AMEX: Companies that Make Money

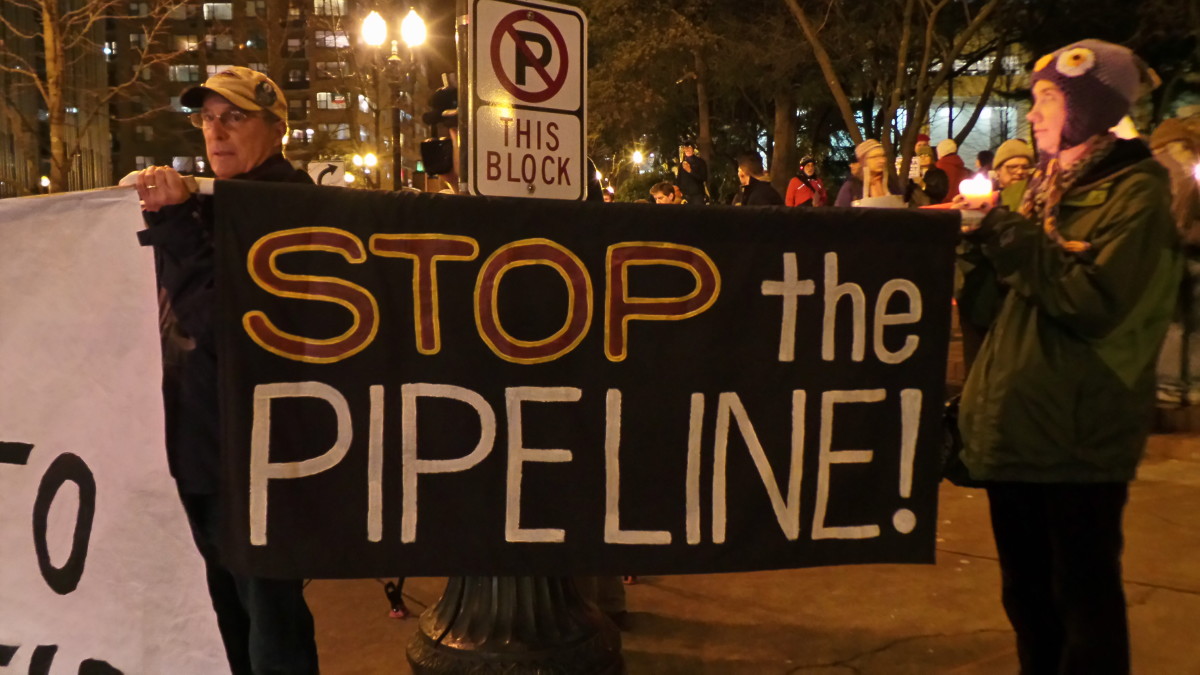

1853 American Express Receipt

American Express

Amexco, as it was once known, has managed over the years to remain in business. Its business, however, has changed. It goes well back into the 19th century, before the War Between the States. During the Civil War it served the nation by sending dead soldiers home for burial. It also transported clothes, medicine, armament, and anything else needed by the Union Army. It does not sound like much, not in the way of commerce, but these shipments form only a single chapter in a multi-chapter history. The company began working with railroads and wagons, not jets or rockets, prior to the invention of the automobile. But it managed to get packages and cargo to where they were meant to go. One can interpret the word "express" with a degree of lattitude. The trips took a while. But whether machine parts or farm products, Amexco worked alongside transportation companies and clients. It got its various jobs done. They required a middle man. Amexco was not the only choice. It had no monopoly. It competed, for instance, with the U.S. Express Co. and the Adams Express Co. There were others as well. The cutthroat competition kept it razor sharp. It almost always made money, even before it branched out into the financial world to get to where it is today. In fact, that is the whole message behind the hub: a company that makes money. It does not just attract shareholders, or con investment money out of newlyweds or retirees alike. Naturally, it is not as simple as all that.

Wells Fargo Express 1890

Travelers Checks

When one is around trains, ships, and anything on wheels, one tends to broaden one's outlook. There was never anything provincial about the American Express Company. To put it another way, a perceptive employee noticed in the late 1880s that Americans abroad were spending close to if not more than a billion dollars a year, especially in France, on any number of things. The usual method of payment involved a Letter of Credit, which had to be taken to a bank, examined, and then, after careful scrutiny, without a set time limit, settled. The introduction of the Travelers Check in the early 1890s was, though speedier, not an overnight success. Executives went to Europe themselves, and, after being forced to wait upwards to and above two hours, were slowly brought to a boil. It might have been a slam dunk requiring two signatures by the same hand. But bankers were new to the innovation, which took a while to catch on. Needless to say, these checks were a great boon.

