerable question with only 1 correct answer, but there’s actually four. It’s important to understand why there are 4 correct answers and the distinction between the different figures.

Here are the 4 correct answers:

- 4,397,478$ million dollars or $4.4 trillion

- 3,727,371$ million dollars or $3.7 trillion

- 3,517,681$ million dollars or $3.5 trillion

- 3,000,665$ million dollars or $3 trillion.

So how are all of these technically correct? Let’s start from the bottom and go up.

The bottom number, 3 trillion, is the total number of on-budget outlays. Whereas the second from the bottom, 3.5 trillion, is the total number of off-budget outlays. Off-budget accounts are programs such as Social Security and the Postal Service. Each of these things are supposed to fund themselves, therefore, they are considered “off-budget”.

To understand the top two numbers you have to understand the concept of an “outlay“. An outlay can represent an account either spending or receiving money. Any income that isn’t a tax is called a negative outlay. Negative outlays can be selling government land, a business-like transaction, like selling stamps, or could even be interest received on a trust-fund or investment.

These accounts that make money are still considered “outlays” even though they are negative. Therefore, when the government reports its total spending it adds up all of its outlays and, as you’ll remember from algebra class, when you add a negative number you subtract it from the total. So how much the government spends is offset by these negative outlays. The top 2 answers are the total government outlays with the negative outlay accounts removed.

In 2009, the total on-budget spending (with negative outlays removed) was 3.7$ trillion dollars – which doesn’t include Social Security or the postal service. The total including both on and off-budget spending (with negative outlays removed) is the top number, 4.4$ trillion dollars.

This is something that should be kept in mind anytime a group reports spending as a percentage of total spending.

How much did the government spend in 2010?

An estimated $5,896 billion according to the government. Why estimated? Because the numbers aren’t in yet.

But wait – the answer isn’t really that simple;’ nothing related to government accounting is. There are four equally correct answers to that question, but as the government still hasn’t got its books in order, we’ll have to visit 2009 for the explanation. Look to the right. So now you know the above figure is total outlay with the negative outlay removed, and that the estimated 2010 spending inclusive of off budget outlays is the official figure of $3.5 trillion – which is still an estimate. But in truth, the government did spend $5.8 trillion. The fact that some outlays produce an income is beside the point – don’t you think?

Why do they prefer $5,896 billion to the term $5.8 trillion? (And what is a trillion anyway? It's a million million. It's a thousand billion. It's a one followed by 12 zeros.) I don’t know. Maybe they think it sounds better, that we won’t figure it out.)

How much did the American people pay in interest on national debt in 2010? Now here’s where you have to forget the governments pie chart (it’s inaccurate) and do a little calculating on your own. The actual figure according to the US Treasury is $413,954,825,362.17 paid out in interest on the national debt.

That $414 billion dollars represents 22% of the $1.8 trillion collected from taxes available to fund government business. Ouch! Now we must reduce our $1.8 trillion by the amount of interest we must pay on past borrowings, which leaves us with $1.4 trillion dollars to cover all other government expenditures.

Now what was that figure I heard bandied about as planned expenditures for fiscal 2011? $3.69 trillion if memory serves. One interesting figure in that budget was $211 billion budgeted as net interest expense. “Net of what?” we may well ask. Does our deeply indebted government have a secret source of interest income, a few trillion tucked away here and there in bearer bonds, or investments? Or is it receiving interest payments on all that bail-out money? (Aha – more on that later.)

No, we’ll use our common sense. If the US Treasury paid out $414 billion in interest in 2010, is it likely to be less in 2011 seeing as we haven’t paid one red cent of the debt, and have in fact increased it? No. So would we be too far wrong in suggesting something in the neighborhood of $500 billion in interest payments? I don’t think so. If some interest income enters into the picture, let’s not use it to obfuscate the facts. So let’s set that amount aside as already spent and we’re looking at a mere $3.2 trillion dollars the government intends to spend.

But we only have $1.4 trillion available.

Right off the bat it becomes clear we must borrow a further $1.8 trillion, because that’s our deficit.

What to do? What to do? Year after year of deficit budgeting and spending has led us to this dreadful impasse that only fools could not see coming, and as not all our elected leaders are fools, we must then understand they intended these results. Of were they so shortsighted they couldn't see beyond the next election?

