Lessons From My First Car Accident

Accidents and Insurance

I have been driving for over 25 years. Throughout that period of time I am lucky to have only been involved in a few minor accidents. My first car accident experience happened shortly after I got my first car. That experience thought me a lot about auto insurance and what to do and not do in order to maintain a good insurance record.

By the time I got my first car I was already driving for a few years. I knew the rules of the road and drove defensively as suggested by driving instructors and the Police. Although I was young and could of easily succumb to the stereotype for my age group I did not want to do anything to jeopardize the freedom that I felt in having my very own car. However, it wasn’t long before I did just that.

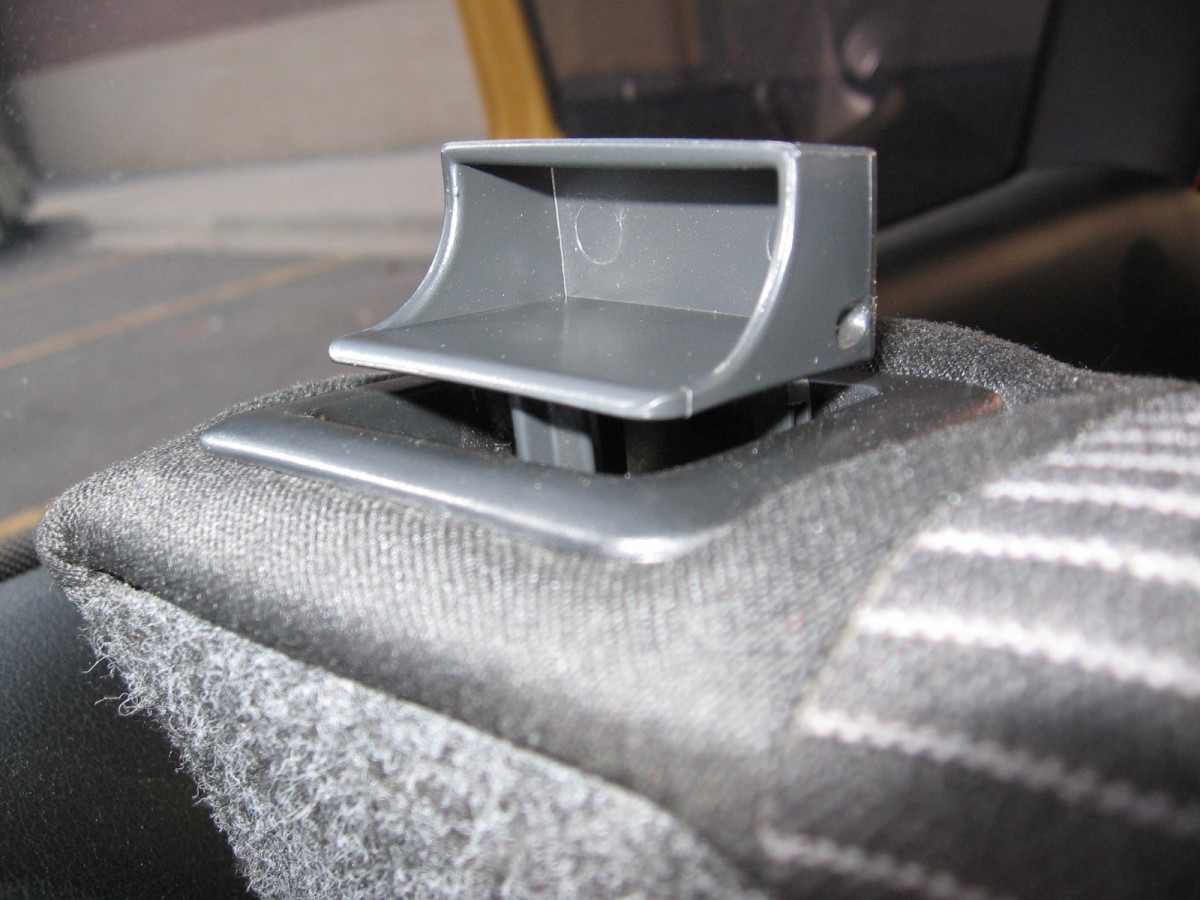

Like many young guys I was into loud music and having a fancy jacked up stereo system. Soon after buying my car I installed large speakers and the Amps needed to power them. Then I added a fancy stereo system with lots of lights ad buttons. But before I get too carried away in reminiscing about the good old days I have to digress and state that my fancy car stereo was the cause of my first accident.

I remember the event like it was yesterday. It was a sunny late afternoon and I had just left work. There was plenty of rush hour traffic so it was all about taking it easy and enjoying the ride. My music was blaring as I stopped behind another car at a red light. I took my eyes off the scene in front of me and began to play with the stereo. The next thing I knew I had rolled forward and bumped the car in front of me.

Oh snap! I exclaimed as I shifted the car into park and jumped out to greet the next driver who was also getting out of her car. The first thing that I noticed about her was that she was pregnant and a sinking feeling added to my already worried expression. I offered my apology over and over and tried to assure her that the situation was no big deal. I showed her the bumpers in order to assure her that there was no damage to either vehicle as all that happened was that I mistakenly rolled into her bumper.

She agreed that there was no damage but still insisted that I give her my insurance information. She accepted my eager apology and I was happy to give her my insurance info. The only problem was I neglected to take hers. If there was no damage then there is no problem I thought. The whole situation lasted no more than 10 minutes and we were both on our way. I experienced a bit of anxiety for a few days after but soon the whole incident disappeared from my mind.

About two weeks later I got a call from my insurance agent who requested an accident report. He explained that the lady that I rolled into had filed a report with her insurance company claiming that I rear-ended her and she was experiencing neck and back pain. I was floored. How could such a simple situation get so blown out of proportion? My agent explained that that was the pitfalls with car accidents. It is all according to personal interpretation as well as a little bit of exaggeration. Every driver has to be diligent to protect them-self and their reputation.

So what did I learn? The first thing that I learned was to never take my eyes off the road for any extended period of time. Tending to a simple thing like my stereo coasted me big time because subsequently my insurance premium went up. Also, it could have been worse if I was going at speed and became distracted by adjusting the stereo. The second thing that I learned was to never take anything for granted while on the road. If ever in an accident, always get the other drivers vehicle and insurance information.

Finally, always call your insurance company and file a report no matter the severity of the accident. You might be afraid to do so because you think that by reporting a minor accident your premiums will go up but you will be protecting yourself in more ways than one. The auto insurance industry has become a magnet for scammers who target unsuspecting drivers. These scammers create intentional collisions in order to milk insurance companies of money.

In turn, the insurance companies hike up our premiums in order to recover their losses. In the end it is us as consumers that lose.