Amexco set up an office in Paris, then, since business thrived, with hardly a slow day, set up additional offices. At first, one could read the currency rates of exchange on the checks themselves. Soon, however, volatility rendered this service impossible. The company had the presence of mind to break the denominations down to as low as twenty dollars. Money had greater purchasing power. So many items were for sale. Lest we forget, Amexco also made sure that the goods found their way to their proper homes. Apparently, fees were, if not nominal, reasonable. The company "floated" cash paid for checks as well as money orders. It was not utterly transparent, in the days prior to the IRS, how much profit they were amassing, though the company rarely ran into monetary trouble. That was not scheduled to happen with a biting sting until the crash of 1929.

Chase Bank Stock Certificate

Chase National Bank

Amexco was not perfect. Early on, it had acquired brokerage firms that dragged down its bottom line. It sold out, incurring losses. But in 1928, Amexco had dealt with many difficulties that plagued the upstart company over seventy-five years earlier. At that time, it was not sure what direction to take, how to expand, and most of all, maximize revenues. In the late 1920s, Chase, to be blunt, wanted Amexco. It essentially became a raider, if only, to begin with, existing in a state of potentiality. Before the Securities and Exchange Commission, one company could take over another simply by buying all its stock. But it had to be done on the sly, then announced after completion. Albert Henry Wiggin, Chairman and Chief Executive of Chase National Bank, had had phenomenal success building up Chase. It came to his attention while doing so that Amexco had bank charters in countries all round the world. Chase needed worldwide access. Amexco could lead Chase into the international arena in terms of power, wealth, and prestige.

What makes this story of acquisition more interesting than normal is how Wiggin and Chase moved so smartly and surreptitiously. Not unimportant, Amexco had a treasure chest of cash Wiggin planned to funnel into the stock market. What Amexco had failed at on its own could now be mastered, with the right kind of help. According to Wiggin, the best way to buy blocks of Amexco stock was to get them from railroad express companies. Interestingly, one of the largest holders of their stocks, such as ARE, the American Railway Express, was Amexco. Apparently, back-patting was the general rule of the day. A side story to American Express occurs when an executive tried to ruin a competitive company only to learn that, without his knowledge, both held ample shareholder positions in each others' stock. In any case, shares were not cheap, well above $200. One gets the sense that 1928 was a banner, whirlwind year for the stock market. Naturally, it would not have crashed a year later in October if anyone had seen it coming.

65 Broadway New York City

Fast Forward: the 1950s

While credit cards made their debut on the financial stage, Amexco was averse to competing internally with its profitable Travelers Checks. But there is something overwhelmingly forceful about the future that the past cannot bring to a standstill. Being in the travel and entertainment business, Amexco quickly eyed Diners Club. Not to put too fine a point on it, a hundred plus years after its inception, Amexco was not the only company to have become a high roller in the casino capitalism that had evolved. To be fair, Diners Club was far and away a better bet than the roll of the dice. But how much was it worth? Also, what about other cards that served the exact same purpose? The American Automobile Association sought to get into credit cards. The American Hotel Association had the same intention. By this time, it was not just all about restaurants. At a board meeting, an executive suggested that they stop speaking of the Diners Club Card with "condescension and reluctance". Millions were using cards, many entirely "creditworthy". The acquisition was do-able. Amexco could issue more stock, and then have enough cash to initiate a loan for IBM equipment. Diners Club already had a line of credit through Chase. It is doubtful if big business decisions take as long as they once did. But it was not until 1958 that the go-ahead was given to create an American Express Credit Card.

It has to be admitted that there was something not only anti-climactic but filled with resignation about this green light. Look at any collection of old photographs of American Express, created in and near to its 1850 inception, and it is visually evident that credit cards were going to ruin so staid and dignified an image. Amexco had never been defined as, if mistakenly, a company that was a hodge-podge assemblage of bankers and lawyers -- in other words, sharpsters! That first European office in Paris, another later in Hong Kong, and those beautiful horses loaned to King Edward in an historic visit to NYC -- gone were the days. American Express coaches were once how tourists toured exotic lands in style. Some of the top officials still knew firsthand what it was to drive goods by day and night in all kinds of weather to their various destinations, no matter where. Money orders to pay taxes, bills, payrolls, and the like, was one thing. Travelers Checks, most of all, which the reigning CEO did not want surpassed, was another. But here again was an instance of not being able to argue with a future that could not be denied.

The Point

For others, it might be something else. For the author it is merely this, Amexco was and remains a company that makes money. It pays a dividend, too. It probably sounds lame since that is what so many listed companies do. However, it is not always the case. Companies do not always make money. Some break even. Many fall short. Dividends are reduced or cut. Earnings fluctuate. Long term debt can be increased to an exhorbitant level. Jobs are threatened, then eliminated. Once great companies might look desperately for a buyer. Now, there are Wall Street Darlings that own enormous shareholder capital and produce no income whatsoever. Some can only handle salaries and expenses. It can almost all be laid bare on a plain T-Chart showing assets and liabilities. There can be lots more to this phenomenon, too. Companies are more complex today than yesterday. They are not necessarily transparent. I have also excised from discussion the Depression, World War II, and the stock market revivals of the 1980s onward. My apologies. But part of what I do is promote books I find interesting. They are out there, if you look.