As though they'd suddenly woken up to the situation this morning, they now decide it was all a bad thing."We must reduce out deficit," they cry.

“Tax the rich to make up the deficit!” suggest some. Okay. Being poor, that sounds like a grand idea to me. But as of the end of 2010, the total worth of all American billionaires is $1.3 trillion, so even if we cleaned them out completely, we still can’t pay this year’s deficit.

Shall we throw in the millionaires? There are approximately 2.6 million millionaires (earning in excess of $1million annually and not to be confused with lesser annual earners who have amassed over $1million in assets, approximately 7.8 million households) in the country with an estimated 4.2 trillion in assets (not including primary residences.)

Yes, take it all; leave them with nothing but the shirts on their backs, and we can cover not only this year’s deficit but if we are frugal, we might cover next year’s as well. Problem solved!

It is simply not possible to pay off the national debt. Rather than delve into the mechanics of currency, Treasury Bonds, fractional reserve banking and all the rest of it here in this article, I offer you a link to a remarkably clear article called “It is now mathematically impossible to pay off the U.S. national debt.” I highly recommend this for anyone not familiar with how these things function.

And then what?

The rest of us who calculate our monthly budgets in hundreds and our annual income in thousands are still faced with $14 trillion of debt to pay. This unimaginable amount, remember, is equal to the entire output of the American economy for one year. (U.S. GDP for 2010 is $14.7 trillion.)

“So can’t we just raise taxes on everybody just a little bit and get rid of this year’s budget deficit at least?” you ask.

Uh – no, not really.

According to the Tax Foundation’s Microsimulation Model, to cover the budget deficit for this one year alone, Congress would have to multiply the tax rate for every American by a factor of 2.4. This would make the 10% tax rate 24%, the 15% rate would become 36% and the 35% rate would have to be 85%.

This would be economic suicide, because there’s one thing the Republican house has dead to right – reducing private wealth and converting it to public wealth is counter-productive to the economy. It would grind to a near halt, and it would not reduce the national debt by one penny, only eliminate the budget deficit for one year.

“The National Debt is like a cancer,” said Erskine Bowles, one of the heads of the President’s national debt commission, addressing the National Governors Association.

“A terminal cancer?” you wonder.

Well, according to Bowles, if the current trend continues, the US Government will be spending $2 trillion just for interest on the debt by 2020. (And we were worried by a $3-4 trillion dollar budget…)

If not terminal, mighty sick!

But wait – there’s more.

Staggering as a debt equal to the entire output of the economy is, it is only the tip of the iceberg. It does not reflect huge liabilities the government has as commitments.

Of course, you’d have to be blind, deaf and encased in a hermetically sealed tomb not to be familiar with the unfunded liability of Social Security, the history of which is worthy reading. Since the Johnson Administration, when the hitherto untouched trust funds were ‘borrowed’ to pay for budgetary deficits of the time, and the subsequent divestiture of the fund by Congress during the Reagan Administration, the Social Security funds contain nothing but unmarketable and illiquid IOU’s. For decades, only an amount equal to current requirements has gone into the trust and the rest of the collected Social Security taxes went into general funds and were spent. As of August 2010, the all too foreseeable consequence of such a policy arrived. The system paid out more benefits than it received in payroll taxes.

Of course, say those now demanding an end to such a state of affairs, if the various administrations who helped themselves to the taxpayers’ retirement funds had not done so, the National Debt would be that much greater. True – but now you have an unfunded liability which amounts to the same thing, does it not?

Or were you planning to default on the entire population?

And then, there’s Medicare. Well, there’s medical care in general – a subject too complex to cover in detail here and one that some economists are calling an H bomb waiting to go off. 52 million Americans without medical insurance and that number is climbing, soaring costs, burdening the employers with cost of their workers’ health care (a heavy handicap in a competitive global economy,) a proposed voucher system sending an aging population full of pre-existing conditions to the private providers that don’t want them….. The picture’s not pretty.

So far, even if we could freeze the picture right where it is, do nothing but pay off our collective national debts and liabilities, cut spending to zero and increase taxes to the maximum supportable, the American taxpayer is on the hook for $33.4 trillion dollars.

