Have a Sliding Scale for National Minimum Wage?

I once sent a letter to the President of the United States (believe it was Clinton). In it I described what I thought would be a fair way to tax the American people's wages. My idea was related to how the dollar is worth more in some areas of the country than in others. My recommendation was that if your dollar is worth more than the national average then you should pay a higher percent in taxes than the average tax rate, and if your dollar is worth less than the average, you should pay an amount below the average tax rate. Unfortunately, my idea probably ended up in the shredder at the White House.

But I haven't let go of my ideas for an economy that is fair to all of America's workers or, as Ronald Reagan would have said: “There he goes again..” Yes, I am back with a new plan, but rather than send it to the president, I'm posting it here for all to read..

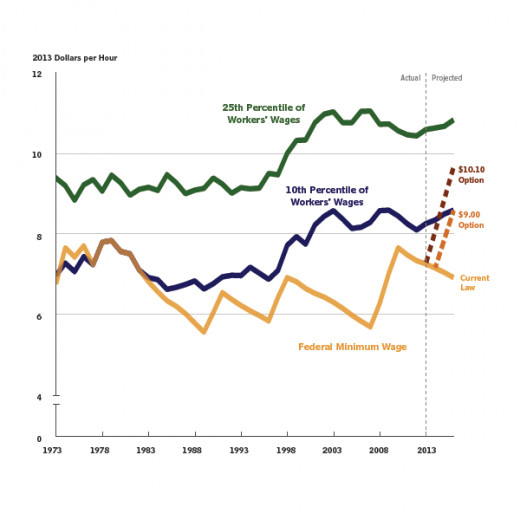

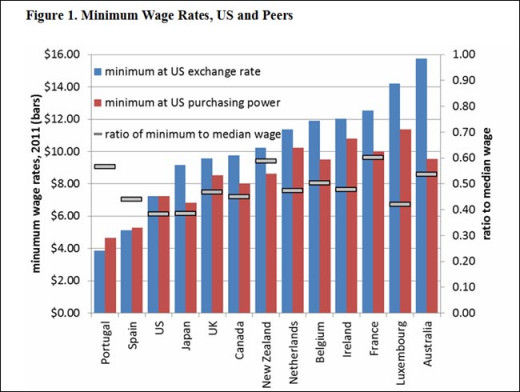

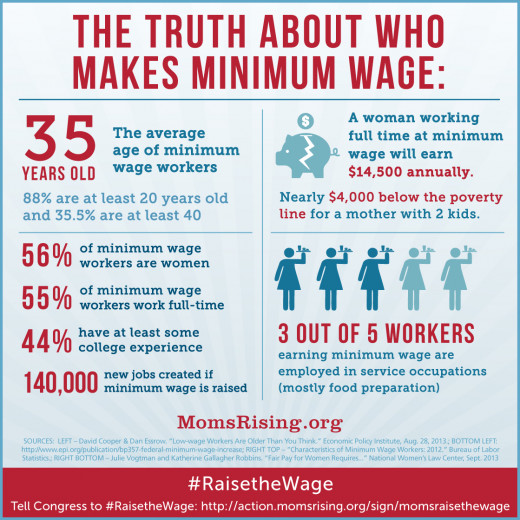

This time my idea, although similar, is tied to the minimum wage. President Obama has proposed that congress increase the minimum wage to $9.00 per hour and have it match inflation increases from then on. That would bring the minimum wage to about the same level as Canada's (as percentage of the national average wage). The only problem with that is that our economy is less efficient than Canada's. We spend much more money on our military, for health care, and for a college education. To bring our minimum wage in line with France, it should go up to at least $11.85. But again, like Canada, they spend significantly less on the military, health care, or education. As a result, our minimum wage should be increased above that.

The move by such cities as Seattle, WA, to have low paid workers make at least $15 an hour within the next few years is commendable, but I believe that, similar to my income tax idea, the minimum wage should be on a sliding scale based on the cost of living in the worker's zip code area.

The estimated national average wage for the year 2014 was $41,080 annually or $19.75 per hour (see http://jobsearch.about.com/od/glossary-a/a/average-salary.htm ). If one uses this as the basis for the minimum wage of $15.00 per hour, we find that this wage would be 75.95% as much as the average wage nationally. However, one's dollar is usually going to be worth more or less than the national average value, depending on your location.

For example, in Pittsburgh, PA, the minimum wage would only need to be $14.26 per hour to have the same buying power as $15.00 in a city that had the same average wage as the national average. Conversely, in Ithica, NY, the minimum wage would need to be $15.78 per hour to have the same buying power.

But then there are cities where, if you are going to work there in a low paying job, you would have to commute from a less expensive area and probably share living space with others. For example, based on the average wage in San Francisco, CA, the minimum wage would be $24.62 per hour (assuming that you were going to both work and live in that city). In New York City, that minimum would be a whopping $28.48 per hour.

Looking at things using a less extreme example, when focusing on my present location of Vancouver, WA, across the river from Portland, OR, although they are very close to each other geographically, there is a pretty significant disparity between pay and cost of living in those two cities. The average hourly wage in Vancouver, WA, is $21.98 (based on 2012 data). In Portland, OR, one would need to make $26.36 per hour to live there in the same fashion. The minimum wage would then translate to $16.69 an hour in Vancouver, WA, and $20.02 in Portland, OR.

Some things to consider about the difference between these last two cities is that Portland, OR does not charge sales taxes while Vancouver, WA does. However, pretty much equalizing the situation, Vancouver, WA does not have a state income tax while Portland, OR does. These kind of differences from place to place may want to be factored in when considered what the local minimum wage should be using a sliding scale.

Going back now to my earlier idea related to federal income taxes, the vast majority of taxpayers would pay less taxes out of each dollar in Portland, OR than in Vancouver, WA. That would be because the cost of living is higher in Portland, OR than in Vancouver, WA and thus the value of the dollars earned in the former would be worth less than those earned in the latter.

The exception, or those excluded from the above tax rule, would relate to the top 20% of income earners. The reason for this is because people with hefty disposable incomes already get breaks because they can afford advice from top accountants and lawyers that the average person doesn't have access to. Also, banks are often biased in their favor, giving them preferential treatment, such as low interest rates on credit cards and loans, or higher interest rates for savings. Also, people in this upper bracket would likely not have trouble saving money and thus don't need the kind of break that people living from pay check to pay check would need.

Another factor to consider is that the middle class fuels the economy more so than the upper 20%. This is because the financially well-off invest more and consume less than the middle class. By expanding the middle class by boosting wages of the lower income group, one increases the purchasing power of American consumers.

Republicans are quick to claim that raising the minimum wage would hurt the economy, negatively impacting small businesses that can not afford to pay their workers more and hampering their ability to compete with larger businesses. These fears can be eased by making the increases gradual and, based on my above recommendations, tailored to match each local economy.

Article Re "The Living Wage Calculator" (algorithm like mine)

- Researcher develops living wage calculator

An MIT researcher is ready to address the problem of poverty in the United States by determining, using a formula similar to mine used for the above article, just what the minimum wage should be for a family to pull themselves out of poverty).

© 2015 Joseph Ritrovato