Option Spreads - Debit Spreads versus Credit Spreads Explained – Debit Spread and Credit Spread Examples

Safe Combination of Making Money

Many traders will never trade stock options because they believe it’s almost certain they will lose their money. This is true because a stock options changes price so fast it’s like fire next to propane – before you realize what is happening you have already lost the better part of your money you used to buy the stock options. But if you combine a long option with a short option you create a safe combination of making money from the stock market.

But first, some definitions:

A call option is a contract that gives the holder the right to buy 100 shares of stock from the writer of the option contact at the strike price within up to a specified period of time up to the expiration day. The one who writes the option contact is “short” the call option. The one who buy the call contract is “long” the call contract.

A put option is a contract that gives the holder the right to sell 100 shares of stock from the writer of put option at the strike price within a specified period of time up to the expiration day. The one who writes the put option contact is “short” the put option. The one who buy the put contract is “long” the put contract.

Option Spreads - What Is Debit Spread?

When an option trader buy an option and at the same time sells an option each with different strike price on the same underlying security, the difference between the prices of the two options is called a spread. If the option with the higher price is purchased and the option with the lower price is sold, the trader gets a debit which is the difference between the two prices. This is called a debit spread.

Example: An investor buys a call option for XYZ stock with a strike price of $90 for $3.00. Immediately the same investor sells a call option for XYZ stock with a strike price of $95 for $1.00. The debit spread is $2.00 which means the investor has actually invested out of pocket $2.00 x 100 equals $200. The investor will do this if he believes the price of the stock is to go higher and that the bought call option will gain more than the sold call option for the same price increase of the underlying stock. If he believes the underlying stock is to go down in price, then he will buy a put at a higher strike price and sell another put at a lower strike price.

Option Spreads – What Is Credit Spread?

When an option trader buy an option and at the same time sells an option each with different strike price on the same underlying security, the difference between the prices of the two options is called a spread. If the option with the higher price is sold and the option with the lower price is bought, the trader gets a credit which is the difference between the two prices. This is called a credit spread. However, the trader will have to provide cash collateral equal to the difference between the two strike prices. The cash collateral is called a margin.

Example: An investor sells a put option for XYZ stock with a strike price of $95 for $3.00. Immediately the same investor buys a call option for XYZ stock with a strike price of $90 for $1.00. The credit spread is $2.00 which means the investor has actually been credited with $2.00 x 100 equals $200. The investor will in addition have to provide cash collateral of $500 ((95-90)x100). The investor will do this if he believes the price of the stock is to go lower and that the sold call option will lose more than the bought call option for the same price decrease of the underlying stock. If he believes the underlying stock is to go up in price, then he will sell a put at a higher strike price and buy another put at a lower strike price.

1. When a stock is expected to go up in price, you can trade it with a debit spread of calls or a credit spread of put.

2. When a stock is expected to go down in price, you can trade it with a debit spread of puts or a credit spread of calls.

Debit Spreads Versus Credit Spreads – Which Is Better?

Which is better Debit Spreads or Credit Spreads? Many people want to tell us that there is no difference between a debit spread and credit spread, but there is a very great difference between Debit Spreads and Credit Spreads.

We are going to find out using a real life example. We are to use QQQQ Powershares options which are traded at very high volumes, they are liquid and chances of finding a miss-priced option are slim. QQQQ Powershares is an ETF which is as good as a stock.

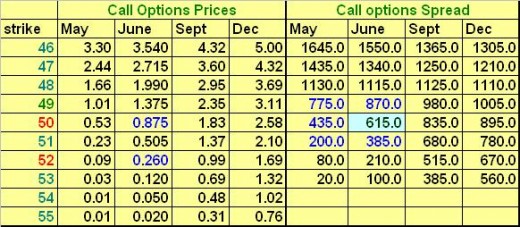

Below are the QQQQ options prices based on the QQQQ closing price of $49.03 0n April 9th 2010. We are to use options that are out of money to avoid the short leg of the option being exercised. As you will notice we have picked options for the month of June because they are more profitable as they are close to expiration date (but far enough to have sufficient time value to avoid early exercise).

The first table shows the debit spread using a long QQQQ call 50 for June and a short QQQQ call 52 for June. The price of the debit spread is $615 which is for 10 contracts.

In the second table, we have a credit spread using a short QQQQ put 50 for June and a long QQQQ put 47 for June. The price of the credit spread is $655 which is for 10 contracts.

It is assumed the cost of debit spread $615 and credit spread $655 are close to each other to allow for comparison. It is also assumed that the current implied volatility of the options will remain constant over the period of comparison.

1. after One Month

(A) Credit spread – if the price of QQQQ remains the same after one month, you gain 655-580 =+$75

(B) Debit spread - if the price of QQQQ remains the same after one month, you lose 615-435=-$180

(C) Question – Would you prefer a credit spread or a debit spread?