This is roughly $101,000 dollars for every man, woman and child in the United States. Oh!

And the interest clock is ticking, ticking, ticking!

Yes, financially speaking we are in a lot of trouble.

But wait – there’s more!

Did you smile a little bitterly to yourself when you heard that Standard and Poors downgraded US bond issues from stable to negative because, said the investment rating service, current budgetary debate does not address the problem of the national debt and spending? I did. I smiled quite broadly. The irony was too much.

Standard and Poors is a private institution owned by the same people who wander Washington hallways greasing the wheels, dispensing largesse and occasionally holding hat in hand looking for help. They are the firm that gave all those mortgage backed securities a triple star rating.

Yep, the same guys that hyped the stinking toxic assets that nearly destroyed not only the American financial system, but teetered the world are now slapping us on the wrist with a “Tut! Tut! You simply must stop this infighting and find the discipline to cut spending -- or else.”

This from the firm that played a major role in leaving the American taxpayer holding the tab for over $13 trillion in liabilities (and still counting.) Now that’s chutzpah!

”… the damage to these companies was self-inflicted: the excess leverage, mortgage exposure, deregulation and lowering of credit standards took place at the behest of these firms. They were not killed by others, they committed suicide. … This was not a "perfect storm" -- unforeseeable random events that just happened. In reality, it was a series of conscious decisions made by investment banks, commercial banks, government officials, regulators and central bankers that were simply awful. ” – from Bailout Nation by Barry Ritholtz

2008 and 2009 saw the greatest financial feeding frenzy in history, including bailouts for Fannie Mae and Freddie Mac (now taxpayer owned,) GM and Chrysler, AIG (three times) Bank of America (two times) and Citigroup (three times); capital injections into other major banks, and government-engineered mergers involving once vaunted firms Bear Stearns, Goldman Sachs, Morgan Stanley, Merrill Lynch, and Washington Mutual; the FDIC receivership, nationalization and sale of Washington Mutual, now in the hands of JP Morgan, and Wachovia, flipped over the course of a weekend to Wells Fargo…. (Wells Fargo bought Wachovia for $15 billion, but managed to squeeze a $74 billion tax shelter through the IRS for the purchase. Net profit: $59 billion dollars. The CEOs of the biggest 15 investment banks, mortgage firms and commercial banks "retired" from the firms they helped to ruin, and took home more than $1.5 billion in compensation.)

This was TARP, and you all remember it.

“Of the $389 billion made in TARP loans by the government, now $234 billion has been repaid, and $35 billion in income has been made on the repaid loans and sale of other securities, according to the Treasury.” – Peter Schroeder, The Hill

Oh ho! the Treasury made an 8.9% return, you would think upon reading this. But the money was borrowed in the first place at an average rate of 3.5%, so let’s not forget to factor that in (because no one has mentioned it, not in this article or in any of the others I’ve found.)

General Motors chairman Ed Whitacre is appearing in ads on all the Sunday morning shows repeating the message of his Wall Street Journal op-ed, titled “The GM Bailout: Paid Back in Full,” and the company’s full-page newspaper ads:

We’re proud to announce: We’ve repaid our government loan. In full. With interest. Five years ahead of the original schedule.

In the Wall Street Journal, Whitacre says the company has made a $5.8 billion payment to the governments of the United States and Canada. But don’t I recall that the GM bailout was $50 billion? First, part of the bailout went into an “escrow fund,” and that government money is being used to pay back the small part of the bailout that was officially a loan. Second, GM is asking for another $10 billion loan to retool its plants to meet the stiffer Corporate Average Fuel Economy standards and paying back one government loan — with other government money — will make it easier to get another government loan.

Because a loan of such a huge amount would have been politically controversial, the Obama administration handed GM only $6.7 billion as a pure loan. (It asked for only a 7% interest rate--a very sweet deal considering that GM bonds at that time were trading below junk level.) The vast bulk of the bailout money was transferred to GM through the purchase of 60.8% equity stake in the company--arguably an even worse deal for taxpayers than the loan, given that the equity position requires them to bear the risk of the investment without any guaranteed return. (The Canadian government likewise gave GM $1.4 billion as a pure loan, and another $8.1 billion for an 11.7% equity stake. The U.S. and Canadian government together own 72.5% of the company.)

