How to Bulldoze the Stock Market Using Stop Loss Order

You Place in Advance a Waiting Order

A stop loss order is meant to alert your stock broker to close your stock positions when the price hits a certain price. For example you may want to get out of the stock position before it falls any farther. You place in advance a waiting order in your broker's trading system. You tell your broker you want a stop loss order at a certain price on the stock. When the stock hits that price, your stop loss order becomes a market order. Your order will then be executed immediately at the prevailing market prices.

A stop loss orders acts like an insurance to your stock at a very minimal commission fee to your broker and may save you from huge losses.

Since you place the stop loss order when you open your stock position, your stop loss will take the emotion out of a decision to close your stock position. This control of your emotions is the single most important thing about stop loss order. Set that automatic stop loss today and not tomorrow.

If you really do know how to compute the market price where to place a stop loss order, then getting stopped by a stop loss order is a strong enough signal that the market may change direction or the trend.

If the stop loss gets you out of market, you stay out of the market without participating again until when the market will form an appropriate trough or crest to start a new position. Sometimes it may take one or two months for an appropriate trough or crest to form during which you will be out of trading. Time spent when you are out of trading is time wasted and time is money. The big question is whether it's right to be out of trading and wait for one to two months because you do not know exactly what the market is doing?

The moment you see the stop loss penetrated, then, the market becomes very unstable because you do not know where it will head next. But the logic is that the market can only have three options, either:

Option 1

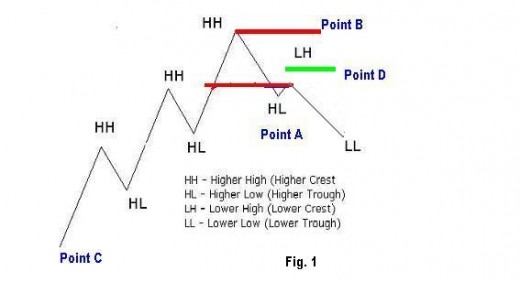

1. The market can move aggressively past the stop loss point A without bouncing back to form a well developed trough or crest at point D as shown in fig. 1.

Option 2

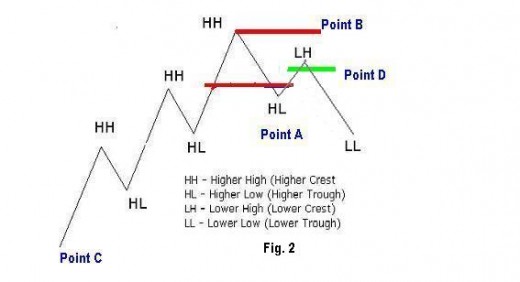

2. The market can bounce back at stop loss Point A and form a well developed trough or crest at point D as shown in fig. 2. This would give you a chance to enter new trades in the opposite direction and move in favour of your chosen direction.

Option 3

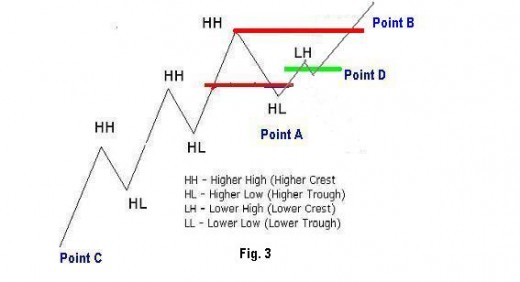

3. The market can bounce back at stop loss Point A and form a well developed trough or crest at point D as shown in fig. 3. This would give you a chance to enter new trades in the opposite direction and then the market would move farther against your chosen direction.

A Stop Loss Order Penetration

If you really do know how to compute the market price where to place a stop loss order, then getting stopped by a stop loss order is a strong enough signal that the market may change direction or the trend.

If the stop loss gets you out of market, you stay out of the market without participating again until when the market will form an appropriate trough or crest to start a new position. Sometimes it may take one or two months for an appropriate trough or crest to form during which you will be out of trading. Time spent when you are out of trading is time wasted and time is money. The big question is whether it's right to be out of trading and wait for one to two months because you do not know exactly what the market is doing?

Bulldoze the Stock Market

Now that we know that the market can move in only the three mentioned options, is there anything we can do so that we do not have to get out of the market?

Suppose that from the illustration above, you establish a calendar spread with 10 short calls and long calls at point C. You would ride in profits all the way to point A. At point A the stop loss would stop you and you are likely to miss the juicy downtrend.

Suppose you had an automatic stop loss order telling your broker to retain your calendar spread of calls at point A but to add 10 long puts (equivalent to 10 long call in your calendar spread). The following would happen:

(a) If the market was to move aggressively past the stop loss point A without bouncing back to form a well developed trough or crest at point D as shown in fig. 1. - Your calendar spread of calls would lose but your long puts would earn you far much more than your loss from calendar spread.

(b) If the market was to bounce back at stop loss Point A and form a well developed trough or crest at point D as shown in fig. 2. This would give you a chance to enter new trades in the opposite direction and move in favour of your chosen direction (it is however very likely other signals would still be showing this market to be still uptrend and there would be no need to trade it in the downside direction). If the market would move downward, your puts would earn you lots of money whilst your calendar spread would lose.

(c) If the market was to bounce back at stop loss Point A and form a well developed trough or crest at point D as shown in fig. 3. This would give you a chance to enter new trades in the opposite direction and then the market would move farther against your chosen direction (it is however very likely other signals would still be showing this market to be still uptrend and there would be no need to trade it in the downside direction). If the market would move upward, your puts would lose money whilst your calendar spread would continue to earn you money. At point B there would be another stop loss order and the whole process would be repeated all over again in the opposite direction until the market stabilizes.

This process will work both in bull and bear markets but positions have to be interchanged accordingly. It will works especially very well for exchange traded funds.

If in your search for a trading formula, this is the only thing you will be able to learn and understand, then you will be past 75% of what is needed to bulldoze the stock market.

The Author’s page is designed to help beginners and average readers make some money as an extra income to supplement what they may be earning elsewhere - details of which you can find in My Page, if you will.