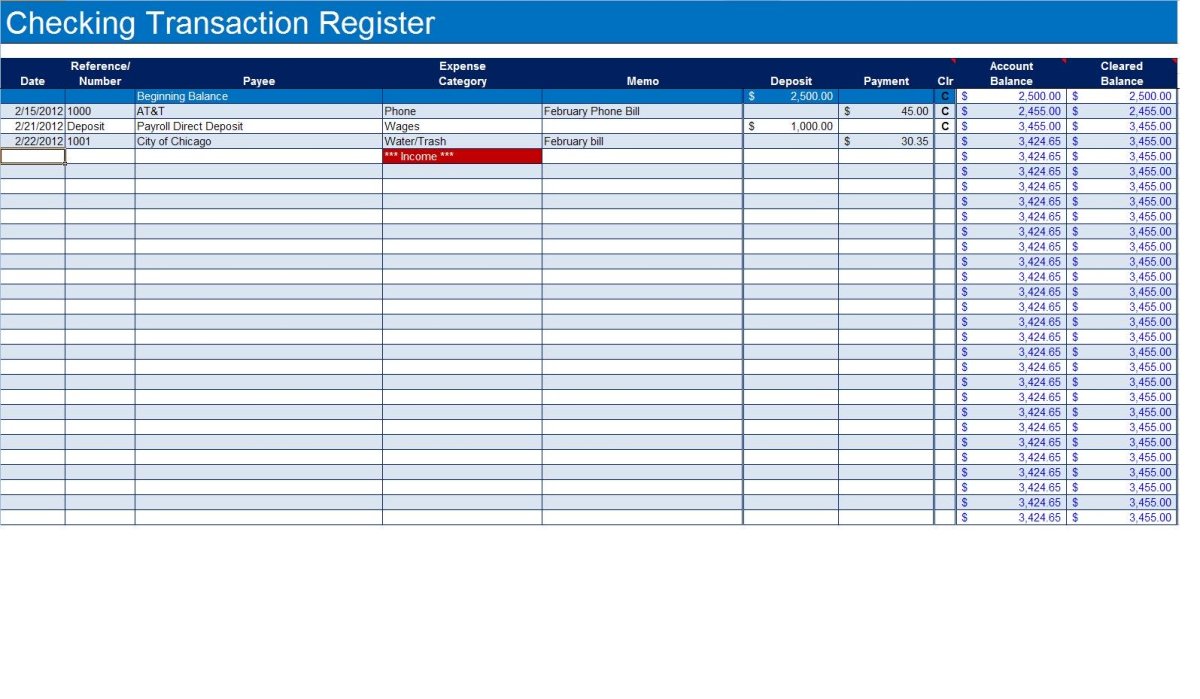

Keeping Good Records and Dealing with Errors in your Checking Account

Good Recordkeeping with Your Checking Account

Many people make use of a checking account and appreciate what it provides. Hopefully nothing ever goes wrong, and there are no discrepancies with your account. There are things you can do to avoid problems, and things to do if (or when) they come up. Most always, the statement you get from your bank monthly, will be correct. Same is true for online banking records. Some people are very careful and keep records of everything, including receipts from the ATM, deposit slips, and anything else that might prove helpful should a problem arise. It is not a bad idea, since errors have been known to occur.

Generally speaking, you have sixty days to question electronic transfers. The amount of time for other mistakes is less, and more like two weeks, approximately. Things change over time, and if nothing else, just remember the sooner the better for notifying your bank of any concerns or question.

Cancelled checks or copies

Many people like having cancelled checks as a back up, or proof of purchase or a receipt. Some recommended keeping your checks as long as it is possible you might need proof of payment for anything. Credit card statements are also helpful to have in such cases as are other bills like utility bills and phone bills, etc. They can show when payments were credited to your account. Mortgage and insurance companies however, don't give confirmations of payments, so the check itself or a copy of it however they keep it, is a receipt.

Some make the habit of keeping copies of checks paid for taxes until the possibility of being audited is no longer a possibility which seems smart. That time frame is usually three to five years. Keeping checks for items that are part of tax records, like home improvements, seems to be a wise thing to do as well.

Getting help if you need to

Usually banks are very helpful if you are experiencing any problems with balancing your check book or having discrepancies, etc They can point you in the right direction and give ideas for things you may not have thought of. They can help to follow up on a check you have written for instance. Sometimes just going in to the branch itself and talking to someone can be the most helpful. Look for numbers to call, to see if they can check on whether or not a check has cleared your account or been credited. Just make sure to find out if they charge fees for these things, and even if they do it may be very worth it for your peace of mind.