But when Mr. Whitacre says GM has paid back the bailout money in full, he means not the entire $49.5 billion--the loan and the equity. In fact, he avoids all mention of that figure in his column. He means only the $6.7 billion loan amount.

So how is it paying it?

As it turns out, the Obama administration put $13.4 billion of the aid money as "working capital" in an escrow account when the company was in bankruptcy. The company is using this escrow money--government money--to pay back the government loan.

For the whole story go to Forbes.com: GM is still Government Motors

But what it boils down to as my simple mind sees it is: GM used government money to pay back other government money in order to get yet more government money.

And oh, by the way, there is no such thing as government money. Every nickel or dime the government hands out either came from the taxpayers or is owed by the taxpayers.

Even GM proudly announced they’d paid back their loan “in full, with interest and years ahead of schedule.” (Did they? Good question. See the excerpt to the right.)

For once the people come out ahead!

And yet, conflicting reports arise. According to the Ethisphere TARP Index, which supposedly tracks the government’s bailout investments, Wall Street provided junk collateral for the low-cost to no-cost financing. In fact, the agency reported the various investments had depreciated in value by almost $147.7 billion by the end of 2009. In other words, TARP’s losses came out to almost $1,300 per taxpayer.

How could there be such diversity in the reports on TARP’s successful profitability and repayment? We’ll probably never know the whole story. Evidently there's more to be written.

“The Troubled Asset Relief Program Inspector General (TARP IG), Neil Barofsky, announced in his January 20, 2010 report that TARP has continued to develop into a sophisticated white-collar investigative agency. Through December 31, 2009, TARP has opened 86 and has 77 ongoing criminal and civil investigations. These investigations include complex issues concerning suspected TARP fraud, accounting fraud, securities fraud, insider trading, bank fraud, mortgage fraud, mortgage servicer misconduct, fraudulent advance-fee schemes, public corruption, false statements, obstruction of justice, money laundering, and tax-related investigations.”

So indeed there was trouble in paradise, but considering the good citizens remained oblivious to the real liability and risk they faced, it was an all's-well-that-ends-well collective shrug that finished the story. It could have been worse, we said to each other.

The credulous public sighed in relief. It hadn’t turned out so bad after all. TARP was now no longer a huge public liability, but was (maybe) even making money. Even if the fund didn’t do what we’d all been told it was supposed to do: save assets, stop foreclosures, open up credit on the lower end so we could all get back to our jobs of spending, at least it paid for itself. And as TARP was being repaid, so was the government’s borrowings the taxpayers had underwritten – wasn’t it?

Not exactly. As is often the case, TARP spawned children, an ocean of alphabet soup to continue the process of “rescuing the economy.” Here are some of these offspring acronyms:

- Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility (AMLF)

- Term Asset-Backed Securities Loan Facility (TALF)

- Primary Dealer Credit Facility (PDCF)

- Commercial Paper Funding Facility (CPFF)

- Term Securities Lending Facility (TSLF)

- TSLF Options Program (TOP)

- Term Auction Facility (TAF)

- Public/Private Investment Program (PPIP)

All of these programs are administered by the Federal Reserve Bank.

This evening, I watched with interest as a second first in history in the past few months played out before my wondering eyes. Ben S. Bernanke, Chairman of the prior-to-now secretive organization held a press conference, which he opened with the line, “…our commitment to transparency.”

In fact, The Fed’s first ever financial report of any kind to the public begins with “The Federal Reserve is committed to transparency…”

But let’s not lose sight of the fact that not only is this commitment a recently developed one, it took an act of Congress: the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 and a lawsuit from Bloomberg News to force this sudden spirit of openness.

That’s why the press conference was the second first in history, because the first first was the Fed opening its books for scrutiny, which had never, in all the years of its existence, not once been done before. They provided the details of 21,000 transactions under TARP and TALF. Now, GAO (Government Accountability Office) has formulated a committee of staffers to audit the approximately $3.3 trillion dollars. (You see, while TALF began with only $200 billion in its budget, like all such publicly funded things, it grew – and grew.)

They are, they report, discovering a series of “outrages and lunacies.”

“Our jaws are literally dropping,” said Warren Gunnels, an aide to Se. Bernie Sanders of Vermont. “Every one of these transactions is outrageous.”

