Tips to Adjust your Budget to be More Effective

Helping The Household Budget

Ideas to Help Your Budget

There are some things you can do to make sure your budget is being maximized to save you the most money. Planning ahead with one's finances is something people don't usually regret doing. The tips below have helped me in my budget planning.

1. Don't buy things if you don't really have a reason for doing so. The best reason to buy anything, is because you need it. You are going for genuine need, but there are times that you can afford your "wants" as well, if you keep to your budget. You can budget for those things also. Some other triggers for buying things we don't need can be things like boredom, depression, just being happy, loneliness and other emotions as well. It will be more depressing over time if you give into poor reasons for buying what you don't need.

2. Watch how you use the ATM and other withdrawals. Its easy to get caught up in taking money out of an ATM or however you get your money. It can be all too easy to not even fully realize how much you have removed from your bank, until you look later on. The money can easily disappear.

3. Plan way ahead for larger purchases. It can be easy to just react and buy something we want or even think we genuinely need without having carefully considered everything before doing so.

4. Don't give in to emotional buying decisions. I touched on this before, but it's a good reminder to not give into emotions when deciding about a purchase. Sit on the idea of purchasing something at least, and you will find that after a day or two, you didn't really want it anyway. If that happens, you know it would have been an emotional purchase. Imagine if you were out all that money now, and you really didn't need it anyway?

5. Always have a back up, emergency fund. There is a great rule of thumb that you can apply to your own situation. That is to have a back up emergency fund that would cover things for three to six months should some emergency occur. Setting aside something is much better than doing nothing, however. Do what you can, and hopefully you will never need it. If you do, you won't be digging into debt that you don't want anyway.

A Great Idea to Get Out of Credit Card Debt, or Avoid it Altogether.

This idea may sound painfully simple, but if you find yourself in credit card debt over and over again, especially while not knowing how you got there in the first place, consider this. Changing your spending money for the week or two weeks, over to a cash only system. Not that long ago, people carried more cash, and as they spent it and the money dwindled from their wallets, they spent less. They simply didn't have the cash to spend it! This seems so obvious, and yet we don't think of money in our banks or on credit cards like money quickly dwindling from our wallets. It is meant to feel that way I think, from a credit card company's point of view!

The money you spend, seems to have a limitless supply, until you get your credit card bill and have to pay! I realized just how true this was once, when I wasn't really expecting a credit card bill one month. I hadn't spent anything really. It was very high, actually! I thought there had to be a mistake. Upon looking more closely, it was little things like a large unsweetened iced tea from McDonald's, or gas, or just little things like buying a greeting card I needed, etc. Those little bits really add up! If I had had money in my wallet, I would never have spent those little bits of cash that led up to what seemed a couple of hundred dollars!

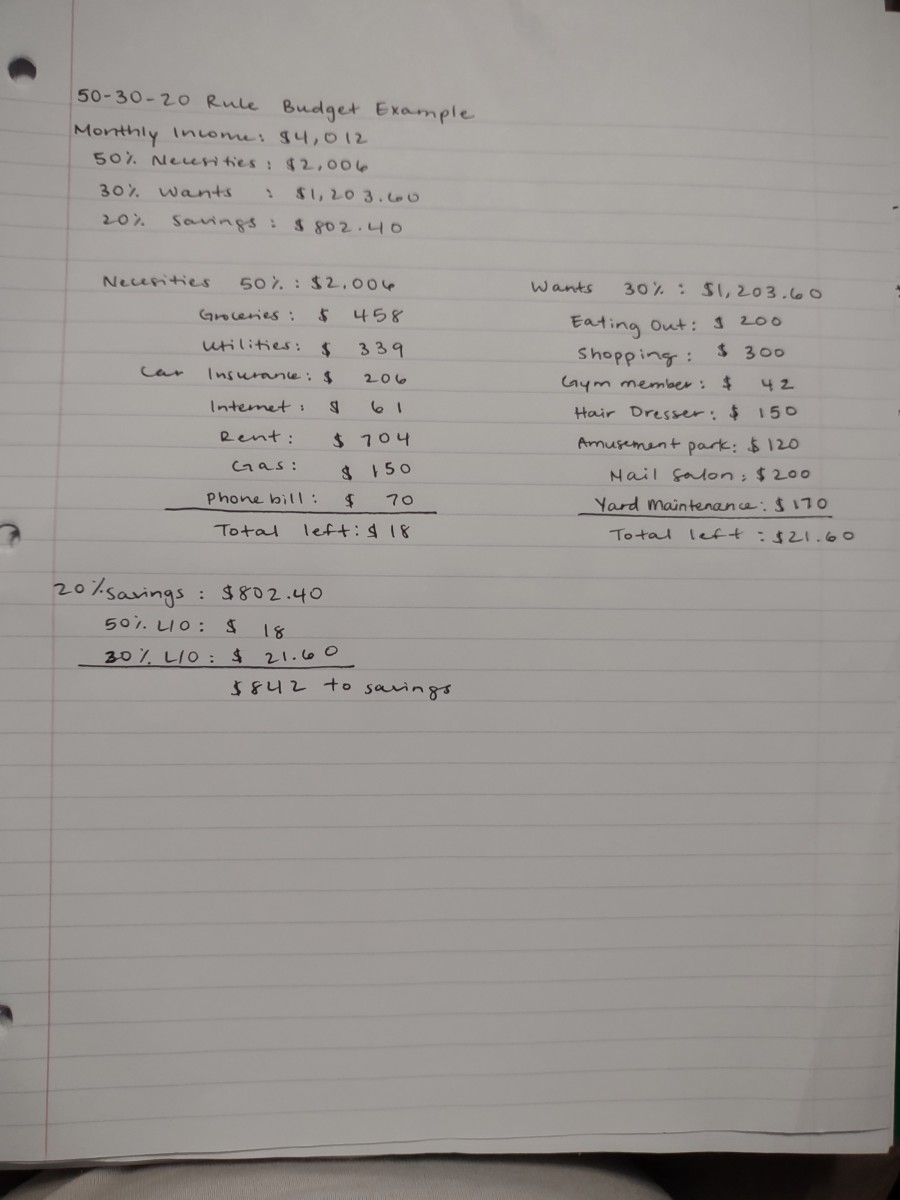

So consider a cash with a labeled envelope system. Put "x" amount of dollars you can allot for that category each month, two weeks, or each week. Only get things you need if there is money left in the envelope. if not, it will have to wait! I think this is so simple, but ingenious at the same time. So I wanted to share. When making a budget and trying to stick to it it really helps so much.

Some Great, "Do-able" Tips for a Great Budget

Budget Tips Poll

If you could keep more of your money you make simply by creating a better budget, would you do it?

© 2011 Paula