Stop Foreclosure - Avoid Foreclosure and Its Consequences

How Do I Stop Foreclosure?

So, you are starting to fall behind on your mortgage, and you are worried that your home will be foreclosed on by your bank. This article is designed to help you stop foreclosure, or at least get you started on dealing with it, and to give you the information and some of the assistance you will need to plan your home pre-foreclosure strategy. If the foreclosure is already underway, there is still a lot you can do to avoid foreclosure, but before you get to that point, first you need to understand what you are facing.

Understanding Foreclosures

Foreclosure is a process through which a lender (usually a bank) attempts to recoup their money from a borrower who has defaulted on their loan. The bank then either sells or takes back the home, resulting in a foreclosure auction.

A first step on the foreclosure railroad is the Notice of Default, once you are sufficiently behind in your payments. After this there is a reinstatement period in the foreclosure process, which occurs before the house is put up for auction, and during which you can square things. Before an auction can occur, you will receive a Notice of Sale, which likely also be posted on the property and published in the local newspaper.

How Long Do I Have?

In normal circumstances, a foreclosure use to take about six months, but that does not mean you have to be out of your home in six months. These are not normal times, and there is such a backlog of homes in foreclosure that it is not unusual for the banks to drag their feet, hoping to not flood the market with foreclosures and drop the bottom out of the real estate market. Even if you can't stop foreclosure on your home, you may be able to stay in your home for well over as a year.

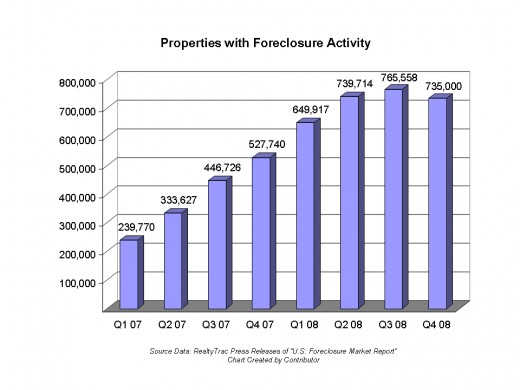

Foreclosures Trend Increasing

So, What Should I Do First?

Well some of the obvious things about home foreclosures should be mentioned. You need to find out local rules and processes, such as whether your state has judicial foreclosure or foreclosure by advertisement. You also need to get your paperwork (tax returns, the mortgage, your budget -you do have a budget now, right? -) and probably you should consider buying a book on foreclosure.

Be sure to save any and all correspondence with the holder of the mortgage, and get a notebook to log all conversations, including when and who you spoke to, and what they said about home foreclosures in their company. Home foreclosures can be confusing, so an organzied system is crucial to keep this straight.

The following section, below, discusses several options for dealing with home foreclosures.

Foreclosure Consequences

Options to Avoid Foreclosure

Several steps may be helpful, depending on your unique situation, but here are some important ones you can consider:

Catching Up on Payments

During the stage where you have missed payments, but are still in pre-foreclosure, you can always catch up on your payments. This makes sense if you have the money and have worked out a budget so you won't fall behind again soon.

Refinace Yourself out Of Foreclosure

Now is a very good time to call a counselor that is approved by the government's office of Housing and Urban Development. (HUD) These counselors will not rip you off (beware of any predators who are not approved) and they can help you with the process of applying for a loan re-modification, or other appropriate strategies to address your situation. Because the housing market is so stressed, and home foreclosures are on everybodies mind, there are several government plans that you may well qualify for, to make your payments more affordable. These counselors may help you get a workable budget going and give other useful advice. You might want to negotiate with your lender, or find another lender to take it over. You may also be able to reinstate your mortgage, with a payment promise, or use a forbearance agreement, which is useful if you have had a temporary financial setback.

Sell Your Property Before They Do

When you are close to, but not yet in foreclosure, selling your property may be the right choice. Not only may you be able to get some of your money out, but obviously you can head off some or all of the damage to your credit, and surely will unload a heavy burden. You don't have time to do a "for sale by owner." Call around and find a Realtor in your town who has experience with these kinds of sales, and who understands your need to sell and close quickly. You need to be candid with them and not hide your predicament. An agent who specializes in this process is best.

Bankruptcy to Avoid or Delay Foreclosure

Bankruptcy may be an option for you to consider. While it is a difficult to contemplate, it is a legitimate strategy for some people, either to delay the sale of your home in pending foreclosure, or to actually protect that asset. The two most common personal bankruptcy approaches are Chapter 7 and Chapter 13 bankruptcy. While most people in foreclosure who seek this route likely will file for Chapter 7, if you have substantial predictable income, sufficient to pay for your needs and then some, you may be eligible for Chapter 13. Chapter 7 can often be used to delay foreclosure by about an extra 3 months, but is not useful for actually protecting your residence beyond that delay, which is called a Stay. Chapter 13 is the best option, if you qualify, because it allows you to pay personal and business related debts over time, including your mortgage arrears. Best of all you do not have to sell! Over a 3 year (or in some cases 5 year) period, you can work out a payment plan to square things.

Using the Courts to Stop or Delay Foreclosure

The same banks and wall street fools who brought us the bursting housing bubble of 2008, along with "toxic" assets and strange financial instruments (that broke mortgages up into tiny toxic pieces), are now having similar problems justifying their paperwork used in foreclosure. As a result, if you can afford an attorney, you may well be able to challenge the banks standing in foreclosure court as the actual holder of your mortgage. Many of the major banks and lenders have been accused of using documents that seem to be inaccurately or possibly fraudulently prepared. This problem is well beyond the scope of this article, and likely beyond your ability to address on your own, but it may be worth exploring with a legal consultation. Other, more typical grounds for disputing or delaying foreclosures in court include irregularities/mistakes in the Notice of Default, or discrepancies between the Notice of Sale and Notice of Default.

If You are in the Military

Active duty military and their families may be able to suspend or stop foreclosures by using the SSCRA benefits, although it will not relieve you of your obligation to pay the loan eventually.