Nine firms -- five of them foreign -- were able to borrow $5 billion in U.S. government securities, which effectively act like cash on Wall Street, for four weeks at the minuscule interest rate of 0.0077 percent.

That is not a typo.

On 31 separate transactions, the lucky nine were able to borrow billions for 28 days as part of a crisis-era Fed program that lent the securities, known as Treasuries, for 28-day chunks to ensure that firms had cash on hand to lend, invest with and trade. The market was seizing up; effectively free money, courtesy of Uncle Sam, helped it thaw.

The European firms -- Credit Suisse (Switzerland), Deutsche Bank (Germany), Royal Bank of Scotland (U.K.), Barclays (U.K.), and BNP Paribas (France) -- borrowed $5 billion worth of Treasuries 19 different times, each paying just $383,561.64 in interest for the privilege. Deutsche led the way with seven such deals.

That's equal to 0.0077 percent interest for the 28-day loan. The annual interest rate equals one tenth of one percent. (For debt backed treasury bonds on which the taxpayer will pay 3-3.5% interest.)

The Fed sent $9.6 billions in bailout aid to the Central Bank of Mexico, to Bavaria and more than 70 loans to the Central Bank of Bahrain (the major shareholder of which is the Bank of Libya, our ex-friend Quaddafi,) $2.2 billion to the South Korea Development Bank (whose purpose is to promote economic development, yes – but in South Korea) and why, when America is borrowing from the Middle East at a rate of 3%, did the Fed send $35 billion to the Arab Banking Corporation of Bahrain at a rate as low as one quarter percent?

.(Let’s see if I have this right: government borrows funds at 3% and uses those funds to loan the money to banks at one quarter percent. Said banks use the money to buy Treasury Bonds on which the government pays rates between 3-3.5%. Which means the taxpayer is now footing the bill to the tune of 6% and the bank is profiting around 3%. Whoowee! What a neat swindle.)

During the crisis, the Fed routinely made billions of dollars in “emergency loans” to big banks at near zero interest. In a startling number of cases, the banks used the funds to buy Treasury bonds, loaning the money back to the Government at a higher rate.

“People talk about how these loans were paid back,” said a congressional aide who has studied the transactions. “But when a bank is lending money at near zero percent, and the bank turns around and lends that money back to the state at three percent, how is that different than just handing them taxpayer money?”

5 billion went at very low interest rates to Toyota and Mitsubishiwhich which granted, do own factories in the United States. But how does the Fed explain massive purchases of securities in BMW, Volkswagon, Honda and Nissan? (Which makes sense when American taxpayers are trying to save GM and Chrysler and even hold a 60% equity in the former??)

But even more disturbing, according to the investigators, were the long lists of investment funds, hedge funds and other investors with addresses in the Cayman Islands that received TALF funding to the tune of hundreds of millions each, for an aggregate of some $71 billion in the first run-off and destined to become $2 trillion.

“It was as if someone sat down and made a list of every individual on earth who actually did not need emergency financial assistance from the United States government and handed them the keys to the Treasury.”

The purpose of TALF according the Fed is to get more loans written, lower rates and bring down the cost of borrowing. You see, even though the Fed funneled piles and piles of money to the banks, they didn’t start lending to consumers again. No, they had other uses for the money, and they went on their merry way foreclosing and buying guaranteed securities (as well as each other.) The benefits of TALF according to Forbes are:

“Firms are now selling funds backed by the government's TALF program. Although the various government bailouts have gotten a lot of bad press, the Term Asset-Backed Loan Facility [TALF] seems to be making the world a better place for financial stock investors.

Now there are new funds that are selling TALF-backed securities to qualified, wealthy and mostly sophisticated investors, in effect helping to get these issues off the books of the banks that hold them. The majority of these TALF funds will be bought by institutional investors, or even family trusts, with few, if any being sold to retail-level investors, at least just yet. For those closely watching the TALF world it sends a message loud and clear that the federal government is loathe to let any major banks fail, and is doing what it can to help them unload some of their most dangerous liabilities.”

