What is the Bretton Woods Agreement ?

How did forex start? Where did forex come from?

Have you ever thought about why forex was invented? When was forex invented and who invented forex? I know I have. And It blew me away to find that it all started right here in my home state of New Hampshire. Bretton Woods, New Hampshire to be exact.

It all started with the " Bretton Woods Agreement "

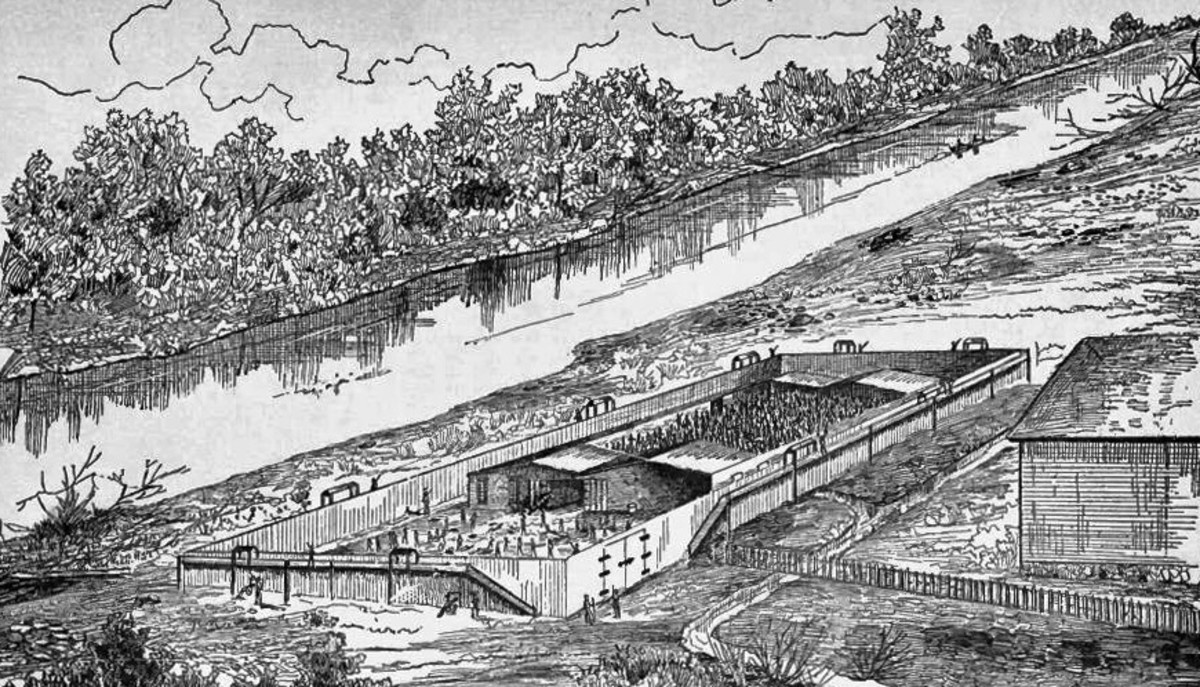

The Bretton Woods agreement ( the Bretton Woods system ) was signed at the end of World War II, and became the main currency conversion mechanism. United States, Britain and France came to Bretton Woods, New Hampshire, for the United Nations Monetary and Financial Conference to design a new global economic order.

How did the Bretton Woods system start?

Choosing the location of the United States was only becuase this state was hit by the war.

Most European countries were still in chaos. Until World War II, the pound was the national currency for reference. But the Nazi attack on the position of making a change in sterling. In fact, since World War II, the dollar out of the stock market crash of 1929 after the haze, has become internationally recognized as the national currency for reference. Bretton Woods agreement was established for the global economic recovery and to create a stable environment. It established a fixed exchange rate system and international monetary economic organizations, hoping to stabilize the global economy.

Thus, the major currencies are pegged to the dollar, up and down only 1%. If a floating currency hit the limit, then the central bank obliged to intervene to return to the normal range. This agreement was finally abolished in 1971. Although the final failure, but in the reconstruction of economic stability in Europe and Japan, it achieved the original intention.

The only book you need to learn how to trade FOREX

The Smithsonian Agreement

Smithsonian Agreemen was implemented in December 1971 to replace the Bretton Woods agreement. This new agreement is similar to the Bretton Woods agreement, but allows the currency to fluctuate within a wider range. In 1972, the European Community tried to get rid of dollar long-term binding situations. Then West Germany, the Netherlands, Italy, France, Belgium, and Luxembourg, a European common floating exchange rate. The agreement is very similar to the Bretton Woods agreement, but allows the currency value float in a wider context.

Both of the two agreements with the Bretton Woods system has a similar error. So in 1973 came the collapse of both agreements. 1973 Smithsonian Agreement and the collapse of the European common floating exchange rate changes marked the formal beginning of a free floating exchange rate. This shift is entirely accidental, since there was no other new agreement can be used to replace it. The Government is now free to bind their currencies, semi-bound to allow their currencies or completely free of exchange rate fluctuations. In 1978, free-floating exchange rate regime was officially started and ok to use.

The Conclusion

By the end of efforts, Europe and the U.S. dollar were out of the binding. In July 1978 they established the European Monetary System.The current changes and other major currencies were no longer associated with currency movements.

Therefore, the cause of the banks, hedge funds, brokers and individual speculation to invest in the industry. Occasionally out of the Government's central bank would intervene. To move or try to make the currency exchange rates move to their desired level. However, the current underlying factors driving the foreign exchange market is the supply and demand factors. For today's foreign exchange market, the free floating exchange rate is very good. If in the future of our planet once again into a world similar to the early 20th century war, how will the foreign exchange market will be affected? U.S. dollar will continue to play like a number of years as a safe haven role? Only time can tell.