2. Price Increases Immediately

(A) Credit spread - if the price of QQQQ moves immediately for $1 gain in price, your credit spread will gain 655-485 = +$170

(B) Debit spread - if the price of QQQQ moves immediately for $1 gain in price, your debit spread will gain 870-615=+$255

(C) Question - Would you prefer a credit spread or a debit spread?

3. Price Decreases Immediately

(A) Credit spread - if the price of QQQQ moves immediately for $1 loss in price, your credit spread will lose 880-655=-$255

(B) Debit spread - if the price of QQQQ moves immediately for $1 loss in price, your debit spread will lose 615-385 = -$230

(C) Question – Would you prefer a credit spread or a debit spread?

4. Price Increases after a Month

(A) Credit Spread - if QQQQ moves for $1 gain in price after a month, your credit spread will gain 655-385 = +$270

(B) Debit Spread - if QQQQ moves for $1 gain in price after a month, your debit spread will gain 775-615 = +$160

(C) Question – Would you prefer a credit spread or a debit spread?

5. Price Decreases after a Month

(A) Credit Spread - if QQQQ moves for $1 loss in price after a month, your credit spread will lose 865-655=-$210

(B) Debit Spread - if QQQQ moves for $1 loss in price after a month, your debit spread will lose 615-200=-$400

(C) Question – Would you prefer a credit spread or a debit spread?

6. Cost of Putting the Spread

(A) Credit Spread - The cost of putting the spread is a credit of $655 and a margin of $2000 =-$1345

(B) Debit Spread - The cost of putting the debit spread is a debit of $615 =-$615

(C) Question – Would you prefer a credit spread or a debit spread?

Same Amount of Money Invested?

If we assume the margin is a cost because the stockbroker holds that money in such a way you can not use it, then it would be logical to assume our credit spread cost $1345 and our debit spread cost $615. To be fair to ourselves in this comparison, we need to compare a debit spread of 20 contracts in each leg to our credit spread of 10 contracts in each leg so that the amount of money invested in each case is almost the same.

We shall compare again using 10 contracts for credit spread and 20 contracts for debit spread, and in each scenario we shall allocate a total of 3 marks.

1. after One Month

(A) Credit spread – if the price of QQQQ remains the same after one month, you gain 655-580 =+$75

(B) Debit spread - if the price of QQQQ remains the same after one month, you lose 1230-870=-$360

(C) Remark. Allocate 3 marks to credit spread and 0 marks to debit spread

2. Price Increases Immediately

(A) Credit spread - if the price of QQQQ moves immediately for $1 gain in price, your credit spread will gain 655-485 = +$170

(B) Debit spread - if the price of QQQQ moves immediately for $1 gain in price, your debit spread will gain 1740-1230=+$510

(C) Remark. Allocate 0.5 marks to credit spread and 2.5 marks to debit spread

3. Price Decreases Immediately

(A) Credit spread - if the price of QQQQ moves immediately for $1 loss in price, your credit spread will lose 880-655=-$255

(B) Debit spread - if the price of QQQQ moves immediately for $1 loss in price, your debit spread will lose 1230-770 = -$460

(C) Remark. Allocate 2 marks to credit spread and 1 mark to debit spread

4. Price Increases after a Month

(A) Credit Spread - if QQQQ moves for $1 gain in price after a month, your credit spread will gain 655-385 = +$270

(B) Debit Spread - if QQQQ moves for $1 gain in price after a month, your debit spread will gain 1550-1230 = +$320

(C) Remark. Allocate 1.4 marks to credit spread and 1.6 marks to debit spread

5. Price Decreases after a Month

(A) Credit Spread - if QQQQ moves for $1 loss in price after a month, your credit spread will lose 865-655=-$210

(B) Debit Spread - if QQQQ moves for $1 loss in price after a month, your debit spread will lose 1230-400=-$800

(C) Remark. Allocate 2.5 marks to credit spread and 0.5 marks to debit spread

6. Cost of Putting the Spread

(A) Credit Spread - The cost of putting the spread is a credit of $655 and a margin of $2000 =-$1345

(B) Debit Spread - The cost of putting the debit spread is a debit of $1230 =-$1230

Would You Prefer A Credit Spread Or A Debit Spread?

The Big Question – Would you prefer a credit spread or a debit spread? The credit spread has scored 9.4 marks against 5.6 marks for the debit spread. This therefore means I would prefer a credit spread instead of a debit spread. The only thing I would have to worry most is for the short leg to get too much in the money to avoid early exercise. Ideally, if I invest, say $300, and it becomes $400, I will need to close the position and lock that profit of $100. I then start all over again with say $300. If you leave too much of your profit on the table, they will one day take it.

To small investors who may not be having much money to invest, they may prefer the debit spread. To successful investors who have large accounts with idle dollars, they may prefer the credit spreads. To trade using a credit spread or a debit spread should be a personal decision which will vary from one investor to the other. Trade using the strategy you feel comfortable trading with.