Unload their most dangerous liabilities” means bundling all the crappy loans they made: credit card debt, car loans, student loans, consumer loans of all sorts -- dark blots on their balance sheets and selling them as “asset-backed securities.” Supposedly, only new loans “with an established credit rating” were to be eligible (though how a new loan can have an established credit rating escapes my logic,) or in the words of the hyped-up press releases “buy only the “best” new loans from banks, lenders and even the U.S. Small Business Administration.”

What happened? The banks could not take their existing shaky loans and borrow through TALF directly, so Bank A bundles up $20 million in loans and Bank B also bundles up $20 million in loans and sell those bundles to each other, thus qualifying as “new” loans. And they did. They laundered toxic loans (and laundered is the right word) passed them through the TALF program, bring them back onto their books all nice and clean – and guaranteed by the taxpayer.

But the story becomes even more twisted.

Borrowings from TALF are leveraged nine to one. That’s right. You, Mr. Hedge Fund, buy an asset with a face value of $100 (value being an unregulated mystery) for $80. You part with $2.40 while the Fed contributes $77.60 (of the taxpayers’ money.) Huge, huge leverage. (And such leverage is what got us into this mess, isn’t it?)

TALF loans are written as no-recourse loans. Which means if you, Mr. Hedge Fund, don’t pay your loan at maturity the Fed takes your asset and calls it square. For a $2.40 investment, you now have $77.60 of the public’s money in your pocket, and the Fed holds your worthless bundle of laundered loans. Why would you bother to pay?

Or, at some point after the loan you rerun the model of your asset and it turns out it was worth only $20. You lose your $2.40 and the taxpayer loses $77.60. But, the bank buys the asset back from you at $20 while paying you a fund-management fee for your trouble. (Bank sells high, buys low; Hedge Fund collects a fee, and the taxpayer is screwed.)

Some Source Links

- Geitners Flawed Assumptions: TARP & TALF Funds Enrich Investors At Taxpayer Expense Report By H

Here is a link to Princeton University Center for Finance and Harvard Business Schools report on Geitners Flawed Assumptions: TARP & TALF Funds Enrich Investors At Taxpayer Expense - Anonymous Banker on TALF

Here is a link to blogger Anonymous Banker an insiders view to the banking industry and economic crisis Here is my take on TALF. It is not going to accomplish what our government proposes it will accomplish..."

The recent scrutiny of these 21,000 transactions is the first oversight the TALF program or any of the other alphabets has undergone, and those doing the scrutiny are appalled at what they’ve found – so far. We should listen to them. The TALF program offers enticing possibilities for bailout profiteers to double, triple or quadruple their investments on highly risky ventures, and if they go bad, the taxpayers absorb 90% of the loss.

Not convinced this is the greatest and most successful redistribution of wealth ever seen in this country?

Then, let’s take a look at yet another program guaranteed by the taxpayers, PPIP (Public-Private Investment Program.) This program encourages private investors to buy "toxic" or risky assets on the books of struggling banks. Doing so, we're told, will get banks lending again because the burdensome assets won't weigh them down. Unfortunately, the incentives the Treasury Department is offering to get private investors to participate are so generous that the government -- and, by extension, American taxpayers -- are left with all the downside.

Here’s how the Nobel Prize-winning economist Joseph Stiglitz described PPIP for the New York Times:

"Consider an asset that has a 50-50 chance of being worth either zero or $200 in a year's time. The average 'value' of the asset is $100. Ignoring interest, this is what the asset would sell for in a competitive market. It is what the asset is 'worth.' Under the plan by Treasury Secretary Timothy Geithner, the government would provide about 92 percent of the money to buy the asset but would stand to receive only 50 percent of any gains, and would absorb almost all of the losses. Some partnership!

"Assume that one of the public-private partnerships the Treasury has promised to create is willing to pay $150 for the asset. That's 50 percent more than its true value, and the bank is more than happy to sell. So the private partner puts up $12, and the government supplies the rest -- $12 in 'equity' plus $126 in the form of a guaranteed loan.

"If, in a year's time, it turns out that the true value of the asset is zero, the private partner loses the $12, and the government loses $138. If the true value is $200, the government and the private partner split the $74 that's left over after paying back the $126 loan. In that rosy scenario, the private partner more than triples his $12 investment. But the taxpayer, having risked $138, gains a mere $37."

Worse still, the PPIP can be easily manipulated for private gain, says economist Jeffrey Sachs.

“A bank with worthless toxic assets on its books could actually set up its own public-private fund to bid on those assets. Since no true bidder would pay for a worthless asset, the bank's public-private fund would win the bid, essentially using government money for the purchase. All the public-private fund would then have to do is quietly declare bankruptcy and disappear, leaving the bank to make off with the government money it received… Time will tell whether private investors actually take advantage of the program's flaws in this fashion.”

What does Wall Street have to say about the mechanics of all this, you wonder. When they stop rubbing their hands with glee at the possibilities, do they stop and ponder the risk of such high-leveraged, public-money guaranteed risky transactions?

"It beats any financing that the private sector could ever come up with," a Wall Street trader commented in a recent Fortune magazine story. "I almost want to say it is irresponsible."

To what extent is the American taxpaying public at risk? Impossible to estimate with any accuracy at this time, is the general consensus, but by examining the opinions of others out there, including those who have been actively involved, I’ve found quotes of from $6 trillion to $16 trillion in risk from both commitments and toxic assets as collateral. If we take the middle ground at $11 trillion…

Kind of makes a few million spent on junkies and welfare bums look like petty cash.

“They did it. Yes, there is a ‘they’: the captains of finance, their lobbyists, and allies among leading politicians of both parties, who together destroyed an American regulatory system that had been functioning splendidly. They got to rewrite the laws to enable their massive greed over everything from the tax codes to the sale of toxic derivatives over the past quarter century, smashing the American middle class and with it the nation’s experiment in democracy.” – The Great American Stickup by Robert Scheer

My point?

The people who arranged things in this manner are not stupid. They knew what they were doing and they know what they are doing. It is intentional. They have built not only a house of cards, but a leaning tower of cards that any good wind will blow away. And worse, it is the American people holding the bill to the tune of $44 trillion (or most likely more.)

In light of all this, the theater presented to us on the nightly

news of self-serving wind-bags slicing off a million here, a billion there from

the barely respiring body of the nation’s economy is more high comedy than

political debate. But it passes for political process in this age of sloganism

and propaganda, of choosing up sides (left or right,) donning our labels and

speaking our roles instead of learning and thinking for ourselves.

Despite all the accusations aimed at this current administration of leaning too far to the left, the only socialism I see in practice is the collectivization of the financial risk and burden left on the public shoulders by short-sighted policies, poor decisions, and a complete abdication of the government’s responsibility to the people. (Yes, the people.) That’s their job and it says so in the constitution.

$44 + trillion. It beggars the imagination.

Standard and Poors can go ….. themselves. They were and are a part of the looting – which is not a thing of the past, and continues even now, just as fast as new acronyms can be thought up. They warn us to get our debt growth down to level that is “sustainable.” But there is no such thing.

No, the truth is that we have created an economic nightmare from which there simply is no escape under the current system. The national debt will never be repaid and the never ending spiral of debt and paper money that we have created is doomed to failure.

So what will happen someday when the current economic system does collapse?

That will be for the American people to decide. Hopefully they will learn from past mistakes and return to constitutional roots, including those warnings left in the writings of those that framed that document regarding central banks and deficits, and devise a financial system based on solid economic principles.

Every day, as though blithely ignorant of what is going on around them, people say things like, “I don’t want to pay taxes to support some junkie on welfare who never worked a day in his life.”

Personally, I don’t want to pay taxes to absolve financial institutions of the consequences of their bad decisions. I don’t want to pay taxes to line the pockets of profiteers who dream up new ways to redistribute wealth into their own pockets. I don’t want to pay taxes to underwrite money going to Behrain (of all places) to stabilize their banks’ liquidity. I don’t want to pay taxes for the likes of Christy Mack, wife of John Mack, CEO of Morgan Stanley and a woman with no previous business experience to get $220 million in TALF funds to play investor with her private offshore fund. I don’t want to pay taxes to become a shareholder in GM and then have my taxes go out in near-zero interest loans to their competitors. I don’t want to pay taxes to cover interest on borrowings at 3.5% only to have it loaned out to people who don’t need it at 0.25%.

I want to pay my taxes so that money may be spent in making this country a better place to live. (And nothing else!)

Where is Robin Hood when you need him?